Colorado Assignment of Leases and Rents as Collateral Security for a Commercial Loan: Colorado Assignment of Leases and Rents refers to a legal document that allows a lender to use the lease payments and rental income from a commercial property as collateral for a commercial loan. This type of arrangement provides security to the lender, as it ensures a steady stream of income that can be used to repay the loan in case of default by the borrower. In Colorado, there are different types of Assignment of Leases and Rents as Collateral Security for a Commercial Loan, including: 1. Absolute Assignment: This type of assignment grants the lender complete ownership rights over the leases and rents generated by the commercial property. The lender can collect and use the rental income as needed until the loan is fully repaid. 2. Conditional Assignment: This form of assignment allows the lender to collect the lease payments and rental income only in the event of default by the borrower. Until then, the borrower retains control over the leases and rents and uses them for their intended purposes. 3. Partial Assignment: A partial assignment allows the lender to collect a portion of the lease payments and rental income as collateral, while the borrower maintains control over the remaining amount. This arrangement provides flexibility to the borrower while still offering security to the lender. 4. Revocable Assignment: A revocable assignment enables the borrower to revoke the assignment of leases and rents as collateral security at any point. This type of assignment is typically used as a temporary measure and can be reversed by the borrower upon meeting certain conditions, such as timely repayment of the loan. Regardless of the type of Assignment of Leases and Rents used in a commercial loan in Colorado, it is crucial for both the lender and borrower to carefully review and negotiate the terms of the agreement. This ensures that the rights and obligations of each party are clearly outlined and understood, minimizing potential disputes or legal complications in the future. In conclusion, a Colorado Assignment of Leases and Rents as Collateral Security for a Commercial Loan is a legal agreement that allows a lender to use the lease payments and rental income from a commercial property as collateral for a loan. There are various types of assignments available, including absolute, conditional, partial, and revocable assignments, each with its own set of implications and benefits.

Colorado Assignment of Leases and Rents as Collateral Security for a Commercial Loan

