Colorado Jury Instruction - 4.4.1 Rule 10(b) - 5(a) Device, Scheme Or Artifice To Defraud Insider Trading

Description

How to fill out Jury Instruction - 4.4.1 Rule 10(b) - 5(a) Device, Scheme Or Artifice To Defraud Insider Trading?

Choosing the right legitimate document design can be a struggle. Needless to say, there are a variety of web templates available online, but how do you find the legitimate form you want? Use the US Legal Forms site. The support delivers 1000s of web templates, like the Colorado Jury Instruction - 4.4.1 Rule 10(b) - 5(a) Device, Scheme Or Artifice To Defraud Insider Trading, which you can use for enterprise and personal requirements. All of the types are checked out by professionals and meet state and federal demands.

If you are previously listed, log in for your profile and click the Obtain key to get the Colorado Jury Instruction - 4.4.1 Rule 10(b) - 5(a) Device, Scheme Or Artifice To Defraud Insider Trading. Use your profile to search through the legitimate types you have bought in the past. Proceed to the My Forms tab of your own profile and acquire one more duplicate of your document you want.

If you are a whole new customer of US Legal Forms, allow me to share basic recommendations so that you can adhere to:

- Initial, make sure you have selected the correct form for your personal metropolis/region. You are able to look through the shape utilizing the Review key and browse the shape description to make certain this is the best for you.

- When the form will not meet your expectations, utilize the Seach industry to find the appropriate form.

- Once you are positive that the shape would work, go through the Acquire now key to get the form.

- Opt for the costs program you would like and enter the needed info. Create your profile and buy an order making use of your PayPal profile or bank card.

- Opt for the document file format and down load the legitimate document design for your system.

- Complete, revise and print out and indicator the acquired Colorado Jury Instruction - 4.4.1 Rule 10(b) - 5(a) Device, Scheme Or Artifice To Defraud Insider Trading.

US Legal Forms will be the largest local library of legitimate types where you can find numerous document web templates. Use the service to down load skillfully-manufactured documents that adhere to status demands.

Form popularity

FAQ

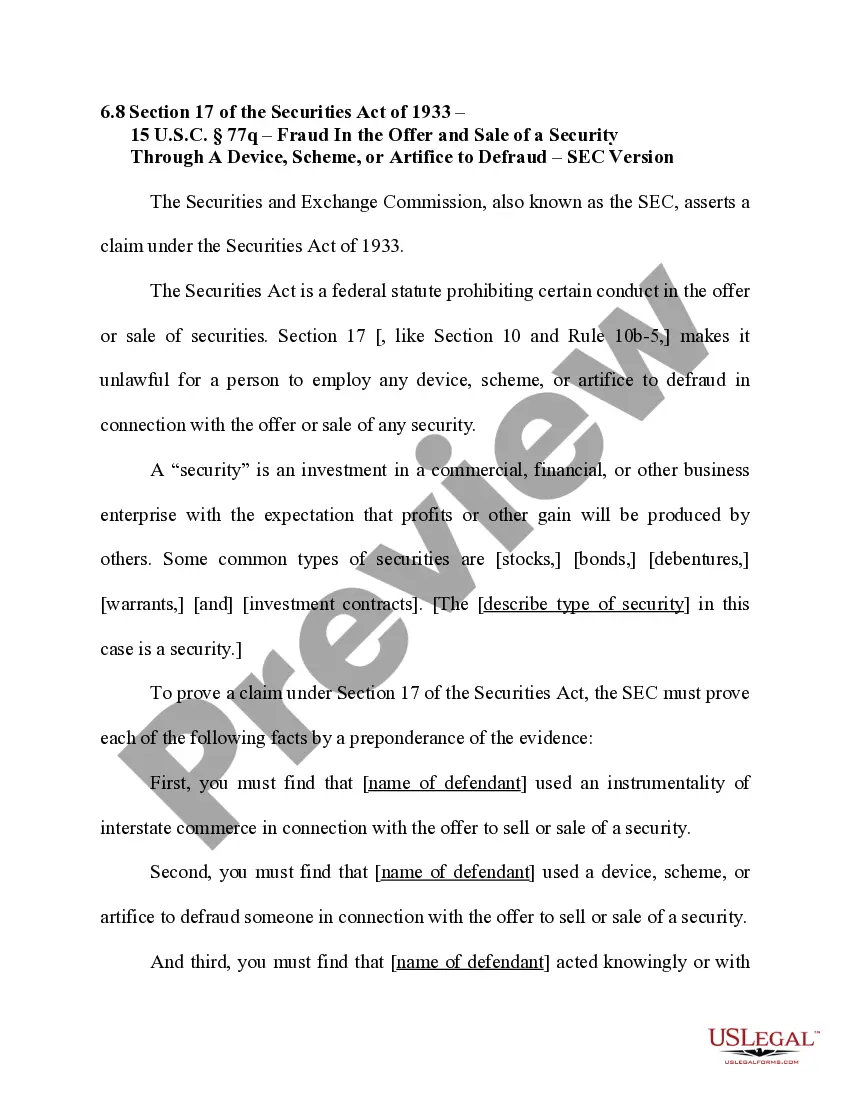

Section 10(b) of the Exchange Act and Rule 10b-5 prohibit material misrepresentations and misleading omissions in connection with the purchase or sale of securities.

?To succeed on a Rule 10b-5 fraud claim [based on an untrue statement or omission of a material fact], a plaintiff must establish (1) a false statement or omission of material fact; (2) made with scienter; (3) upon which the plaintiff justifiably relied; (4) that proximately caused the plaintiff's injury.? Robbins v.

Rule 10b5-1 originally provided an affirmative defense against insider trading liability if trades were undertaken in ance with a written plan adopted in good faith when the insider was not aware of MNPI. The amendments impose additional conditions for the affirmative defense, including: Cooling-Off Periods.

Rule 10b-5 covers insider trading, which occurs when confidential information is used to manipulate the market in one's favor. Changes to Rule 10b5-1, outlining ways for insiders to proactively avoid the appearance of insider trading, took effect on Feb. 27, 2023.

The instruction tells jurors that if they're ?firmly convinced? of the defendant's guilt, the crime has been proven beyond a reasonable doubt, but if they think there's a ?real possibility? the defendant isn't guilty, the prosecution didn't prove the crime beyond a reasonable doubt.

Introduction. On December 14, 2022, the Securities and Exchange Commission (the ?Commission?) adopted amendments to Rule 10b5-1 under the Securities Exchange Act of 1934 (the ?Exchange Act?), which provides affirmative defenses to trading on the basis of material nonpublic information in insider trading cases.

SEC Rule 10b-5, states that it is illegal for any person to defraud or deceive someone, including through the misrepresentation of material information, with respect to the sale or purchase of a security.

Section 10(b) of the Exchange Act and Rule 10b-5 prohibit material misrepresentations and misleading omissions in connection with the purchase or sale of securities.