A Colorado Irrevocable Trust for Future Benefit of Trust or with Income Payable to Trust or after Specified Time is a legal arrangement that provides individuals with the opportunity to secure financial assets while maintaining control over the income generated from those assets for a specified period of time. It is important to understand the various types of Colorado Irrevocable Trust for Future Benefit of Trust or with Income Payable to Trust or after Specified Time, each designed to meet specific needs and objectives. One type of trust falling under this category is the Colorado Revocable Irrevocable Trust. This trust allows the trust or to establish a trust while maintaining the ability to revoke or amend it during their lifetime. It gives flexibility in managing the trust assets and accommodates any potential changes in circumstances. Another type is the Colorado Special Needs Trust. This trust is designed for individuals with disabilities who may receive government benefits. By establishing this trust, the trust or can ensure that these beneficiaries receive supplemental income without jeopardizing their eligibility for government assistance programs. The Colorado Charitable Remainder Trust is another variant that allows trustees to transfer assets into a trust, with income generated payable to the trust or for a specified time. After this period, the remaining assets are then transferred to a charitable organization designated by the trust or. This type of trust offers both income to the trust or and the ability to contribute to charitable causes. The Colorado Spendthrift Trust is yet another form of this trust. It is designed to protect the assets and income of beneficiaries. By placing assets into this trust, the trust or ensures that they are protected from creditors and financial mismanagement, allowing the beneficiary to benefit from the trust's income while safeguarding the principal. In summary, a Colorado Irrevocable Trust for Future Benefit of Trust or with Income Payable to Trust or after Specified Time provides individuals with a diverse range of options to secure their assets and control the income generated from those assets. By understanding the different types of trusts available, individuals can tailor their estate planning to meet their specific needs and objectives.

