Colorado Reorganization of Partnership by Modification of Partnership Agreement

Description

How to fill out Reorganization Of Partnership By Modification Of Partnership Agreement?

You can dedicate numerous hours online searching for the sanctioned document template that fulfills the state and federal standards you need.

US Legal Forms offers thousands of legal forms that can be assessed by professionals.

You can conveniently acquire or print the Colorado Reorganization of Partnership by Modification of Partnership Agreement through our service.

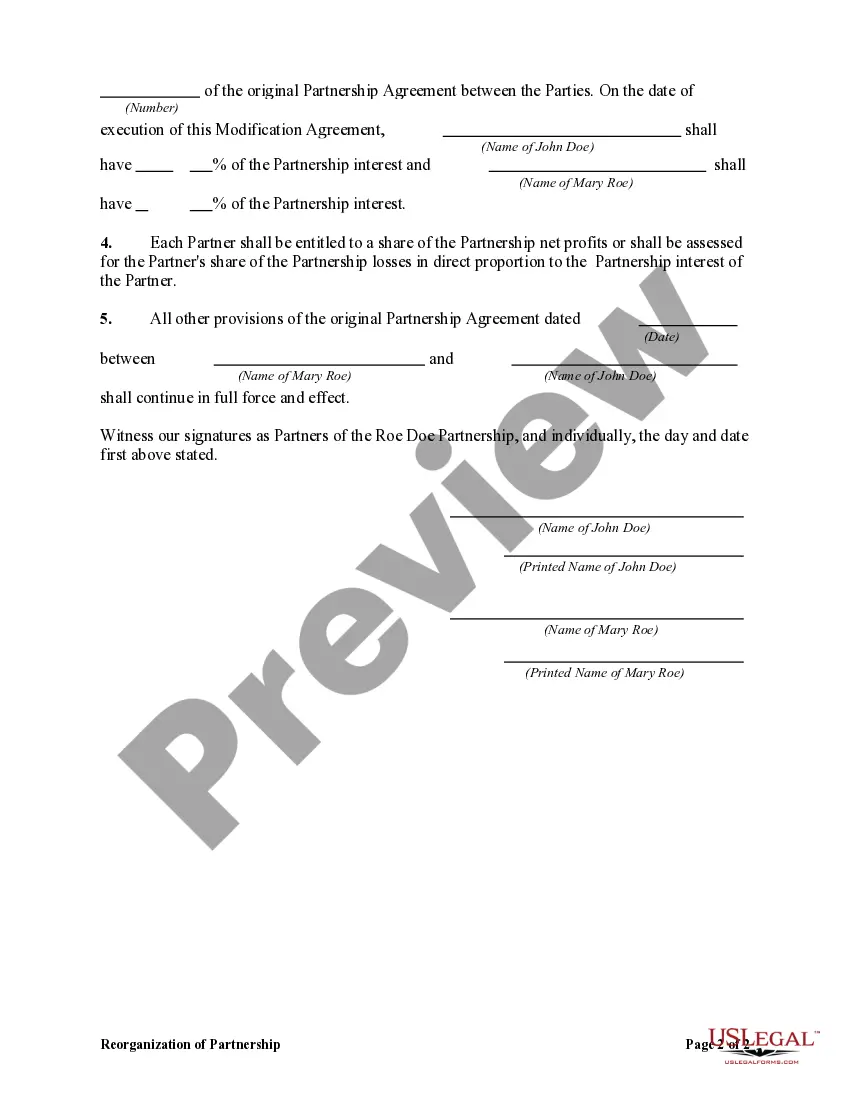

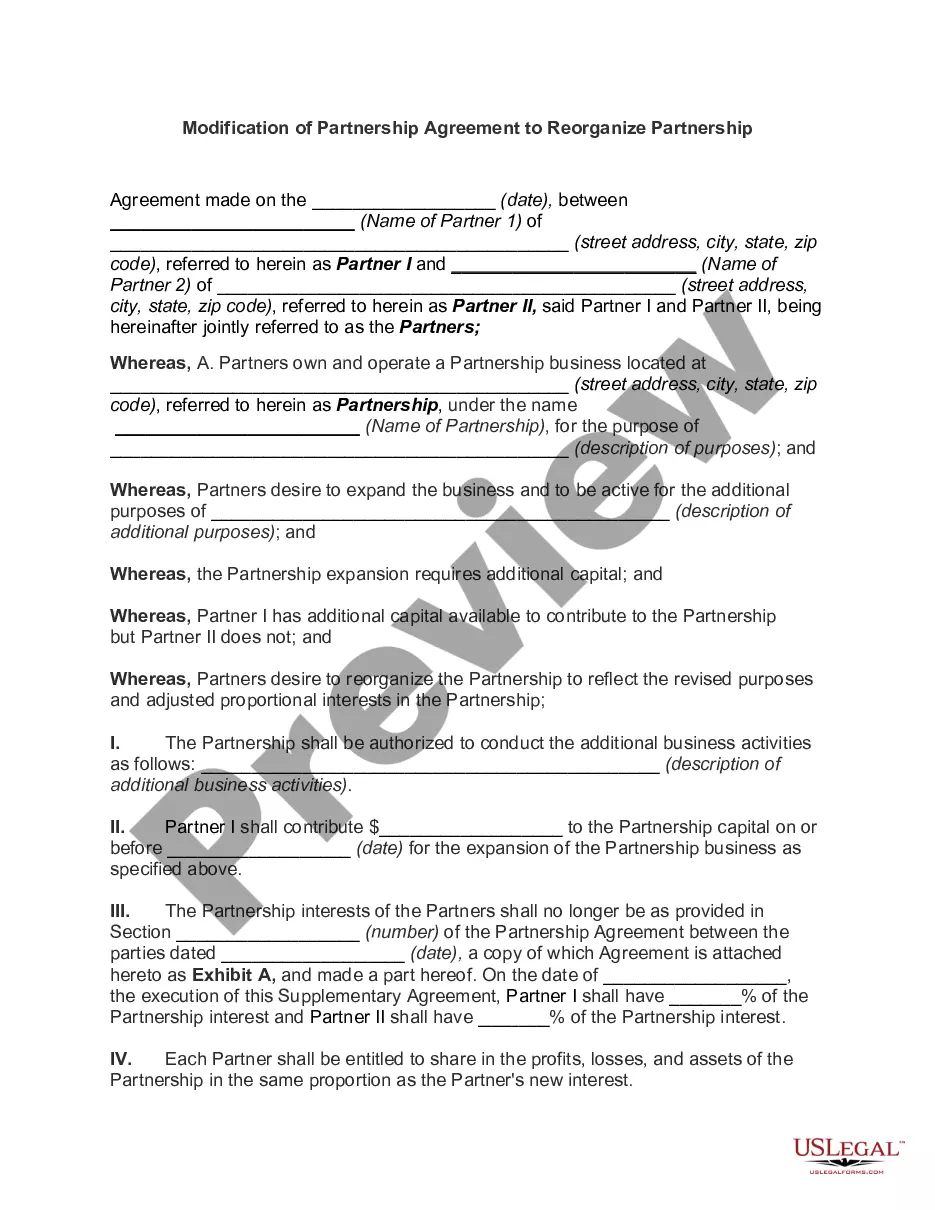

First, ensure you have selected the correct document template for the region/area of your choice. Review the form description to make sure you've chosen the right form. If available, utilize the Preview button to peruse the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click the Download button.

- Then, you can complete, modify, print, or sign the Colorado Reorganization of Partnership by Modification of Partnership Agreement.

- Every legal document template you obtain is yours indefinitely.

- To acquire another copy of any downloaded form, navigate to the My documents section and click the appropriate button.

- If this is your first time using the US Legal Forms website, follow the simple instructions provided below.

Form popularity

FAQ

Yes, a partnership agreement is legally binding, reinforcing the principles outlined in the Colorado Reorganization of Partnership by Modification of Partnership Agreement. This agreement creates obligations for all partners and establishes the foundation for business operations and decision-making. Since partnership agreements outline the rights and responsibilities of each partner, it is essential to draft them carefully. To ensure that your partnership agreement remains legally binding and well-structured, consider using uslegalforms for reliable resources and guidance.

Absolutely, you can modify an agreement, especially in the context of the Colorado Reorganization of Partnership by Modification of Partnership Agreement. Modifications can address changes in ownership, financial contributions, or partnership duties. Both partners must discuss and agree to the modifications, confirming that all revisions are documented to avoid misunderstandings. Utilizing a platform like uslegalforms can streamline this process and provide necessary templates for clarity and legality.

Yes, you can amend a partnership agreement under the Colorado Reorganization of Partnership by Modification of Partnership Agreement. Amending a partnership agreement allows partners to modify specific terms without completely rewriting the document. It is crucial to ensure that all partners agree to the changes and that the amendments are properly documented. Working with a legal platform, such as uslegalforms, can simplify this process and ensure compliance with state laws.

