Colorado Qualified Personnel Residence Trust (PRT) is a legal arrangement designed to help individuals minimize their estate taxes while maintaining control and use of their primary residences. This trust is specifically structured to meet the requirements set forth by the state of Colorado. A Colorado PRT, also known as a One Term Holder, is a type of irrevocable trust that allows homeowners to transfer their residence into the trust for a specific term, typically between 10 and 20 years. Once the term expires, the trust's assets (the residence) will pass on to the beneficiaries, usually family members, named in the trust agreement. The primary purpose of a Colorado PRT One Term Holder is to reduce the value of the homeowner's estate for estate tax purposes. By transferring the residence into the trust, the homeowner can potentially remove the full value of the home from their taxable estate, thereby reducing the estate tax liability. This strategy can be particularly beneficial for individuals with valuable residences that may significantly increase their estate's value. One of the key advantages of a Colorado PRT One Term Holder is the ability for the homeowner to continue residing in the property during the trust term. The homeowner can maintain full control and use of the residence, paying rent to the trust per the terms of the agreement. This allows the homeowner to continue enjoying the benefits of homeownership while simultaneously reducing their estate tax burden. It is important to note that a Colorado PRT One Term Holder comes with certain conditions and limitations. For instance, if the homeowner were to pass away before the expiration of the trust term, the residence would be included back in their taxable estate, potentially defeating the purpose of the trust. Additionally, once the term ends, the residence will be transferred to the beneficiaries, and the homeowner may no longer live in the property without paying fair market rent. There are different types of trusts similar to the Colorado PRT, including the Granter Retained Annuity Trust (GREAT) and the Qualified Personnel Residence Trust — Zeroed Out (QPRT-ZERO). These trusts operate under similar principles but have different terms or structures. In the case of QPRT-ZERO, the homeowner transfers their residence to the trust and retains the right to live in it rent-free until the term ends, but no gift tax exemption is used, effectively zeroing out the transfer. Each type of trust has unique features and potential benefits, depending on the homeowner's specific goals and circumstances. In conclusion, a Colorado Qualified Personnel Residence Trust One Term Holder is an estate planning tool that allows homeowners to transfer their primary residence to an irrevocable trust for a specific term and thereby reduce their estate tax liability. With the ability to continue residing in the property during the term, individuals can enjoy the benefits of homeownership while simultaneously minimizing tax obligations. However, it is crucial to consult with a qualified estate planning attorney to determine the most suitable trust structure and ensure compliance with Colorado state laws.

