Colorado Irrevocable Trust which is a Qualifying Subchapter-S Trust

Description

How to fill out Irrevocable Trust Which Is A Qualifying Subchapter-S Trust?

You can spend time online attempting to locate the approved document format that complies with the state and federal standards you require.

US Legal Forms offers thousands of legal documents that can be reviewed by professionals.

It is possible to acquire or create the Colorado Irrevocable Trust, which is a Qualifying Subchapter-S Trust, through my assistance.

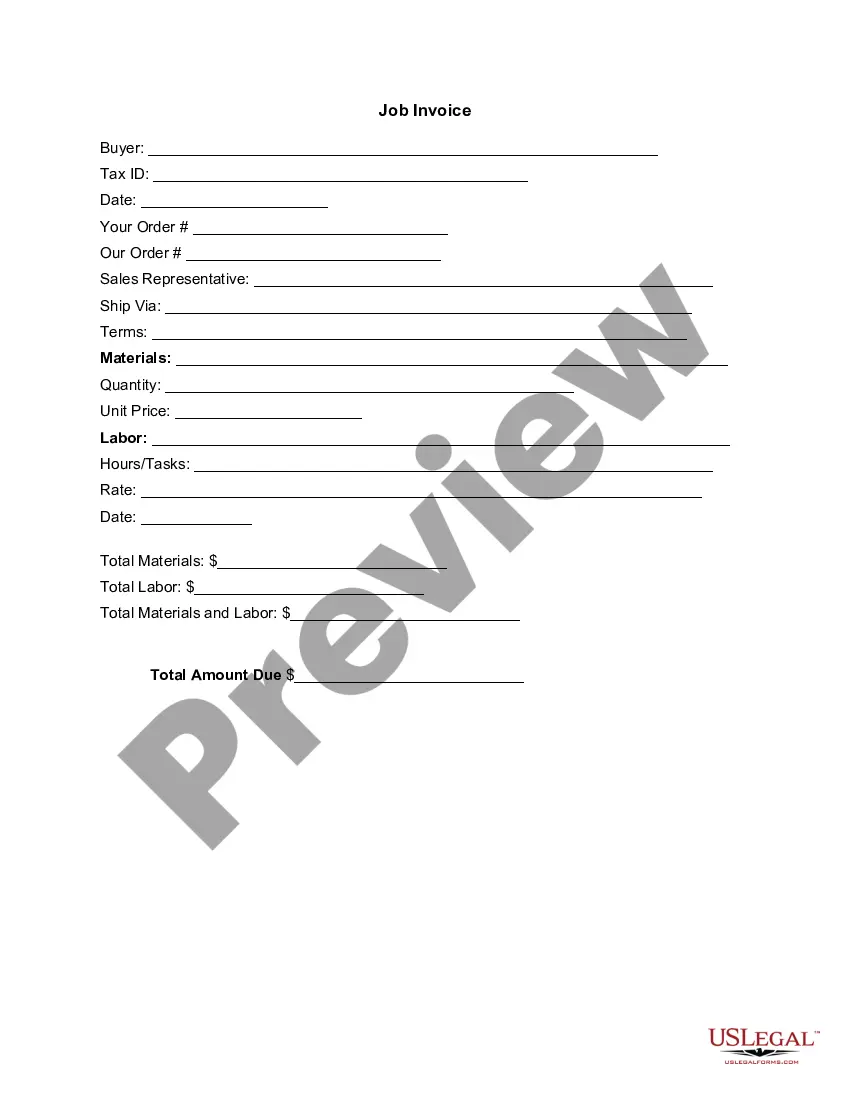

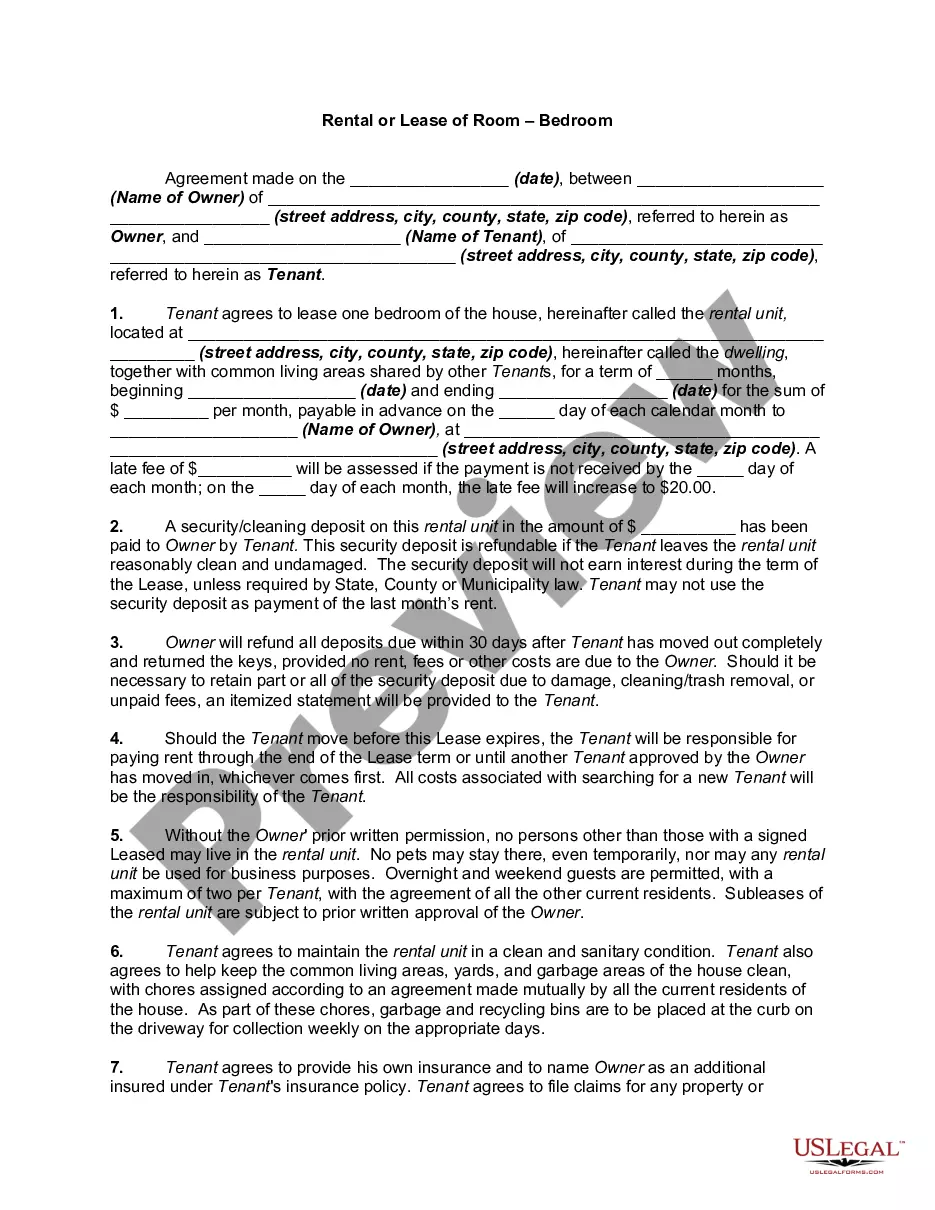

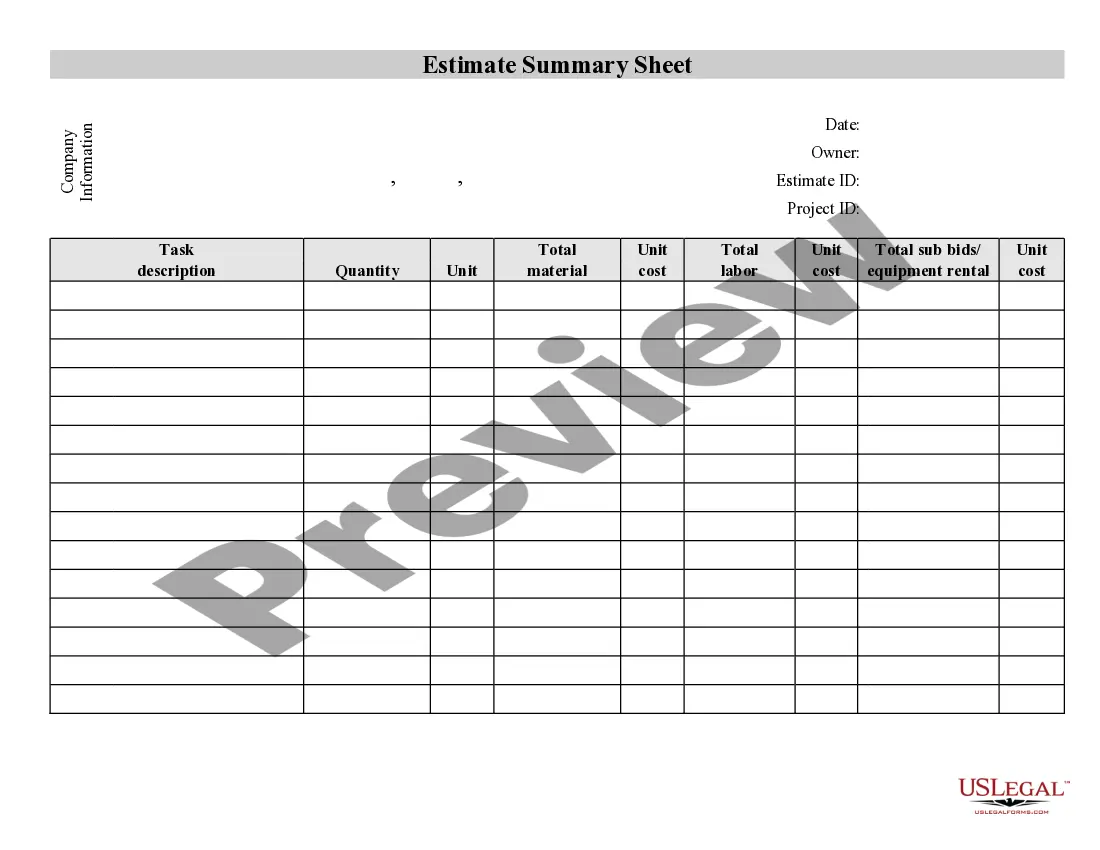

First, ensure that you have chosen the correct document template for the region/area of your preference. Review the document description to confirm you have selected the right form. If available, utilize the Preview option to examine the document template as well. If you wish to obtain an additional version of your form, use the Search field to find the template that suits your needs and requirements.

- If you currently possess a US Legal Forms account, you can Log In and select the Acquire option.

- Subsequently, you can complete, modify, create, or sign the Colorado Irrevocable Trust, which is a Qualifying Subchapter-S Trust.

