A Colorado Gift Agreement with Institution is a legal document that outlines the terms and conditions involved in making a gift to an institution located in the state of Colorado. This agreement serves as a contractual agreement between the donor and the institution, ensuring that both parties are on the same page regarding the donation and its usage. The Colorado Gift Agreement with Institution typically includes important details such as the name and contact information of the donor and the institution. It also outlines the nature and purpose of the gift, whether it is a monetary contribution, an in-kind donation, or any other form of valuable asset. Additionally, the agreement specifies how the gift will be utilized by the institution. This may include funding scholarships, establishing an endowment, purchasing equipment, supporting research initiatives, or for general operating expenses. The donor may have specific wishes regarding the allocation of the gift, and these preferences are typically addressed within the agreement. Furthermore, the agreement states the tax implications of the gift for the donor and ensures compliance with state and federal regulations. It outlines any potential tax benefits that the donor may be eligible for and provides relevant documentation to support the donor's tax deductions. There can be various types of Colorado Gift Agreements with Institutions, depending on the specific circumstances and objectives of the donor. Some common types include: 1. Endowment Agreement: This type of gift agreement establishes a permanent fund where the principal amount is invested, and only the generated income or a specified portion of it is used for the institution's ongoing support. 2. Scholarships or Educational Grants Agreement: This agreement outlines the terms and conditions for providing financial assistance to students, such as tuition fees, books, or other related expenses, ensuring that the funds are used strictly for educational purposes. 3. Capital Improvement Agreement: This type of gift agreement is focused on supporting the institution's infrastructure development, construction projects, or the renovation of existing facilities. 4. Research Funding Agreement: A gift agreement specifically dedicated to supporting research activities and projects conducted by the institution, aimed at advancing scientific knowledge or addressing specific societal issues. 5. Program Support Agreement: This agreement is tailored to provide financial resources for specific programs or initiatives within the institution, such as art or cultural programs, community outreach, or athletic programs. In conclusion, a Colorado Gift Agreement with Institution encompasses a comprehensive framework outlining the terms, conditions, and purpose of a gift to an institution located within the state. It ensures that the intentions of the donor are respected and provides a clear understanding of how the gift will be utilized by the institution for the betterment of its mission and the communities it serves.

