Subject: Colorado Sample Letter for Corporate Tax Return — Comprehensive Guide and Forms Dear [Company Name], We understand that tax season can be a complex and time-consuming process for corporations like yours. To assist you in accurately filing your corporate tax return to the state of Colorado, we have prepared a comprehensive guide that includes sample letters and forms. This guide aims to simplify the tax filing process, ensuring you are well-prepared and in compliance with Colorado state tax regulations. Colorado is home to a thriving business environment, attracting numerous corporations across various industries. Complying with the state's tax laws is crucial for maintaining a healthy relationship with the local government and avoiding any potential penalties or legal issues. Our sample letter for corporate tax return to Colorado, along with the accompanying forms, is tailored to meet your specific needs. The following are different types of Colorado sample letters for corporate tax return: 1. Colorado C Corporation Tax Return: If your corporation is incorporated in Colorado under Subchapter C of the Internal Revenue Code, you are required to file Form 112, the Colorado C Corporation Income Tax Return. Our sample letter provides you clarity on the necessary information to include, such as identifying information, federal income tax liability, CO alternative minimum tax, tax credits, and more. 2. Colorado S Corporation Tax Return: If your corporation is incorporated in Colorado under Subchapter S of the Internal Revenue Code, you need to file Form 106, the Colorado S Corporation Income Tax Return. Our sample letter outlines the specific data you need to complete the form accurately, including details about distributions, draw and guarantees, and any built-in gains tax implications. 3. Colorado Partnership Tax Return: For partnerships operating in Colorado, it is vital to file Form 106, the Colorado Partnership Information Return. This sample letter caters to partnership tax requirements, providing guidance on partnership income, deductions, credits, distributions, and other necessary details. 4. Colorado Limited Liability Company (LLC) Tax Return: LCS in Colorado may be subject to taxation as either a corporation, a partnership, or a disregarded entity. With various filing options, it is essential to select the appropriate tax return form based on how your LLC is classified for tax purposes. Our sample letter assists you in understanding the requirements for each classification, helping you choose the correct form. In conclusion, our detailed Colorado sample letter for corporate tax return serves as a valuable resource throughout the tax filing process. It provides clarity, reduces the likelihood of errors, and ultimately helps you maximize deductions and credits while staying in compliance with Colorado state tax regulations. Please find the enclosed sample letter for Colorado corporate tax return and related forms. If you have any further queries or require additional assistance, feel free to contact our dedicated team of tax experts who are well-versed in Colorado's tax laws. Thank you for choosing our services, and we wish you a successful tax filing season. Sincerely, [Your Name] [Your Title/Company] [Contact Information]

