Colorado Security Agreement between Dealer and Distributor

Description

How to fill out Security Agreement Between Dealer And Distributor?

Are you presently engaged in a position where you frequently require documents for both business and personal purposes.

There are numerous legitimate document templates accessible online, but finding reliable ones can be challenging.

US Legal Forms offers a wide array of form templates, such as the Colorado Security Agreement between Dealer and Distributor, designed to comply with state and federal regulations.

Once you find the right form, click on Acquire now.

Select your preferred pricing plan, fill in the required information to create your account, and pay for the transaction using your PayPal or credit card. Choose a convenient file format and download your copy. You can access all the document templates you have purchased in the My documents section. You can obtain another copy of the Colorado Security Agreement between Dealer and Distributor at any time if needed. Just click on the desired form to download or print the document template.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Colorado Security Agreement between Dealer and Distributor template.

- If you do not have an account and wish to use US Legal Forms, follow these steps.

- Locate the form you require and confirm it is for the correct city/region.

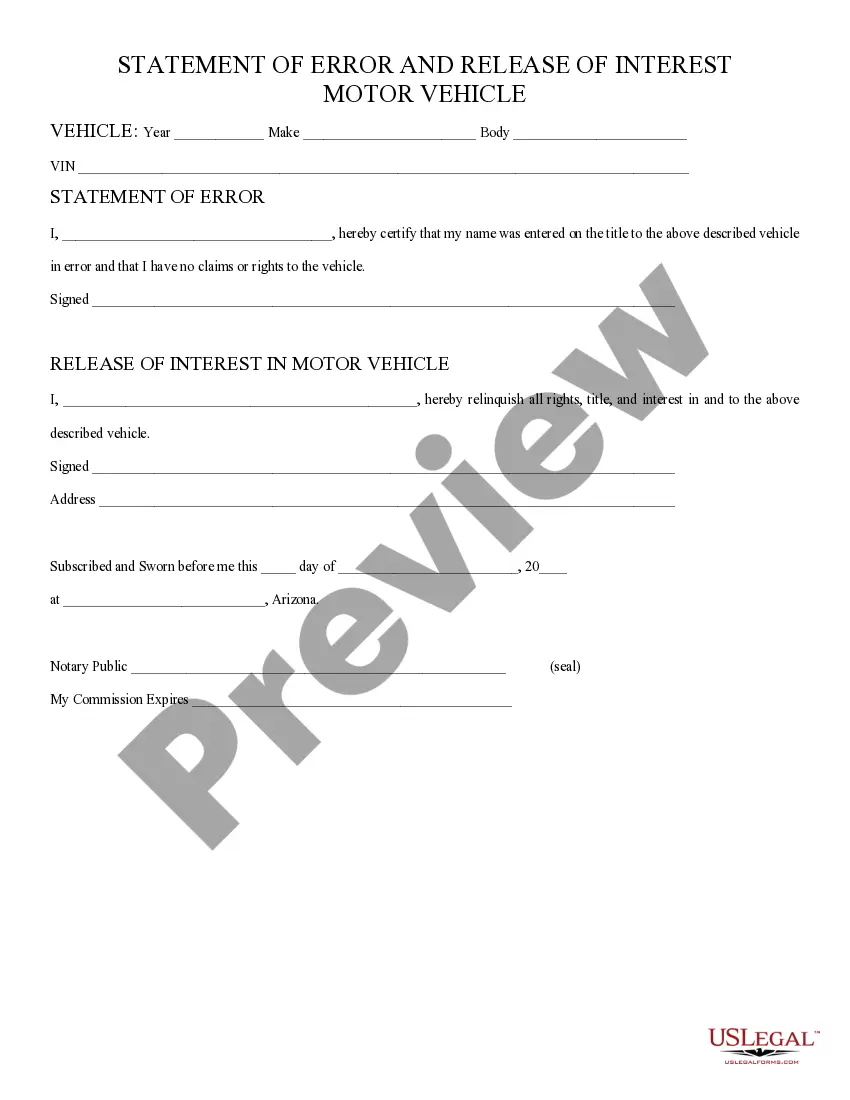

- Use the Preview button to review the document.

- Check the details to ensure you have selected the correct form.

- If the form is not what you're seeking, utilize the Search field to find the document that meets your needs.

Form popularity

FAQ

Here is a checklist of ten common mistakes to avoid when drafting your next distributor agreement.Too Much Too Fast.Termination for Cause Only.Annual Termination and Semiautomatic Renewal.Exclusive or Nonexclusive.Frequency of Price Changes.Termination by Only One Party - Not Both.Frequency of Amendments.More items...

A distribution agreement, also known as a distributor agreement, is a contract between a supplying company with products to sell and another company that markets and sells the products. The distributor agrees to buy products from the supplier company and sell them to clients within certain geographical areas.

A master distributor agreement is a legal agreement that allows a manufacturer to enter into a contract with another party, known as a distributor, who will sell and market the manufacturer's goods on their behalf.

Six Rules for Negotiating a Better Distribution AgreementBalance. Balance in a distribution agreement ensures that neither party holds unfair power over the other.Due Diligence.Annual Termination and Semiautomatic Renewal.Comparison with Proven Industry Agreements.Four Eyes versus Two Eyes.Cause and Convenience.

Distribution agreements define the terms and conditions under which a distributor may sell products provided by a supplier. Such an agreement may be for a limited term, and be further restricted by territory and distribution channel.

Parts of a Distribution AgreementNames and addresses of both parties.Sale terms and conditions.Contract effective dates.Marketing and intellectual property rights.Defects and returns provisions.Severance terms.Returned goods credits and costs.Exclusivity from competing products.More items...

Best Practices to Protect Your MerchandiseUnderstand Your Customer Base.Do Your Homework.Protect Yourself in Writing.Avoid Inconsistent Pricing.Manage Your Route to Market.Monitor Case Marking.Consider Distinct Package Sizing.Examine All Purchase Orders.More items...?

In legal terms, an Agent is acting on behalf of your Company whereas a Distributor is likely to act on its own behalf but will still have a contractual relationship with your Company to purchase certain products or goods and then market same directly subject to any restraints you may seek to impose.

Products: The agreement should specify what products, product lines, or brands are included under the agreement. The agreement should also address whether and to what extent any new brands developed or acquired by the supplier would be included, or specifically, excluded from the agreement.