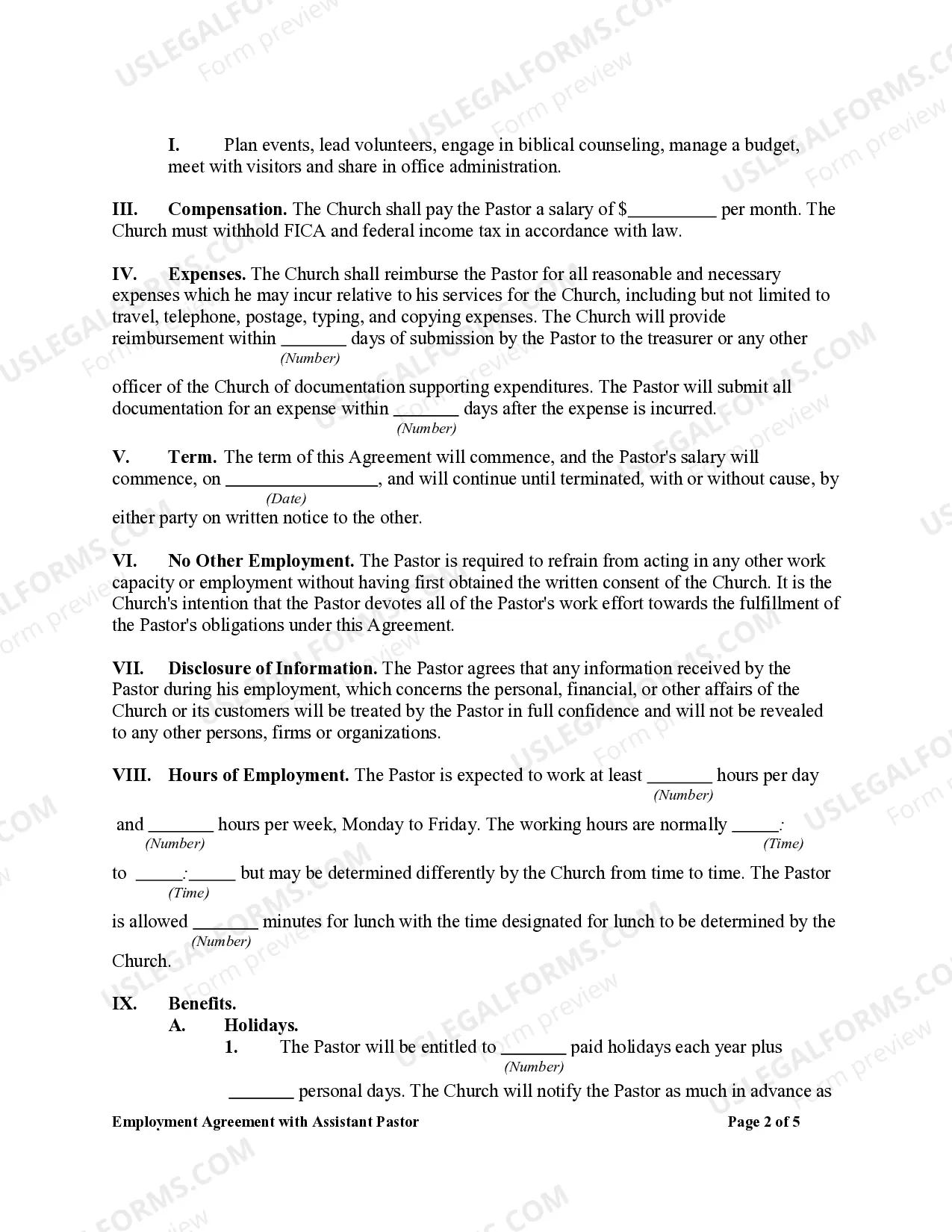

An assistant pastor helps a senior pastor at a church lead others into a growing relationship with Jesus Christ. This typically includes taking on important responsibilities within the church, such as overseeing key leaders and leading a ministry. However, some denominations may put you in this role solely to prepare you to become a senior pastor. Further ordinances regarding who can be a pastor, such as women or individuals without a formal education, are typically determined by the traditions and affiliations of your church.

Colorado Employment Agreement with Assistant Pastor

Description

How to fill out Employment Agreement With Assistant Pastor?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal templates that you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms like the Colorado Employment Agreement with Assistant Pastor in a matter of minutes.

If you already have an account, Log In and download the Colorado Employment Agreement with Assistant Pastor from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously downloaded forms in the My documents section of your account.

Process the payment. Use your credit card or PayPal account to complete the purchase.

Select the format and download the form to your device. Edit. Fill out, modify, and print and sign the downloaded Colorado Employment Agreement with Assistant Pastor. Every template you have added to your account does not have an expiration date and is your property indefinitely. Therefore, if you wish to download or print another copy, simply visit the My documents section and click on the form you need. Access the Colorado Employment Agreement with Assistant Pastor through US Legal Forms, one of the most comprehensive libraries of legal document templates. Utilize thousands of expert and state-specific templates that cater to your business or personal needs and requirements.

