A Colorado Granter Retained Income Trust with Division into Trusts for Issue after Term of Years is an estate planning tool that allows the granter to transfer assets to a trust while still retaining income from those assets for a specified period of time. It is designed to minimize estate taxes and maximize wealth transfer to future generations. This type of trust is commonly used by individuals who have a significant estate and want to reduce their estate tax liability while still enjoying a stream of income during their lifetime. By transferring assets to the trust, the granter removes them from their taxable estate, potentially reducing the estate tax burden. The trust is divided into two parts: the income interest and the remainder interest. The granter retains the income interest, which means they continue to receive income generated by the trust assets. The remainder interest is held for the benefit of the granter's named beneficiaries, typically their children or grandchildren. The division into trusts for issue after the term of years refers to the further division of the remainder interest into individual trusts for each beneficiary. This allows the trust assets to be distributed to the beneficiaries once the specified term of years has passed. There are different types of Colorado Granter Retained Income Trust with Division into Trusts for Issue after Term of Years, including: 1. Grants (Granter Retained Annuity Trusts): In a GREAT, the granter receives a fixed annual payment from the trust for the term of years. At the end of the term, any remaining assets are transferred to the beneficiaries free of estate and gift taxes. 2. Guts (Granter Retained Unit rusts): In a GUT, the granter receives a fixed percentage of the trust assets' fair market value each year. The value of the income interest fluctuates with the performance of the trust assets. At the end of the term, the remaining assets pass to the beneficiaries. 3. Parts (Qualified Personnel Residence Trusts): Parts are used specifically for transferring primary residences or vacation homes to beneficiaries. The granter retains the right to live in the home for a specified number of years, and after that, it passes to the beneficiaries. 4. Grits (Granter Retained Income Trusts): Grits function similarly to Grants, but instead of an annuity, the granter receives a fixed percentage of the trust assets' fair market value each year. The remaining assets pass to the beneficiaries at the end of the term. Colorado Granter Retained Income Trusts with Division into Trusts for Issue after Term of Years can be valuable tools for high net worth individuals seeking to protect and transfer their assets while still benefitting from income generated by those assets. It is essential to consult with legal and financial professionals to determine the most suitable trust structure based on individual circumstances.

Colorado Grantor Retained Income Trust with Division into Trusts for Issue after Term of Years

Description

How to fill out Colorado Grantor Retained Income Trust With Division Into Trusts For Issue After Term Of Years?

If you want to total, download, or produce lawful record layouts, use US Legal Forms, the greatest variety of lawful types, that can be found on-line. Use the site`s simple and handy research to obtain the files you will need. A variety of layouts for organization and specific uses are categorized by classes and claims, or key phrases. Use US Legal Forms to obtain the Colorado Grantor Retained Income Trust with Division into Trusts for Issue after Term of Years within a couple of clicks.

Should you be currently a US Legal Forms buyer, log in to the bank account and click the Acquire key to get the Colorado Grantor Retained Income Trust with Division into Trusts for Issue after Term of Years. Also you can gain access to types you formerly delivered electronically in the My Forms tab of your respective bank account.

If you use US Legal Forms the very first time, follow the instructions beneath:

