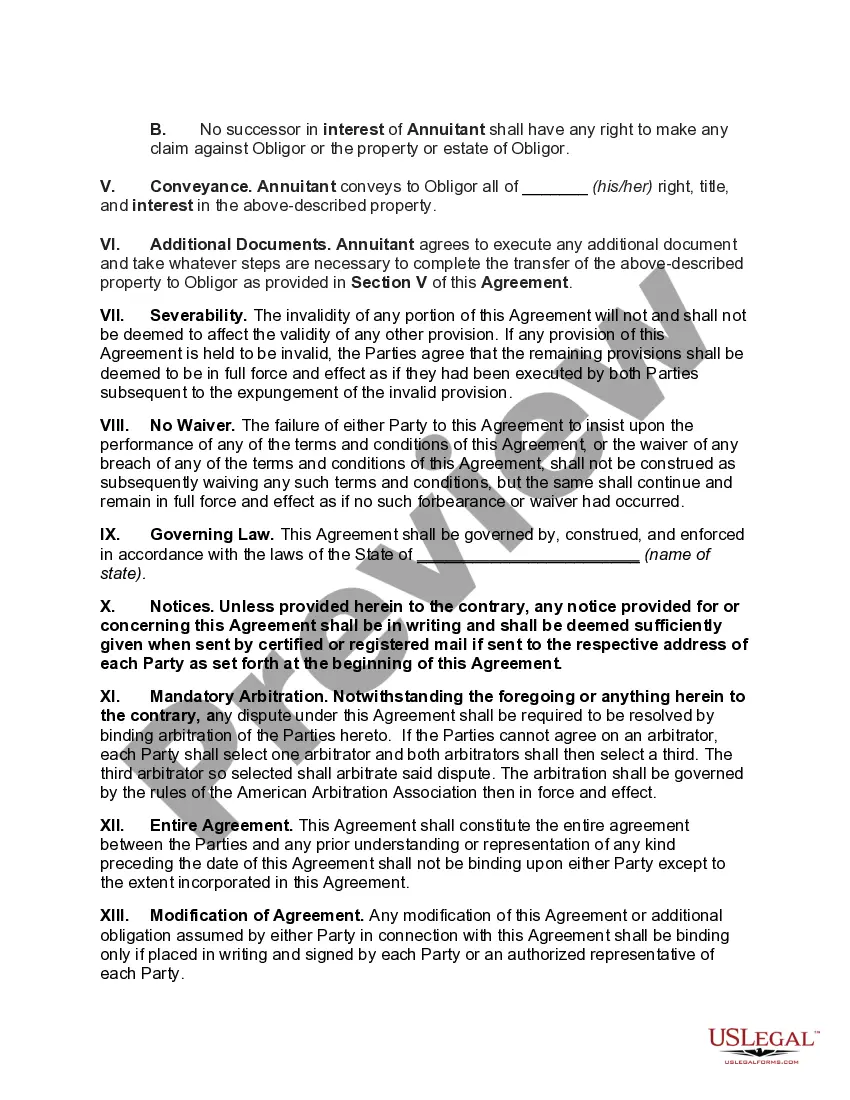

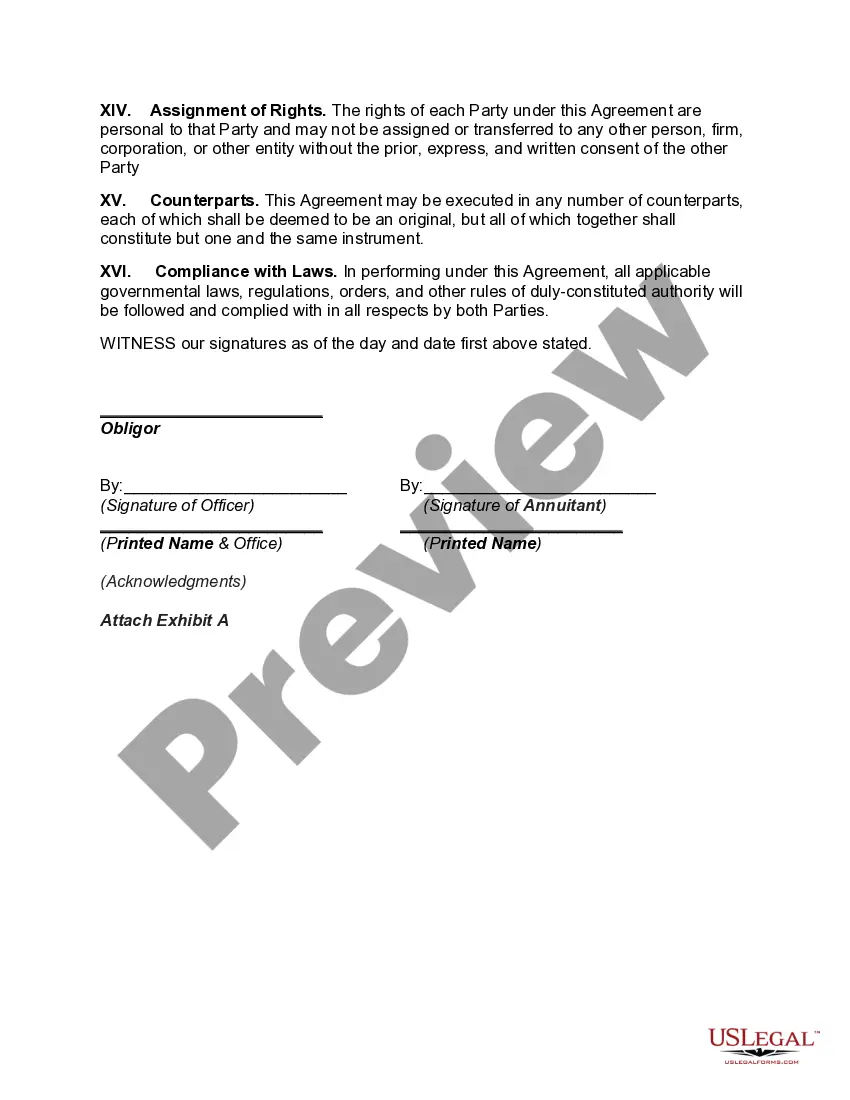

The Colorado Agreement Replacing Joint Interest with Annuity is a legal agreement that allows for the transfer of joint interest in real estate or property to an annuity. This agreement is commonly used in Colorado but can be adapted for use in other states as well. By employing this agreement, parties involved can change their existing ownership structure by exchanging their joint interest for annuity payments. The agreement ensures a smooth transition of ownership by outlining the terms, conditions, and responsibilities of all parties involved. It typically includes detailed information about the property, such as its location, legal description, and any encumbrances or liens attached to it. Keywords: Colorado Agreement, Replacing Joint Interest, Annuity, real estate, property ownership, legal agreement, transition, ownership structure, annuity payments, terms, conditions, responsibilities, property description, encumbrances, liens. There are different types of Colorado Agreements Replacing Joint Interest with Annuity, including: 1. Joint Interest to Annuity Exchange Agreement: This type of agreement is used when two or more individuals or entities want to transfer their joint interest in a property to an annuity. The agreement specifies how ownership percentages will be divided and how annuity payments will be calculated and distributed. 2. Corporate Joint Interest to Annuity Agreement: In this scenario, a corporation holds joint interest in a property, and it desires to replace this interest with annuity payments. The agreement outlines the process of transferring ownership from the corporation to the annuity provider and establishes the terms of the annuity payments. 3. Family Joint Interest to Annuity Exchange Agreement: This type of agreement is utilized when family members jointly own property and wish to convert their collective interest into annuity payments. The agreement details how the annuity payments will be distributed among family members and any conditions or restrictions that may apply. 4. Partnership Joint Interest to Annuity Agreement: Partnerships that jointly own real estate or property may decide to replace their joint interest with annuity payments. The agreement specifies how the partnership's ownership percentage will be converted to annuity payments and may also include provisions regarding partnership dissolution or changes in partnership structure. These different types of agreements account for various scenarios and parties involved in the process of converting joint interest into annuity in Colorado.

Colorado Agreement Replacing Joint Interest with Annuity

Description

How to fill out Colorado Agreement Replacing Joint Interest With Annuity?

US Legal Forms - one of many largest libraries of legal forms in America - provides an array of legal file layouts you are able to acquire or printing. Making use of the website, you can get a huge number of forms for business and individual uses, categorized by types, claims, or keywords.You will discover the newest models of forms like the Colorado Agreement Replacing Joint Interest with Annuity in seconds.

If you already possess a monthly subscription, log in and acquire Colorado Agreement Replacing Joint Interest with Annuity from the US Legal Forms catalogue. The Acquire switch will appear on every form you see. You have access to all earlier delivered electronically forms inside the My Forms tab of your respective profile.

