Colorado Conflict of Interest Disclosure of Director of Corporation

Description

How to fill out Conflict Of Interest Disclosure Of Director Of Corporation?

If you want to finalize, acquire, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms, accessible online.

Employ the site's straightforward and convenient search feature to find the documents you need.

Numerous templates for professional and personal use are categorized by type and state, or by keywords.

Step 4. Once you have found the form you need, click the Get now button. Select the pricing plan you prefer and enter your information to register for an account.

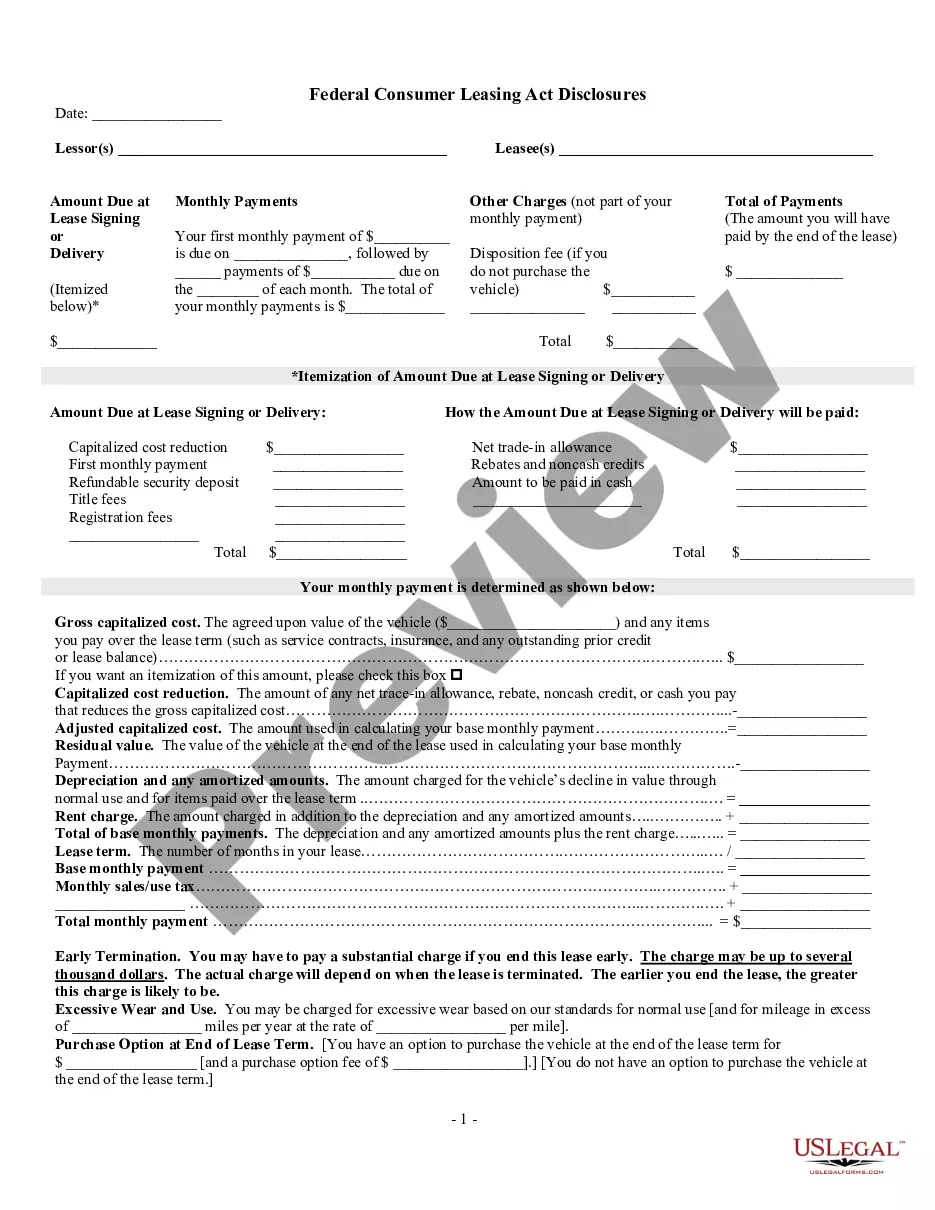

Step 5. Complete the transaction. You can use your Visa or Mastercard or PayPal account to finish the payment. Step 6. Choose the format of the legal document and download it to your device. Step 7. Complete, edit, and print or sign the Colorado Conflict of Interest Disclosure of Director of Corporation.

- Use US Legal Forms to obtain the Colorado Conflict of Interest Disclosure of Director of Corporation with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to get the Colorado Conflict of Interest Disclosure of Director of Corporation.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have chosen the form for your correct city/state.

