Colorado Motor Vehicle or Automobile Lease Between Individuals

Description

How to fill out Motor Vehicle Or Automobile Lease Between Individuals?

Locating the appropriate valid document template might present a challenge.

Of course, there are numerous templates available online, but how can you acquire the valid form you require.

Utilize the US Legal Forms website. The service offers thousands of templates, such as the Colorado Motor Vehicle or Automobile Lease Between Individuals, that you can use for both business and personal purposes.

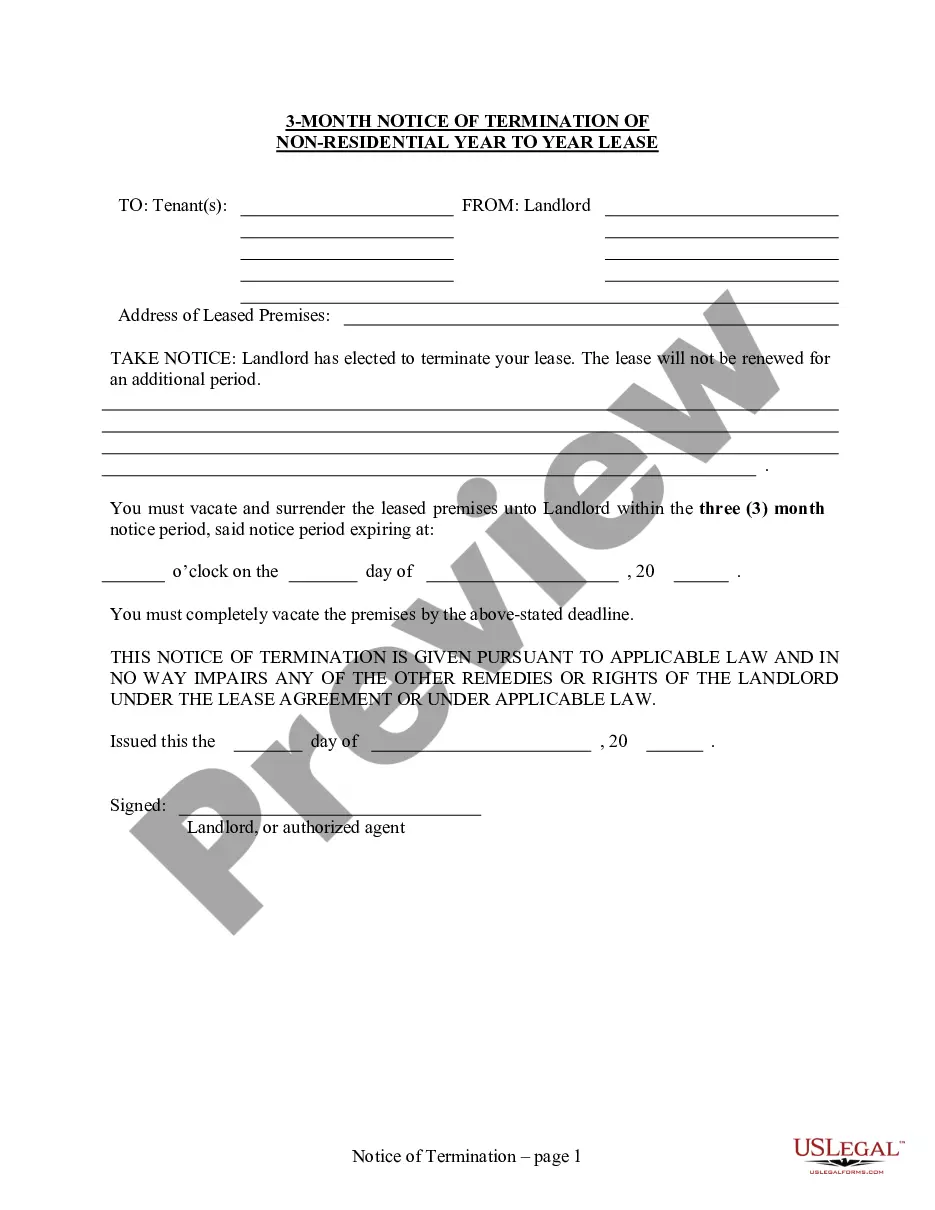

You can view the form using the Preview button and read the form details to ensure it is suitable for you.

