Colorado License of Vending Machines: A Comprehensive Guide Colorado, known for its breathtaking mountains and charming landscapes, offers a wide range of vending machines throughout the state. However, to operate these machines legally, vending machine operators must obtain the required license from the Colorado Department of Public Health and Environment (CACHE). The Colorado License of Vending Machines is a mandatory permit that ensures vending operators comply with health and safety regulations, maintaining hygiene standards, and safeguarding public health. This license is applicable to various types of vending machines, including but not limited to: 1. Food and Beverage Vending Machines: These machines dispense a variety of food and beverage items such as snacks, cold drinks, coffee, sandwiches, and pre-packaged meals. Vendors operating these machines must obtain the Colorado License of Vending Machines specific to food and beverage products. 2. Tobacco Vending Machines: For vendors dealing with tobacco products like cigarettes, cigars, or e-cigarettes, a specialized license is required. The Colorado License of Vending Machines for tobacco ensures compliance with laws regarding age restrictions, packaging, and proper placement of warning labels. 3. Cannabis Vending Machines: In Colorado, where the recreational use of marijuana is legal, cannabis vending machines have become popular. However, these machines require a separate license specific to the cannabis industry, as regulated by the Colorado Marijuana Enforcement Division (MED). 4. Pharmaceutical Vending Machines: Some medical facilities and pharmacies opt for automated pharmaceutical vending machines in Colorado. These machines typically dispense prescription medications, over-the-counter drugs, and other healthcare products. Operators must obtain a specialized license that adheres to pharmacy regulations and safety measures. Obtaining the Colorado License of Vending Machines involves a thorough application process. Vending operators must complete the necessary paperwork provided by the CACHE, with details such as business information, machine location(s), product types, and compliance with applicable regulations. Additionally, an inspection may be conducted to ensure machines meet required standards. Once the license is granted, vendors must prominently display their license number on each vending machine. It is crucial to renew this license annually and keep up-to-date records of all transactions and maintenance activities. To summarize, the Colorado License of Vending Machines allows operators to legally run various types of vending machines, including food and beverage, tobacco, cannabis, and pharmaceutical vending machines. By obtaining the necessary license and complying with regulations, vending operators contribute to a safe and healthy vending environment throughout the beautiful state of Colorado.