Colorado Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time

Description

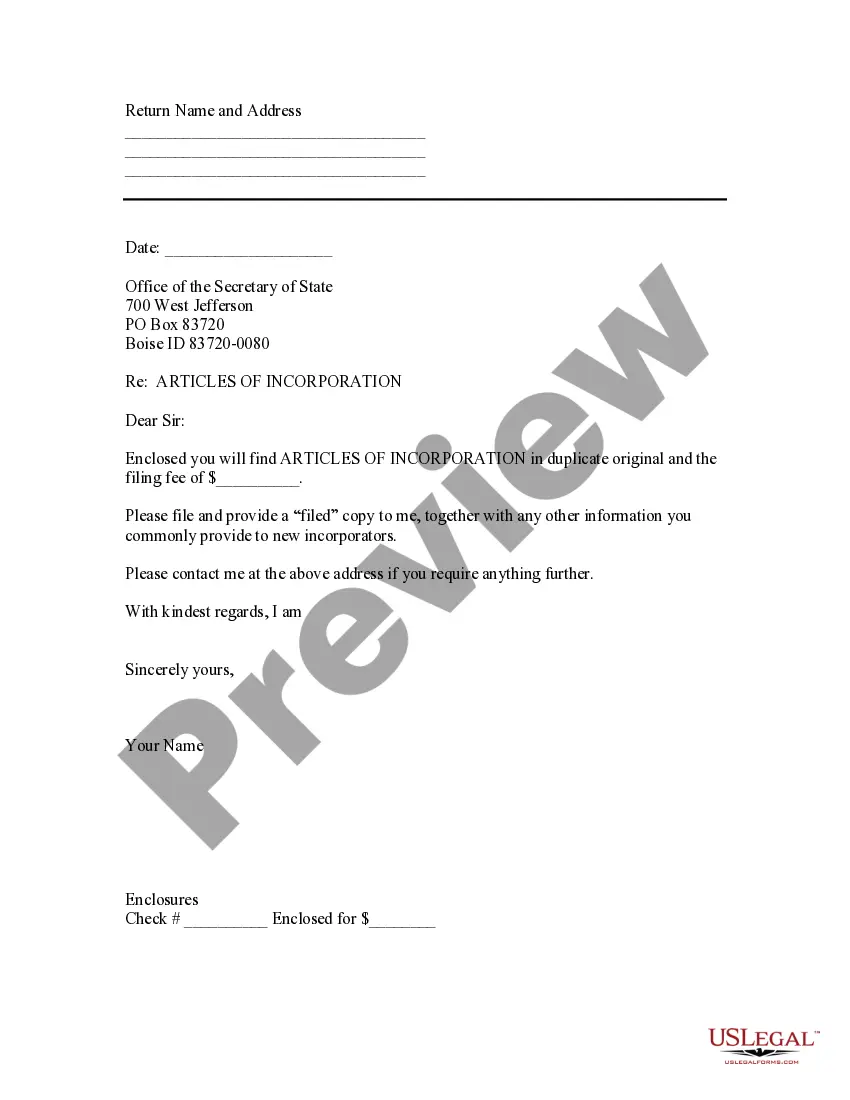

How to fill out Colorado Irrevocable Trust For Future Benefit Of Trustor With Income Payable To Trustor After Specified Time?

Are you presently in the position in which you will need files for sometimes enterprise or person reasons almost every day? There are a variety of legitimate record web templates accessible on the Internet, but finding types you can rely on isn`t straightforward. US Legal Forms provides thousands of form web templates, such as the Colorado Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time, which are written to fulfill state and federal specifications.

In case you are presently acquainted with US Legal Forms site and possess a free account, just log in. Next, it is possible to down load the Colorado Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time template.

If you do not come with an profile and would like to begin using US Legal Forms, abide by these steps:

- Find the form you need and ensure it is for that right metropolis/area.

- Make use of the Review option to review the form.

- See the outline to actually have chosen the correct form.

- If the form isn`t what you are looking for, use the Research field to obtain the form that fits your needs and specifications.

- When you find the right form, simply click Purchase now.

- Choose the prices prepare you would like, complete the desired information and facts to generate your account, and pay money for the order making use of your PayPal or Visa or Mastercard.

- Pick a practical file formatting and down load your version.

Discover each of the record web templates you have purchased in the My Forms food selection. You can aquire a more version of Colorado Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time whenever, if required. Just click the needed form to down load or printing the record template.

Use US Legal Forms, by far the most substantial assortment of legitimate types, to save time as well as stay away from errors. The support provides professionally made legitimate record web templates that can be used for a range of reasons. Make a free account on US Legal Forms and commence making your life easier.

Form popularity

FAQ

When an irrevocable trust makes a distribution, it deducts the income distributed on its own tax return and issues the beneficiary a tax form called a K-1. This form shows the amount of the beneficiary's distribution that's interest income as opposed to principal.

The trustee of an irrevocable trust can only withdraw money to use for the benefit of the trust according to terms set by the grantor, like disbursing income to beneficiaries or paying maintenance costs, and never for personal use.

Irrevocable Trusts Generally, a trustee is the only person allowed to withdraw money from an irrevocable trust. But just as we mentioned earlier, the trustee must follow the rules of the legal document and can only take out income or principal when it's in the best interest of the trust.

The step-up in basis tax provision protects the asset in a revocable trust from heavy taxation. Grantors and trustees can take advantage of this provision to reduce or eliminate capital gains taxes. The assets in a revocable trust appreciate and provide the grantor with a consistent stream of income in their lifetime.

An irrevocable trust provides an alternative to simply giving an asset to a beneficiary in order to reduce your taxable estate. With a trust, you can set the timing of distributions (i.e. when the beneficiary attains 30 years of age) as well as the reasons for distributions (i.e. for education only).

But assets in an irrevocable trust generally don't get a step up in basis. Instead, the grantor's taxable gains are passed on to heirs when the assets are sold. Revocable trusts, like assets held outside a trust, do get a step up in basis so that any gains are based on the asset's value when the grantor dies.

The 65-day rule relates to distributions from complex trusts to beneficiaries made after the end of a calendar year. For the first 65 days of the following year, a distribution is considered to have been made in the previous year.

Can a beneficiary withdraw money from an irrevocable trust? The trustee of an irrevocable Trust cannot withdraw money except to benefit the Trust. These terms include paying maintenance costs and disbursement income to beneficiaries. However, it is not possible to withdraw money for personal or business use.

The grantor (as an individual or couple) transfers their assets to an irrevocable trust. However, unlike other irrevocable trusts, the grantor can be the income beneficiary. Their children or spouse would be the residual beneficiaries.

The step-up in basis is equal to the fair market value of the property on the date of death. In our example, if the parents had put their home in this irrevocable income only trust, and the fair market value upon their demise was $300,000, the children would receive the home with a basis equal to this $300,000 value.