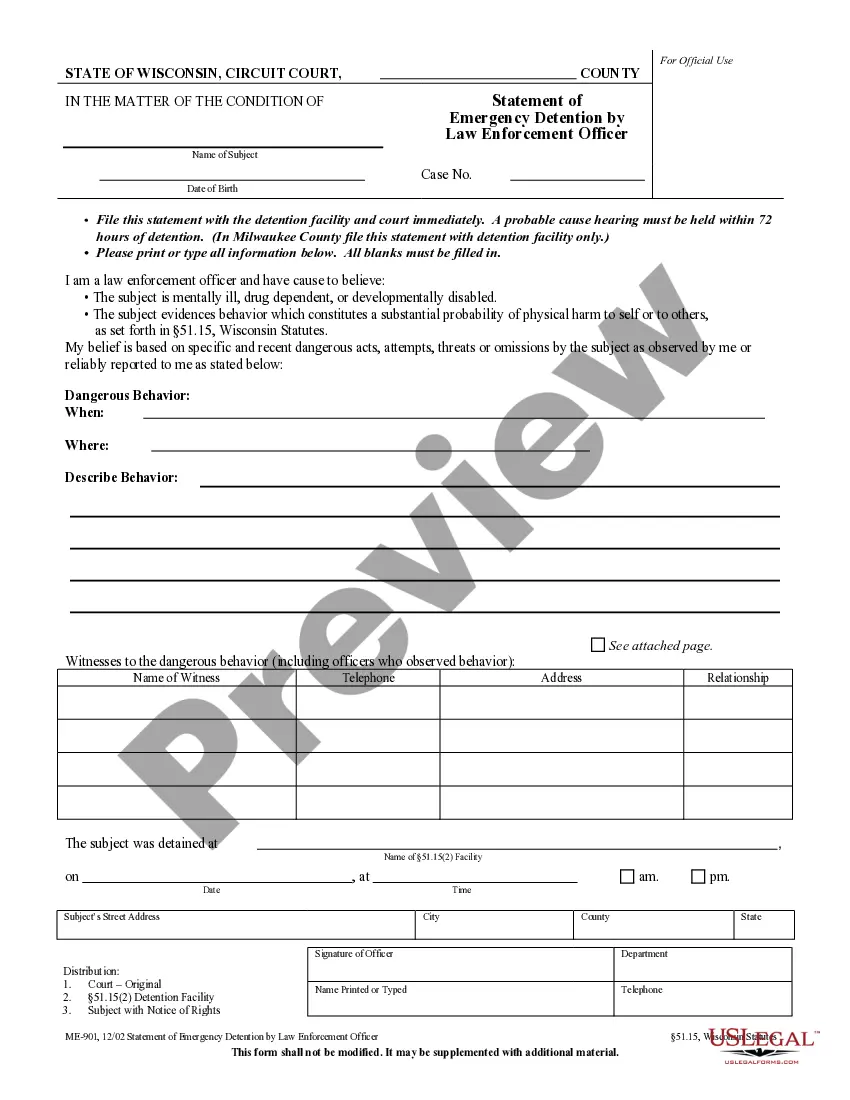

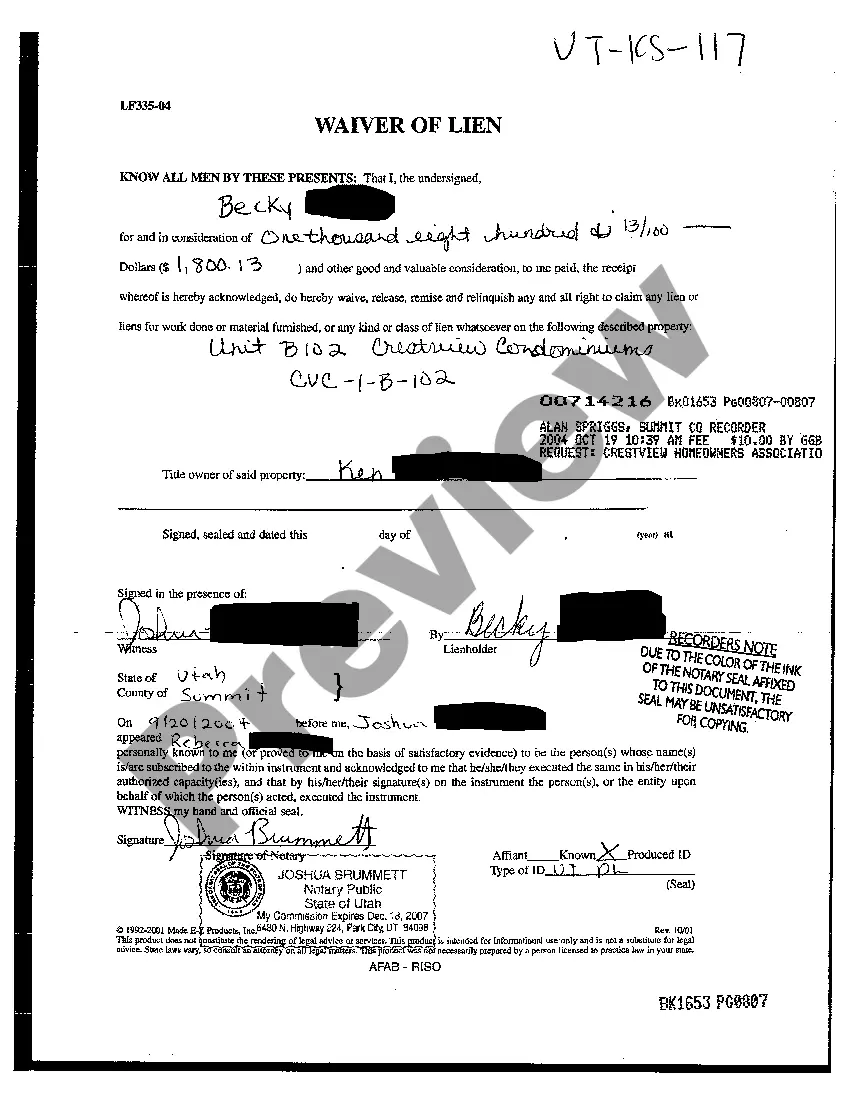

- Step 1. Make sure you have selected the form for your appropriate metropolis/region.

- Step 2. Use the Review option to look through the form`s content material. Don`t forget to see the information.

- Step 3. Should you be not satisfied with the kind, utilize the Research field on top of the display to get other versions of your lawful kind template.

- Step 4. After you have identified the form you will need, go through the Purchase now key. Select the pricing prepare you prefer and include your credentials to register for an bank account.

- Step 5. Procedure the deal. You can use your credit card or PayPal bank account to accomplish the deal.

- Step 6. Choose the format of your lawful kind and download it on the device.

- Step 7. Complete, modify and produce or indication the Colorado Grantor Retained Income Trust with Division into Trusts for Issue after Term of Years.

Each and every lawful record template you acquire is your own permanently. You might have acces to each and every kind you delivered electronically within your acccount. Click on the My Forms area and select a kind to produce or download once more.

Be competitive and download, and produce the Colorado Grantor Retained Income Trust with Division into Trusts for Issue after Term of Years with US Legal Forms. There are millions of professional and status-specific types you can use to your organization or specific needs.

Form popularity

FAQ

To implement this strategy, you zero out the grantor retained annuity trust by accepting combined payments that are equal to the entire value of the trust, including the anticipated appreciation. In theory, there would be nothing left for the beneficiary if the trust is really zeroed out.

Since a GRAT represents an incomplete gift, it is not a suitable vehicle to use in a generation-skipping transfer (GST), as the value of the skipped gift is not determined until the end of the trust term.

