Colorado Merger Agreement for Type A Reorganization

Description

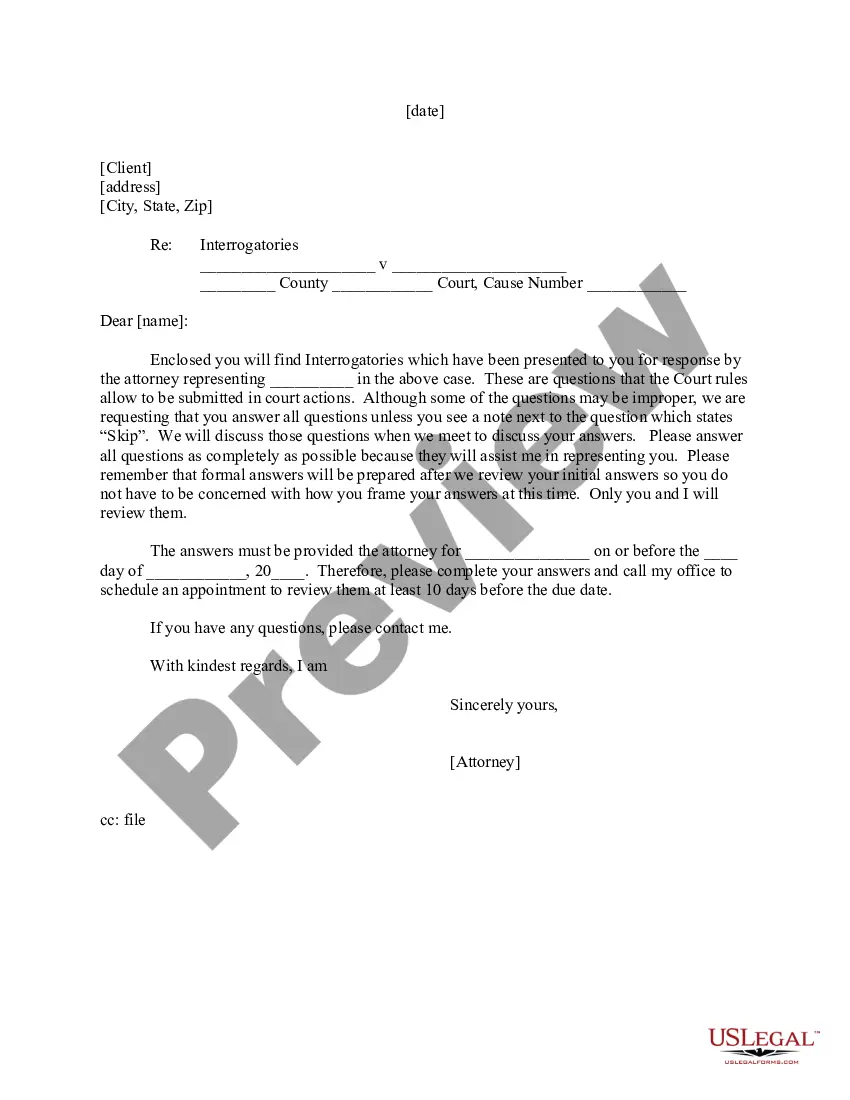

How to fill out Merger Agreement For Type A Reorganization?

Are you currently in a place that you will need files for both company or person purposes nearly every time? There are a lot of legal record templates accessible on the Internet, but getting ones you can trust is not effortless. US Legal Forms offers 1000s of form templates, like the Colorado Merger Agreement for Type A Reorganization, which are composed to fulfill federal and state specifications.

Should you be already knowledgeable about US Legal Forms website and also have an account, basically log in. Following that, you may down load the Colorado Merger Agreement for Type A Reorganization format.

If you do not come with an bank account and want to begin to use US Legal Forms, follow these steps:

- Obtain the form you will need and make sure it is to the correct area/area.

- Use the Preview option to review the form.

- Browse the explanation to actually have chosen the right form.

- In case the form is not what you are looking for, use the Look for field to find the form that meets your needs and specifications.

- When you get the correct form, simply click Get now.

- Select the pricing plan you desire, fill in the required info to produce your money, and pay for your order making use of your PayPal or bank card.

- Select a convenient file structure and down load your copy.

Discover all the record templates you may have bought in the My Forms menu. You can aquire a extra copy of Colorado Merger Agreement for Type A Reorganization whenever, if needed. Just go through the necessary form to down load or printing the record format.

