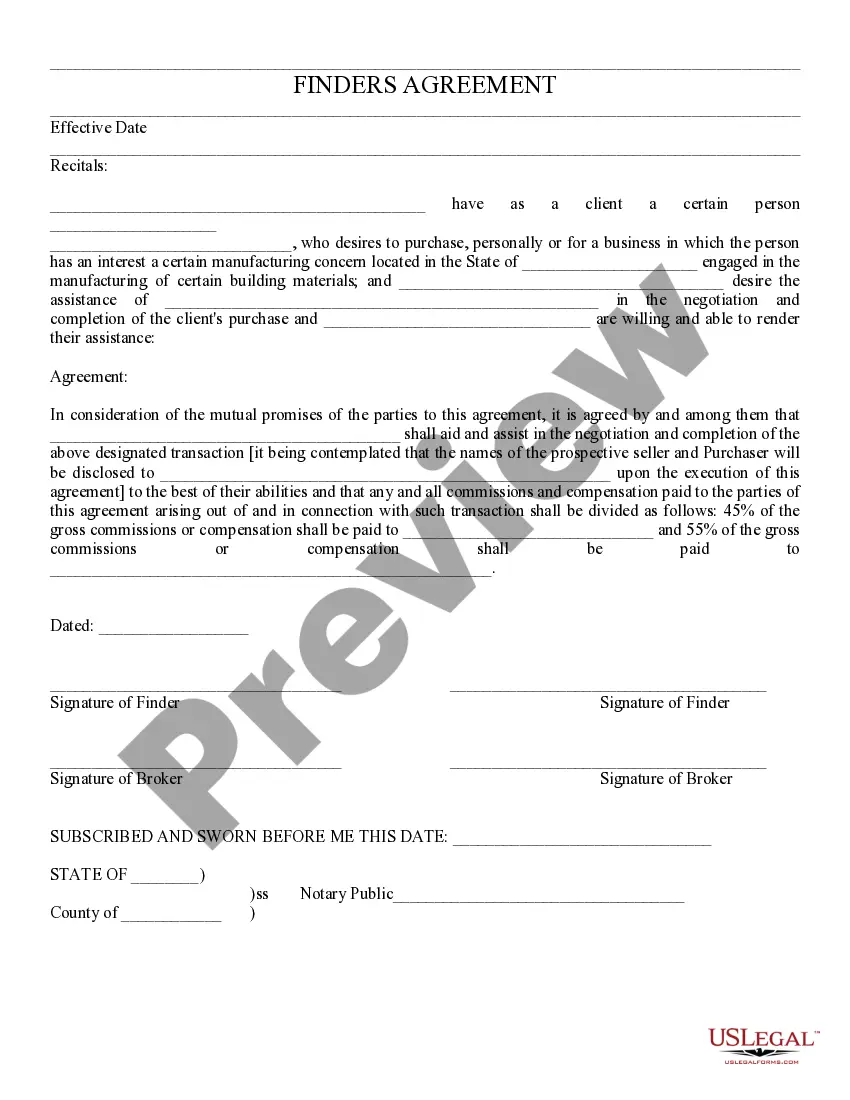

Colorado Presentation of Stock Notice is a legal document that serves as a formal notice to existing shareholders regarding the issuance or transfer of stock in a Colorado corporation. This document provides detailed information about the stock offering or transfer, allowing shareholders to make informed decisions regarding their ownership interests. The Presentation of Stock Notice is an essential requirement under the Colorado Corporations and Associations Act, ensuring transparency and compliance with state laws. It is typically drafted and submitted by the corporation's board of directors or authorized representatives. Key details included in the Colorado Presentation of Stock Notice may encompass the type and class of stock being offered or transferred, the number of shares available, the price per share or the valuation method used, the terms and conditions of the offering or transfer, any restrictions on the stock, and the deadline for shareholders to respond or exercise their rights. Different types of Colorado Presentation of Stock Notice can vary based on the nature of the stock transaction. Some common variations include: 1. Initial Public Offering (IPO) Presentation of Stock Notice: In cases where a private Colorado corporation decides to go public and offer its stocks to the public for the first time, an IPO Presentation of Stock Notice must be prepared. It includes all the necessary details about the offering, such as number of shares, pricing structure, underwriting arrangement, and a prospectus or offering memorandum. 2. Private Placement Presentation of Stock Notice: This type of Notice is utilized when a Colorado corporation offers its stock to a select group of accredited investors, such as institutional investors, venture capital firms, or high-net-worth individuals. It includes specific information about the private placement, such as the exemption utilized under federal and state securities laws, minimum investment requirements, and any associated risks. 3. Transfer of Restricted Stock Notice: When an existing shareholder wishes to transfer their restricted stock to another party, a Notice is prepared to outline the terms and conditions of the transfer. This Notice typically includes information about the number of shares being transferred, any securities' law restrictions, shareholder approval requirements, and the restrictions placed on the new holder of the stock. 4. Employee Stock Option Plan (ESOP) Presentation of Stock Notice: Sops are commonly used to incentivize employees by granting them stock options in the company. This type of Notice provides comprehensive details about the ESOP, including eligibility criteria, exercise price, vesting schedule, and any restrictions on the options. In summary, the Colorado Presentation of Stock Notice is a crucial document in the process of stock issuance or transfer within a Colorado corporation. It is designed to inform and protect shareholders by providing clear and detailed information about the transaction. Various types of Presentation of Stock Notice exist to address different kinds of stock offerings or transfers, ensuring compliance with applicable laws and regulations.

Colorado Presentation of Stock Notice

Description

How to fill out Colorado Presentation Of Stock Notice?

It is possible to commit time on-line looking for the legal document web template that meets the state and federal needs you require. US Legal Forms provides 1000s of legal types which are analyzed by pros. You can actually obtain or printing the Colorado Presentation of Stock Notice from our assistance.

If you currently have a US Legal Forms profile, you may log in and click the Download key. Following that, you may comprehensive, edit, printing, or sign the Colorado Presentation of Stock Notice. Every legal document web template you acquire is your own property permanently. To acquire yet another version for any purchased develop, visit the My Forms tab and click the related key.

If you work with the US Legal Forms website initially, stick to the basic instructions beneath:

- Initially, ensure that you have selected the best document web template to the state/area that you pick. See the develop outline to ensure you have picked the proper develop. If available, make use of the Preview key to look with the document web template also.

- In order to get yet another version of your develop, make use of the Lookup field to find the web template that suits you and needs.

- After you have found the web template you want, click on Buy now to carry on.

- Find the costs prepare you want, type in your qualifications, and register for a free account on US Legal Forms.

- Comprehensive the deal. You may use your Visa or Mastercard or PayPal profile to pay for the legal develop.

- Find the file format of your document and obtain it to your product.

- Make adjustments to your document if required. It is possible to comprehensive, edit and sign and printing Colorado Presentation of Stock Notice.

Download and printing 1000s of document web templates using the US Legal Forms website, that provides the largest variety of legal types. Use expert and condition-specific web templates to take on your company or person needs.