Colorado Employee Lending Agreement

Description

How to fill out Employee Lending Agreement?

If you want to acquire, download, or create valid document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Employ the site’s easy and user-friendly search feature to find the documents you need. Various templates for business and personal purposes are organized by categories and states, or keywords.

Use US Legal Forms to obtain the Colorado Employee Lending Agreement with just a few clicks.

Every legal document format you obtain is yours permanently. You have access to every form you purchased within your account. Choose the My documents section and select a form to print or download again.

Compete and download, and print the Colorado Employee Lending Agreement with US Legal Forms. There are thousands of professional and state-specific forms you can utilize for your business or personal needs.

- If you are already a US Legal Forms user, sign in to your account and then click the Download button to get the Colorado Employee Lending Agreement.

- You can also access forms you previously acquired from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Make sure you have selected the form for your correct city/state.

- Step 2. Use the Preview option to review the form's content. Remember to read through the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other forms in your desired legal format.

- Step 4. Once you have found the form you need, click on the Get now button. Choose the payment plan you prefer and enter your details to register for an account.

- Step 5. Process the payment. You may use your Visa or Mastercard or PayPal account to complete the transaction.

- Step 6. Select the format of your legal document and download it to your device.

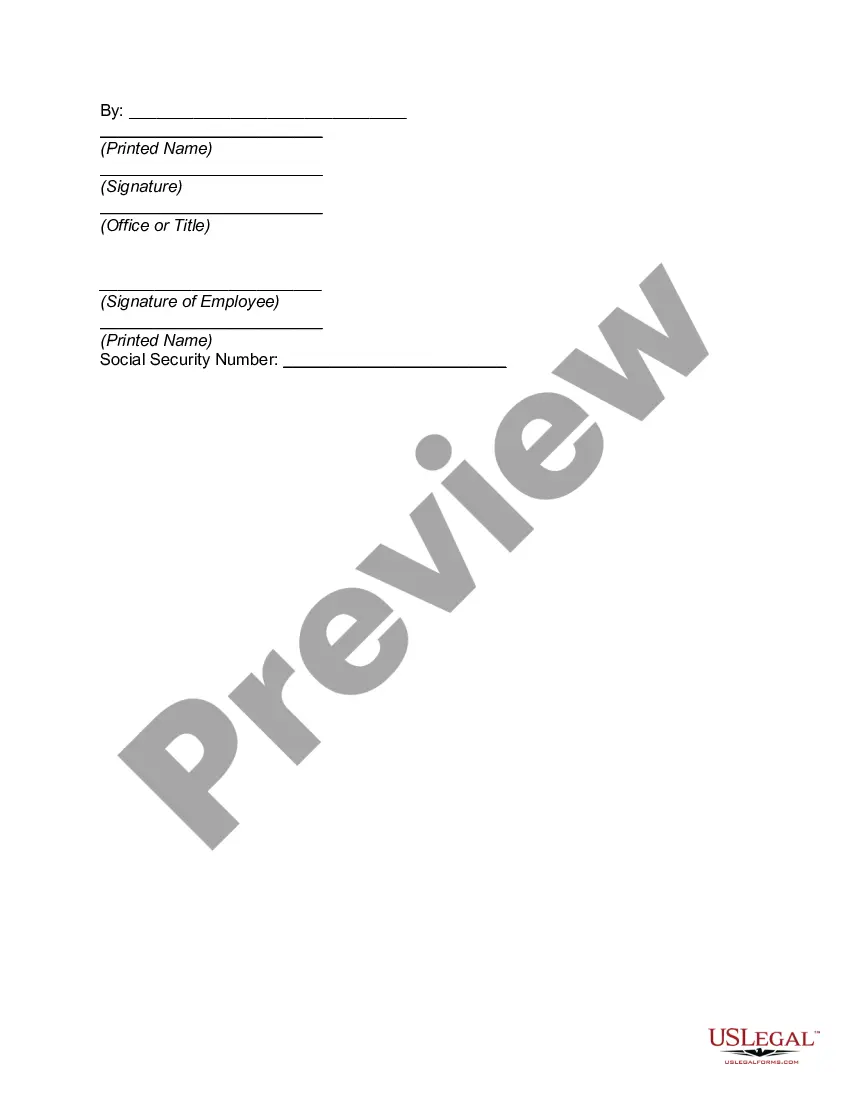

- Step 7. Complete, modify, and print or sign the Colorado Employee Lending Agreement.