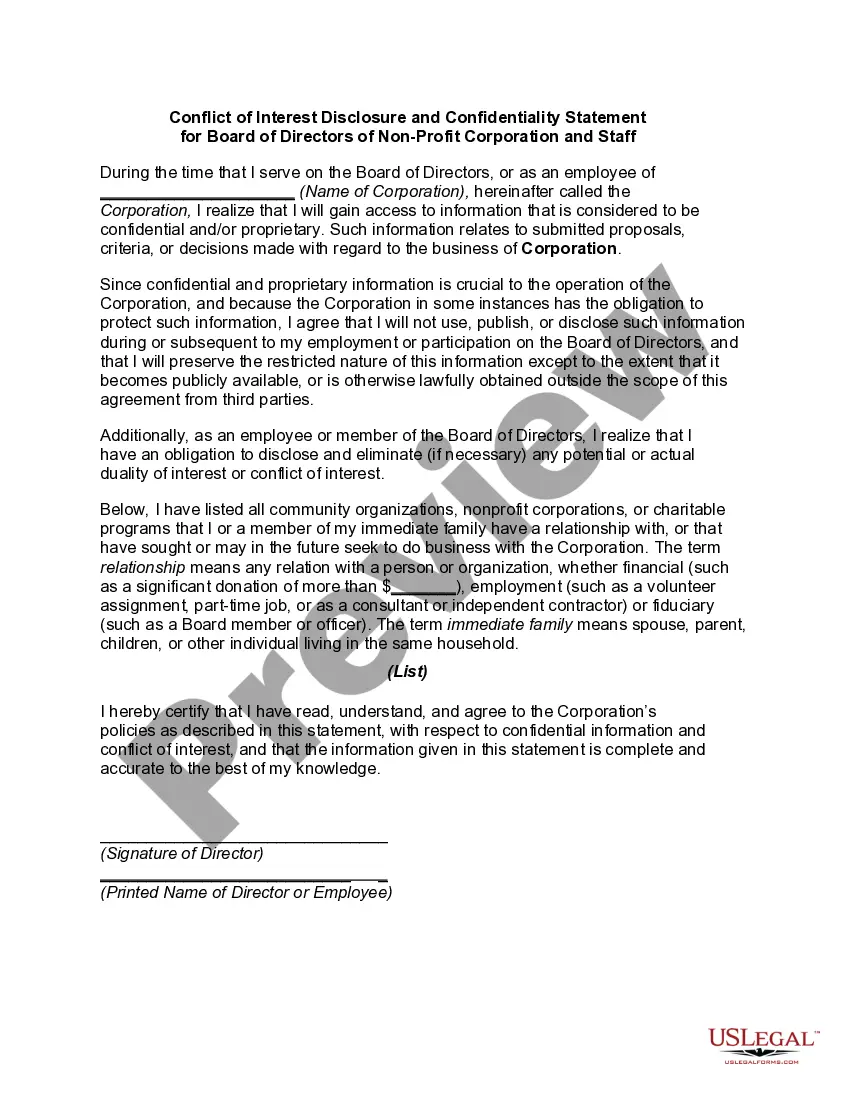

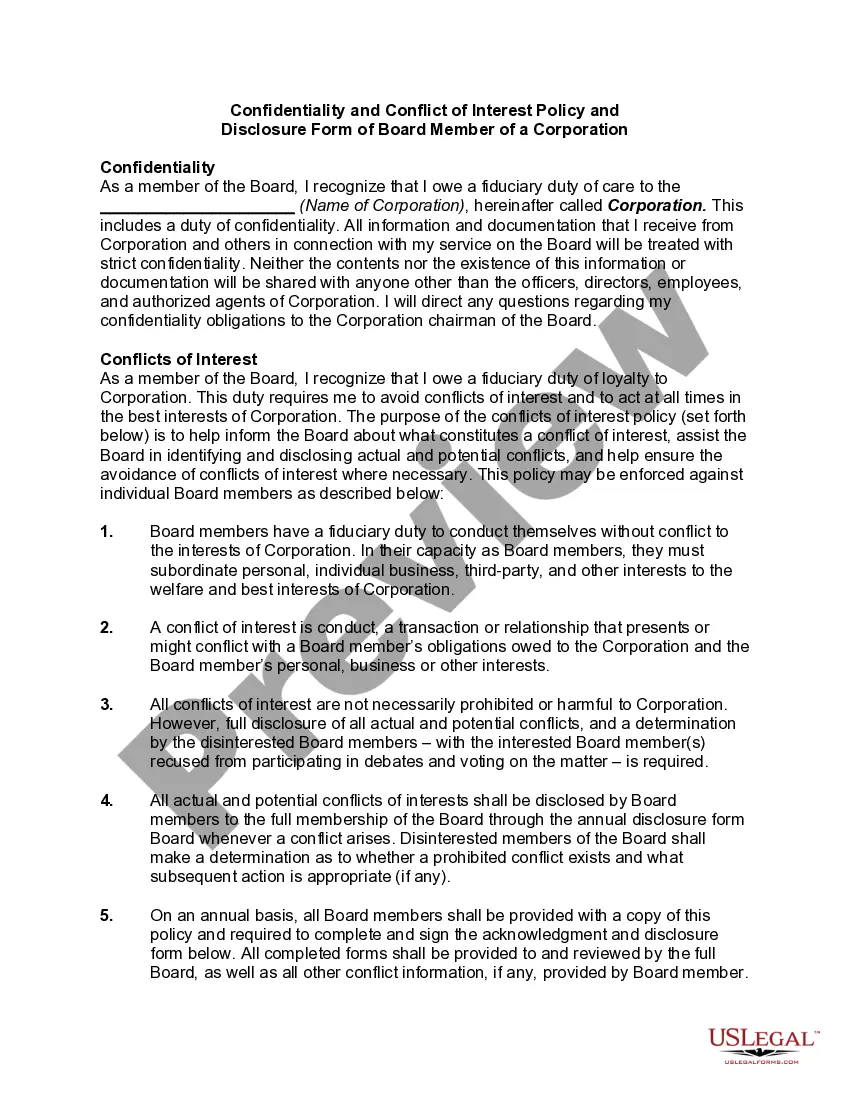

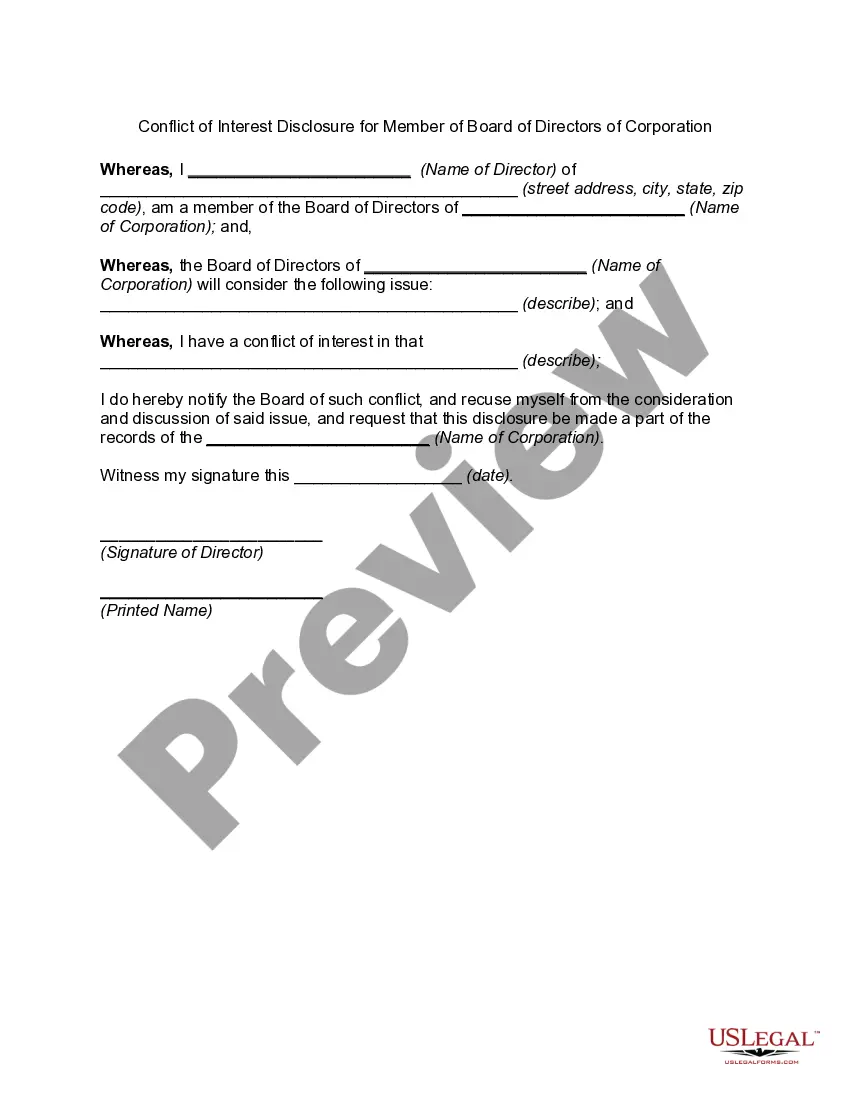

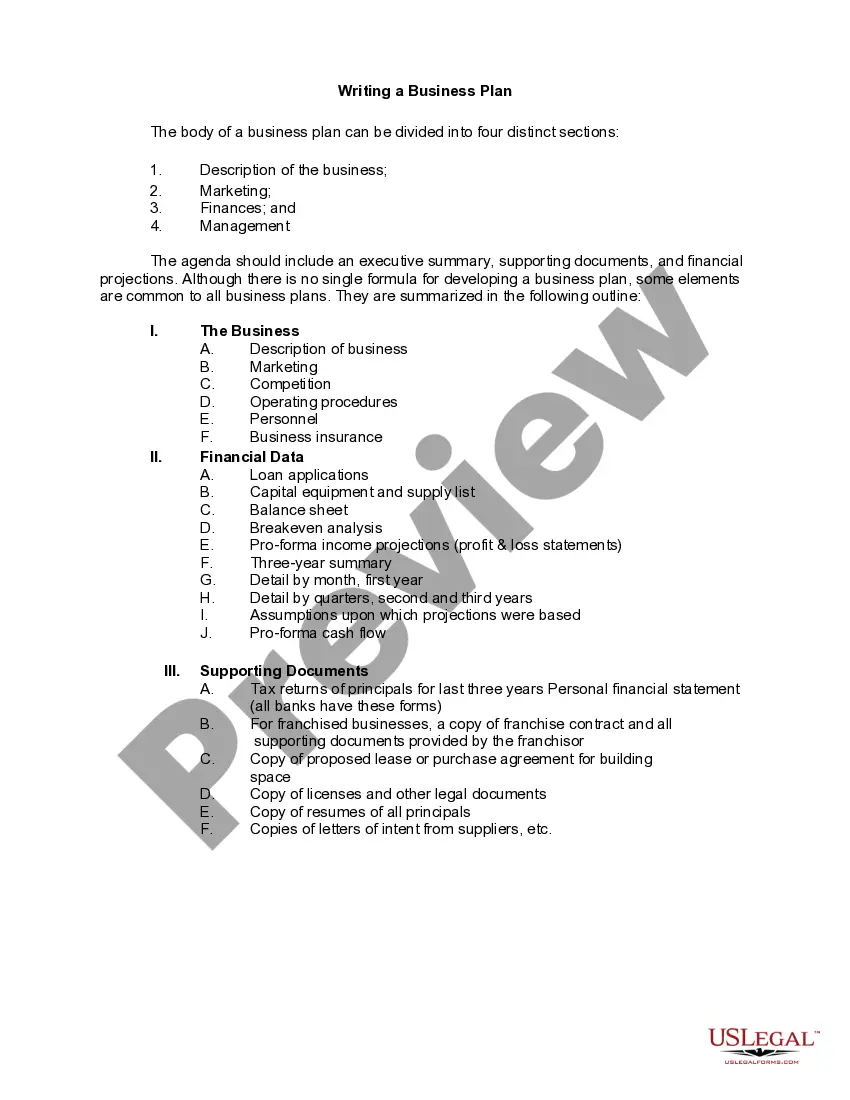

- Step 2. Use the Preview option to review the form’s contents. Remember to check the summary.

- Step 3. If you are unsatisfied with the form, utilize the Search area at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

As a matter of style, we do not recommend putting the conflict policy in bylaws, but recommend passing one as a Resolution. (See Ready Reference Page: Conflict of Interest Policies Help Avoid Problems.) We think the Board has a little more flexibility to revise the policy as the need may arise.

