Colorado Stock Option Agreement between Corporation and Officer or Key Employee

Description

How to fill out Stock Option Agreement Between Corporation And Officer Or Key Employee?

If you need to acquire, download, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms accessible online.

Utilize the website's straightforward and convenient search feature to find the documents you require.

Numerous templates for business and personal use are organized by categories and states, or keywords. Use US Legal Forms to retrieve the Colorado Stock Option Agreement between Corporation and Officer or Key Employee with just a few clicks.

Step 5. Process the transaction. You can use your Visa, Mastercard, or PayPal account to complete the payment.

Step 6. Choose the format of the legal form and download it to your device. Step 7. Fill out, modify, and print or sign the Colorado Stock Option Agreement between Corporation and Officer or Key Employee.

- If you are currently a US Legal Forms user, sign in to your account and click the Download button to access the Colorado Stock Option Agreement between Corporation and Officer or Key Employee.

- You can also access documents you previously saved in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure that you have selected the form for the correct region/state.

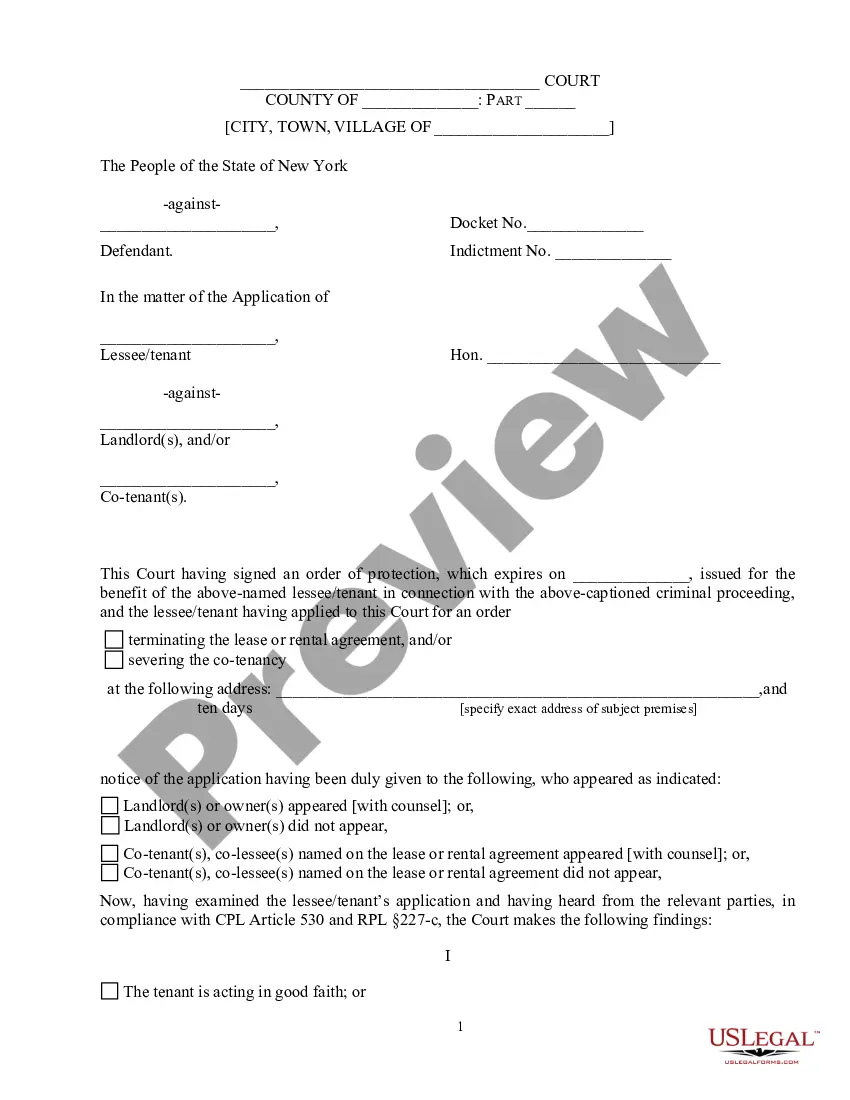

- Step 2. Use the Review option to examine the form's content. Be sure to read through the summary.

- Step 3. If you are unsatisfied with the form, utilize the Search area at the top of the screen to find other variants in the legal document format.

- Step 4. Once you have found the form you need, select the Buy now button. Choose the payment plan you prefer and provide your details to register for the account.

Form popularity

FAQ

The $100,000 limit for incentive stock options pertains to the maximum value of options that can be granted to an employee in any year, eligible for special tax treatment. If the value goes beyond this threshold, the excess options are typically treated as non-qualified. Clarifying this point is vital for a Colorado Stock Option Agreement between Corporation and Officer or Key Employee to ensure compliance with IRS regulations and enable strategic financial planning.

Key Takeaways. Employee stock options are offered by companies to their employees as equity compensation plans. These grants come in the form of regular call options and give an employee the right to buy the company's stock at a specified price for a finite period of time.

In a private company setting, after the founders have been issued fully vested or restricted stock under their stock purchase agreements, the employees, consultants, advisors and directors who are subsequently hired commonly receive equity compensation through stock options.

Stock options are an employee benefit that grants employees the right to buy shares of the company at a set price after a certain period of time. Employees and employers agree ahead of time on how many shares they can purchase and how long the vesting period will be before they can buy the stock.

A stock option is a contract that gives its owner the right, but not the obligation, to buy or sell shares of a corporation's stock at a predetermined price by a specified date. Private company stock options are call options, giving the holder the right to purchase shares of the company's stock at a specified price.

Basically, as the company profits, employees profit as well. Thus, stock options are a way to create a loyal partnership with employees. Stock options are a way for companies to motivate employees to be more productive. Through stock options, employees receive a percentage of ownership in the company.

The phenomena of stock options is more prevalent in start-up companies which can not afford to pay huge salaries to its employees but are willing to share the future prosperity of the company. In such cases the employees are given the stock options as part of the compensation package.

Eligibility. Excluding directors and promoters of a company who have more than 10% equity in the company, every employee is eligible for ESOP. However, an employee should meet any of the following criteria. A full-time or part-time Director of the Company.

Offering ESOP in Private Limited CompanyESOP can be provided to employees, as defined below: A permanent employee of the company who has been working in India or outside India; or. A Director of the company, whether a whole-time director or not, but excluding independent director; or.

Stock options are a form of compensation. Companies can grant them to employees, contractors, consultants and investors. These options, which are contracts, give an employee the right to buy, or exercise, a set number of shares of the company stock at a preset price, also known as the grant price.