Form popularity

FAQ

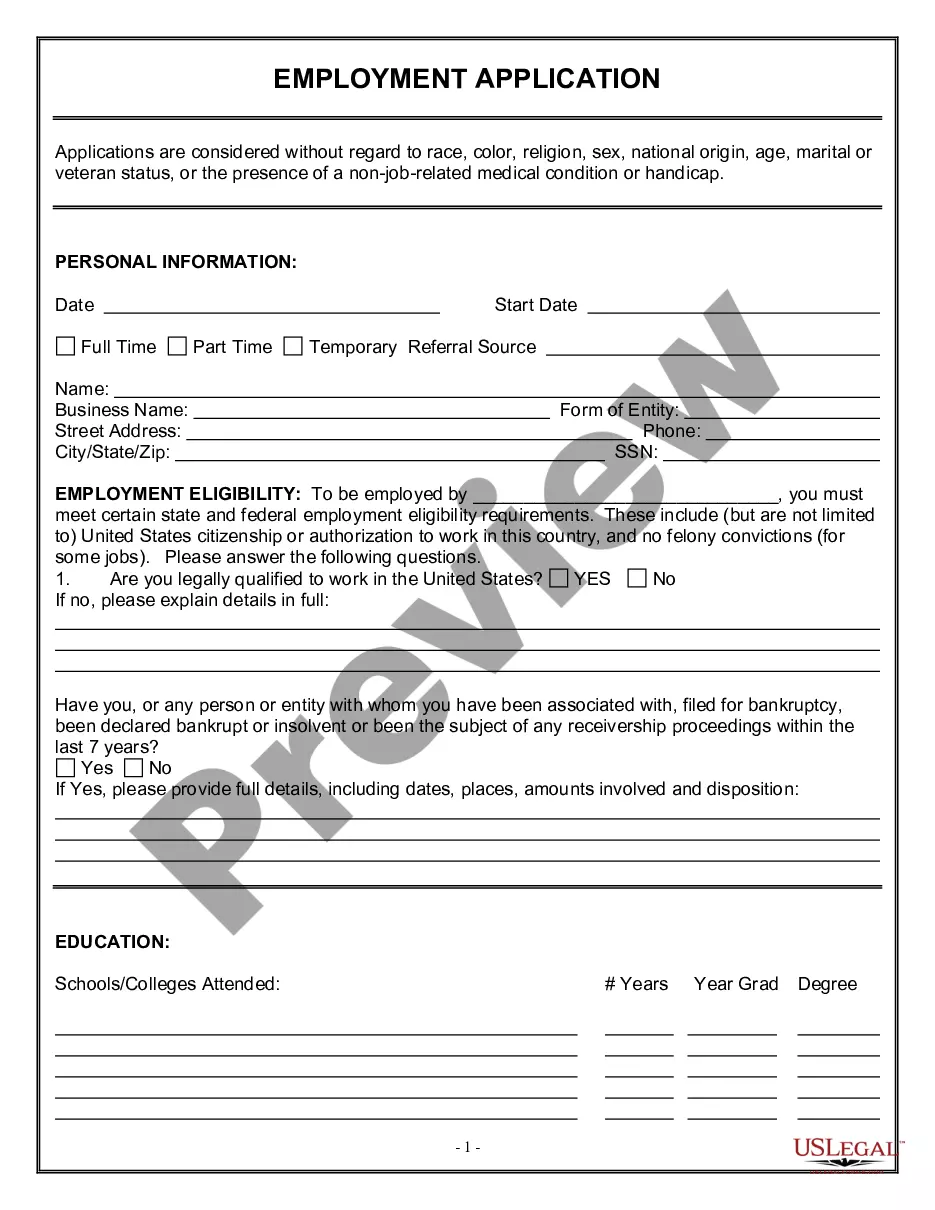

Filling out a Colorado Employee Lending Agreement form is straightforward. First, gather essential details about the employee and the lending specifics, such as the amount and terms. Next, carefully complete each section of the agreement form, ensuring accuracy and clarity. Finally, review the completed form for any errors and ensure both parties sign the document to validate the agreement.

Terms and Conditions of Employment : being items such:Name and address of employer.Name and address of employee.Job title.Job description.Salary.Agreed Deductions from salary.Pension or Provident fund benefits, rules and contributions.Medical Aid benefits, rules and contributions.More items...

In general, the legal doctrine of employment at-will in Colorado allows an employer or employee to terminate employment at any time, with or without any cause or reason, and without prior notice.

Yes, a Private Limited Company can grant a loan to a managing/whole-time director of the company if it is approved by a special resolution in the meeting and if this facility is given by the PLC to all its employees.

Workplace safety You have three basic rights: the right to refuse dangerous work and know that you're protected from reprisal. the right to know about workplace hazards and have access to basic health and safety information. the right to participate in health and safety discussions and health and safety committees.

