Colorado Sample Holiday Letter to Stockholders

Description

How to fill out Sample Holiday Letter To Stockholders?

If you require thorough, obtain, or producing legal document templates, utilize US Legal Forms, the largest collection of legal forms, that can be accessed online.

Employ the site’s straightforward and efficient search to find the documents you need.

An array of templates for business and personal purposes are categorized by types and states, or keywords.

Every legal document template you purchase is your property permanently.

You have access to every form you downloaded within your account. Click the My documents section and choose a form to print or download again.

- Utilize US Legal Forms to locate the Colorado Sample Holiday Letter to Stockholders within a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the Colorado Sample Holiday Letter to Stockholders.

- You can also access forms you previously downloaded from the My documents tab of your account.

- If you are using US Legal Forms for the first time, refer to the instructions below.

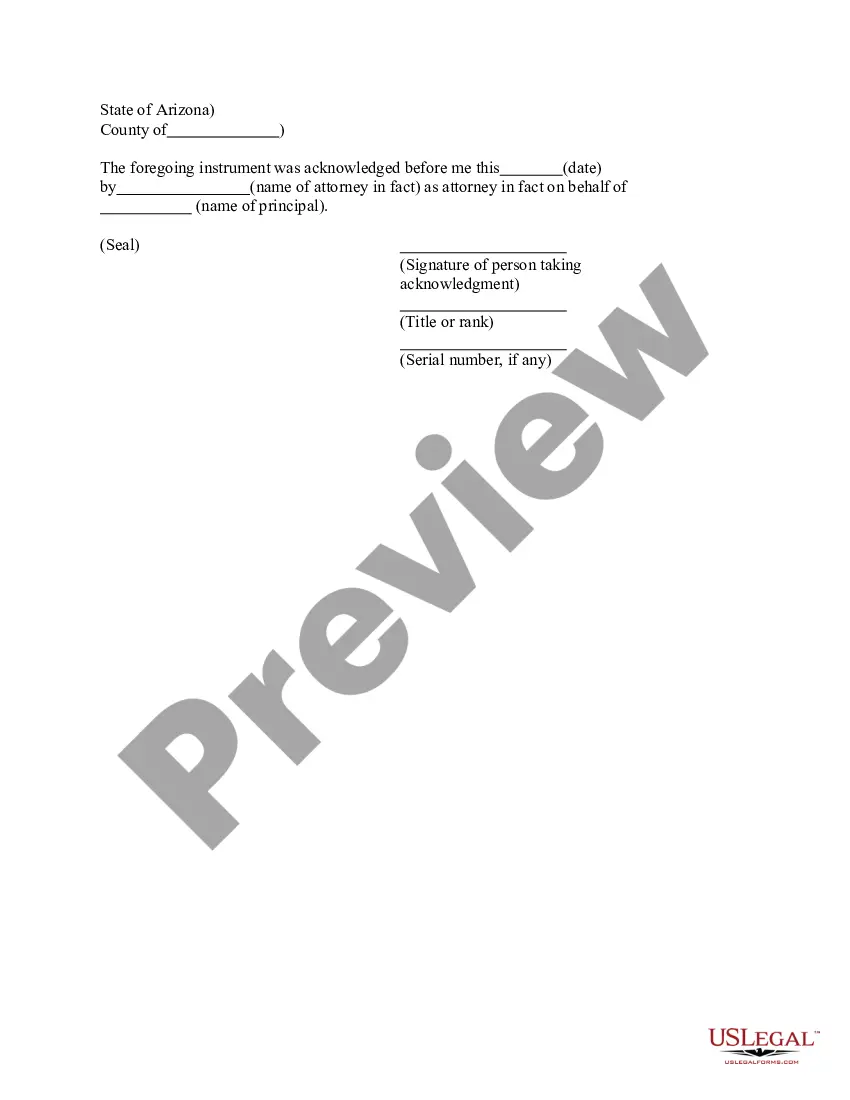

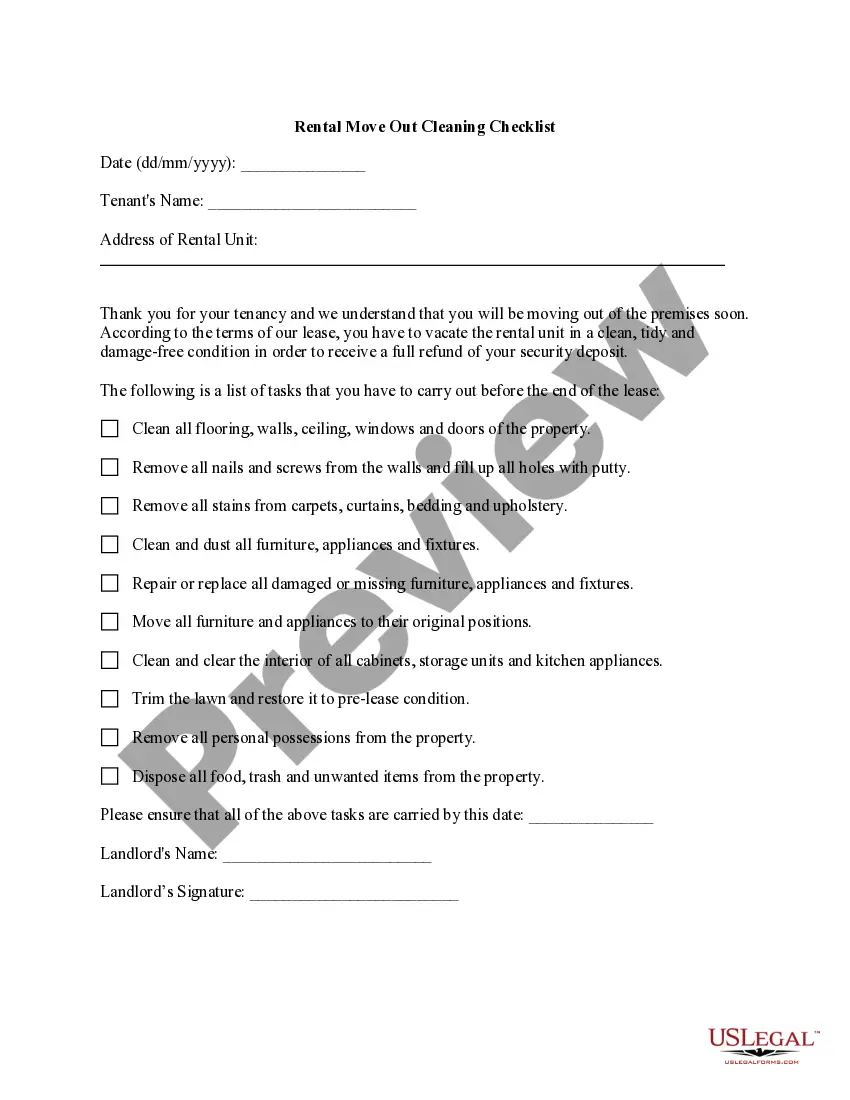

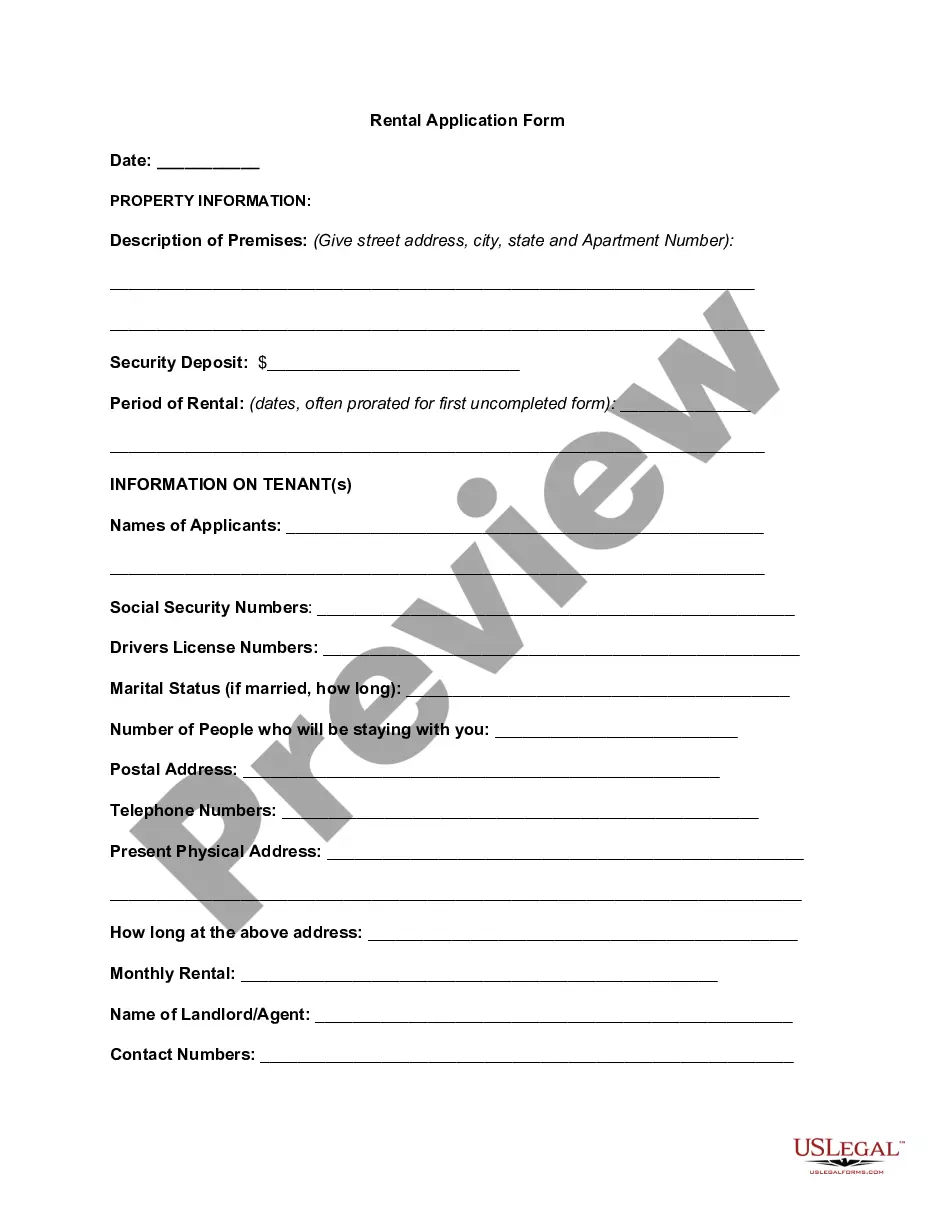

- Step 1. Ensure you have selected the form for the correct city/region.

- Step 2. Utilize the Preview option to examine the form’s content. Remember to read through the description.

- Step 3. If you are unsatisfied with the form, use the Search field at the top of the screen to find other types in the legal form template.

- Step 4. Once you have found the form you need, choose the Buy now option. Select the pricing plan you prefer and enter your details to register for an account.

- Step 5. Complete the transaction. You can use your Visa or Mastercard or PayPal account to finalize the payment.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Complete, modify and print or sign the Colorado Sample Holiday Letter to Stockholders.