Description

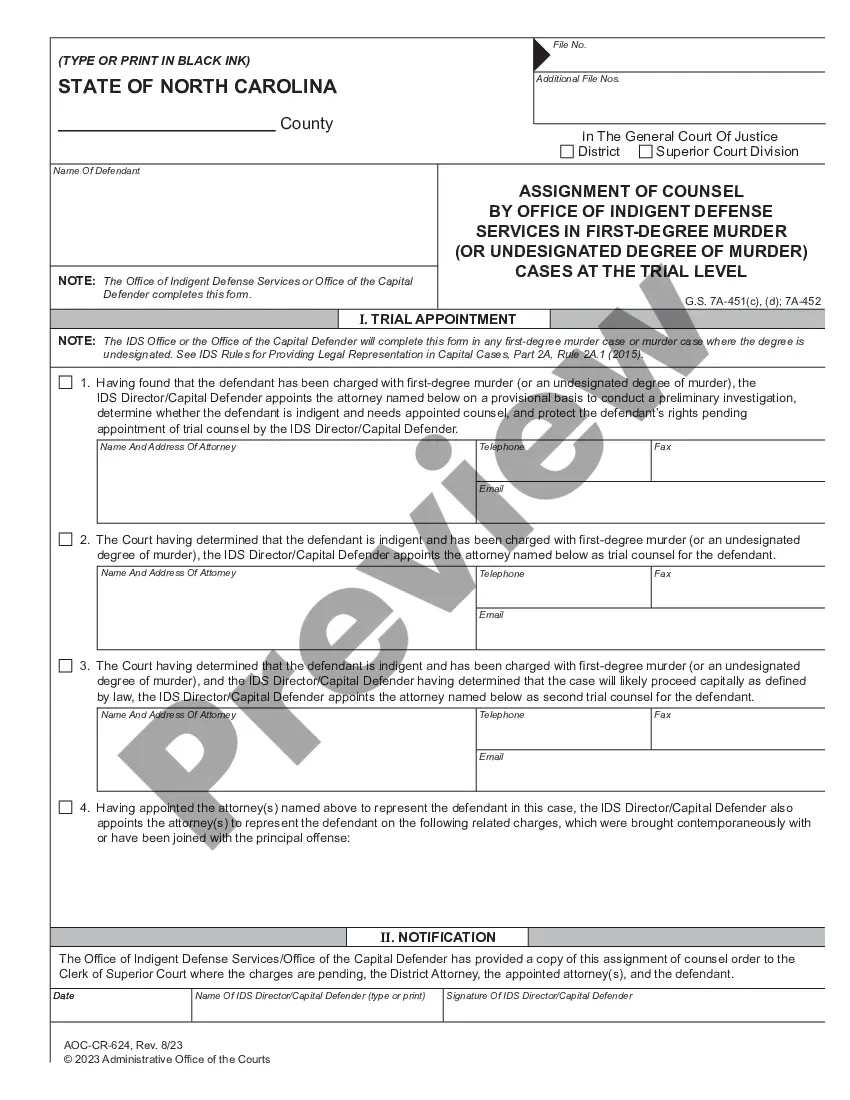

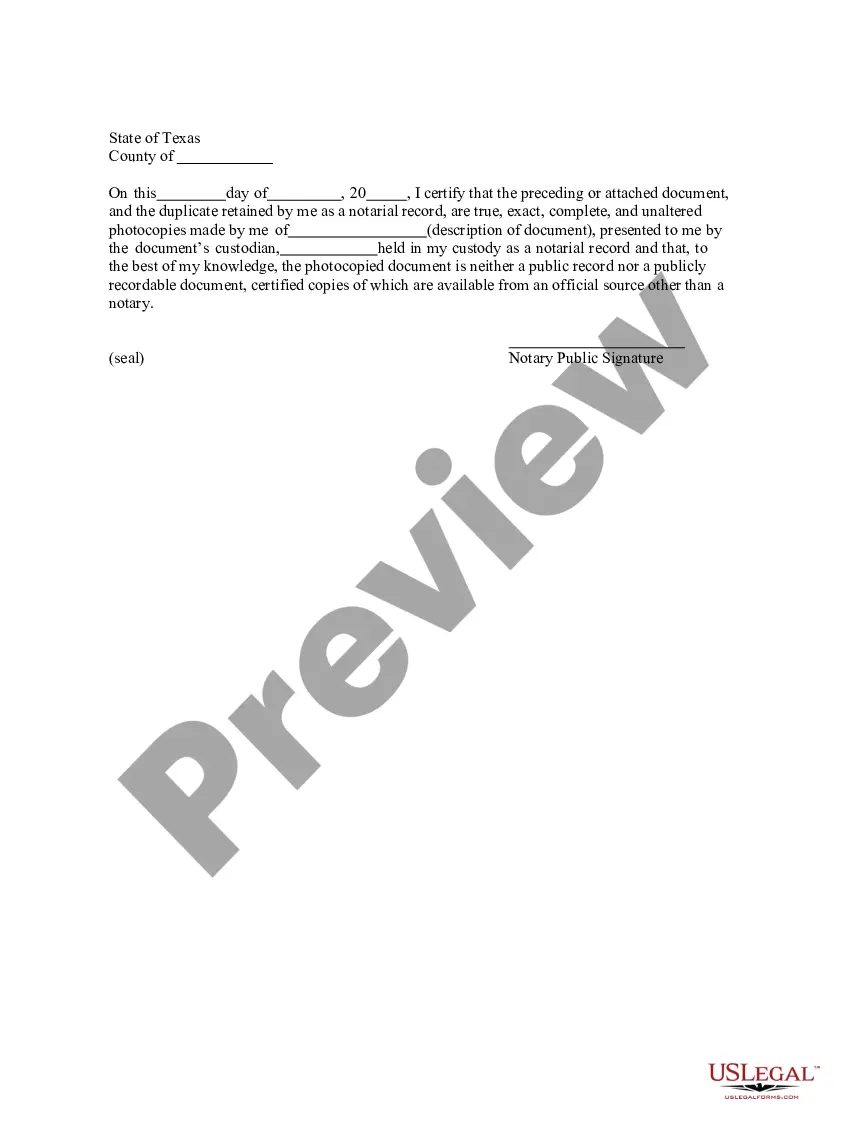

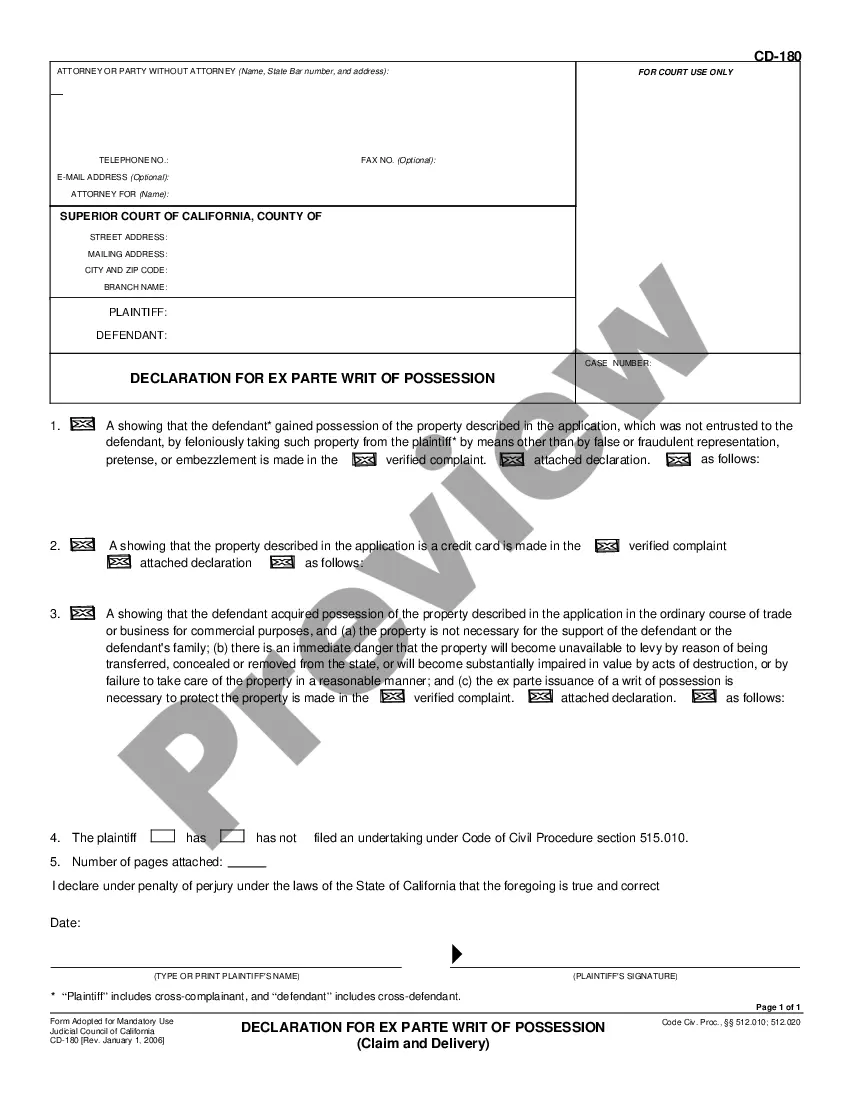

How to fill out Colorado Assignment Of Leases And Rents As Collateral Security For A Commercial Loan?

Are you presently within a position the place you need to have papers for sometimes enterprise or personal reasons almost every day time? There are a variety of legal file templates available on the Internet, but discovering types you can rely is not straightforward. US Legal Forms gives 1000s of type templates, such as the Colorado Assignment of Leases and Rents as Collateral Security for a Commercial Loan, which are created to fulfill federal and state specifications.

When you are presently knowledgeable about US Legal Forms site and possess your account, simply log in. Next, you are able to obtain the Colorado Assignment of Leases and Rents as Collateral Security for a Commercial Loan template.

If you do not provide an bank account and wish to begin using US Legal Forms, abide by these steps:

- Find the type you require and ensure it is for the right metropolis/area.

- Make use of the Preview switch to review the shape.

- Look at the information to actually have chosen the appropriate type.

- In case the type is not what you`re trying to find, use the Look for field to obtain the type that meets your needs and specifications.

- Whenever you obtain the right type, click on Get now.

- Opt for the pricing program you want, submit the specified information and facts to make your money, and pay money for your order using your PayPal or Visa or Mastercard.

- Decide on a practical paper format and obtain your duplicate.

Locate each of the file templates you have bought in the My Forms menus. You can get a extra duplicate of Colorado Assignment of Leases and Rents as Collateral Security for a Commercial Loan at any time, if possible. Just click on the required type to obtain or printing the file template.