Colorado Qualified Personal Residence Trust One Term Holder

Description

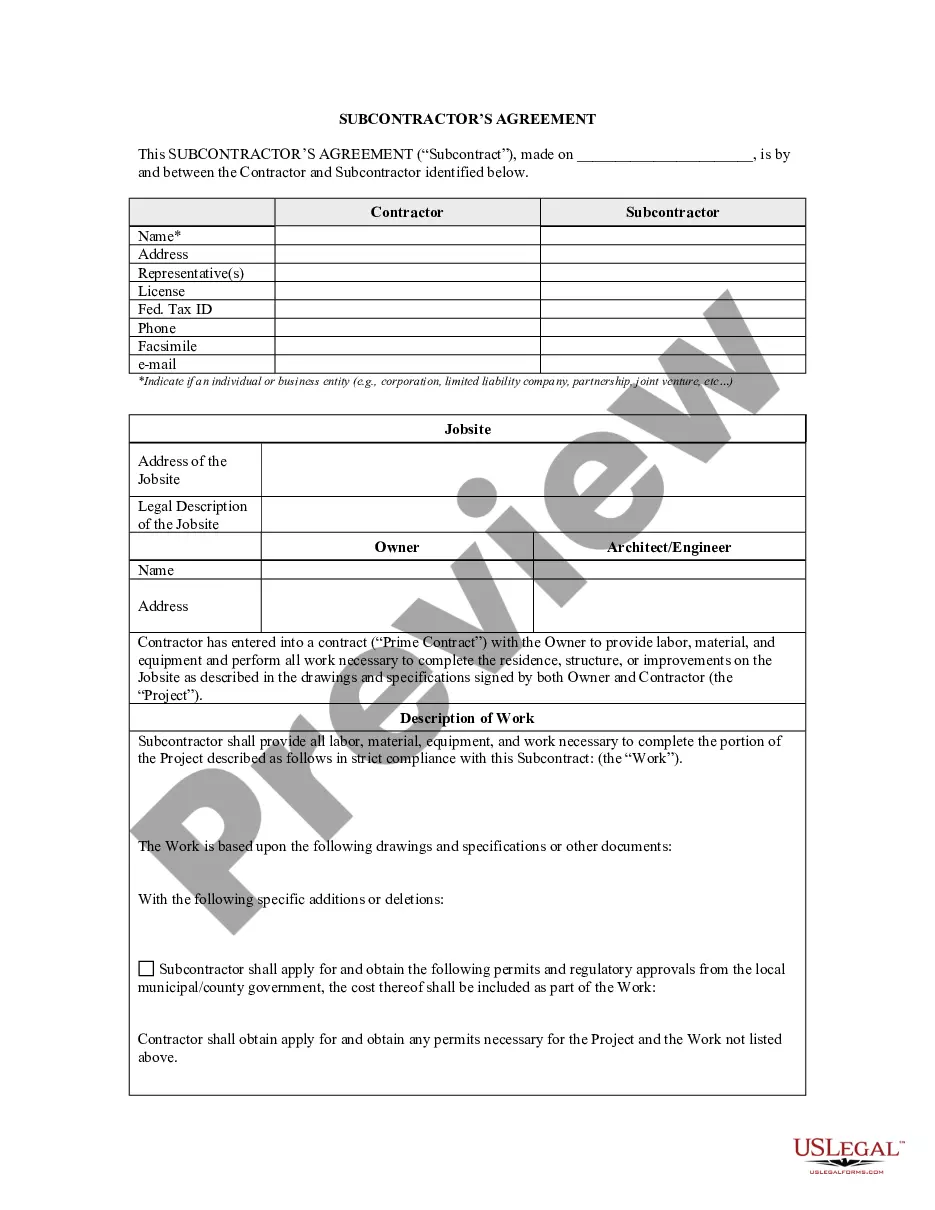

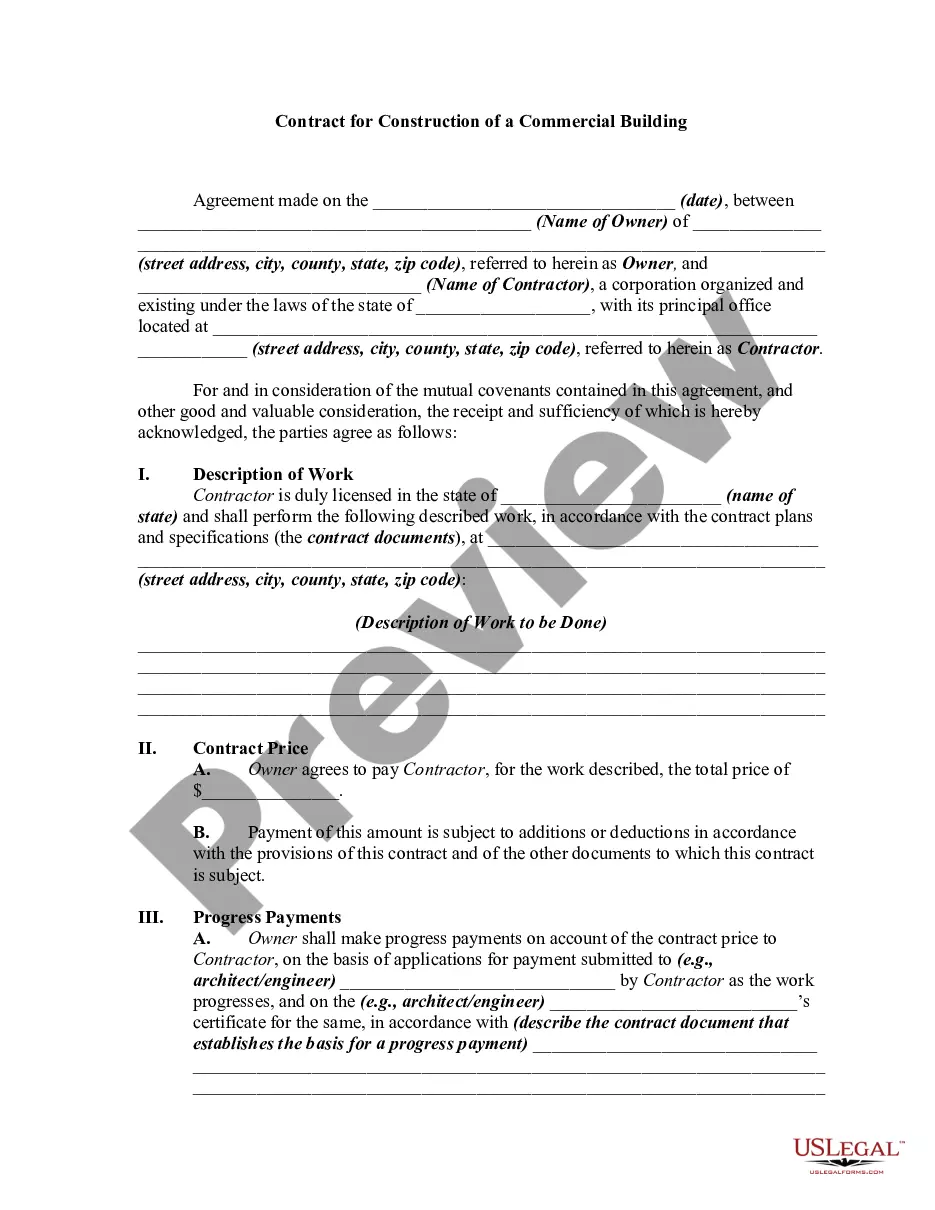

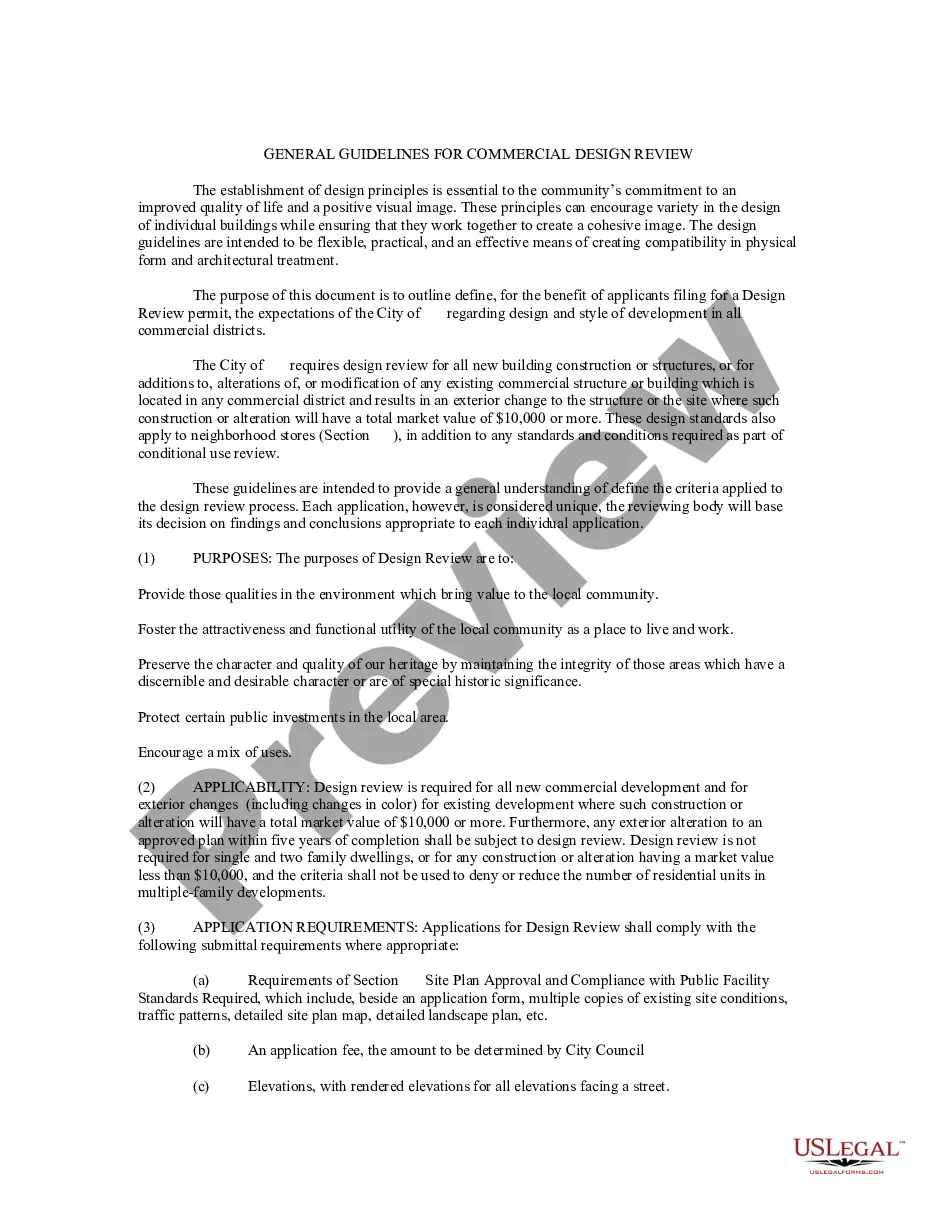

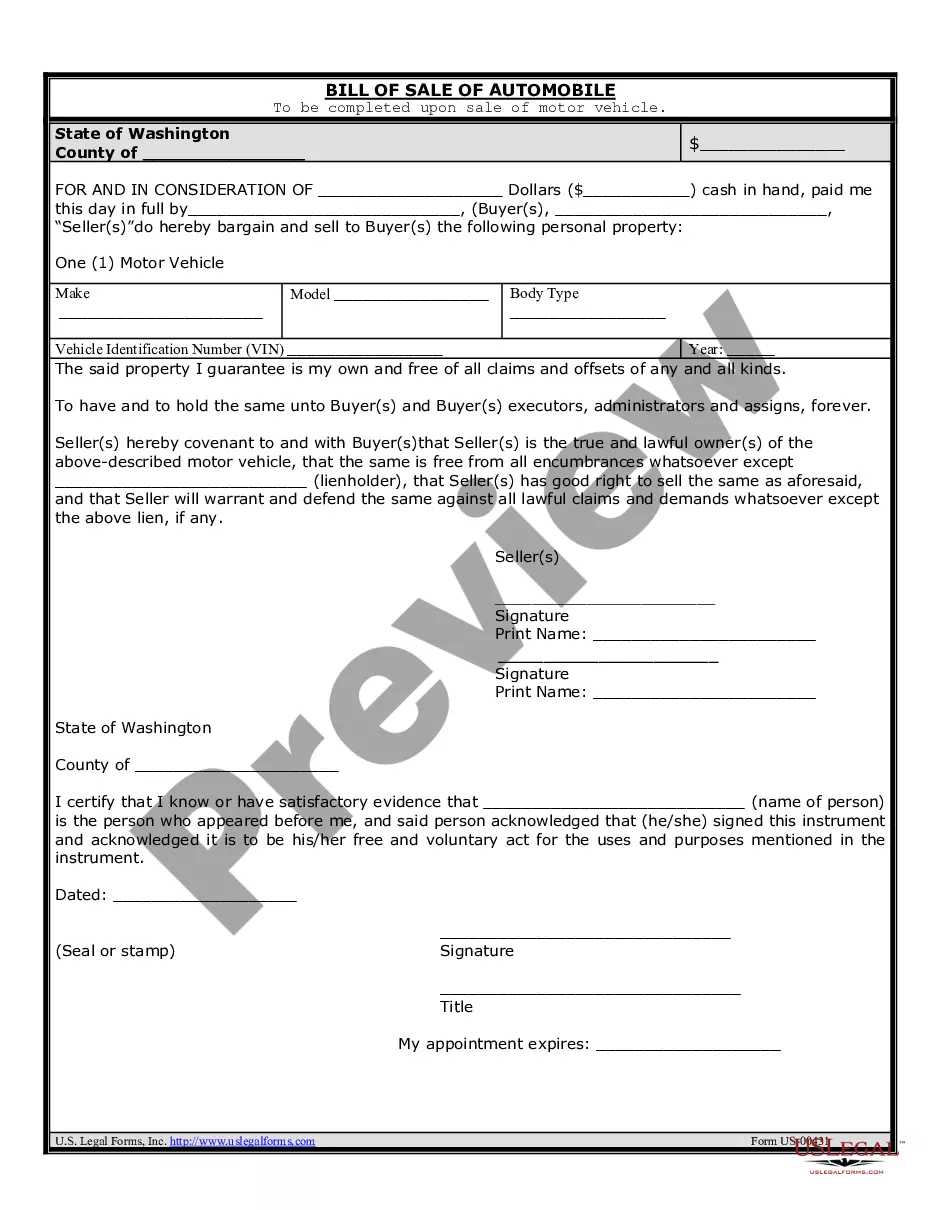

How to fill out Colorado Qualified Personal Residence Trust One Term Holder?

You may invest several hours online trying to find the lawful papers format which fits the state and federal specifications you will need. US Legal Forms offers a large number of lawful varieties which are evaluated by professionals. It is simple to obtain or printing the Colorado Qualified Personal Residence Trust One Term Holder from the assistance.

If you currently have a US Legal Forms bank account, you can log in and click the Down load button. After that, you can comprehensive, edit, printing, or indication the Colorado Qualified Personal Residence Trust One Term Holder. Each lawful papers format you get is your own property for a long time. To get yet another copy of the obtained type, go to the My Forms tab and click the related button.

If you use the US Legal Forms internet site the very first time, adhere to the basic directions below:

