A Colorado Notice of Disputed Account is a legal document used in the state of Colorado to challenge or dispute a debt or account claimed by a creditor. It is an important tool for consumers to protect their rights and ensure fair treatment in debt collection proceedings. When a consumer receives a Colorado Notice of Disputed Account, it signifies that they have formally disputed a debt that a creditor or collection agency claims they owe. It is an essential step to halt the debt collection process until the dispute is resolved. This notice allows individuals to legally challenge the validity, accuracy, or legitimacy of a particular debt or account. The Colorado Notice of Disputed Account serves multiple purposes. Firstly, it acts as written documentation that clearly communicates the consumer's objection to the debt. This ensures that all parties involved understand the existence of a dispute. Moreover, it serves as a crucial evidence piece in case legal action is necessary. One important keyword that should be included in content about the Colorado Notice of Disputed Account is "Colorado Fair Debt Collection Practices Act" (CFD CPA). It is a legislation that outlines regulations for debt collectors and protects consumers from unfair collection practices. Familiarity with the CFD CPA is essential for understanding the rights and responsibilities of both debtors and creditors in Colorado. Additionally, there are different types of Colorado Notice of Disputed Account that can be filed depending on the situation. These include: 1. Initial Notice of Disputed Account: This is the first notice a consumer sends to the creditor or collection agency upon receiving a debt collection notice. It states the consumer's refusal to acknowledge the debt until it is proven valid and provides a thorough explanation of why the account is disputed. 2. Follow-up Notice of Disputed Account: In case the creditor or collection agency fails to respond or adequately address the dispute within the required timeframe, consumers may send a follow-up notice. This reiterates the consumer's position and emphasizes their rights to stop collection activities until the dispute is resolved. 3. Colorado Notice of Disputed Account under the Fair Credit Reporting Act (FCRA): If misinformation or inaccurate account details have been reported by credit bureaus, consumers can send a separate notice to both the creditor and credit reporting agencies to correct the inaccuracies and update their credit report. It is critical for consumers to understand their rights and obligations regarding debt collection disputes in Colorado. By utilizing the Colorado Notice of Disputed Account and following the CFD CPA guidelines, individuals can safeguard themselves from unjust collection practices and ensure the accuracy and validity of their financial records.