Form popularity

FAQ

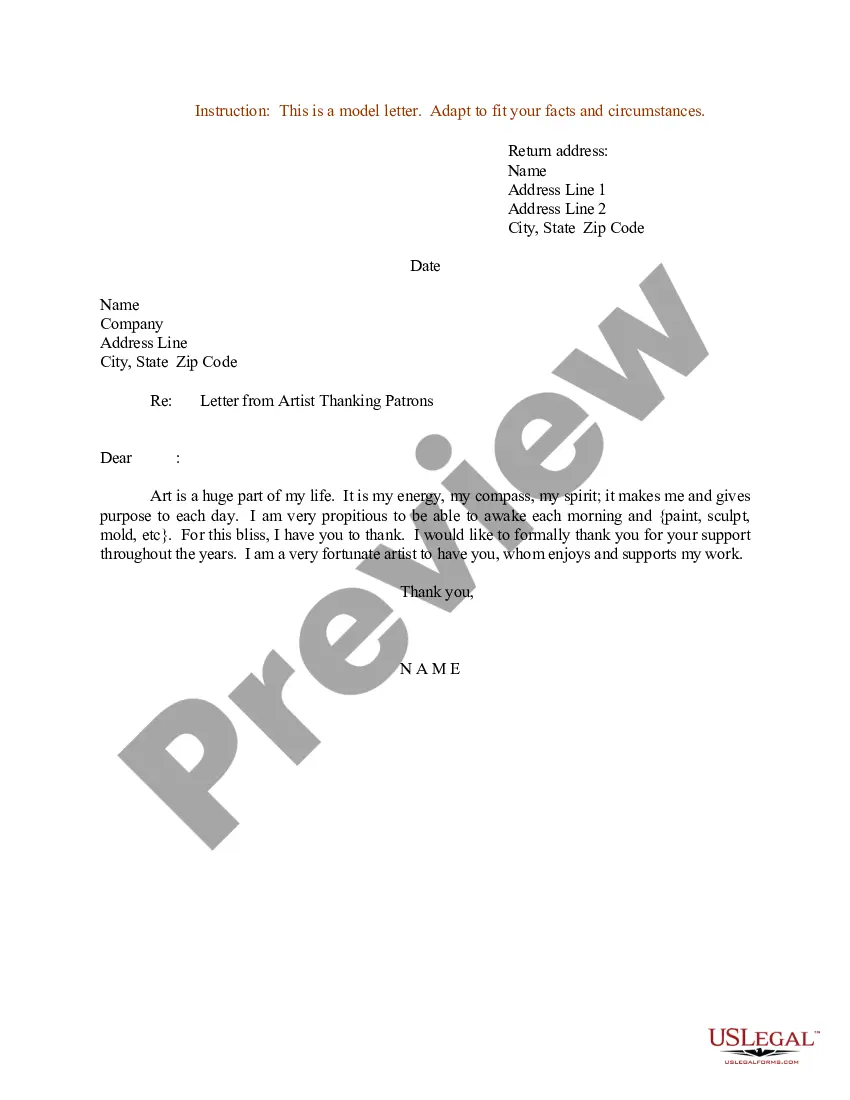

Begin your holiday letter with a friendly greeting that sets a cheerful tone. You might use an opening sentence to reflect on the joy of the season or express your good wishes. Make it personal by addressing your loved ones directly and sharing a brief update about your year. For inspiration, take a look at the Colorado Sample Holiday Letter to Stockholders for more ideas.

To create a simple Christmas letter, focus on a warm introduction that conveys your holiday spirit. Keep your message concise by sharing joyful memories and expressing wishes for the season. Remember to invite your recipients to respond with their updates too. For additional guidance, explore examples like the Colorado Sample Holiday Letter to Stockholders.

Creating a holiday letter involves a few simple steps. Start by outlining your main points, such as updates and sentiments you want to communicate. Personalize your message with anecdotes that reflect your relationships and cherished moments. If you seek ideas, consider the Colorado Sample Holiday Letter to Stockholders as a helpful guide.

To write a holiday letter to family, begin by sharing recent updates about your life and your family's milestones. Include a personal touch by reminiscing about memories you cherish together. You might want to conclude with warm wishes and a heartfelt invitation to connect more often. For reference, check the Colorado Sample Holiday Letter to Stockholders for structure and inspiration.

Meals are still 50% deductible in Colorado under specific circumstances, aligning with federal tax guidelines. This includes meals that are directly associated with the active conduct of a trade or business. Keeping accurate records of meal expenses is essential for maintaining this deduction. A Colorado Sample Holiday Letter to Stockholders can serve as a great tool to communicate these details to stakeholders.

Yes, Colorado permits meal deductions; however, certain criteria apply to qualify. Businesses can often deduct meal costs associated with client meetings or employee events. Understanding these rules is vital for optimizing business expenses. Referring to a Colorado Sample Holiday Letter to Stockholders can enhance stakeholders' awareness about meal deduction benefits.

To find your Colorado account number, visit the Colorado Department of Revenue's website or contact their customer service. Account numbers are typically located on state tax correspondence or tax returns. Keeping a record of these details is crucial for efficient tax management. Consider noting this in a Colorado Sample Holiday Letter to Stockholders for your stakeholders' benefit.

Colorado does conform to the federal Qualified Business Income (QBI) deduction for eligible taxpayers. This provision can significantly reduce taxable income for pass-through entities, enhancing business viability. To ensure proper filing of this deduction, resources such as a Colorado Sample Holiday Letter to Stockholders may provide useful reminders to stakeholders.

Yes, Colorado allows a 50% deduction for business meals under certain conditions. This means businesses can deduct half of their meal expenses when dining with clients or partners. Keeping track of these expenses is key to maximizing your tax return. A mention of the Colorado Sample Holiday Letter to Stockholders could also guide stakeholders in understanding these deductions thoroughly.

Dr. 0106 is a Colorado tax form specifically for reporting certain types of income from pass-through entities. This form is essential for ensuring accurate tax filing for individual and corporate stakeholders. Completing Dr. 0106 correctly helps to avoid penalties and streamline tax obligations. You might find references to this form in a Colorado Sample Holiday Letter to Stockholders.