Colorado Estoppel Affidavit of Mortgagor

Description

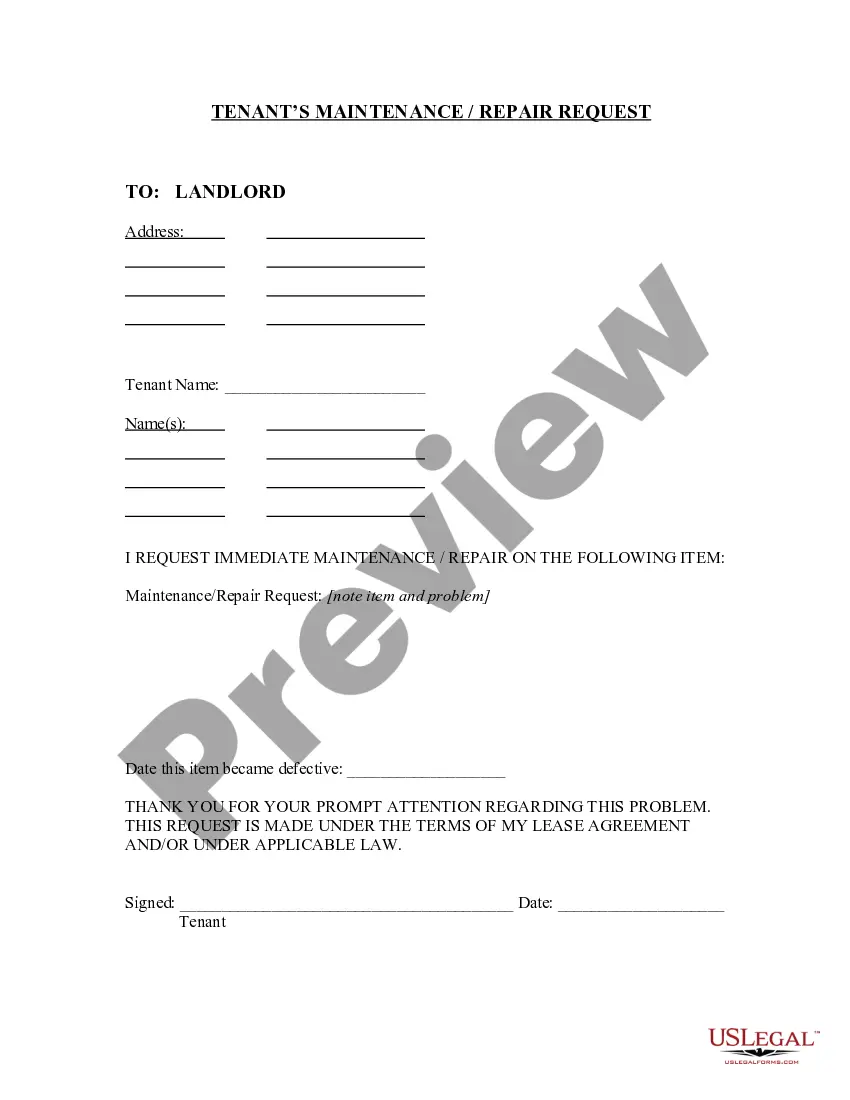

How to fill out Estoppel Affidavit Of Mortgagor?

Are you in a circumstance that requires documentation for organization or personal purposes almost every day? There are numerous legal document templates available online, but finding reliable versions isn't easy. US Legal Forms offers a wide array of form templates, including the Colorado Estoppel Affidavit of Mortgagor, designed to comply with federal and state regulations.

If you are already acquainted with the US Legal Forms website and have an account, simply Log In. After that, you can download the Colorado Estoppel Affidavit of Mortgagor template.

If you don't have an account and wish to begin using US Legal Forms, follow these steps.

View all the document templates you have purchased in the My documents menu. You can download an additional copy of the Colorado Estoppel Affidavit of Mortgagor at any time if necessary. Simply click on the desired form to download or print the document template.

