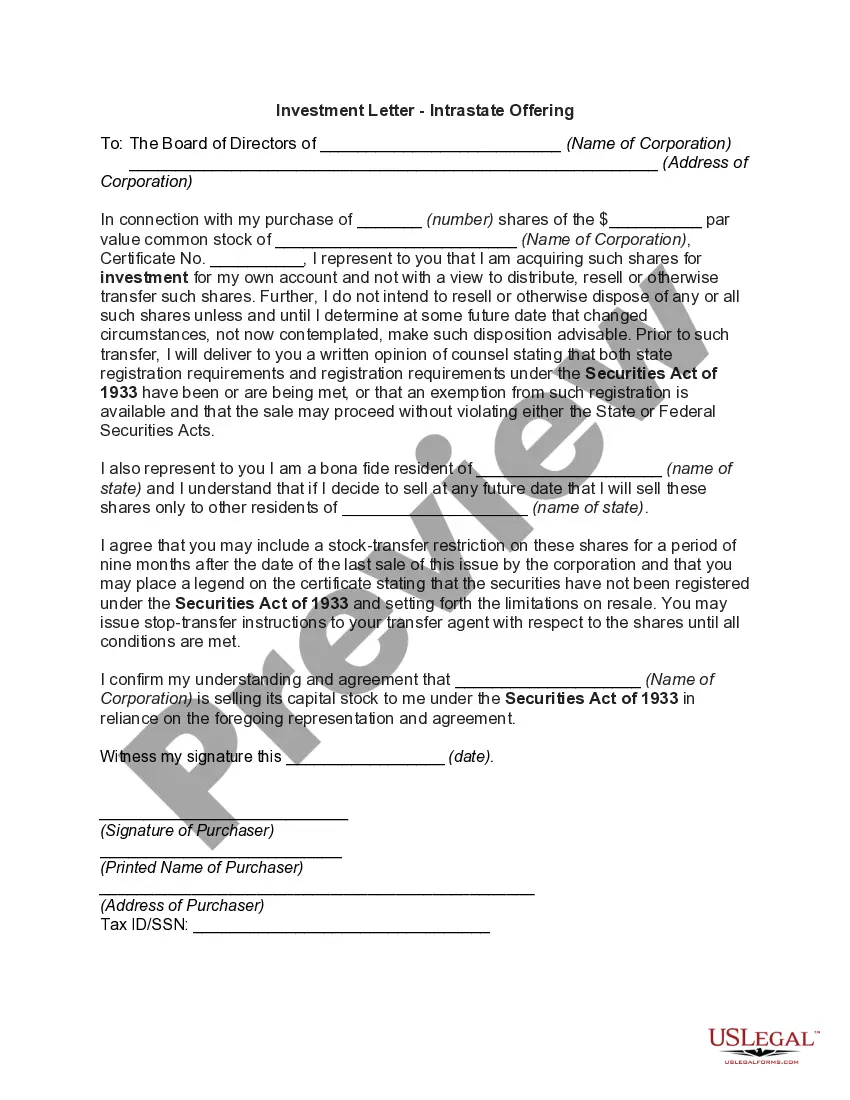

The Colorado Investment Letter — Intrastate Offering is a legal document that pertains to securities offerings within the state of Colorado. This letter serves as an important tool for individuals and businesses seeking to raise funds through investment offerings. In Colorado, intrastate offerings are regulated under the Colorado Securities Act, which allows for companies to raise capital within the state without requiring registration with the U.S. Securities and Exchange Commission (SEC). This type of offering is also known as the "Colorado Crowdfunding Exemption." The purpose of the Colorado Investment Letter — Intrastate Offering is to provide potential investors with a comprehensive overview of the investment opportunity, including the risks involved, financial projections, and other relevant information. The letter helps investors make well-informed decisions by equipping them with the necessary details to evaluate the investment's potential. The content of the Colorado Investment Letter — Intrastate Offering typically includes: 1. Executive Summary: An introduction to the investment opportunity, summarizing the key points and benefits. 2. Company Overview: A detailed description of the company seeking investments, including its history, mission, and management team. 3. Investment Terms: Clear details on the investment terms, such as the minimum investment amount, potential returns, and any additional benefits offered to investors. 4. Use of Funds: A breakdown of how the raised capital will be utilized, providing transparency and accountability to potential investors. 5. Risk Factors: A comprehensive analysis of the potential risks associated with the investment, helping investors understand the possible downsides and make informed decisions. 6. Financial Projections: Presentation of the projected financial performance and growth prospects of the company, including revenue forecasts and profitability expectations. 7. Offering Details: Information regarding the completion deadline, any limitations on the number of investors, and any specific requirements for Colorado residents to participate in the offering. Different types of Colorado Investment Letters — Intrastate Offerings can vary depending on the nature and industry of the business seeking investment. Some examples may include: 1. Colorado Real Estate Investment Letter — Intrastate Offering: Pertaining to real estate development projects and investments within Colorado. 2. Colorado Start-Up Investment Letter — Intrastate Offering: Targeting start-up companies within the state looking to raise capital for their business operations and growth. 3. Colorado Renewable Energy Investment Letter — Intrastate Offering: Focusing on investments in renewable energy projects, such as solar or wind power, within Colorado. 4. Colorado Small Business Investment Letter — Intrastate Offering: Designed for small businesses in Colorado seeking investment to expand their operations or launch new products/services. In conclusion, the Colorado Investment Letter — Intrastate Offering is a key legal document used within the state to enable businesses and entrepreneurs to raise funds through investment opportunities while complying with the Colorado Securities Act. It provides potential investors with the necessary information to evaluate investment risks and rewards, fostering transparency and informed decision-making.

Colorado Investment Letter - Intrastate Offering

Description

How to fill out Colorado Investment Letter - Intrastate Offering?

Have you been in the position where you need paperwork for sometimes business or specific reasons just about every day time? There are tons of authorized document themes available on the Internet, but finding kinds you can rely isn`t straightforward. US Legal Forms offers 1000s of form themes, just like the Colorado Investment Letter - Intrastate Offering, that happen to be composed in order to meet state and federal needs.

In case you are currently knowledgeable about US Legal Forms site and possess your account, just log in. Following that, it is possible to down load the Colorado Investment Letter - Intrastate Offering format.

If you do not provide an bank account and would like to begin to use US Legal Forms, follow these steps:

- Discover the form you want and make sure it is to the correct area/region.

- Use the Review button to review the form.

- See the outline to ensure that you have selected the appropriate form.

- In the event the form isn`t what you are seeking, take advantage of the Search discipline to obtain the form that meets your requirements and needs.

- Once you get the correct form, click Purchase now.

- Select the costs program you want, complete the required info to create your money, and pay for an order with your PayPal or bank card.

- Decide on a handy document file format and down load your version.

Locate every one of the document themes you might have bought in the My Forms food selection. You can obtain a additional version of Colorado Investment Letter - Intrastate Offering anytime, if possible. Just click the essential form to down load or print out the document format.

Use US Legal Forms, probably the most extensive assortment of authorized kinds, to save lots of some time and steer clear of faults. The assistance offers skillfully produced authorized document themes that can be used for a selection of reasons. Make your account on US Legal Forms and start creating your way of life a little easier.