Colorado Balance Sheet Deposits refer to the financial holdings and liabilities that are recorded on the balance sheet of banks and financial institutions located in the state of Colorado, United States. These deposits consist of various types of funds or assets held by banks to fulfill their obligations and facilitate their lending activities. Keywords: Colorado, Balance Sheet Deposits, financial holdings, liabilities, banks, financial institutions. 1. Demand Deposits: Demand deposits are funds held in checking accounts, where individuals and businesses can deposit and withdraw money on demand. These deposits typically have no maturity period and provide customers with easy access to their funds through checks and electronic transfers. 2. Time Deposits: Time deposits, also known as certificates of deposits (CDs), are deposits with a fixed term, ranging from a few months to several years. These deposits offer a higher interest rate than demand deposits but restrict the withdrawal of funds until the maturity date. 3. Savings Deposits: Savings deposits are interest-bearing accounts primarily meant for individuals to save money over a longer period. These deposits often have a lower interest rate than time deposits and provide limited withdrawal options to promote saving behavior. 4. Money Market Deposit Accounts (Midas): Midas are interest-bearing accounts that combine aspects of both checking and savings accounts. Banks offer a competitive interest rate on these deposits, and customers usually enjoy limited check-writing privileges. 5. Negotiable Order of Withdrawal (NOW) Accounts: Also referred to as interest-bearing checking accounts, NOW accounts allow customers to earn interest on their deposited funds while maintaining the flexibility of demand deposits. NOW accounts typically require a higher minimum balance compared to regular checking accounts. 6. Brokered Deposits: Brokered deposits are deposits acquired by a bank through a broker, rather than directly from customers. Brokers gather funds from multiple depositors and allocate them to various banks, ensuring diversification of deposits. This method helps banks attract necessary funds without extensive marketing efforts. 7. Core Deposits: Core deposits are the stable and long-term deposits that banks rely on to conduct their day-to-day operations. These include demand deposits, savings deposits, and long-term deposits from loyal customers who have an established relationship with the bank. It is important to note that while these deposit types are common across most banks, each institution may have specific terms, conditions, and features associated with their Colorado Balance Sheet Deposits.

Colorado Balance Sheet Deposits

Description

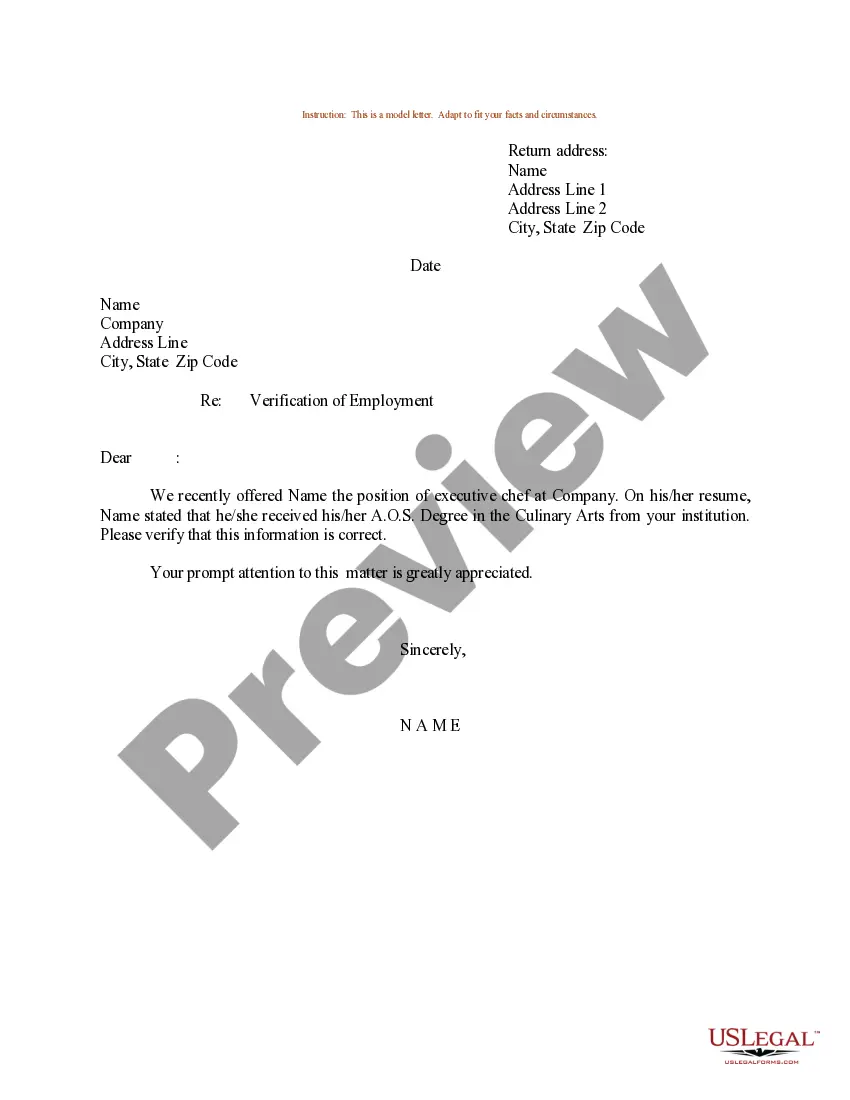

How to fill out Colorado Balance Sheet Deposits?

If you want to total, download, or print lawful file web templates, use US Legal Forms, the biggest assortment of lawful forms, which can be found on the web. Take advantage of the site`s basic and hassle-free look for to get the files you require. Different web templates for organization and person reasons are categorized by classes and says, or key phrases. Use US Legal Forms to get the Colorado Balance Sheet Deposits in just a handful of click throughs.

Should you be presently a US Legal Forms customer, log in in your accounts and click the Obtain key to find the Colorado Balance Sheet Deposits. Also you can access forms you earlier delivered electronically in the My Forms tab of the accounts.

If you are using US Legal Forms initially, follow the instructions beneath:

- Step 1. Be sure you have chosen the shape for that correct area/region.

- Step 2. Use the Review choice to check out the form`s articles. Do not forget to see the outline.

- Step 3. Should you be unsatisfied with the kind, take advantage of the Research area on top of the display to discover other versions from the lawful kind web template.

- Step 4. Once you have found the shape you require, click on the Buy now key. Opt for the costs plan you prefer and add your accreditations to register on an accounts.

- Step 5. Approach the purchase. You should use your credit card or PayPal accounts to complete the purchase.

- Step 6. Find the structure from the lawful kind and download it on your device.

- Step 7. Total, edit and print or signal the Colorado Balance Sheet Deposits.

Each and every lawful file web template you acquire is your own eternally. You may have acces to every kind you delivered electronically with your acccount. Click on the My Forms section and pick a kind to print or download yet again.

Compete and download, and print the Colorado Balance Sheet Deposits with US Legal Forms. There are millions of expert and express-specific forms you can utilize for the organization or person needs.