Colorado Prenuptial Property Agreement with Business Operated by Spouse Designated to be Community Property

Description

How to fill out Prenuptial Property Agreement With Business Operated By Spouse Designated To Be Community Property?

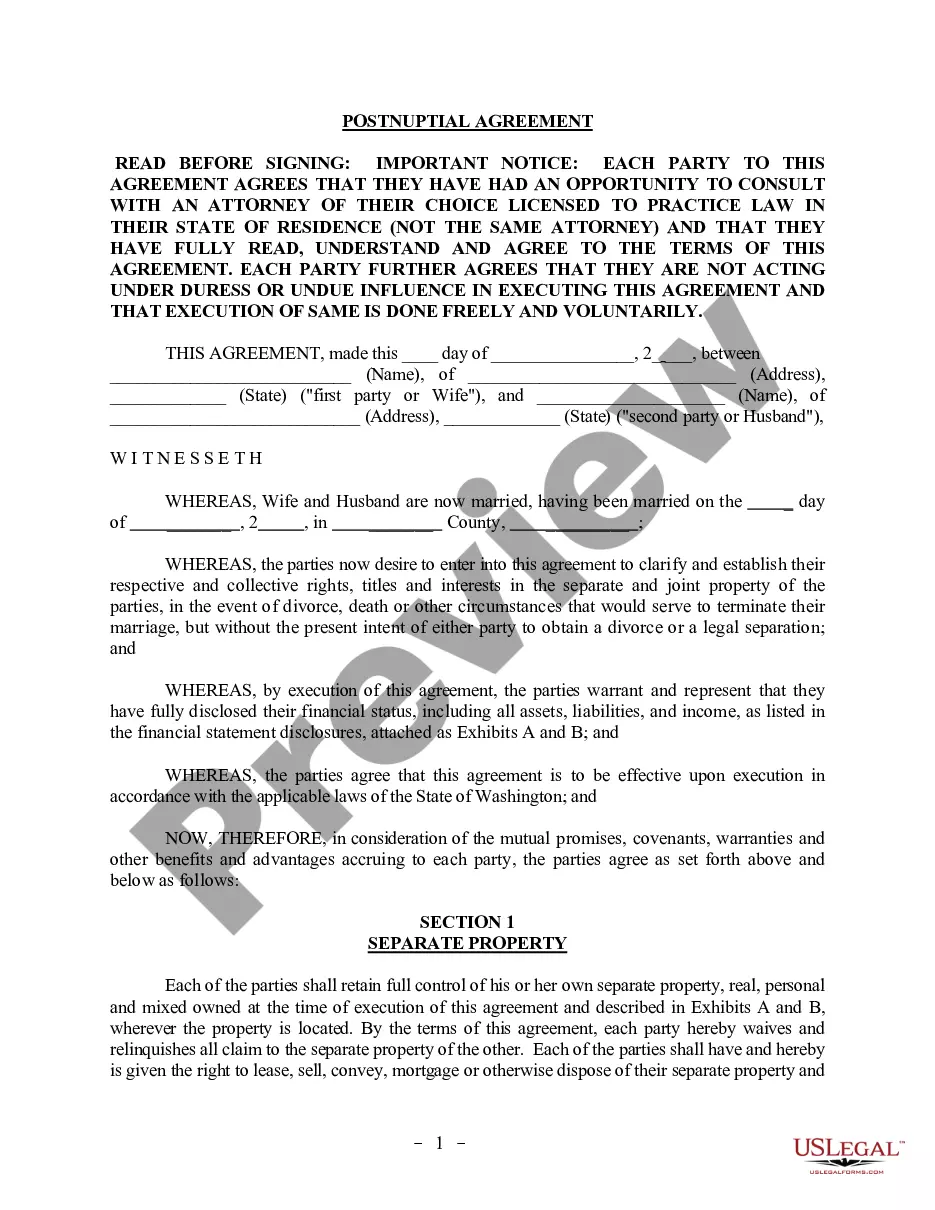

You can spend time on-line attempting to find the legitimate record design that fits the federal and state requirements you need. US Legal Forms supplies thousands of legitimate kinds which are evaluated by pros. It is simple to obtain or printing the Colorado Prenuptial Property Agreement with Business Operated by Spouse Designated to be Community Property from your support.

If you have a US Legal Forms bank account, you can log in and then click the Acquire switch. Next, you can comprehensive, modify, printing, or signal the Colorado Prenuptial Property Agreement with Business Operated by Spouse Designated to be Community Property. Each legitimate record design you purchase is your own property permanently. To get yet another copy associated with a purchased develop, go to the My Forms tab and then click the corresponding switch.

