Colorado is a state in the western United States known for its stunning natural landscapes, including the Rocky Mountains, picturesque canyons, and beautiful plains. It is a popular destination for outdoor enthusiasts, offering opportunities for hiking, skiing, camping, and more. The state is also home to vibrant cities such as Denver, Boulder, and Colorado Springs, where visitors can explore a mix of art, culture, and history. When it comes to financial matters, it is common for individuals to find themselves in debt, with credit card bills being a significant contributor. In such cases, debtors may need to take proactive steps to manage their finances effectively. One common strategy to alleviate financial burdens is to write a letter to a credit card company, requesting a lower interest rate for a specific period. This approach aims to lessen the monthly payment amount, allowing the debtor to pay off the debt more efficiently or to better handle their financial situation during a particular timeframe. In Colorado, debtors have the option to write different types of letters to credit card companies, requesting a lower interest rate. Some possible variations could include: 1. Colorado Personal Letter from Debtor to Credit Card Company: This type of letter is used when an individual is seeking a temporary lower interest rate on their credit card debt for a specific period. The debtor may include personal details, highlighting their financial struggles, and providing reasons why they need the reduced rate. 2. Colorado Formatted Letter from Debtor to Credit Card Company: This type of letter follows a specific format or template designed to make the communication more professional and structured. It typically includes sections such as the debtor's personal information, the credit card company's details, an explanation of the request, and any necessary supporting documentation. 3. Colorado Hardship Letter from Debtor to Credit Card Company: When a debtor is facing significant financial hardship, such as a loss of income, job loss, medical issues, or other unforeseen circumstances, they may opt to write a hardship letter. This letter discusses the debtor's current situation, the impact on their ability to pay, and requests a lower interest rate to manage the debt effectively during this challenging period. In any of these letters, it is important to include relevant keywords that address the debtor's circumstances and express their intention clearly. Key elements may involve explaining their financial position, highlighting the need for temporary assistance, emphasizing the commitment to make regular payments, and conveying gratitude for the credit card company's consideration. By tailoring the content of these letters using relevant keywords and phrases, debtors in Colorado can effectively communicate their financial struggles to credit card companies while seeking a lower interest rate.

Colorado Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time

Description

How to fill out Colorado Letter From Debtor To Credit Card Company Requesting A Lower Interest Rate For A Certain Period Of Time?

Finding the right lawful file template might be a struggle. Needless to say, there are a variety of web templates accessible on the Internet, but how can you find the lawful form you will need? Use the US Legal Forms site. The service provides a large number of web templates, like the Colorado Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time, which you can use for organization and personal demands. All of the types are inspected by experts and meet up with state and federal demands.

When you are currently listed, log in to the account and click on the Obtain button to have the Colorado Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time. Use your account to check from the lawful types you possess bought previously. Proceed to the My Forms tab of your account and acquire yet another version from the file you will need.

When you are a whole new end user of US Legal Forms, here are easy guidelines so that you can follow:

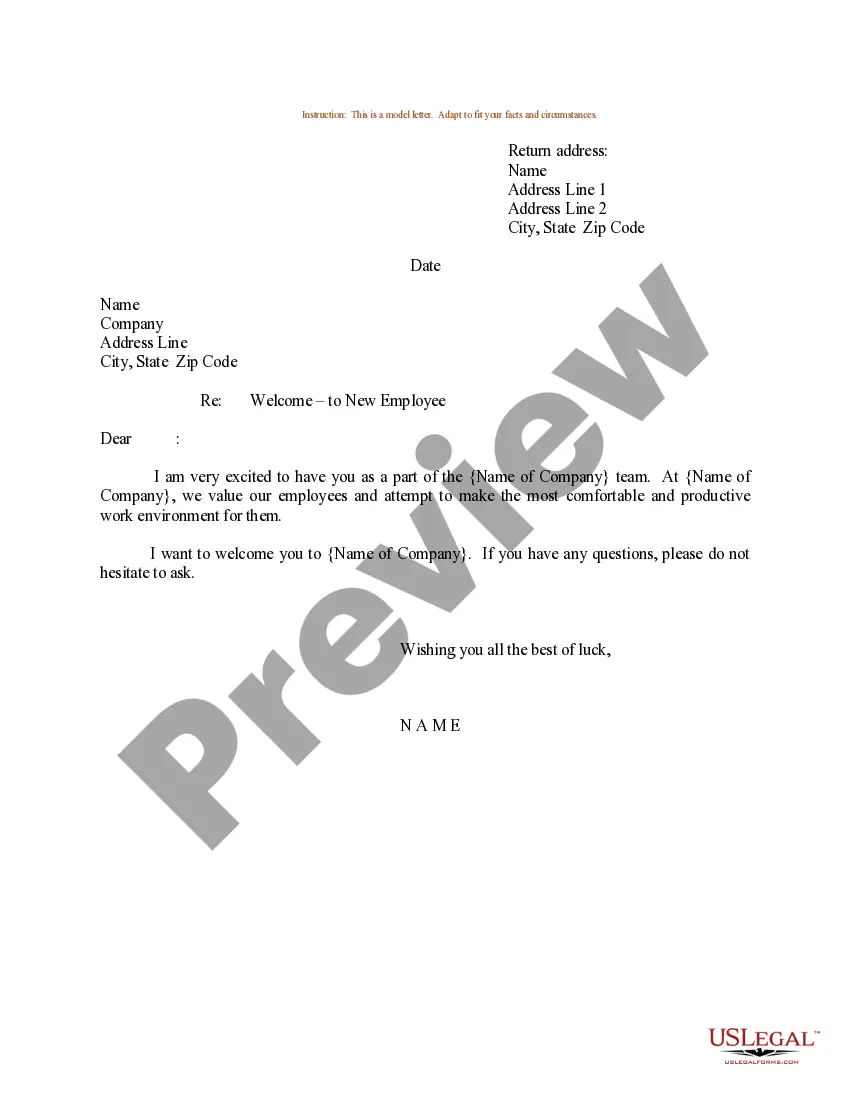

- Initially, ensure you have selected the right form for your personal city/state. You can look through the shape making use of the Review button and study the shape explanation to make sure it will be the right one for you.

- If the form fails to meet up with your expectations, utilize the Seach industry to discover the proper form.

- Once you are positive that the shape is acceptable, click the Buy now button to have the form.

- Pick the pricing plan you would like and enter the required information. Create your account and pay for an order using your PayPal account or charge card.

- Select the file formatting and acquire the lawful file template to the product.

- Complete, modify and print out and indicator the attained Colorado Letter from Debtor to Credit Card Company Requesting a Lower Interest Rate for a Certain Period of Time.

US Legal Forms will be the greatest collection of lawful types where you can find numerous file web templates. Use the company to acquire professionally-produced papers that follow status demands.