In the context of the Colorado Reorganization of Partnership by Modification of Partnership Agreement, it is important to understand the four main types of partnerships: general partnerships, limited partnerships, limited liability partnerships, and limited liability limited partnerships. General partnerships involve all partners sharing responsibilities and liabilities equally, while limited partnerships consist of both general and limited partners. Limited liability partnerships offer partners protection against personal liability for certain debts, and limited liability limited partnerships combine elements of both. Knowing these types helps you make informed decisions about your partnership structure.

The four stages of partnership are formation, development, maintenance, and dissolution. Initially, partners come together to form the partnership and outline their objectives. As the partnership develops, relationships strengthen and roles become more established. Maintenance involves ongoing management of the relationship, while dissolution occurs when partnerships end, often requiring reflection on a Colorado Reorganization of Partnership by Modification of Partnership Agreement for smooth transitions.

Removing a partner from a partnership typically involves reviewing the partnership agreement for terms regarding dissolution or expulsion. You may need to negotiate an exit strategy with the partner in question, ensuring compliance with any legal stipulations. It is also advisable to seek guidance on a Colorado Reorganization of Partnership by Modification of Partnership Agreement to ensure all legalities are observed and the remaining partners' interests are protected.

Key partnerships generally fall into four categories: strategic alliances, joint ventures, equity partnerships, and contractual partnerships. Strategic alliances involve collaboration without a formal commitment, while joint ventures require shared investment and risk. Equity partnerships allow partners to share ownership, whereas contractual partnerships are based on legal agreements. Each type influences how a Colorado Reorganization of Partnership by Modification of Partnership Agreement might be structured.

In a partnership, you will typically find four main types of partners: general partners, limited partners, silent partners, and nominal partners. General partners manage the business and are personally liable for its debts. Limited partners, on the other hand, contribute capital but do not engage in daily operations, which limits their liability. Understanding these roles can be essential during a Colorado Reorganization of Partnership by Modification of Partnership Agreement.

Any individual or entity that earns income in Colorado must file a tax return. This applies to residents and non-residents alike, especially if they have a business income. If you're involved in a partnership, it's crucial to understand how these requirements relate to your partnership's financial activities, particularly in light of the Colorado Reorganization of Partnership by Modification of Partnership Agreement.

Generally, partnerships do not file their own tax returns. Instead, they report income and expenses on each partner's tax return based on individual shares. This structure emphasizes the need for a good partnership agreement. For those navigating the Colorado Reorganization of Partnership by Modification of Partnership Agreement, understanding these aspects can streamline your tax processes.