Colorado Sample Letter for Corporate Tax Return

Description

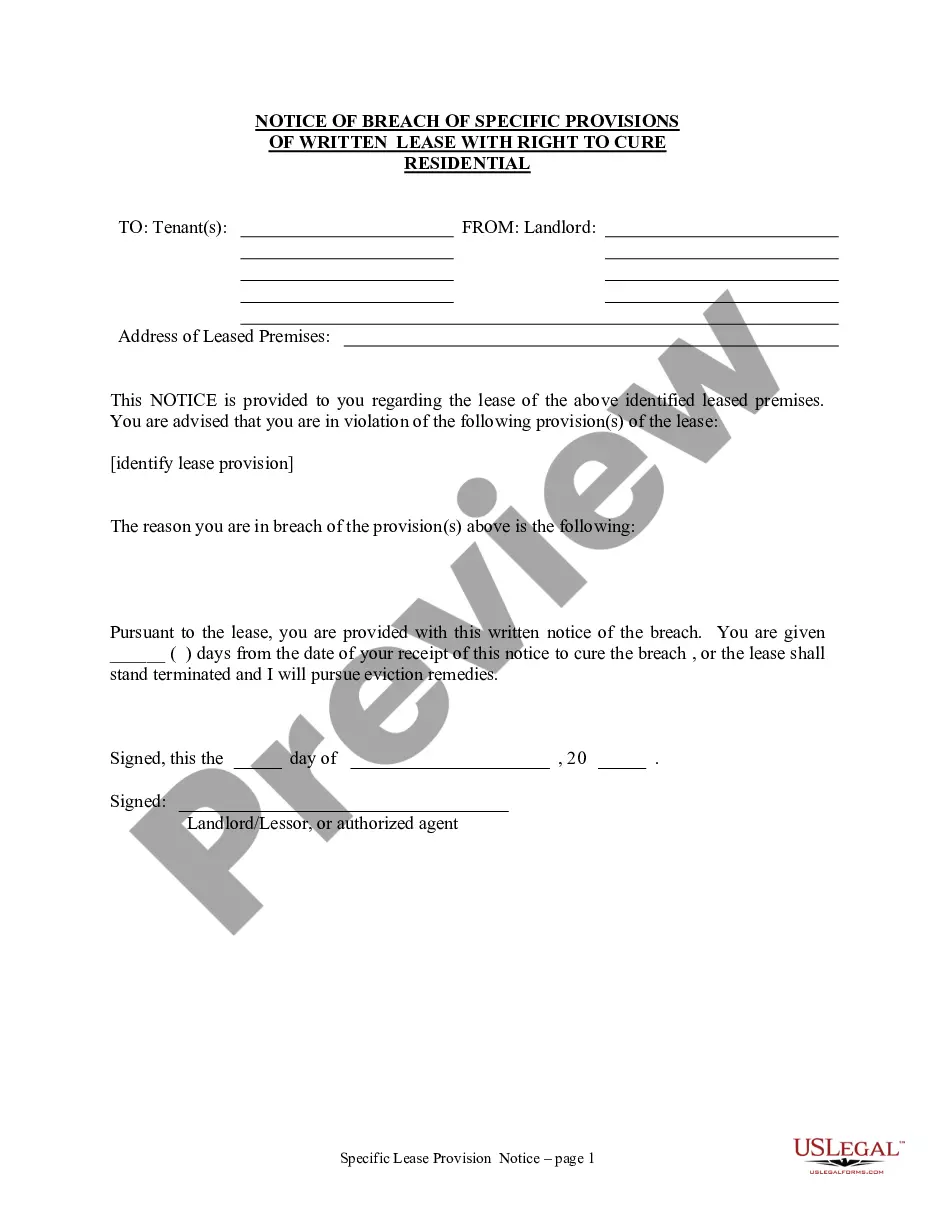

How to fill out Colorado Sample Letter For Corporate Tax Return?

Discovering the right lawful record web template can be a battle. Of course, there are plenty of web templates available online, but how will you discover the lawful kind you require? Make use of the US Legal Forms web site. The services provides 1000s of web templates, including the Colorado Sample Letter for Corporate Tax Return, that you can use for company and private requires. All the types are examined by experts and meet up with federal and state needs.

When you are presently signed up, log in for your account and click the Down load key to have the Colorado Sample Letter for Corporate Tax Return. Make use of your account to search with the lawful types you possess bought formerly. Visit the My Forms tab of your account and acquire yet another version of your record you require.

When you are a new consumer of US Legal Forms, listed here are basic guidelines for you to comply with:

- Very first, make certain you have selected the proper kind for your metropolis/county. You are able to look through the shape using the Review key and browse the shape description to ensure this is the best for you.

- In case the kind does not meet up with your preferences, use the Seach field to get the proper kind.

- Once you are certain that the shape would work, click the Acquire now key to have the kind.

- Choose the pricing program you need and enter in the essential information and facts. Make your account and pay for your order with your PayPal account or charge card.

- Opt for the submit formatting and download the lawful record web template for your product.

- Full, change and produce and indication the acquired Colorado Sample Letter for Corporate Tax Return.

US Legal Forms may be the most significant catalogue of lawful types that you can see different record web templates. Make use of the service to download expertly-manufactured papers that comply with status needs.

Form popularity

FAQ

A domestic corporation (including a Subchapter S corporation) must file an income tax return whether it has taxable income or not, unless it's exempt from filing under section 501.

An S CORPORATION must file Form 106 for any year it is doing business in Colorado. Doing business in a state is defined as having income arising from the activity of one or more employees located in the state; or arising from the fact that real or personal property is located in the state for business purposes.

Colorado has a 4.40 percent corporate income tax rate. There are jurisdictions that collect local income taxes. Colorado also has a 2.90 percent state sales tax rate, a max local sales tax rate of 8.30 percent, and an average combined state and local sales tax rate of 7.78 percent.

In Colorado, on the other hand, as a single-member LLC, you are only required to file federal income tax as the state does not impose a state income tax.

Colorado imposes a tax on the income of any C corporation that is doing business in Colorado. The tax applies generally to every C corporation that is organized or commercially domiciled in Colorado and to every C corporation that has property, payroll, or sales in Colorado in excess of certain thresholds.

Mailing to Colorado Department of Revenue, PO Box 17087, Denver, CO 80217-0087. Visiting one of several Taxpayer Service Locations around the state.

Filing Requirements Any corporation, partnership, joint venture, common trust fund, limited association, pool or working agreement, limited liability company or any other combination of persons or interests, that is required to file a federal income tax return, must file a Colorado Income Tax Return.

No matter what kind of business entity you have, including a corporation, you'll need to provide the following documentation: Estimated tax payment receipts. Year-end balance sheet and profit & loss statement. Year-end business bank account and investment account statements.