A Colorado Partnership Agreement Re Land is a legal document that defines the rights, obligations, and responsibilities of individuals or entities who form a partnership to collectively invest in or manage land in the state of Colorado. This agreement establishes the terms and conditions under which the partners will allocate resources, make decisions, and share profits or losses related to the land investment. Colorado offers various types of partnership agreements for land, depending on the specific objectives and requirements of the partners involved. These agreements may include: 1. General Partnership Agreement: This is the most common type of partnership agreement, where each partner contributes capital, labor, or expertise to the land investment and shares in the profits or losses according to their agreed-upon percentage. 2. Limited Partnership Agreement: In this type of agreement, there are general partners who actively manage the land investment and limited partners who solely contribute capital without actively participating in management decisions. Limited partners have limited liability and are not personally liable for the partnership's debts or obligations. 3. Limited Liability Partnership Agreement: This agreement provides partners with limited personal liability protection. It allows partners to avoid personal responsibility for the actions, debts, or liabilities of other partners within the partnership. 4. Joint Venture Agreement: Although not strictly a partnership agreement, a joint venture agreement is commonly used for land investments in Colorado. It is a contractual arrangement between two or more parties to pool resources, share risks, and jointly undertake a particular project related to land acquisition, development, or management. The Colorado Partnership Agreement Re Land addresses several key elements necessary for the smooth functioning of the partnership, which may include: 1. Purpose and Objectives: Clearly defining the purpose and objectives of the partnership, whether it's for commercial real estate development, land acquisition, conservation, or any other specific endeavor. 2. Contributions and Responsibilities: Stating the nature and value of each partner's contribution to the land investment, such as capital, property, expertise, or labor. Roles, responsibilities, and decision-making authority should also be outlined. 3. Profit and Loss Distribution: Specifying how the profits or losses from the partnership's land investment will be allocated among the partners. This may be based on the percentage of capital contributed or as agreed upon by the partners. 4. Management and Decision-Making: Detailing how management decisions will be made, whether by majority vote, unanimous consent, or through designated managing partners. Defining decision-making processes related to land use, leases, development plans, or any other significant matters is crucial. 5. Duration and Termination: Establishing the duration of the partnership and outlining provisions for termination or dissolution. This includes withdrawal of partners, death, bankruptcy, or any other event that might trigger dissolution. 6. Dispute Resolution: Determining the method of resolving disputes that may arise among the partners, such as negotiation, mediation, or arbitration. A well-defined dispute resolution process helps prevent legal conflicts and ensures a smoother partnership operation. Colorado Partnership Agreement Re Land is a vital legal instrument that aids in establishing a clear understanding among partners involved in land investments. It provides a framework for collaboration, division of responsibilities, and distribution of profits or losses. Depending on the partnership's structure and goals, partners can choose the most appropriate type of partnership agreement to best suit their needs and protect their interests.

