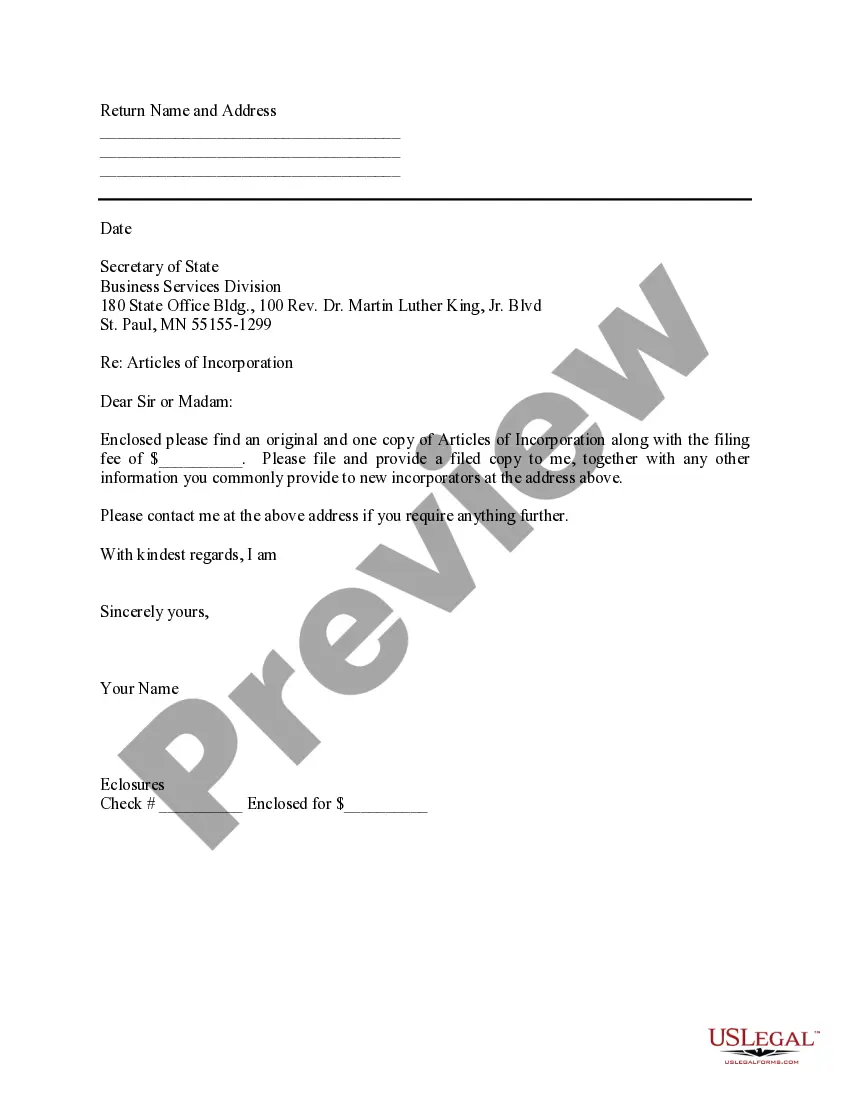

Subject: Colorado Sample Letter for Explanation of Bankruptcy — Comprehensive Guide Dear [Lender/Bank], I hope this letter finds you well. I am writing to provide you with a detailed explanation of my bankruptcy filing and the circumstances leading up to it. As a responsible borrower, I value transparency and believe it is crucial to provide you with an accurate account of my financial situation. Firstly, let me introduce myself. My name is [Your Name], a resident of Colorado. Colorado is a magnificent state located in the western United States, known for its breathtaking landscapes, including the majestic Rocky Mountains, vibrant cities like Denver, and diverse outdoor recreational opportunities. Now, turning to my bankruptcy filing, I want to emphasize that my decision was not taken lightly and was a last resort to address overwhelming financial difficulties. Colorado's residents facing financial hardships are protected by the bankruptcy laws provided by the state, which offer a chance at a fresh start. 1. Chapter 7 Bankruptcy: Chapter 7 bankruptcy, also known as liquidation bankruptcy, involves the sale of non-exempt assets to repay the creditors. This type of bankruptcy is designed for individuals or businesses with little to no disposable income, seeking a discharge of overwhelming debts. 2. Chapter 13 Bankruptcy: Chapter 13 bankruptcy, also called reorganization bankruptcy, offers a structured repayment plan over three to five years. This allows debtors to retain valuable assets, such as homes and vehicles, while repaying their creditors based on their income and ability to pay. Regarding my bankruptcy, I filed for [Chapter 7 or Chapter 13], as it was the most suitable option for my financial circumstances. Dates and details will be provided in the attached documentation, which includes the necessary court filings and bankruptcy discharge records. Now, let me shed light on the events leading to my bankruptcy. [Explain the sequence of events, such as unemployment, medical emergencies, or any unforeseen circumstances that caused financial distress]. Despite my efforts to handle my obligations, the mounting debts became unmanageable. Since my bankruptcy filing, I have embarked on the journey of rebuilding my financial stability. I have undertaken various initiatives to improve my financial literacy, budgeting skills, and have sought professional advice from financial advisors and credit counselors. These steps demonstrate my sincere commitment to restoring my creditworthiness, and I am determined to honor my financial obligations moving forward. Attached to this letter, you will find the necessary documentation substantiating my bankruptcy filing, including the discharge notice, court documents, and any additional records you may require. These documents should provide you with insight into my bankruptcy case and support my explanation of the situation. I understand that my bankruptcy may raise concerns about my creditworthiness. However, I assure you that I am actively taking steps to rebuild my financial standing and learn from my past mistakes. If given the opportunity, I am confident in my ability to meet my financial obligations promptly and judiciously. In conclusion, I genuinely appreciate your understanding regarding my bankruptcy filing. I believe that with time and a second chance, I can demonstrate my commitment to responsible financial practices. If you require any further information or have any questions, please do not hesitate to contact me. Thank you for considering my explanation, and I look forward to a positive resolution. Kind regards, [Your Name] [Your Contact Information]