- Very first, make certain you have selected the best papers format for the area/area of your choosing. Read the type explanation to ensure you have selected the proper type. If available, use the Preview button to check with the papers format also.

- If you would like get yet another version in the type, use the Search industry to find the format that meets your requirements and specifications.

- Once you have identified the format you would like, simply click Get now to proceed.

- Select the costs prepare you would like, key in your references, and sign up for your account on US Legal Forms.

- Comprehensive the deal. You should use your charge card or PayPal bank account to cover the lawful type.

- Select the formatting in the papers and obtain it to your product.

- Make alterations to your papers if necessary. You may comprehensive, edit and indication and printing Colorado Qualified Personal Residence Trust One Term Holder.

Down load and printing a large number of papers layouts while using US Legal Forms website, that offers the most important assortment of lawful varieties. Use specialist and state-particular layouts to tackle your organization or person demands.

Form popularity

FAQ

Unwinding a QPRT All you have to do is enter into a lease agreement that pays fair market rent. After the QPRT expiration term, the grantor must pay rent if they continue to reside in the property.

One of the most important steps for the trustee to follow at the end of the QPRT term is to transfer title and ownership of the residence into the names of the remainder beneficiaries to ensure the correct titling and insuring of the asset.

A qualified personal residence trust (QPRT) is a specific type of irrevocable trust that allows its creator to remove a personal home from their estate for the purpose of reducing the amount of gift tax that is incurred when transferring assets to a beneficiary.

Because there's no limit on how long the QPRT must run, it's not uncommon to see QPRTs that were created 10 to 15 years ago finally expire today.

In a recent decision TVA obtained for the Chapter 7 bankruptcy trustee, the U.S. Bankruptcy Court held that a QPRT - generally irrevocable and commonly used in estate planning to hold personal residences - may nonetheless be revoked when the debtor retains an right to reacquire ownership of the residence.

The biggest benefit of a QPRT is that it removes the value of your primary or second home and its appreciation from your taxable estate. Continued use of the property. With your home in a QPRT, you can still live in the property rent-free and enjoy any income tax deductions associated with it. Gift tax benefits.

A QPRT is typically considered a Grantor Trust for income tax purposes. Most QPRTs do not generate any income and an income tax return is not typically required.

The sale of the residence without any reinvestment of the proceeds in a new residence will cause the QPRT status to terminate as to all of the assets.

A qualified personal residence trust (QPRT) is a trust to which a person (called the settlor, donor, or grantor) transfers his personal residence. The grantor reserves the right to live in the house for a period of years; this retained interest reduces the current value of the gift for gift tax purposes.

A qualified personal residence trust (QPRT) is a specific type of irrevocable trust that allows its creator to remove a personal home from their estate for the purpose of reducing the amount of gift tax that is incurred when transferring assets to a beneficiary.