Colorado Partnership Agreement Re Land

Description

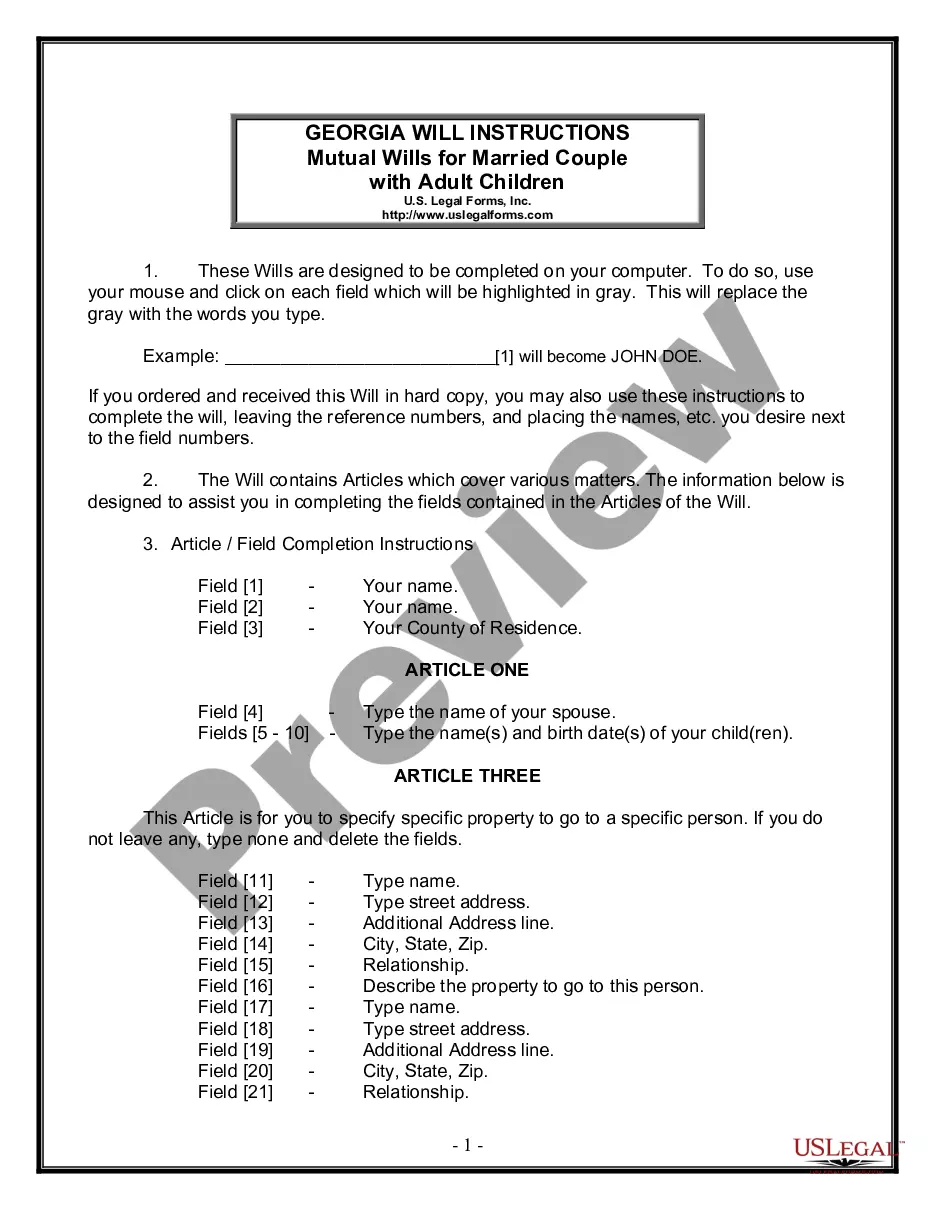

How to fill out Colorado Partnership Agreement Re Land?

You can devote time on the Internet trying to find the authorized papers template which fits the state and federal specifications you need. US Legal Forms supplies a huge number of authorized types that are evaluated by specialists. You can easily acquire or produce the Colorado Partnership Agreement Re Land from my service.

If you have a US Legal Forms account, you are able to log in and click the Acquire option. Following that, you are able to complete, change, produce, or sign the Colorado Partnership Agreement Re Land. Each and every authorized papers template you buy is your own property permanently. To have one more backup for any bought kind, go to the My Forms tab and click the related option.

If you are using the US Legal Forms internet site the very first time, keep to the simple instructions listed below:

- Very first, make sure that you have chosen the right papers template for your area/metropolis that you pick. Look at the kind outline to ensure you have picked out the right kind. If readily available, use the Preview option to look through the papers template too.

- If you want to find one more variation of your kind, use the Search discipline to obtain the template that meets your needs and specifications.

- When you have discovered the template you would like, just click Buy now to carry on.

- Select the prices prepare you would like, key in your references, and sign up for an account on US Legal Forms.

- Total the purchase. You may use your Visa or Mastercard or PayPal account to pay for the authorized kind.

- Select the structure of your papers and acquire it to your product.

- Make alterations to your papers if needed. You can complete, change and sign and produce Colorado Partnership Agreement Re Land.

Acquire and produce a huge number of papers layouts making use of the US Legal Forms site, that offers the biggest collection of authorized types. Use skilled and state-certain layouts to take on your organization or person needs.

Form popularity

FAQ

A partnership has no separate legal personality and it cannot therefore own property and it will be owned by the individual property owning partners. The Land Registry will allow up to four property owning partners to be named at the Land Registry as legal owners.

Because a partnership is not a legal person, it cannot acquire or hold a registered interest in real property. In order to acquire and hold real property, the partnership requires an individual or corporation to become a registered owner.

Here are five clauses every partnership agreement should include:Capital contributions.Duties as partners.Sharing and assignment of profits and losses.Acceptance of liabilities.Dispute resolution.

A partnership agreement need only be a contract/agreement signed by the parties (sometimes referred to as a simple contract 'under hand') unless there is some part of the agreement that relates to the transfer of property, in which case the agreement must take the form of a deed note 5.

Such partnerships have no ownership restrictions, meaning that the owners can be people, corporations, LLCs, or any other kind of business.

In community property states, including California, spouses and registered domestic partners take title as community property unless they elect otherwise. Each spouse has a half-interest in the property, and equal control over the property's management and use. To sell the property, both spouses must act together.

Because a partnership is not a legal person, it cannot acquire or hold a registered interest in real property. In order to acquire and hold real property, the partnership requires an individual or corporation to become a registered owner.

8 things your small business partnership agreement should includeWhat each business partner will contribute.How finances will be managed.Distribution of profits and losses.A process for dispute resolution.A non-compete clause.A non-disclosure confidentiality clause.A non-solicitation clause.More items...?

A business partnership is when two or more people run a business together to make a profit. It is a different type of business to a limited company, which is run by shareholders. Within that environment, a partnership agreement is a legally binding agreement between all business partners.

A partnership deed normally contains the following clauses:Name of the firm.Nature of the firm's business.The principal place of business.Duration of partnership, if any.Amount of capital to be contributed by each partner.The amount which can be withdrawn by each partner.The profit-sharing ratio.More items...?