Colorado Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance is a legally binding contract entered into between an employer and an employee in the state of Colorado. This agreement outlines the terms and conditions for providing a nonqualified retirement plan to the employee, with the funding being facilitated through life insurance policies. The use of relevant keywords is crucial in understanding the essence of this agreement, and below you will find a detailed description of it: 1. Colorado Employment Agreement: This agreement refers to a contract of employment governed by the laws and regulations of Colorado, specifically tailored to meet the requirements of the state jurisdiction. 2. Nonqualified Retirement Plan: A nonqualified retirement plan is a financial benefit provided by employers to selected employees, usually high-level executives or key personnel who are not eligible for traditional qualified retirement plans (such as 401(k) or pension plans). Unlike qualified plans, nonqualified plans don't comply with certain tax regulations and offer more flexibility in terms of contribution limits and participant eligibility. 3. Funding with Life Insurance: A nonqualified retirement plan funded with life insurance involves using life insurance policies as an investment vehicle to accumulate funds for retirement benefits. Employers purchase life insurance policies for designated employees and pay the premiums. Upon retirement, the employee receives the accumulated cash value or the death benefit proceeds, providing a source of income during their retirement years. Different types of Colorado Employment Agreements with Nonqualified Retirement Plans Funded with Life Insurance: 1. Deferred Compensation Agreement: This type of agreement allows employees to defer a portion of their current compensation into a nonqualified retirement plan, funded with life insurance as an investment vehicle. 2. Supplemental Executive Retirement Plan (SERP): SERP is typically designed for high-level executives and provides an additional retirement benefit beyond what's offered in qualified retirement plans. Life insurance policies fund the SERP, ensuring a substantial retirement income source. 3. Split-Dollar Life Insurance Agreement: This agreement involves a shared arrangement between the employer and employee in paying the premiums for a life insurance policy. Upon the employee's retirement, the split-dollar agreement is terminated, and the employee can access the accumulated cash value as a retirement benefit. 4. Executive Bonus Plan: Under this agreement, the employer pays a bonus to the employee, who can then use the bonus amount to purchase a life insurance policy. The accumulated cash value in the policy is accessible upon retirement, providing a tax-advantaged retirement benefit. In conclusion, Colorado Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance is a comprehensive contract that outlines the provisions for providing retirement benefits using life insurance policies. The varied types of agreements mentioned above provide flexibility and tax advantages to employees while ensuring a secure source of income during their retirement years.