Utilize US Legal Forms, one of the largest collections of legal forms, to save time and avoid errors. The service provides professionally crafted legal document templates that can be used for a variety of purposes. Create an account on US Legal Forms and start simplifying your life.

- Locate the form you need and ensure it is for the correct city/county.

- Utilize the Preview button to review the form.

- Check the description to confirm you have chosen the appropriate form.

- If the form isn't what you're looking for, use the Search field to find the form that suits your needs and requirements.

- Once you find the correct form, click Buy now.

- Choose the payment plan you would like, fill in the required information to create your account, and complete the purchase with your PayPal or credit card.

- Select a convenient file format and download your copy.

Form popularity

FAQ

The preparation of a Colorado Estoppel Affidavit of Mortgagor typically falls to the mortgage lender or the borrower, depending on the circumstances of the transaction. Often, lenders require these affidavits to confirm the details of the mortgage agreement and any outstanding debts. It's crucial to ensure that the information included is accurate, as it serves to protect all parties involved in the mortgage process. If you need assistance, our platform, US Legal Forms, offers templates and guidance to help you create a compliant and thorough Colorado Estoppel Affidavit of Mortgagor.

To write an estoppel letter, start by clearly stating the purpose of the letter and include all necessary details about the mortgage. Incorporate information that reflects the current status of your mortgage, which can be formalized through a Colorado Estoppel Affidavit of Mortgagor. Be concise and provide any supporting documents if needed. If you're unsure about the format, using a platform like USLegalForms can simplify the process by providing templates tailored for estoppel letters.

The estoppel clause in a mortgage is a provision that prevents the mortgagor from denying certain facts concerning the mortgage agreement. This means that if you provide a Colorado Estoppel Affidavit of Mortgagor, you affirm the accuracy of your mortgage's terms, ensuring clarity for both parties involved. It enhances trust and helps prevent future disputes regarding mortgage agreements. Understanding this clause is essential as it safeguards your rights in the mortgage process.

The purpose of an estoppel letter is to confirm the details of a mortgage agreement and to prevent disputes. It clarifies obligations and rights related to the mortgage, offering protection to both borrowers and lenders. A Colorado Estoppel Affidavit of Mortgagor serves this function effectively and ensures all parties are on the same page.

In many cases, estoppel certificates do not require notarization, but this can depend on local laws. In Colorado, it’s always a good idea to check the requirements for your specific situation. Utilizing a Colorado Estoppel Affidavit of Mortgagor can help clarify any notary requirements as well.

You can obtain an estoppel certificate from your lender or a legal documents service. Many providers, like uslegalforms, offer resources to help you create your own Colorado Estoppel Affidavit of Mortgagor. This simplifies the process and provides guidance on obtaining necessary documentation.

An estoppel certificate is generally provided to the lender and sometimes to other parties involved in the mortgage. This includes other financial institutions that may need confirmation of the mortgage status. By having a Colorado Estoppel Affidavit of Mortgagor, all parties maintain transparency regarding the mortgage agreement.

Typically, the borrower is responsible for paying for an estoppel letter. However, the specifics can vary depending on the agreement between the borrower and lender. Understanding these financial responsibilities is essential, and using the Colorado Estoppel Affidavit of Mortgagor can clarify these obligations during a mortgage transaction.

Lenders often request an estoppel certificate to verify the current status of a mortgage. This certificate provides crucial information about the borrower’s obligations and any changes that may have occurred. By reviewing the Colorado Estoppel Affidavit of Mortgagor, lenders gain assurance that the details are reliable, preventing potential disputes.

An estoppel in mortgage is a legal document that confirms the details of a mortgage agreement. This document serves to prevent the mortgagor from denying the validity of the mortgage terms. It ensures that all parties have a clear understanding of their obligations. Often, the Colorado Estoppel Affidavit of Mortgagor serves this purpose for those in Colorado.