- Ensure you have selected the correct form for your city/state.

- Click on the Preview button to review the contents of the form.

- Read the form description to confirm that you have chosen the correct document.

- If the form does not meet your requirements, use the Search box at the top of the page to find a better match.

- If you are satisfied with the form, confirm your choice by clicking the Buy now button.

- Next, select your payment plan and provide your credentials to register for an account.

Form popularity

FAQ

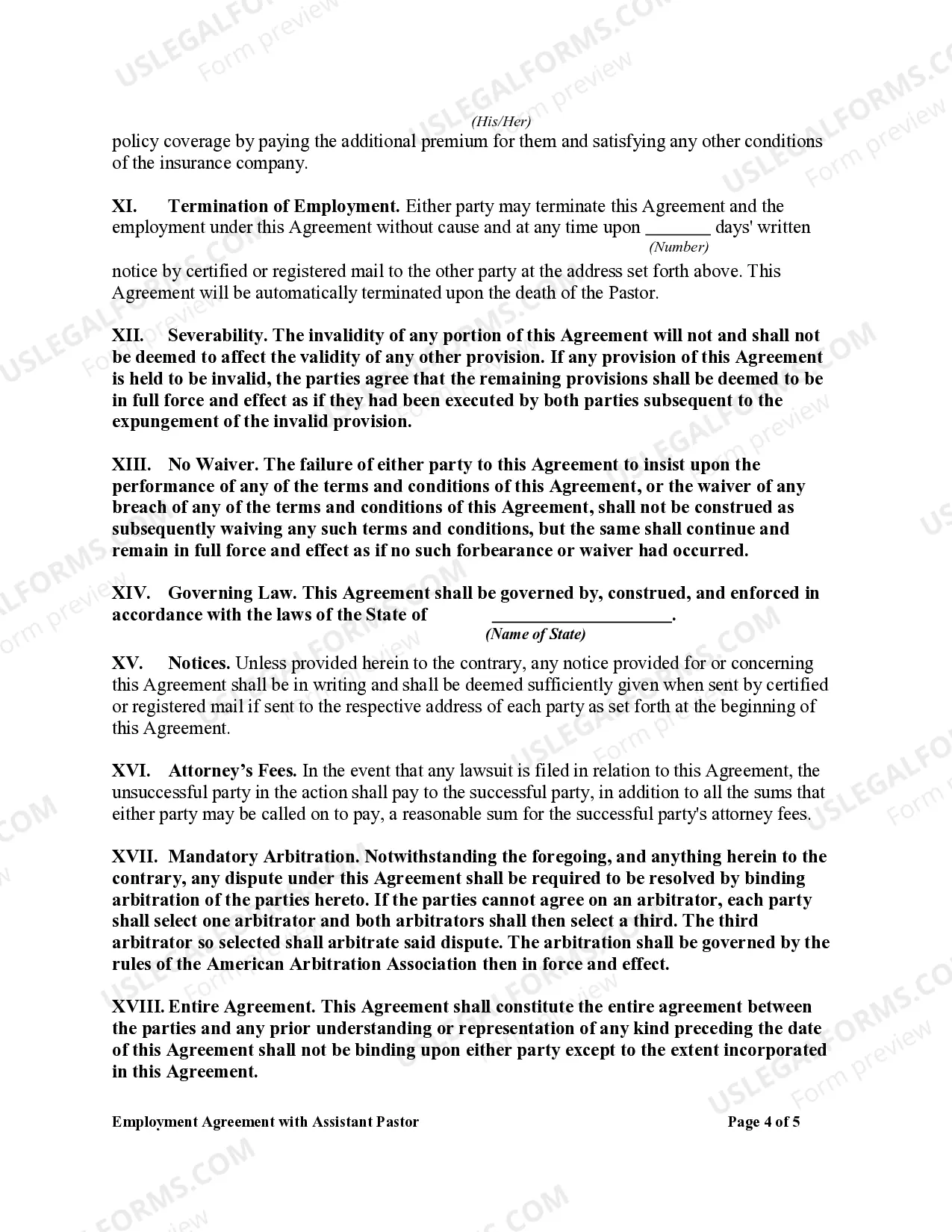

Ministers are not deemed employees, however, if their remuneration (other than by payment in kind) does not consist wholly or mainly of salary or stipend.

While they can be considered an employee of a church, for federal income tax purposes a pastor is considered self-employed by the IRS. Some pastors are considered independent contractors if they aren't affiliated with one specific church, like traveling evangelists.

At-will means that an employer can terminate an employee at any time for any reason, except an illegal one, or for no reason without incurring legal liability. Likewise, an employee is free to leave a job at any time for any or no reason with no adverse legal consequences.

When it comes to Social Security and Medicare taxes, also known as payroll taxes, you are always considered self-employed. Pastors are always self-employed for Social Security taxes and pay under the SECA system.

