Colorado Gift Agreement with Institution

Description

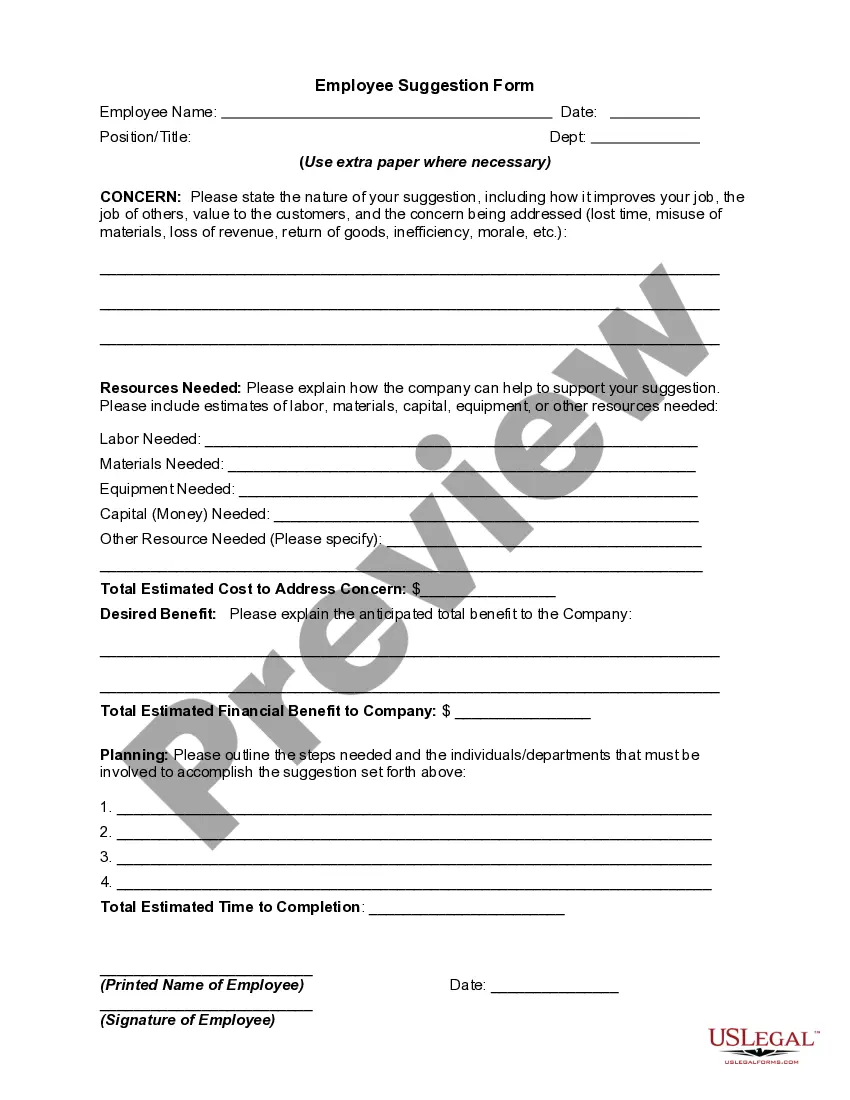

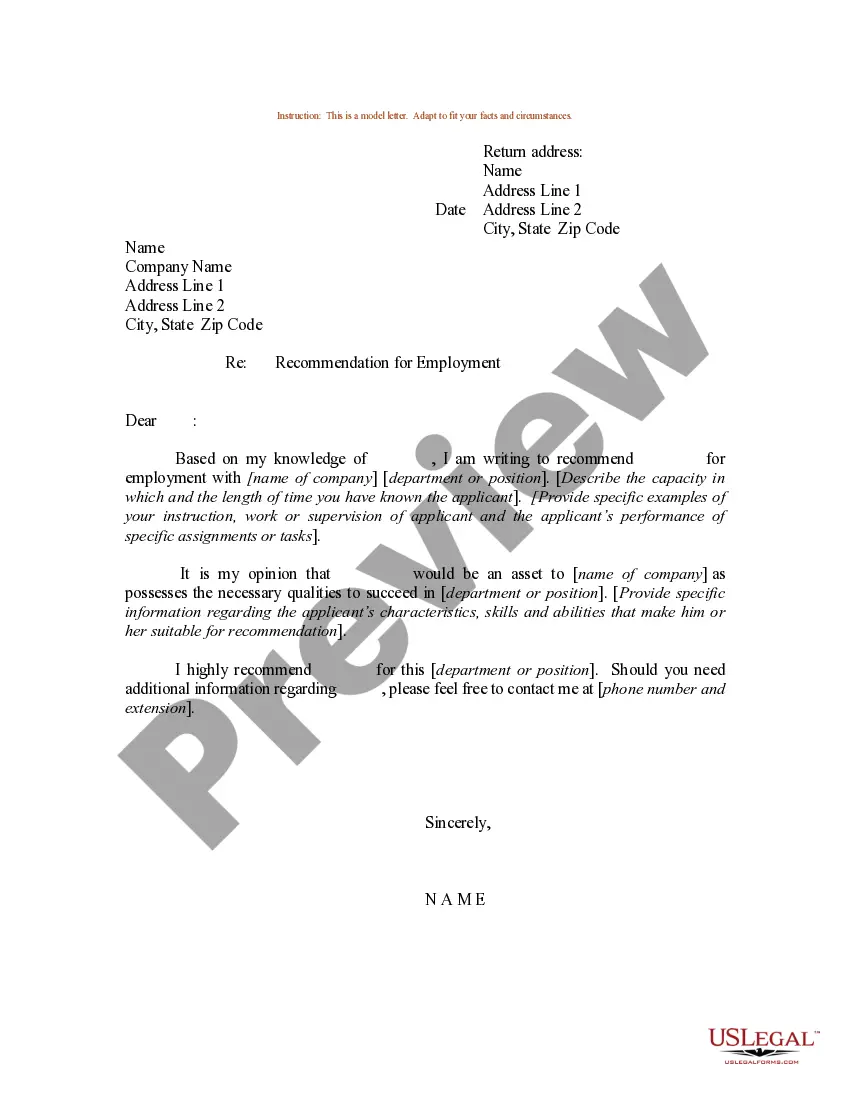

How to fill out Gift Agreement With Institution?

You might spend numerous hours online searching for the appropriate legal format that meets the state and federal requirements you desire.

US Legal Forms offers a vast array of legal forms that have been evaluated by experts.

You can easily download or print the Colorado Gift Agreement with Institution from our service.

To find another version of the form, use the Search area to locate the format that fits your needs and requirements.

- If you possess a US Legal Forms account, you can Log In and click the Download button.

- Afterward, you can complete, modify, print, or sign the Colorado Gift Agreement with Institution.

- Every legal format you buy is yours forever.

- To obtain another copy of any purchased form, navigate to the My documents tab and click the appropriate button.

- If this is your first time using the US Legal Forms site, follow the simple instructions below.

- First, ensure that you have selected the correct format for the state/city of your choice.

- Review the form details to guarantee you have chosen the right format.

Form popularity

FAQ

A gift agreement documents a gift has been made by the donor to a charitable organization and is legally enforceable. A pledge agreement records a commitment by a donor to make a gift at a future time.

In California, like most other states, charitable pledges are analyzed as a matter of contract law. This means that pledges are not enforceable unless: (1) the pledgor receives consideration for making the pledge; or (2) the charity has detrimentally relied on the pledge.

