Colorado Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for Benefit of Children after the Death of the Wife

Description

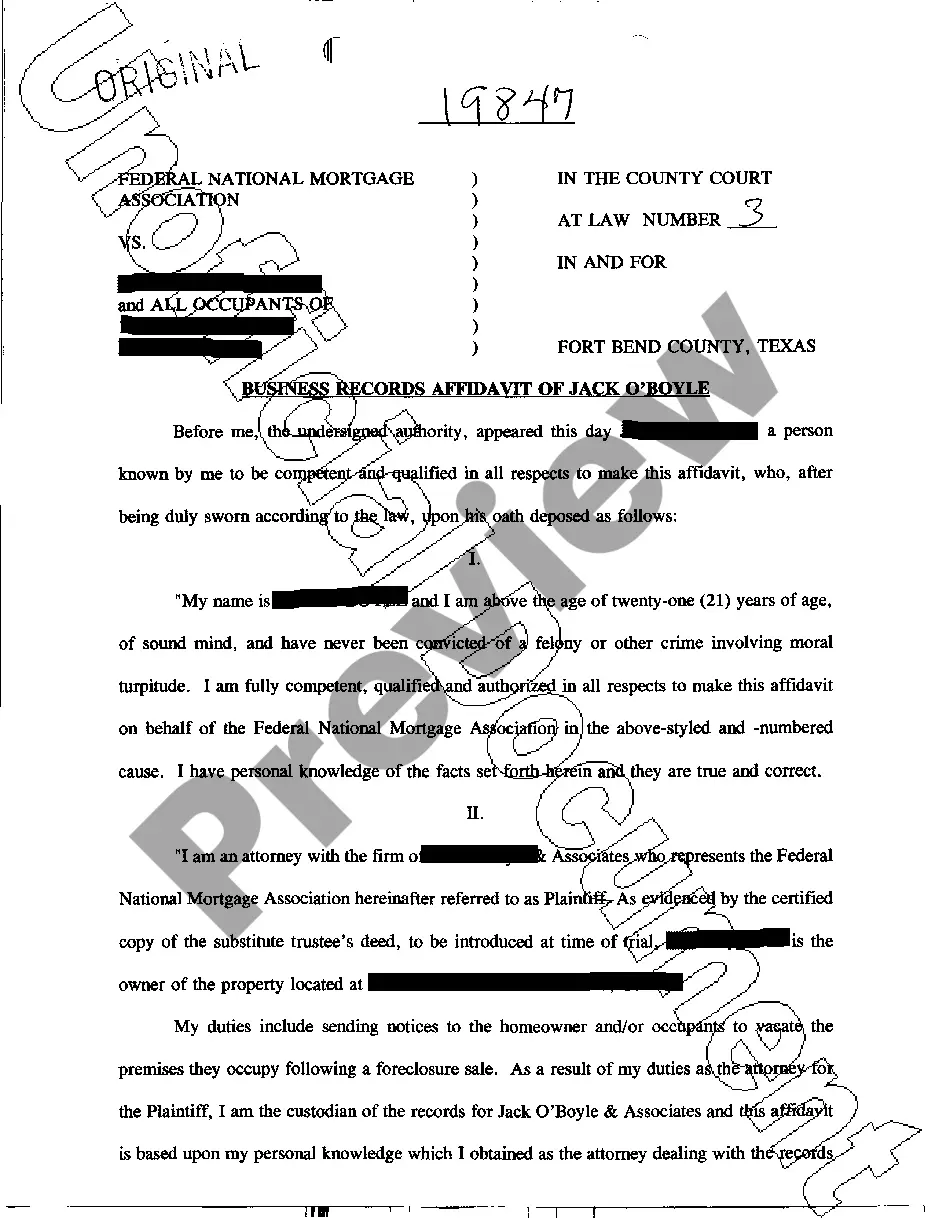

How to fill out Testamentary Trust Of The Residue Of An Estate For The Benefit Of A Wife With The Trust To Continue For Benefit Of Children After The Death Of The Wife?

It is feasible to dedicate hours online attempting to discover the valid document template that satisfies the state and federal requirements you need.

US Legal Forms provides thousands of valid forms that are reviewed by experts.

It is easy to obtain or print the Colorado Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for Benefit of Children after the Death of the Wife from our platform.

If you wish to get another version of the form, use the Search field to find the template that meets your needs and requirements.

- If you have a US Legal Forms account already, you can Log In and click the Download button.

- After that, you can complete, edit, print, or sign the Colorado Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for Benefit of Children after the Death of the Wife.

- Each valid document template you purchase is your own forever.

- To obtain another copy of any purchased form, visit the My documents tab and click the appropriate button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have chosen the correct document template for the county/city of your choice.

- Check the document outline to confirm you have selected the correct form.

- If available, use the Review button to consult the document template as well.

Form popularity

FAQ

Well, because a testamentary trust allows the grantor some control over the assets during his or her lifetime. After the grantor passes away, the testamentary trust, which is considered an irrevocable trust, is created. Irrevocable trusts can sometimes protect assets against judgments and creditors.

The first step in dissolving a revocable trust is to remove all the assets that have been transferred into it. The second step is to fill out a formal revocation form, stating the grantor's desire to dissolve the trust.

Once a trust is irrevocable, a trust beneficiary can neither be added nor removed. In California, there are exceptions to this rule. They include: If everyone named in the trust the trustee, trust beneficiaries and heirs unanimously agree to modify or terminate the trust.

A testamentary trust is created to manage the assets of the deceased on behalf of the beneficiaries. It is also used to reduce estate tax liabilities and ensure professional management of the assets of the deceased.

Living trusts and testamentary trustsA living trust (sometimes called an inter vivos trust) is one created by the grantor during his or her lifetime, while a testamentary trust is a trust created by the grantor's will.

Taxation of Testamentary Trusts Once a testamentary trust has been created, it becomes a taxable entity in its own right and is thus subject to income taxes. If it has $600 or more in annual income, it must file a U.S. Income Tax Return for Estates and Trusts (Form 1041) for that year.

A beneficiary can renounce their interest from the trust and, upon the consent of other beneficiaries, be allowed to exit. A trustee cannot remove a beneficiary from an irrevocable trust. A grantor can remove a beneficiary from a revocable trust by going back to the trust deed codes that allow for the same.

A Bypass Trust is sometimes called a Residual Trust, a Family Trust, or a Tax Avoidance Trust. Typically, the entire estate is divided in half (provided the entire estate is community property) and the decedent's half goes into a Bypass Trust.

Trusts are a crucial element to Estate Planning as they help provide more control over asset distribution after death. Among the various types available, a Testamentary Trust can be one of the best options for those thinking of their young children or grandchildren.