Use US Legal Forms, probably the most substantial collection of legal types, to conserve efforts and prevent faults. The service gives skillfully produced legal file templates which can be used for a range of reasons. Make your account on US Legal Forms and initiate producing your lifestyle easier.

Form popularity

FAQ

Transfer generally refers to titles whereas assignment is used with obligations and rights.

By contrast, an assignment occurs when you transfer all your space to someone else (called an assignee) for the entire remaining term of the lease. As with a sublet, you are free to choose your assignee and determine the rent unless your lease says otherwise.

In fact, once the lease assignment is complete you can still be liable should the new tenant miss any payments or otherwise break the terms of their contract.

When a tenant signs up to this agreement they may not be aware of certain unforeseen factors which may require them to move out before the end of the lease. If this is the case and they can no longer afford to live in the property they have the option of assigning the lease.

Example of Collateral Assignment of Life Insurance You have a whole life insurance policy with a cash value of $65,000 and a death benefit of $300,000, which the bank accepts as collateral. So, you then designate the bank as the policy's assignee until you repay the $50,000 loan.

To complete an assignment of a lease, the assignor and assignee must typically enter into a legal agreement known as a Deed of Assignment. This document outlines the terms of the transfer and ensures that all parties involved are aware of their rights and obligations.

What is a Collateral Assignment Of Lease? A collateral assignment of lease is a legal contract that transfers the rights to rental payments from the asset's owner to a lender to secure funding. In this contract, the lease's rentals are like a loan from the funder to the lessor and the lease acts as security.

A commercial lease assignment happens when a tenant transfers all of the rights to a lease to someone else but remains liable for rent payments to the landlord.