A donation agreement will include the names of the parties, a description of the donation, whether a receipt that was given, and possibly the intended use for the donation. The agreement should also include a revocability (whether the donation can be taken back) section and define expense responsibility.

A gift to be valid must be made by a person with his free consent and not under compulsion. The donor must not be insane but a mere weakness of the intellect would not be sufficient to invalidate the gift if the donor was able to apprehend the transaction.

In order to determine whether the pledge is enforceable, attention needs to be paid to the particular language of the written instrument. If the charitable pledge is an enforceable contract, it is binding on the donor and, if the donor is an individual, the pledge is enforceable on the donor's estate.

Goals of your written gift agreementa donation subject to restrictions that allow the donor control over the future use of the donation.a donation to be held, invested or disbursed pursuant to certain agreed-upon terms.a donation that will result in naming a property or project after the donor.

A charitable pledge is enforceable if it is a legally binding contract. A legally binding contract exists when there is agreement between the parties and there has been consideration given in exchange for the pledge.

Gift agreements are completed and signed to prevent misunderstandings, and show your donor that you care and that they are valued and important. As a nonprofit organization must keep accurate records on donations received, so must a donor keep records of donations they've made especially when it comes to tax time.

A gift agreement documents a gift has been made by the donor to a charitable organization and is legally enforceable. A pledge agreement records a commitment by a donor to make a gift at a future time.