A Colorado Testamentary Trust Provision for the Establishment of a Trust for a Charitable Institution for the Care and Treatment of Disabled Children is a legal document that allows individuals to set up a trust in their will specifically designated for a charitable institution catering to the needs of disabled children. This provision ensures that the trust is established after the individual's death and is legally binding in the state of Colorado. The Colorado Testamentary Trust Provision for the Establishment of a Trust for a Charitable Institution for the Care and Treatment of Disabled Children serves as a way to support the ongoing care, treatment, and wellbeing of disabled children by providing them with the necessary resources and services. This provision enables individuals to leave a lasting legacy by ensuring that their assets are used to benefit the charitable organization dedicated to disabled children. There may be different types of Colorado Testamentary Trust Provisions for the Establishment of a Trust for a Charitable Institution for the Care and Treatment of Disabled Children, depending on an individual's specific intentions and the needs of the charitable institution. Some possible variations or considerations include: 1. Discretionary Trust: This type of trust gives the trustee discretion to determine how the trust funds are allocated among various programs and services offered by the charitable institution. It allows flexibility in addressing the changing needs of disabled children. 2. Specific Purpose Trust: In this type of trust, the assets are specifically earmarked for a particular program or project within the charitable institution that focuses on the care and treatment of disabled children. This ensures that funds are directed towards a specific cause or initiative. 3. Restricted Trust: A restricted trust imposes certain limitations on how the funds can be used, ensuring they are solely dedicated to supporting the care and treatment of disabled children. This type of trust may have specific guidelines regarding the use of funds, such as funding research, therapies, medical equipment, or educational programs. 4. Revocable Trust: A revocable trust allows individuals to modify or revoke the trust during their lifetime. This flexibility can be advantageous in case of changes in circumstances or if there is a need to revise the beneficiaries or the charitable institution named as the recipient. It is crucial to consult with an experienced estate planning attorney in Colorado to understand the legal requirements and options available when drafting a Testamentary Trust Provision for the Establishment of a Trust for a Charitable Institution for the Care and Treatment of Disabled Children. By doing so, individuals can ensure that their wishes are properly executed, and disabled children benefit from their philanthropic intentions.

Colorado Testamentary Trust Provision for the Establishment of a Trust for a Charitable Institution for the Care and Treatment of Disabled Children

Description

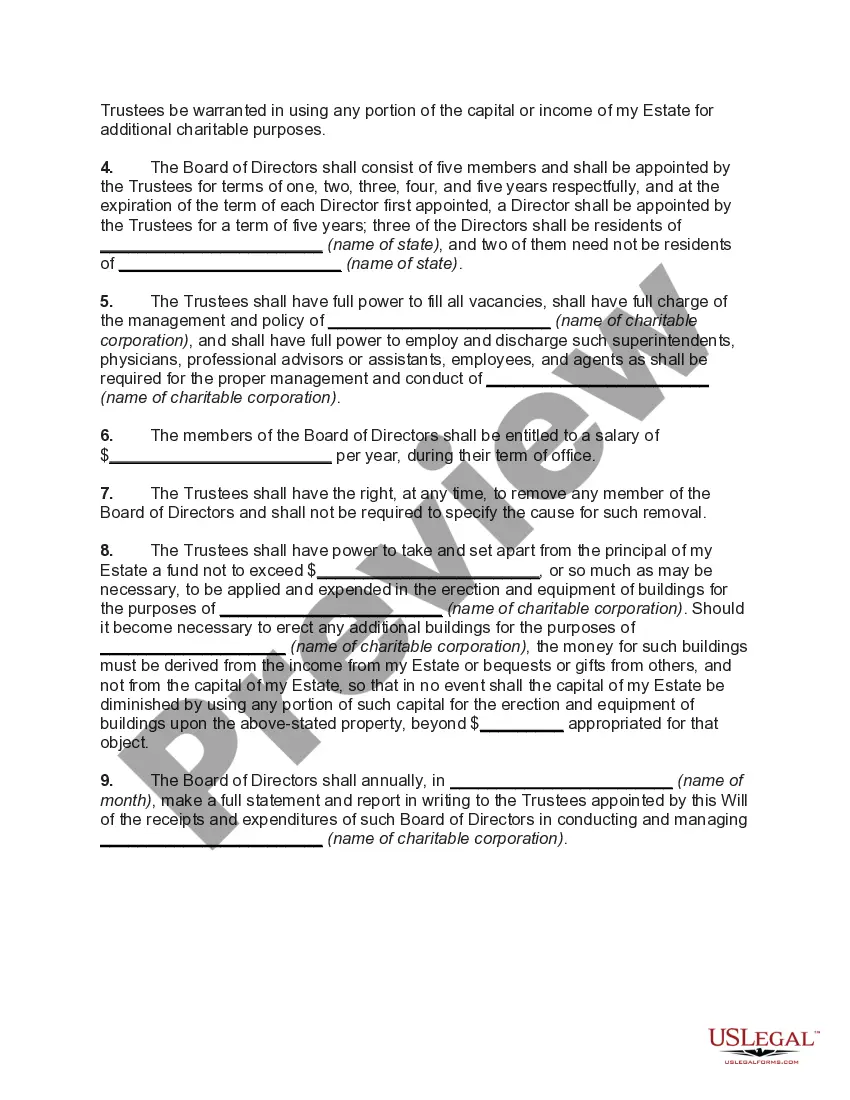

How to fill out Colorado Testamentary Trust Provision For The Establishment Of A Trust For A Charitable Institution For The Care And Treatment Of Disabled Children?

Are you in a place in which you will need papers for possibly company or specific reasons just about every time? There are plenty of legitimate record web templates available on the Internet, but finding ones you can rely on isn`t straightforward. US Legal Forms gives 1000s of type web templates, just like the Colorado Testamentary Trust Provision for the Establishment of a Trust for a Charitable Institution for the Care and Treatment of Disabled Children, that happen to be created in order to meet state and federal demands.

If you are previously acquainted with US Legal Forms website and possess an account, simply log in. Following that, you can down load the Colorado Testamentary Trust Provision for the Establishment of a Trust for a Charitable Institution for the Care and Treatment of Disabled Children format.

Unless you offer an bank account and want to begin using US Legal Forms, abide by these steps:

- Find the type you will need and ensure it is to the proper city/area.

- Utilize the Preview switch to check the form.

- See the information to ensure that you have chosen the right type.

- When the type isn`t what you`re looking for, utilize the Lookup area to find the type that meets your needs and demands.

- Whenever you get the proper type, click Get now.

- Opt for the rates prepare you would like, fill in the required details to make your money, and pay for an order with your PayPal or charge card.

- Pick a convenient document formatting and down load your version.

Locate all of the record web templates you might have purchased in the My Forms food list. You may get a extra version of Colorado Testamentary Trust Provision for the Establishment of a Trust for a Charitable Institution for the Care and Treatment of Disabled Children whenever, if needed. Just click on the essential type to down load or print out the record format.

Use US Legal Forms, one of the most substantial variety of legitimate forms, to save some time and steer clear of blunders. The services gives expertly manufactured legitimate record web templates which can be used for a variety of reasons. Make an account on US Legal Forms and start making your lifestyle easier.