Colorado License of Vending Machines

Description

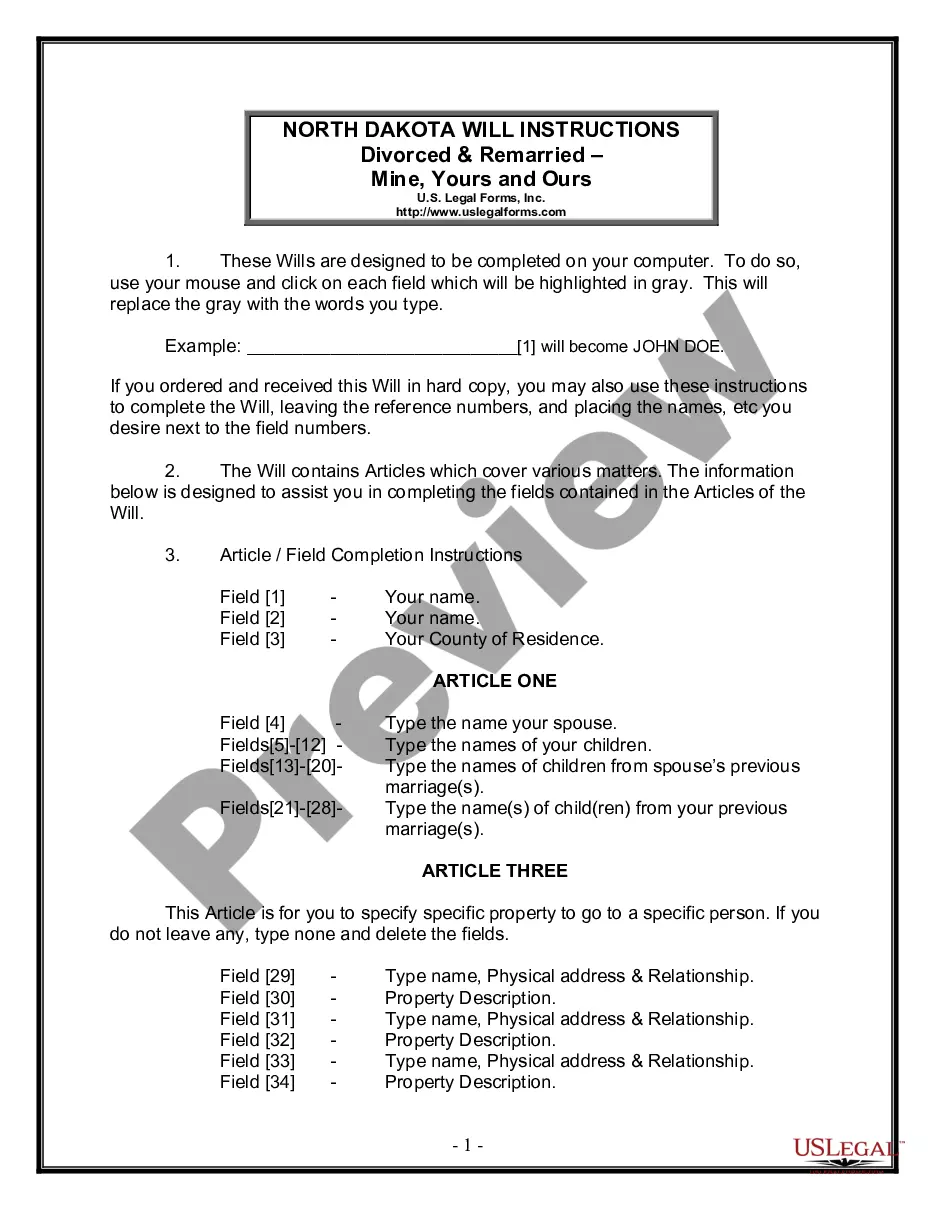

How to fill out Colorado License Of Vending Machines?

Have you been inside a placement the place you need paperwork for possibly enterprise or specific purposes just about every working day? There are a lot of legal document themes available online, but discovering kinds you can rely is not simple. US Legal Forms gives a huge number of type themes, much like the Colorado License of Vending Machines, that are written to meet federal and state requirements.

If you are currently familiar with US Legal Forms web site and have a merchant account, basically log in. After that, you are able to download the Colorado License of Vending Machines format.

Unless you provide an accounts and need to begin to use US Legal Forms, adopt these measures:

- Discover the type you want and make sure it is for your appropriate city/area.

- Utilize the Preview button to review the shape.

- Browse the outline to actually have chosen the proper type.

- In the event the type is not what you`re trying to find, utilize the Research industry to discover the type that meets your requirements and requirements.

- If you obtain the appropriate type, just click Buy now.

- Pick the pricing plan you need, fill in the necessary information to make your account, and pay money for the transaction making use of your PayPal or charge card.

- Decide on a practical document formatting and download your version.

Find all of the document themes you may have purchased in the My Forms food list. You can get a extra version of Colorado License of Vending Machines anytime, if possible. Just go through the required type to download or print the document format.

Use US Legal Forms, one of the most substantial assortment of legal varieties, in order to save time as well as stay away from blunders. The services gives professionally produced legal document themes which you can use for a selection of purposes. Create a merchant account on US Legal Forms and start creating your life easier.

Form popularity

FAQ

Apply for the sales tax license on form CR 0100, Business Reg- istration. A retail sales tax license costs $16 for a two-year calendar period plus a one-time $50 deposit.

Your location needs to have enough people that will use the machine to generate the amount of sales needed to support having equipment there. This means at least 40 full-time employees for an office setting. Vending machines typically run on 115 volts at 10-12 amps, so a regular three-prong electrical outlet is needed.

With as little as a $2,000 investment, you can generally get a basic vending machine business up and running. Many vending machine operators recommend buying used or refurbished machines, which you can find between $1,200 and $3,000.

Note: You can't just place your vending machine anywhere without permission! Most locations will require you to follow state and local vending laws. You will often have to sign a contract with the property owner. Make sure to read up on state and local vending laws when doing your research.

1. Who needs a sales tax permit in Colorado? According to the Colorado Department of Revenue, if your business will be selling, renting or leasing tangible personal property, you must obtain a sales tax license and file sales tax returns.

Laws covering vending machines selling food and drinkRegistration is free, can usually be done online and cannot be refused. It can, however, be revoked if an operator fails to meet minimum standards in safety and hygiene. Vending machines selling food and drink must be located in an area that is free from pests.

Owners, operators, lessors and lessees of vending machines who have control of the receipts must obtain a Colorado sales tax license.

If you are an online retailer who ONLY sells on approved marketplaces (such as Amazon, eBay, etc), Colorado sales tax will be remitted by the marketplace and you do not need to get a sales tax permit based on the physical location of your inventory.

You can place vending machines in most commercial spaces such as offices, retail shops, bowling alleys, and more. But you'll need to sign a contract with the property owner first.

Standard Retail License (Sales Tax License) For businesses that make retail sales in Colorado: if your business makes both retail sales and wholesale sales, then the Retail Sales Tax License allows you to do both. You do not need to obtain a Wholesale License in addition to the Retail Sales Tax License.