Should you use the US Legal Forms web site the very first time, keep to the straightforward directions under:

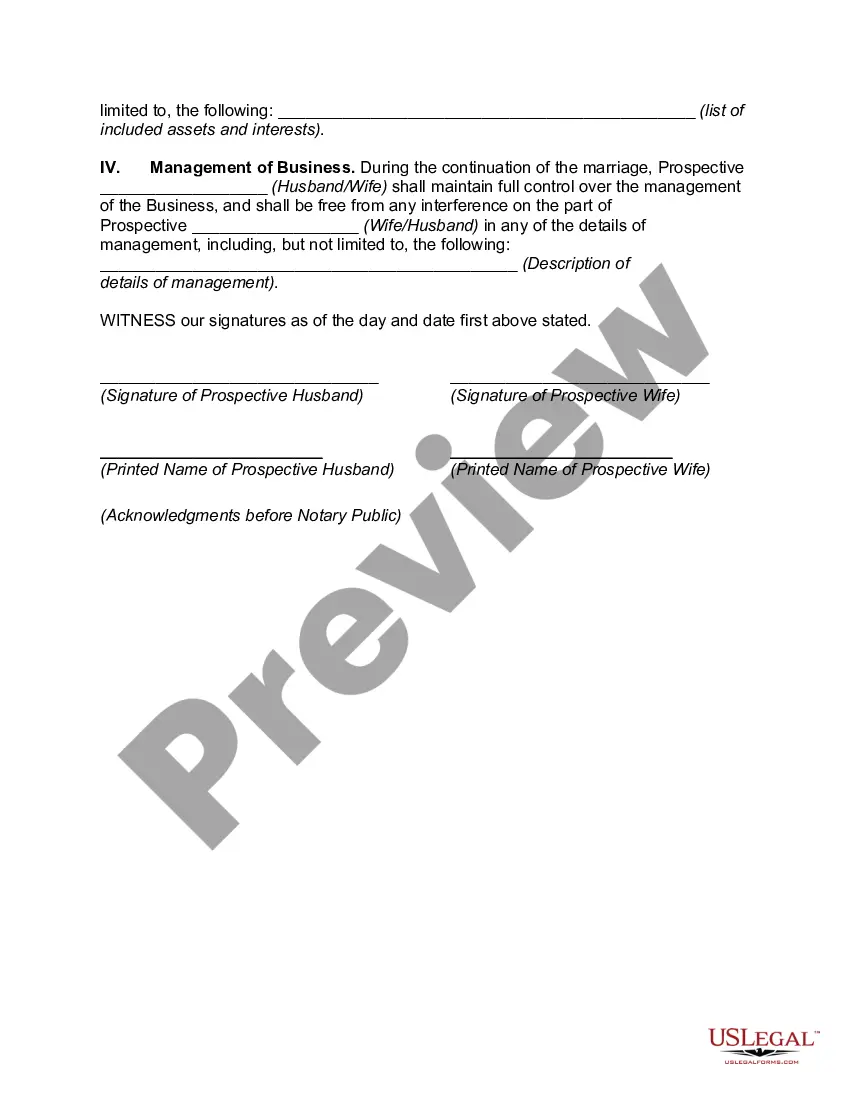

- Initial, be sure that you have chosen the right record design for the region/metropolis of your choosing. Browse the develop outline to make sure you have picked out the appropriate develop. If offered, take advantage of the Preview switch to search with the record design as well.

- If you wish to find yet another model of your develop, take advantage of the Look for field to discover the design that meets your needs and requirements.

- Upon having found the design you need, click Buy now to carry on.

- Choose the costs strategy you need, enter your references, and register for a free account on US Legal Forms.

- Comprehensive the deal. You should use your bank card or PayPal bank account to purchase the legitimate develop.

- Choose the file format of your record and obtain it for your device.

- Make adjustments for your record if necessary. You can comprehensive, modify and signal and printing Colorado Prenuptial Property Agreement with Business Operated by Spouse Designated to be Community Property.

Acquire and printing thousands of record web templates using the US Legal Forms web site, that offers the biggest variety of legitimate kinds. Use expert and state-specific web templates to take on your small business or specific demands.

Form popularity

FAQ

(1) the property owned or claimed by the spouse before marriage; (2) the property acquired by the spouse during marriage by gift, devise, or descent; (3) the recovery for personal injuries sustained by the spouse during marriage, except any recovery for loss of earning capacity during marriage.

Relationship property includes the family home (the main residence of the couple) and all family chattels, whenever acquired. Family chattels include furniture, appliances, household tools, pets, as well as motor vehicles, boats, caravans and trailers used for family purposes.

Essentially, the shareholders of a company will be able to control who the directors are. Where all of a company's shares are owned by one or both partners in a relationship, the company will be relationship property.

The only asset that may be excluded from the joint estate is an inheritance.

Generally, under California Community Property law found in California Family Code fffd 760. Defined, everything acquired after the date of marriage, before the date of separation (that is not inheritance or gift from third party) is community property.

Property that one party owned before the marriage is not owned by the community, and thus is treated as separate, and not community property. Separate property also encompasses gifts and inheritance specifically given to one party, and property purchased or earned after the separation.

The shares in the business, although held by a trust, were effectively treated as relationship property and therefore the payment for the restraint of trade was also declared to be relationship property. This case is a good reminder that business assets can be treated as relationship property.

A prenuptial agreement cannot include personal preferences, such as who has what chores, whose name to use, where to spend the holidays, information on child-rearing, or what relationship to have with specific relatives. Premarital agreements are meant to address monetary issues.

Separate property in a community property state includes:All property owned by a spouse prior to marriage. Any property obtained by a spouse after a legal separation. Any property received as a gift or inheritance during the marriage from a third party such as joint banking accounts. Any pre-marriage debts.

Can a California divorce affect my business? In California, businesses are considered assets and will be divided based on whether or not the business is separate or community property.