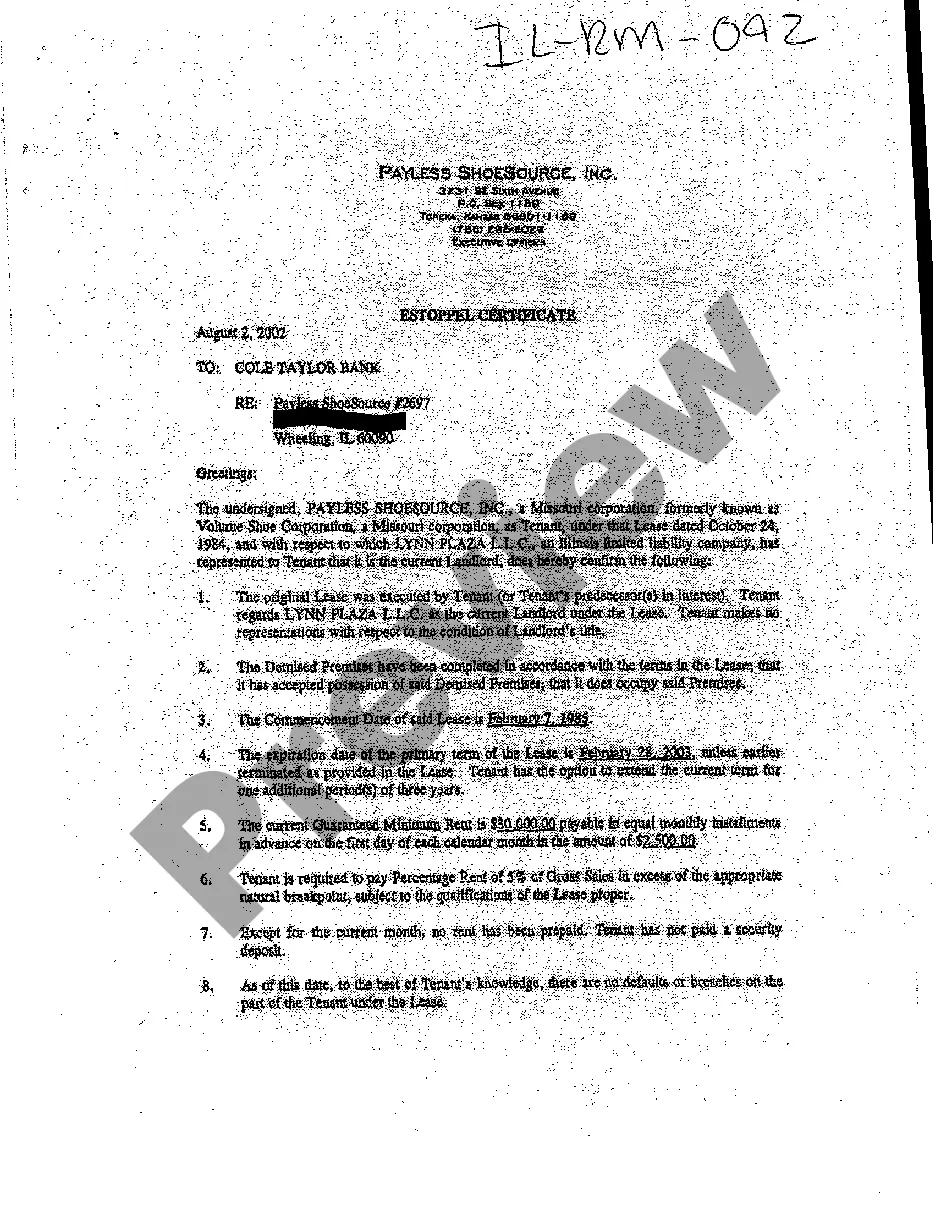

Colorado Gift Agreement with Institution

Description

How to fill out Colorado Gift Agreement With Institution?

You may commit several hours on-line looking for the lawful file format that suits the state and federal needs you want. US Legal Forms gives a large number of lawful kinds that are examined by pros. You can actually download or produce the Colorado Gift Agreement with Institution from our assistance.

If you have a US Legal Forms account, you are able to log in and click the Download key. Following that, you are able to total, change, produce, or indication the Colorado Gift Agreement with Institution . Every single lawful file format you purchase is the one you have eternally. To acquire another duplicate for any acquired type, go to the My Forms tab and click the related key.

Should you use the US Legal Forms site initially, keep to the simple directions beneath:

- Initial, ensure that you have chosen the proper file format for the state/metropolis of your choosing. Look at the type information to make sure you have selected the appropriate type. If offered, use the Review key to search with the file format too.

- In order to discover another edition from the type, use the Lookup area to obtain the format that meets your needs and needs.

- Once you have discovered the format you want, simply click Purchase now to proceed.

- Select the costs strategy you want, enter your credentials, and sign up for a merchant account on US Legal Forms.

- Total the deal. You may use your charge card or PayPal account to purchase the lawful type.

- Select the formatting from the file and download it to the gadget.

- Make adjustments to the file if required. You may total, change and indication and produce Colorado Gift Agreement with Institution .

Download and produce a large number of file themes using the US Legal Forms site, that offers the greatest collection of lawful kinds. Use professional and condition-specific themes to tackle your company or specific requirements.

Form popularity

FAQ

A gift agreement documents a gift has been made by the donor to a charitable organization and is legally enforceable. A pledge agreement records a commitment by a donor to make a gift at a future time.

In California, like most other states, charitable pledges are analyzed as a matter of contract law. This means that pledges are not enforceable unless: (1) the pledgor receives consideration for making the pledge; or (2) the charity has detrimentally relied on the pledge.

A donation agreement will include the names of the parties, a description of the donation, whether a receipt that was given, and possibly the intended use for the donation. The agreement should also include a revocability (whether the donation can be taken back) section and define expense responsibility.

A gift to be valid must be made by a person with his free consent and not under compulsion. The donor must not be insane but a mere weakness of the intellect would not be sufficient to invalidate the gift if the donor was able to apprehend the transaction.

In order to determine whether the pledge is enforceable, attention needs to be paid to the particular language of the written instrument. If the charitable pledge is an enforceable contract, it is binding on the donor and, if the donor is an individual, the pledge is enforceable on the donor's estate.

Goals of your written gift agreementa donation subject to restrictions that allow the donor control over the future use of the donation.a donation to be held, invested or disbursed pursuant to certain agreed-upon terms.a donation that will result in naming a property or project after the donor.

A charitable pledge is enforceable if it is a legally binding contract. A legally binding contract exists when there is agreement between the parties and there has been consideration given in exchange for the pledge.

Gift agreements are completed and signed to prevent misunderstandings, and show your donor that you care and that they are valued and important. As a nonprofit organization must keep accurate records on donations received, so must a donor keep records of donations they've made especially when it comes to tax time.

A gift agreement documents a gift has been made by the donor to a charitable organization and is legally enforceable. A pledge agreement records a commitment by a donor to make a gift at a future time.