Grantor retained annuity trusts (GRAT) are estate planning instruments in which a grantor locks assets in a trust from which they earn annual income. Upon expiry, the beneficiary receives the assets with minimal or no gift tax liability. GRATS are used by wealthy individuals to minimize tax liabilities.

In other words, if the grantor (or a non-adverse party) has the power to revoke any part of a trust and reclaim the trust assets, then the grantor will be taxed on the trust income.

Grantor Retained Income Trust, Definition A grantor retained income trust allows the person who creates the trust to transfer assets to it while still being able to receive net income from trust assets. The grantor maintains this right for a fixed number of years.

The creator of the trust (the Grantor) transfers assets to the GRAT while retaining the right to receive fixed annuity payments, payable at least annually, for a specified term of years. After the expiration of the term, the Grantor will no longer receive any further benefits from the GRAT.

Upon the death of the grantor, grantor trust status terminates, and all pre-death trust activity must be reported on the grantor's final income tax return. As mentioned earlier, the once-revocable grantor trust will now be considered a separate taxpayer, with its own income tax reporting responsibility.

The annuity amount is paid to the grantor during the term of the GRAT, and any property remaining in the trust at the end of the GRAT term passes to the beneficiaries with no further gift tax consequences.

At the end of the initial term retained by the Grantor, if the Grantor is still living, the remainder beneficiaries (or a trust to be administered for the benefit of the remainder beneficiaries) receive $100,0000 plus all capital growth (which is the amount over and above the net income that was paid to the Grantor).