Types of conflict of interest and dutyActual conflict of interest:Potential conflict of interest:Perceived conflict of interest:Conflict of duty:Direct interests:Indirect interests:Financial interests:Non-financial interests:

A conflict of interest is signified by someone who has competing interests or loyalties. An individual that has two relationships that might compete with each other for the person's loyalties is also considered a conflict of interest.

Conflict of InterestContractual or legal obligations (to business partners, vendors, employees, employer, etc.)Loyalty to family and friends.Fiduciary duties.Professional duties.Business interests.

Examples of Conflicts of Interest At WorkHiring an unqualified relative to provide services your company needs.Starting a company that provides services similar to your full-time employer.Failing to disclose that you're related to a job candidate the company is considering hiring.More items...

What should a conflicts of interest policy include? A policy on conflicts of interest should (a) require those with a conflict (or who think they may have a conflict) to disclose the conflict/potential conflict, and (b) prohibit interested board members from voting on any matter in which there is a conflict.

The keys to avoiding conflicts of interest are having statements and policies for managing them and creating awareness for potential conflicts. Because of the negative consequences to the organization, each board member has a responsibility to identify and address potential conflicts.

A conflict of interest involves a person or entity that has two relationships competing with each other for the person's loyalty. For example, the person might have a loyalty to an employer and also loyalty to a family business. Each of these businesses expects the person to have its best interest first.

Bylaws generally define things like the group's official name, purpose, requirements for membership, officers' titles and responsibilities, how offices are to be assigned, how meetings should be conducted, and how often meetings will be held.

The keys to avoiding conflicts of interest are having statements and policies for managing them and creating awareness for potential conflicts. Because of the negative consequences to the organization, each board member has a responsibility to identify and address potential conflicts.