Colorado Shareholders Buy Sell Agreement of Stock in a Close Corporation with Noncompetition Provisions

Description

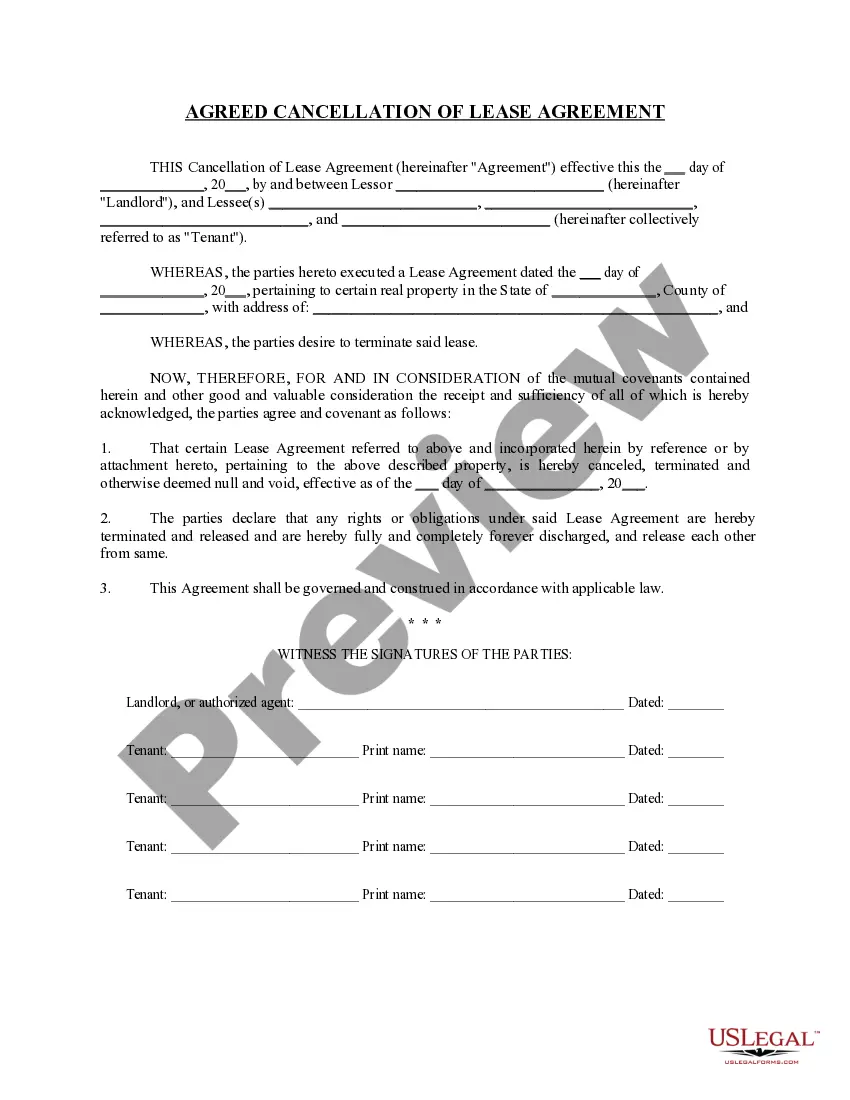

How to fill out Shareholders Buy Sell Agreement Of Stock In A Close Corporation With Noncompetition Provisions?

You can spend hours online searching for the legal document template that meets the federal and state requirements you need.

US Legal Forms offers thousands of legal forms that have been reviewed by experts.

You can easily obtain or print the Colorado Shareholders Buy Sell Agreement of Stock in a Close Corporation with Noncompetition Provisions from our service.

If available, take advantage of the Preview button to view the document template as well. If you wish to find another version of the form, utilize the Search field to locate the template that meets your needs and requirements.

- If you already have a US Legal Forms account, you can Log In and click the Acquire button.

- After that, you can complete, modify, print, or sign the Colorado Shareholders Buy Sell Agreement of Stock in a Close Corporation with Noncompetition Provisions.

- Each legal document template you purchase is your property permanently.

- To get another copy of any purchased form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple guidelines below.

- First, ensure that you have selected the correct document template for the area/city you choose.

- Check the form description to ensure you have chosen the right form.

Form popularity

FAQ

While a Colorado Shareholders Buy Sell Agreement of Stock in a Close Corporation with Noncompetition Provisions offers many benefits, it also has some disadvantages. For example, it can limit a shareholder's ability to sell their shares freely, possibly reducing their market value. Additionally, the costs associated with drafting and enforcing such agreements can be significant. It's vital to weigh these factors against the benefits to make an informed decision.

What is a Buy-Sell Agreement? Buy-sell agreements, also called buyout agreements and shareholder agreements, are legally binding documents between two business partners that govern how business interests are treated if one partner leaves unexpectedly.

The two most common types of buy-sell agreements are entity-purchase and cross-purchase agreements.

The business owners individually own the policies insuring each other's lives. When a business owner dies, the proceeds are paid to those surviving owners who hold one or more policies on the deceased owner, and these surviving owners buy the shares from the deceased owner's personal representative.

Your agreement should include detailed information about your business' worth. It is important for these numbers to be as accurate as possible. Because your company's value may not remain the same, you should consider having it professionally appraised or using a clearly defined formula to value the business.

There are four common buyout structures:Traditional cross purchase plan. Each owner who is left in the business agrees to purchase the co-owner's shares if that individual dies or leaves the business.Entity redemption plan.One-way buy sell plan.Wait-and-see buy sell plan.

Entity-purchase agreement Under an entity-purchase plan, the business purchases an owner's entire interest at an agreed-upon price if and when a triggering event occurs. If the business is a corporation, the plan is referred to as a stock redemption agreement.

The four types of buy sell agreements are:Cross-purchase agreement.Entity purchase agreement.Wait-and-See.Business-continuation general partnership.

Buy-sell agreements, also called buyout agreements and shareholder agreements, are legally binding documents between two business partners that govern how business interests are treated if one partner leaves unexpectedly.

The purpose of a buy-and-sell agreement is to provide the surviving co-owners with cash to purchase the interest of a deceased co-owner. According to the agreement, each co-owner takes out life cover on the other co-owners' lives.