A licensed, commissioned, or ordained minister is generally the common law employee of the church, denomination, sect, or organization that employs him or her to provide ministerial services.

Ministers are self-employed for Social Security tax purposes with respect to their ministerial services, even though most are treated as employees for federal income tax purposes. Self-employment tax is assessed on taxable compensation and nontaxable housing allowance/parsonage.

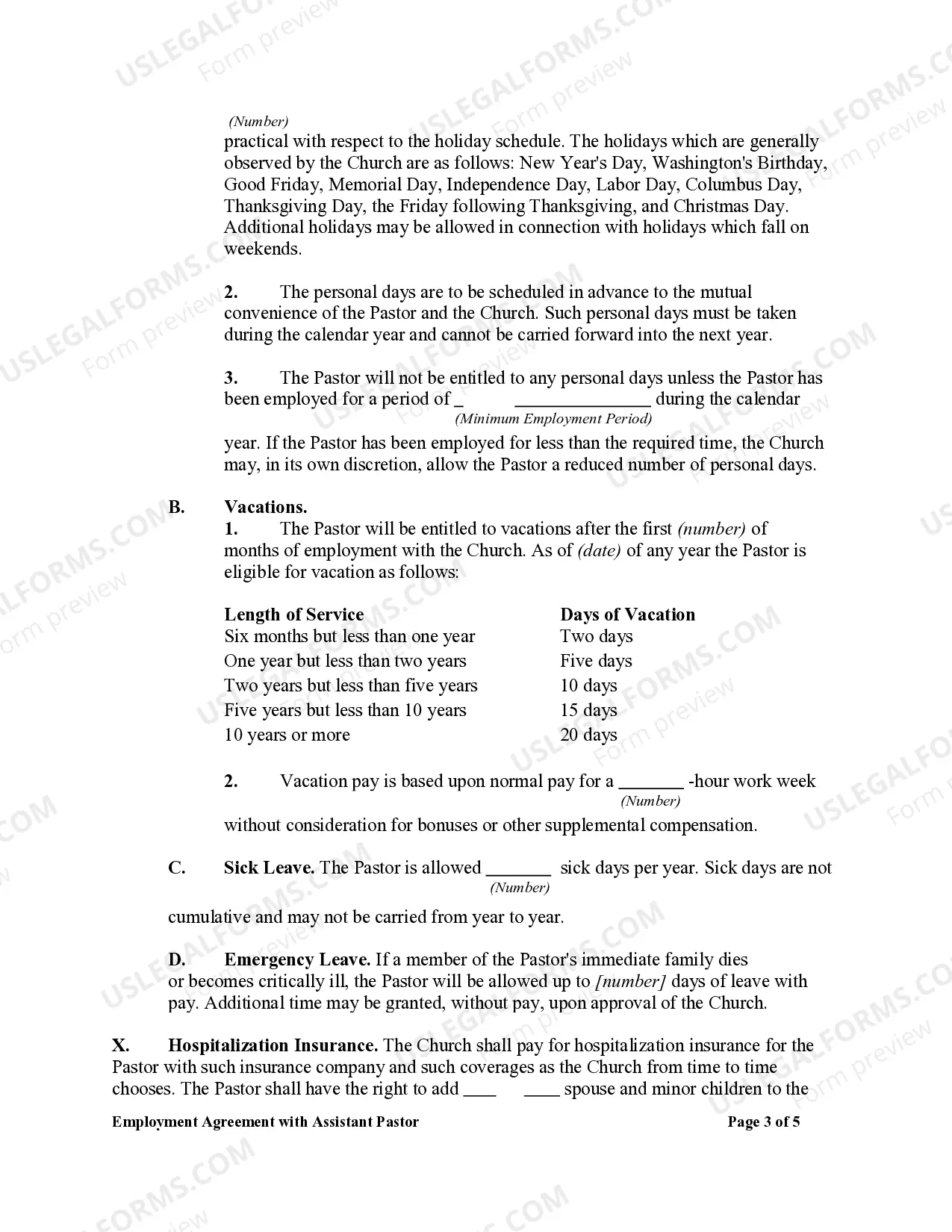

Specific Contract Terms To Include Pay and benefits: Give details of pay rate, pay dates, and benefits provided by the company. Full-time employment: The employee must agree to devote their best efforts to the company's business, not doing work for anyone else during work hours without prior approval.

They expect to work for the church and do what they are asked to do. They serve as an at-will employee meaning that at any time, for any reason they can leave or be let go.

A pastor has a unique dual tax status. While they can be considered an employee of a church, for federal income tax purposes a pastor is considered self-employed by the IRS. Some pastors are considered independent contractors if they aren't affiliated with one specific church, like traveling evangelists.

How to write an employment contractTitle the employment contract.Identify the parties.List the term and conditions.Outline the job responsibilities.Include compensation details.Use specific contract terms.Consult with an employment lawyer.