Colorado Sample Letter for Explanation of Bankruptcy

Description

How to fill out Colorado Sample Letter For Explanation Of Bankruptcy?

Are you currently within a position in which you need to have files for sometimes business or individual purposes almost every time? There are plenty of lawful file layouts available on the net, but discovering types you can rely on is not straightforward. US Legal Forms delivers thousands of form layouts, like the Colorado Sample Letter for Explanation of Bankruptcy, that are created to satisfy state and federal demands.

When you are previously acquainted with US Legal Forms web site and also have a merchant account, simply log in. Following that, it is possible to obtain the Colorado Sample Letter for Explanation of Bankruptcy template.

If you do not offer an accounts and would like to start using US Legal Forms, follow these steps:

- Discover the form you require and make sure it is for the correct metropolis/area.

- Make use of the Review button to examine the shape.

- Browse the information to ensure that you have chosen the right form.

- When the form is not what you`re looking for, make use of the Lookup field to find the form that meets your requirements and demands.

- Whenever you discover the correct form, click Acquire now.

- Pick the costs prepare you want, fill in the specified information to generate your money, and buy your order with your PayPal or Visa or Mastercard.

- Choose a handy file structure and obtain your duplicate.

Locate all of the file layouts you possess purchased in the My Forms food selection. You can aquire a further duplicate of Colorado Sample Letter for Explanation of Bankruptcy any time, if required. Just click the required form to obtain or print the file template.

Use US Legal Forms, probably the most comprehensive selection of lawful forms, to save lots of some time and steer clear of errors. The assistance delivers expertly created lawful file layouts which can be used for an array of purposes. Make a merchant account on US Legal Forms and start creating your daily life a little easier.

Form popularity

FAQ

When drafting a Letter of Explanation for Bankruptcy, you need to state the reason you are submitting this explanation, record the type of bankruptcy you filed for, the timeline of the bankruptcy proceedings, and a brief description of the circumstances that led to the bankruptcy.

The key to writing a great letter of explanation is to keep it short, simple and informative. Be clear and write with as much detail as you can since someone else will need to understand your situation. Avoid including irrelevant information or answers to questions the underwriter didn't ask.

The key to writing a great letter of explanation is to keep it short, simple and informative. Be clear and write with as much detail as you can since someone else will need to understand your situation. Avoid including irrelevant information or answers to questions the underwriter didn't ask.

Bankruptcy is a generalized term for a federal court procedure that helps consumers and businesses get rid of their debts and repay their creditors. If you can prove that you are entitled to it, the bankruptcy court will protect you during your bankruptcy proceeding.

Examples include a job loss followed by an extended period of unemployment, a business failure, a divorce, a period of disability, or a critical illness of yourself or a family member. There are others, but those are the most common. The reader should absolutely state his job loss as the reason for the bankruptcy.

How to write a letter of explanationThe lender's name and address.Your name and your application number.The date you're submitting the letter and expected closing date (if you know it)A short statement that helps an underwriter fully understand your situation in regards to the reason for concern.More items...?

How to write a letter of explanationFacts. Include all the details with correct dates and dollar amounts.Resolution. Explain how and when the situation was resolved.Acknowledge. It's important that the letter outline why the problem won't arise again. Recognize if and how you could have avoided this mistake.

In other words, a letter of explanation is exactly what it sounds like. The lender and their underwriter are asking the borrower to explain something. That could be a change in jobs, a gap in employment, a large deposit into their bank account, a source of self-employed income, or just about anything else.

How to write a letter of explanationThe lender's name and address.Your name and your application number.The date you're submitting the letter and expected closing date (if you know it)A short statement that helps an underwriter fully understand your situation in regards to the reason for concern.More items...?

If you explain that you had financial difficulties in the past, but took steps to resolve the situation, have a job (or proof of steady income) and are able to show you've been responsible with your financial obligations since your bankruptcy, it might be enough to convince them to give you a chance.