- All of the forms are reviewed by experts and comply with state and federal regulations.

- If you are already a member, Log In to your account and click the Download button to get the Colorado Motor Vehicle or Automobile Lease Between Individuals.

- Use your account to browse through the valid forms you have previously purchased.

- Go to the My documents section of your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

- First, ensure you have selected the correct form for your city/state.

Form popularity

FAQ

Yes, both parties typically need to be present to transfer a title in Colorado. Each party must sign the title to validate the transfer. However, if one party is unable to attend, a notarized signature may suffice. Understanding this process is crucial for managing a Colorado Motor Vehicle or Automobile Lease Between Individuals effectively.

To fill out a Colorado statement of fact, you should begin by providing a clear explanation of the circumstances necessitating the statement. Include pertinent details such as dates, names, and any related documentation. This form is often used in conjunction with the Colorado Motor Vehicle or Automobile Lease Between Individuals to clarify ownership or leasing terms appropriately.

Transferring ownership of a title in Colorado is a straightforward process. First, both the seller and buyer must complete the necessary sections on the title form. Then, you must visit your local county clerk's office to submit the title transfer application along with any required fees. Following these steps ensures a smooth transition under the Colorado Motor Vehicle or Automobile Lease Between Individuals.

To fill out a Colorado vehicle title, start with the current owner's information in the seller section. Clearly write your name, address, and the odometer reading. Next, complete the buyer section with the new owner's details. Finally, both parties must sign the title before submission, ensuring compliance with the Colorado Motor Vehicle or Automobile Lease Between Individuals.

Driving a car home without plates in Colorado is allowed under certain conditions. You must carry proof of ownership and insurance while driving the vehicle. It's advisable to obtain a temporary permit from the seller or DMV to avoid unnecessary complications, especially if you're considering a Colorado Motor Vehicle or Automobile Lease Between Individuals in the future.

To be considered a resident of Colorado, you typically need to establish your primary home in the state and demonstrate your intent to stay. This can include registering to vote in Colorado, obtaining a Colorado driver's license, and paying state income taxes. Doing so solidifies your residency and can simplify matters when dealing with local laws, such as those regarding a Colorado Motor Vehicle or Automobile Lease Between Individuals.

Yes, you can drive a used car you just bought in Colorado, provided you have the necessary documentation, including proof of insurance and the vehicle's title. Before hitting the road, ensure that you are compliant with Colorado regulations to avoid any potential citations. If you're entering into a Colorado Motor Vehicle or Automobile Lease Between Individuals, ensure the lease documentation is clear and accurate to safeguard your rights.

To transfer a car title to a family member in Colorado, you'll need to complete the title transfer section on the current title. Both parties must sign the title, and you must provide necessary identification, along with any additional forms required by the Colorado DMV. Consider using uslegalforms to simplify the process of title transfers, especially in cases involving a Colorado Motor Vehicle or Automobile Lease Between Individuals.

Yes, you can drive a newly purchased car home without plates in Colorado, but you must have the proper documentation such as the bill of sale and insurance proof. You should obtain a temporary permit or a temporary tag from the dealership or county clerk. This ensures that you stay compliant with the law while protecting your interests when engaging in a Colorado Motor Vehicle or Automobile Lease Between Individuals.

When you lease a car, you are generally responsible for routine maintenance and minor repairs, while the leasing company may cover significant repairs under warranty. It’s essential to review your leasing agreement to understand what is covered. If you enter a Colorado motor vehicle or automobile lease between individuals, clarify these responsibilities to avoid unexpected costs down the line.