Use US Legal Forms, the most comprehensive selection of legal varieties, in order to save time and stay away from errors. The assistance offers professionally produced legal record templates that you can use for a variety of purposes. Produce an account on US Legal Forms and commence making your way of life easier.

Form popularity

FAQ

A. In a Type A reorganization under recent Treasury? Regulations, at least? 30% of the consideration used must be the acquiring? corporation's stock. This rule permits money securities and other property to constitute up to? 70% of the total consideration used. Fed Tax II - Chapter 7: Corporate Acquisitions & Reorganizations quizlet.com ? fed-tax-ii-chapter-7-corporate-acqui... quizlet.com ? fed-tax-ii-chapter-7-corporate-acqui...

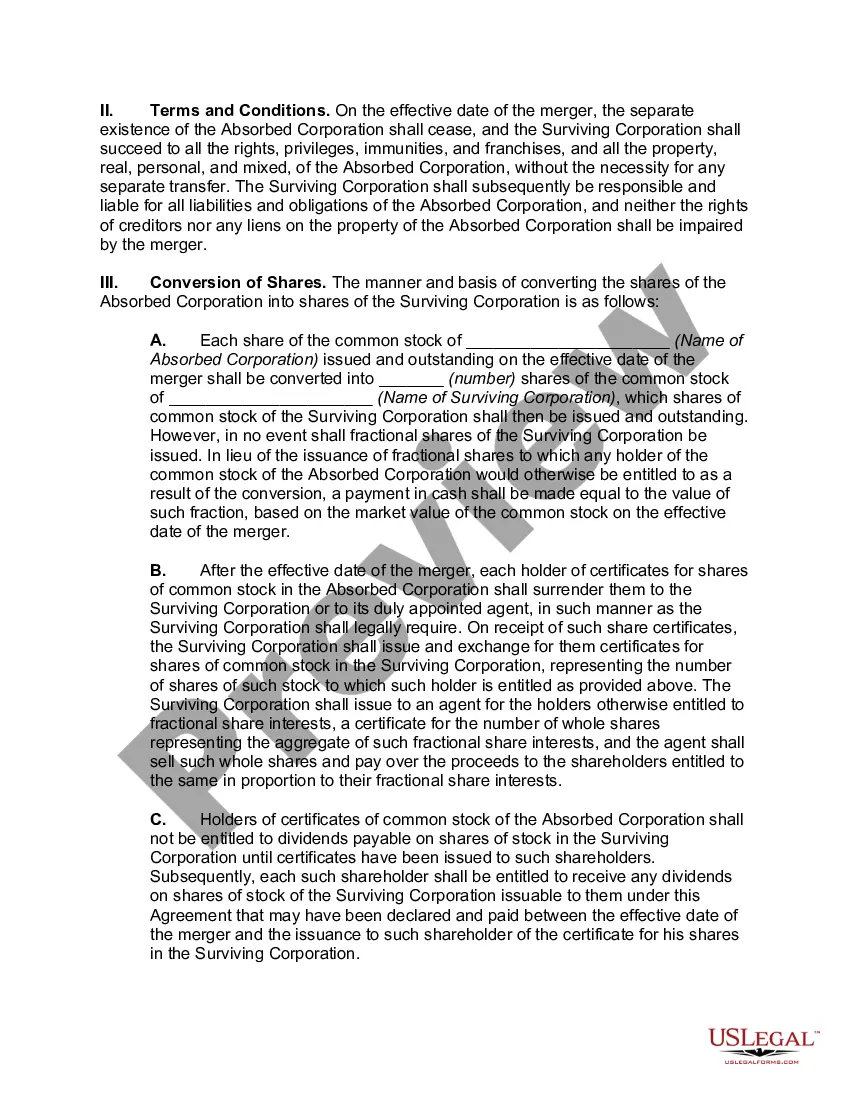

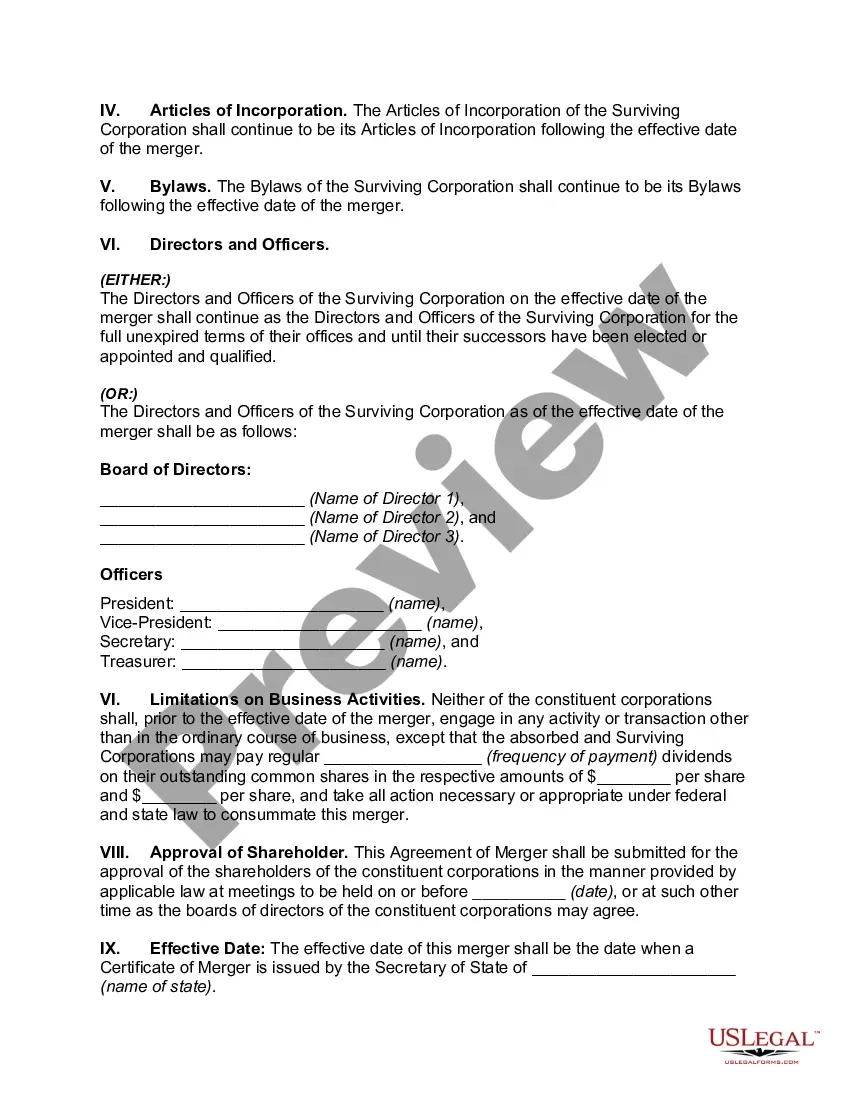

In a typical merger, the assets and liabilities of T are transferred to P, and T dissolves by operation of law. The consideration received by T's shareholders is determined by a merger agreement. A consolidation is a transfer of assets and liabilities of two or more existing corporations to a newly created corporation.

What is a Type ?A? Reorganization? Under IRC § 368(a)(1)(A), a Type A reorganization is a ?statutory merger or consolidation.? An ?A? reorganization must meet the requirements of applicable state corporate law or the merger laws of a foreign jurisdiction, as well as regulatory requirements in Treas. What Does a Type ?A? Reorganization Look Like in a Structure ... Blue J Legal ? blog ? type-a-reorganization-... Blue J Legal ? blog ? type-a-reorganization-...