- Each legal document template you purchase is yours permanently.

- To obtain a duplicate of any purchased form, visit the My documents tab and select the appropriate option.

- If you are utilizing the US Legal Forms website for the first time, follow the simple instructions below.

Form popularity

FAQ

Irrevocable trusts are often set up as grantor trusts, which simply means that they are not recognized for income tax purposes (all of the income tax attributes of the trust, such as income, loss, gains, etc. is passed on to the grantor of the trust).

An irrevocable grantor trust can own S corporation stock if it meets IRS regulations. The trust must contain language stating that all the ordinary income the trust earns along with the original trust assets are owned by the trust grantor.

A Qualified Subchapter S Trust, commonly referred to as a QSST Election, or a Q-Sub election, is a Qualified Subchapter S Subsidiary Election made on behalf of a trust that retains ownership as the shareholder of an S corporation, a corporation in the United States which votes to be taxed.

Three commonly used types of ongoing trusts qualify as S corporation shareholders: grantor trusts, qualified subchapter S trusts (QSSTs) and electing small business trusts (ESBTs).

Four eligible trust typesGrantor trusts. An important caveat is that these trusts must have one deemed owner who is a U.S. citizen or resident and meet certain other requirements.Testamentary trusts. This trust type is established by your will.QSSTs.ESBTs.

An irrevocable trust that is setup as a grantor trust, qualified subchapter S trust or as an electing small business trust may own shares of an S corporation.

Testamentary trusts. These trusts, which are established by your will, are eligible S corporation shareholders for up to two years after the transfer and then must either distribute the stock to an eligible shareholder or qualify as a QSST or ESBT.

Designing a QSSTThe trust must have only one income beneficiary during the life of the current income beneficiary, and that beneficiary must be a U.S. citizen or resident;All of the income of the trust must be (or must be required to be) distributed currently to the one income beneficiary;More items...?

The main difference between an ESBT and a QSST is that an ESBT may have multiple income beneficiaries, and the trust does not have to distribute all income. Unlike with the QSST, the trustee, rather than the beneficiary, must make the election.