Colorado Notice of Disputed Account

Description

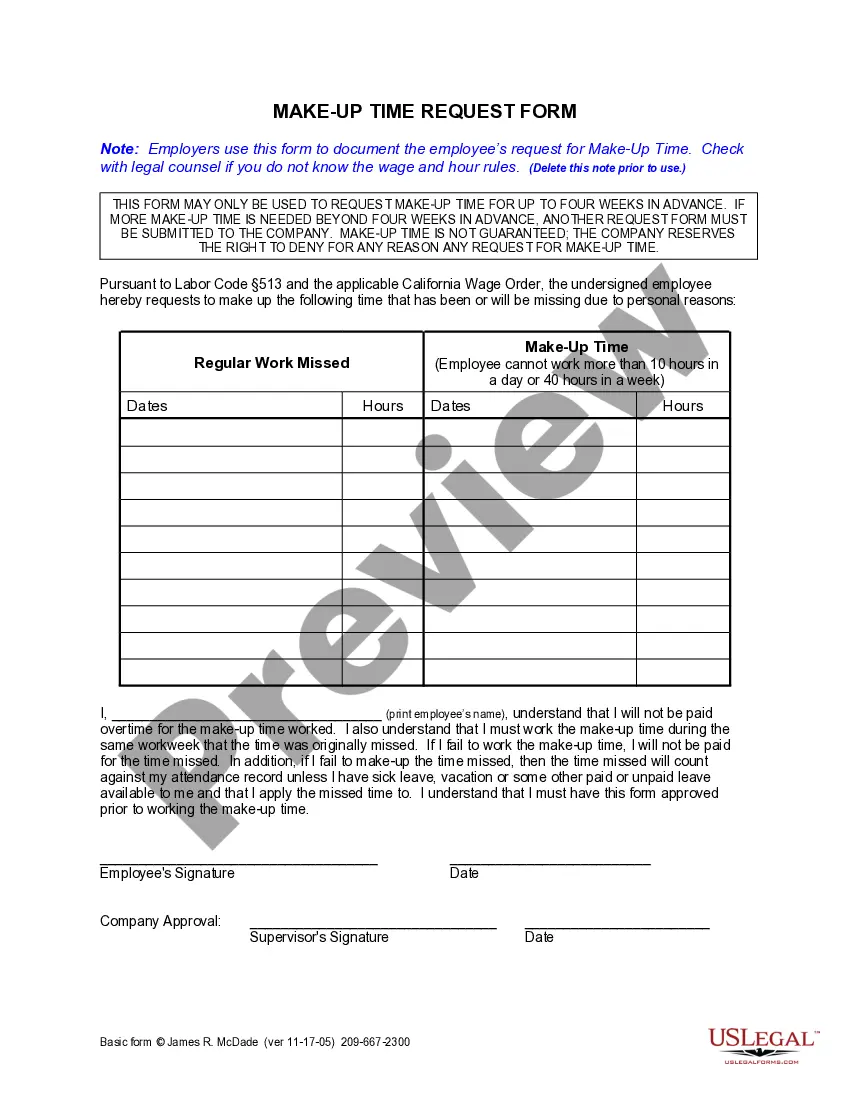

How to fill out Colorado Notice Of Disputed Account?

You can spend hours online searching for the correct legal document format that complies with the federal and state regulations you need. US Legal Forms provides a vast array of legal templates that are reviewed by professionals.

It is easy to download or print the Colorado Notice of Disputed Account from the platform.

If you already possess a US Legal Forms account, you can Log In and click the Download button. Then, you can fill out, edit, print, or sign the Colorado Notice of Disputed Account. Every legal document template you obtain is yours indefinitely.

Complete the transaction. You can use your credit card or PayPal account to purchase the legal document. Select the format of the document and download it to your device. Make changes to your document if necessary. You can fill out, edit, sign, and print the Colorado Notice of Disputed Account. Download and print a vast number of document templates using the US Legal Forms website, which offers the largest collection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- To get another copy of the purchased document, visit the My documents section and select the appropriate option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have chosen the correct document format for the district/area you select. Review the form description to confirm you have selected the right document.

- If available, use the Preview option to review the document format as well.

- To find another version of the document, utilize the Search field to locate the format that fulfills your needs and criteria.

- After locating the desired format, simply click Get now to proceed.

- Choose your preferred pricing plan, enter your credentials, and sign up for your account on US Legal Forms.