Colorado Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance

Description

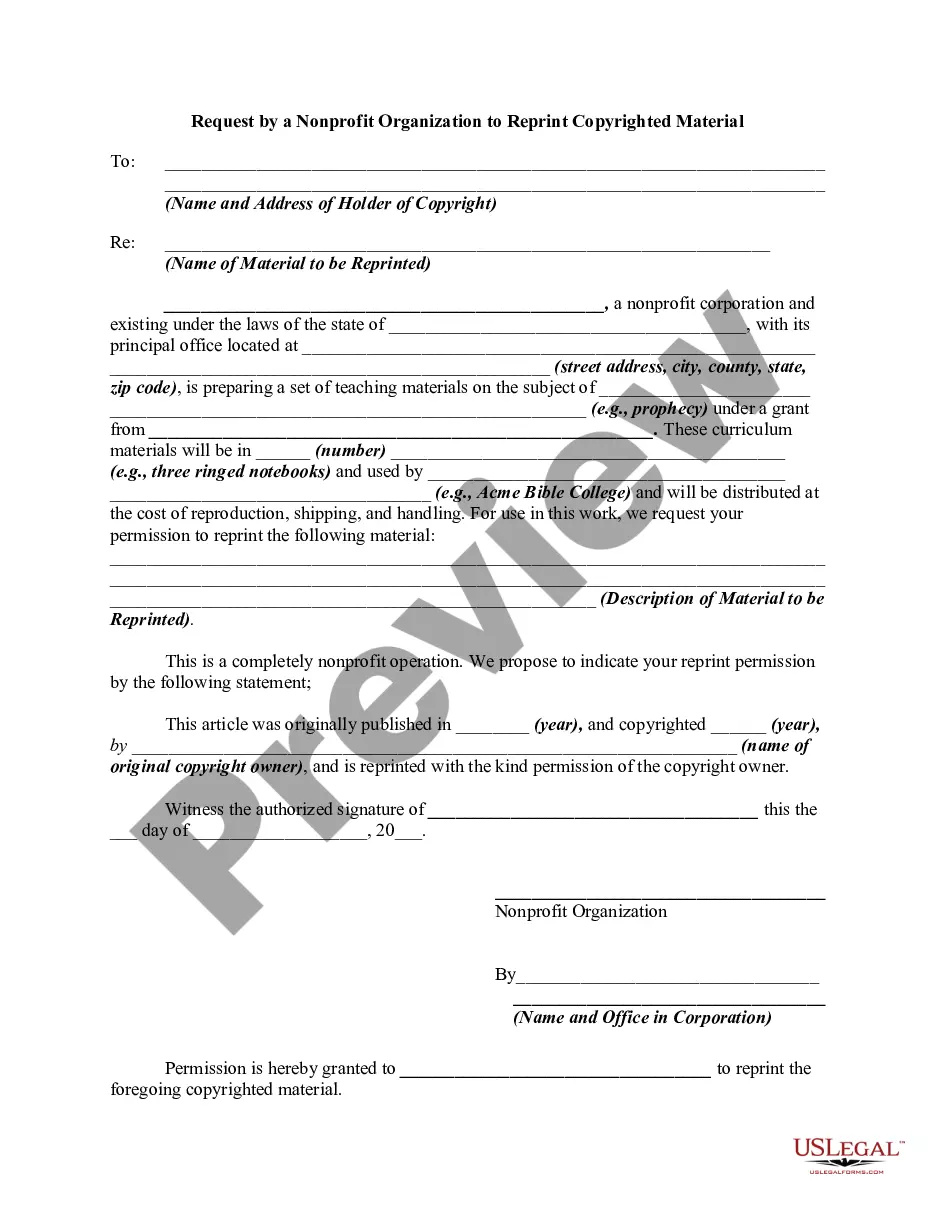

How to fill out Colorado Employment Agreement With Nonqualified Retirement Plan Funded With Life Insurance?

Discovering the right authorized record web template could be a battle. Naturally, there are a lot of templates available on the Internet, but how can you obtain the authorized develop you will need? Utilize the US Legal Forms web site. The services provides a huge number of templates, for example the Colorado Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance, which can be used for enterprise and private demands. Each of the types are inspected by professionals and meet up with state and federal needs.

In case you are currently registered, log in to your account and click the Acquire option to have the Colorado Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance. Make use of your account to search through the authorized types you possess bought formerly. Visit the My Forms tab of your account and acquire another copy of your record you will need.

In case you are a fresh user of US Legal Forms, here are simple guidelines so that you can adhere to:

- First, make certain you have chosen the correct develop for your personal town/area. You are able to look over the shape making use of the Preview option and browse the shape description to make certain it is the best for you.

- In the event the develop is not going to meet up with your expectations, make use of the Seach area to find the appropriate develop.

- When you are certain the shape is proper, select the Purchase now option to have the develop.

- Opt for the prices prepare you desire and type in the required information. Create your account and buy an order making use of your PayPal account or charge card.

- Select the document file format and down load the authorized record web template to your device.

- Full, revise and print and indication the received Colorado Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance.

US Legal Forms is the biggest local library of authorized types in which you can see numerous record templates. Utilize the company to down load professionally-created files that adhere to status needs.

Form popularity

FAQ

A nonqualified plan does not fall under ERISA guidelines so it does not receive the same tax advantages. They are considered to be assets of the employer and can be seized by creditors of the company. If the employee quits, they will likely lose the benefits of the nonqualified plan.

NQDC plans are exempt from most Employee Requirement Income Security Act (ERISA) requirements and related reporting requirements. This means there are no limitations on the amounts that can be deferred and no minimum distribution rules.

qualified deferred compensation plan is a binding contract between an employer and an employee where the employer agrees to pay the employee at a later time. Specifically, the employer makes an unsecured promise to pay an employee's future benefits, subject to the specific terms of the contract.

Common types of employer-sponsored retirement accounts that fall under ERISA include 401(k) plans, pensions, deferred-compensation plans, and profit-sharing plans. In addition, ERISA laws don't apply to Simplified employee pensions (SEPs) or, as mentioned above, IRAs.

Examples of nonqualified plans are deferred compensation plans, supplemental executive retirement plans, split-dollar arrangements and other similar arrangements. Contributions to a deferred compensation plan will reduce an employee's gross income, but there's no rollover option upon termination of employment.

A nonqualified deferred compensation plan is an unfunded plan that may be: (i) an excess benefit plan under ERISA §3(36); (ii) a plan maintained primarily for the purpose of providing deferred compensation for a select group of management or highly compensated employees (top-hat plan) under ERISA A§A§201(2), 301(a

Whenever life insurance is included in a qualified retirement plan, the insured is receiving an immediate benefit in the form of the life insurance protection. The value of this benefit is reported and added to the insured's taxable income each year.

qualified deferred compensation (NQDC) plan allows a service provider (e.g., an employee) to earn wages, bonuses, or other compensation in one year but receive the earningsand defer the income tax on themin a later year.

The non-qualified plan on a W-2 is a type of retirement savings plan that is employer-sponsored and tax-deferred. They are non-qualified because they fall outside the Employee Retirement Income Security Act (ERISA) guidelines and are exempt from the testing required with qualified retirement savings plans.

Qualified plans have tax-deferred contributions from the employee, and employers may deduct amounts they contribute to the plan. Nonqualified plans use after-tax dollars to fund them, and in most cases employers cannot claim their contributions as a tax deduction.