A type A Reorganization is a tax-free merger or consolidation. Generally, in a merger, one corporation (the acquiring corporation) acquires the assets and assumes the liabilities of another corporation (the target corporation) in exchange for its stock. Corporate Reorganizations: Tax-Free Mergers (Type A) - Topics CCH Answer Connect ? topic ? corporate-reo... CCH Answer Connect ? topic ? corporate-reo...

The sole requirement here is that the acquiring/parent company own above and beyond majority ownership of the acquiree after the transaction. This requires that the target corporation exchange around 75-85% ownership to the acquiring company (IRC § 368(a)(1)(B)). Tax-Free Reorganization - Corporate Finance Institute corporatefinanceinstitute.com ? valuation ? tax-fre... corporatefinanceinstitute.com ? valuation ? tax-fre...

Summary. A type A Reorganization is a tax-free merger or consolidation. Generally, in a merger, one corporation (the acquiring corporation) acquires the assets and assumes the liabilities of another corporation (the target corporation) in exchange for its stock.

A Type A reorganization must fulfill the continuity of interests requirement. That is, the shareholders in the acquired company must receive enough stock in the acquiring firm that they have a continuing financial interest in the buyer.

Under IRC § 368(a)(1)(A), a Type A reorganization is a ?statutory merger or consolidation.? An ?A? reorganization must meet the requirements of applicable state corporate law or the merger laws of a foreign jurisdiction, as well as regulatory requirements in Treas.