Form popularity

FAQ

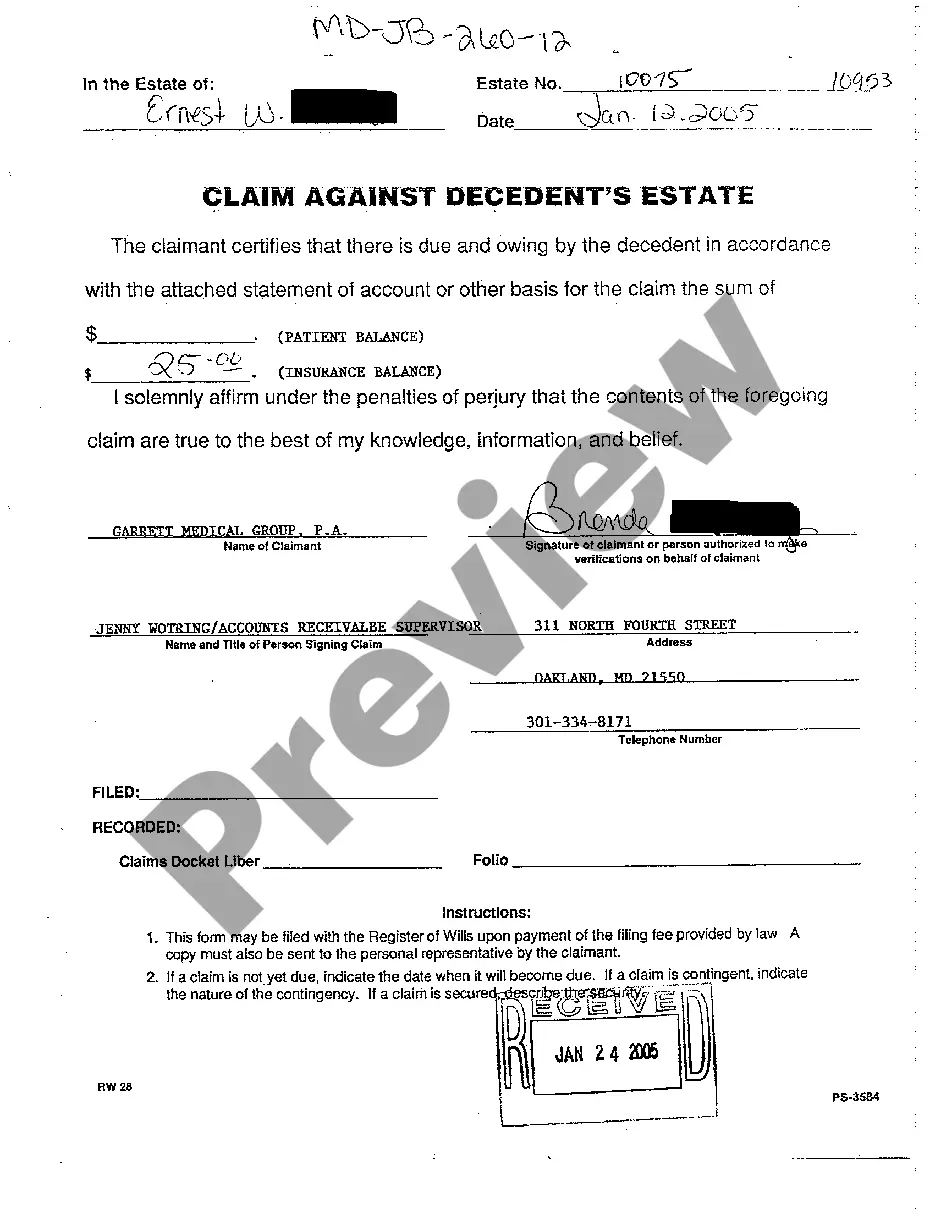

To write a good credit dispute letter, begin with your contact information and the date. Clearly state the purpose of your letter, identifying the specific item you dispute along with reasons for your claim. Attach any supportive documents and request a prompt investigation into the matter. The Colorado Notice of Disputed Account can enhance your credit dispute letter's effectiveness by ensuring you include all necessary details.

Writing a dispute form involves clearly stating your information and the nature of the dispute. Start by including your name, address, and account number, followed by a detailed description of the issue you are disputing. Provide any evidence that substantiates your claim, ensuring clarity throughout. Utilize the Colorado Notice of Disputed Account for structured guidance when crafting your dispute form.

To dispute a credit report accurately, start by identifying the error in your report. Write to the credit reporting agency specifying the mistake and include any evidence that supports your claim. Be detailed and direct in your communication, and ensure you keep a copy of your dispute for your records. The Colorado Notice of Disputed Account serves as an effective guide for structuring your dispute.

To fill out a credit dispute form, begin by gathering all relevant information about your account. You should provide your personal details, the account number, and a clear explanation of the dispute. Additionally, it is essential to attach any supporting documents to strengthen your case. Using the Colorado Notice of Disputed Account can help you format your dispute efficiently.

You can clear a dispute on your credit report by providing evidence that supports the accuracy of the information. If you have resolved the issue, file a request with the credit bureaus to update your account using the Colorado Notice of Disputed Account. This step is essential to ensure the disputed items are reviewed and cleared effectively. You might also consider using platforms like UsLegalForms for guidance and necessary forms.

To stop disputes on your credit report, you need to confirm that the issues have been resolved. Once you settle everything, ensure you follow up with the credit bureaus to confirm that your Colorado Notice of Disputed Account has been addressed. If necessary, you can withdraw your dispute formally in writing. Keeping a record of your communications will help maintain clarity.

Yes, disputes can be removed from a credit report once the investigation is complete. If the credit bureau finds that the disputed information is incorrect, they will remove it and update your report accordingly. The Colorado Notice of Disputed Account plays a crucial role in this process. By using this notice, you ensure that your dispute is officially recognized.

Yes, you can raise a dispute with the credit bureaus to correct or remove inaccurate records. Begin by filing a Colorado Notice of Disputed Account through the appropriate channels. This notice alerts the credit bureau to investigate your claim. Ensure you provide all necessary documentation to support your dispute.

The rule to show cause in Colorado refers to the legal framework that governs when and how a court may issue an order compelling a party to appear and justify their actions. It is often applied in cases, such as those involving a Colorado Notice of Disputed Account, where disputes arise that require judicial intervention. Understanding this rule is essential for parties involved in disputes to ensure compliance and proper representation during legal proceedings.

In Colorado, an order to show cause is a legal tool utilized to compel a party to justify their position in court. It typically arises in situations involving disputes, such as a Colorado Notice of Disputed Account, where one party contests the validity of claims or actions. This order requires a response by a specified date and often leads to a hearing where both sides can present their arguments and evidence.

Interesting Questions

More info

You are transferring any amount from your bank account to your bank account. This payment may come in the form of check, ACH transfer, direct deposit, or wire transfer. Websites are the websites that our clients use to advertise their companies or products or services. You are responsible for maintaining and updating your company's websites. When you make a change to your company's website, you must also update your Business Registration online with the state of Colorado. You must also register with the state by visiting the state's Business Registration Information Center for Colorado. You may change your business registration online or call us at for assistance. Websites If you are a small business or an employee business, you are responsible for maintaining all of your websites.