Contracts are illegal when the written content therein causes those involved in the contract to act illegally. The illegality being considered should be directly related to the content of the contract and not to some outlying concept. An illegal contract is not enforceable in a court of law.

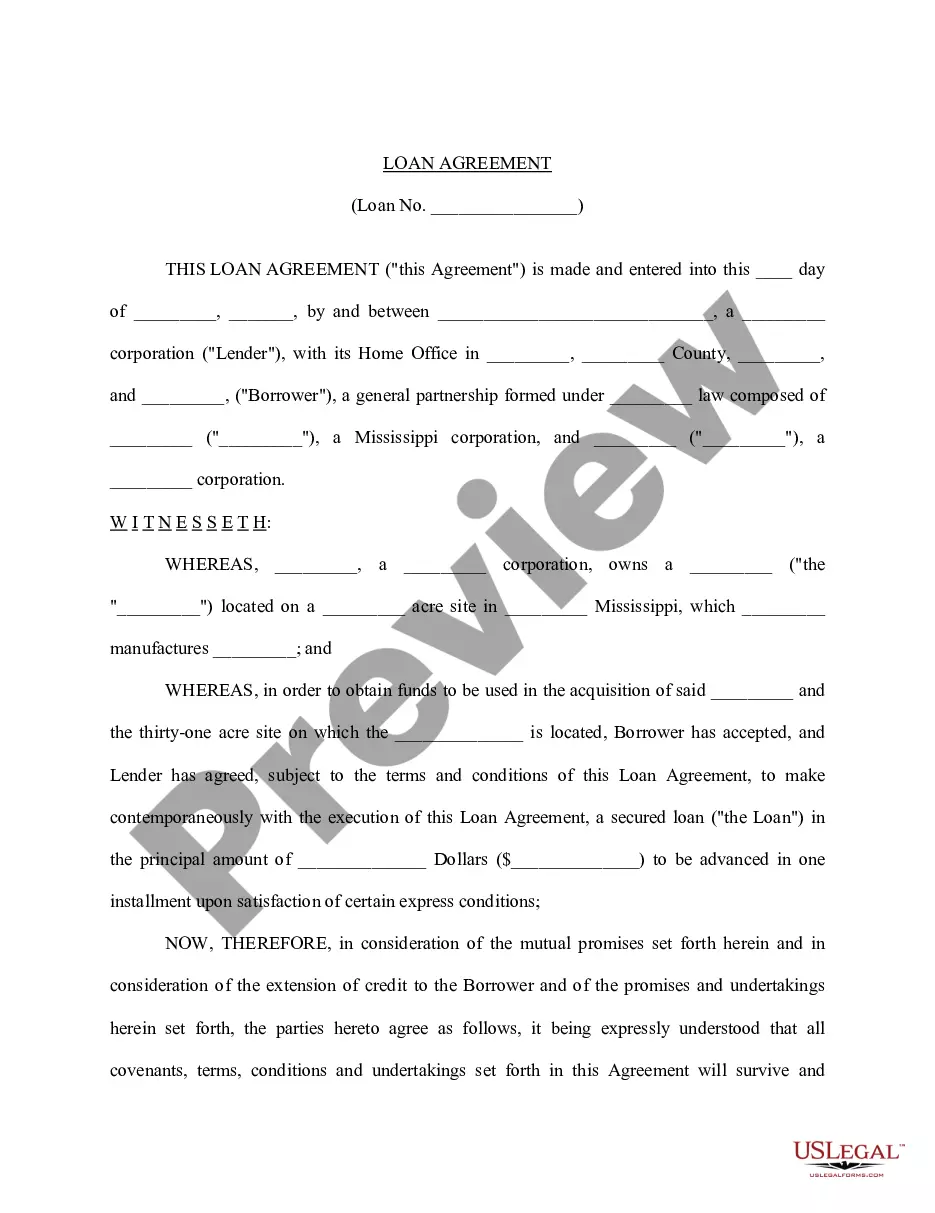

Employers in the U.S. can provide loans to their employees, but may have to comply with different laws depending on your state. Some states allow employees to repay loans through payroll deductions, but only if it doesn't reduce their wages below the $7.25-per-hour federal minimum wage.

A contract of employment is a legally binding agreement between you and your employer. A breach of that contract happens when either you or your employer breaks one of the terms, for example your employer doesn't pay your wages, or you don't work the agreed hours. Not all the terms of a contract are written down.

Employment Contracts in Colorado. Contracts serve as the basis for every employment relationship. Employment contracts can be created by a written document, by oral statements, or implied by the conduct of the employer and employee.

The State shall protect labor, promote full employment, provide equal work opportunity regardless of gender, race, or creed; and regulate employee-employer relations.