If you would like use US Legal Forms initially, allow me to share easy guidelines to obtain started out:

- Be sure you have picked the best form for your metropolis/county. Select the Preview switch to check the form`s information. Look at the form outline to ensure that you have selected the right form.

- In case the form does not fit your needs, take advantage of the Look for area near the top of the screen to obtain the one which does.

- When you are happy with the shape, verify your option by clicking on the Purchase now switch. Then, choose the pricing plan you favor and supply your references to sign up on an profile.

- Method the transaction. Utilize your bank card or PayPal profile to finish the transaction.

- Choose the format and acquire the shape on your product.

- Make alterations. Load, edit and printing and indication the delivered electronically Colorado Agreement Replacing Joint Interest with Annuity.

Each design you added to your bank account does not have an expiry day and is also your own forever. So, if you want to acquire or printing an additional version, just go to the My Forms segment and click around the form you require.

Obtain access to the Colorado Agreement Replacing Joint Interest with Annuity with US Legal Forms, one of the most extensive catalogue of legal file layouts. Use a huge number of skilled and status-distinct layouts that satisfy your company or individual needs and needs.

Form popularity

FAQ

The most common disposition of an annuity in divorce proceedings is to split the annuity in half. This is typically executed by withdrawing half of the account value and giving it to one of the spouses.

An annuity purchased prior to marriage may not be subject to a division of property. However, if your annuity was purchased during your marriage, it may likely be included in the division of property. That may mean a contract split or total forfeiture by you or your spouse, depending on other conditions.

A court issues the order and often divides retirement assets. However, if the annuity is nonqualified and taxes have already been paid on the money invested in the account, a QDRO is not required to split the annuity. Only the earnings are taxed upon withdrawal.

An annuity purchased prior to marriage may not be subject to a division of property. However, if your annuity was purchased during your marriage, it may likely be included in the division of property. That may mean a contract split or total forfeiture by you or your spouse, depending on other conditions.

An annuity can be used to bypass probate if it names a specific beneficiary. Because the person is named in the contract itself, there's nothing to contest at a court hearing.

A life insurance policy can be exchanged for an annuity under the rules of a 1035 exchange, but you cannot exchange an annuity contract for a life insurance policy.

Generally, the Section 1035 exchange rules allow the owner of a financial product, such as a life insurance or annuity contract, to exchange one product for another without treating the transaction as a saleno gain is recognized when the first contract is disposed of, and there is no intervening tax liability.

So what is not allowable in a 1035 exchange? Single Premium Immediate Annuities (SPIAs), Deferred Income Annuities (DIAs), and Qualified Longevity Annuity Contracts (QLACs) are not allowed because these are irrevocable income contracts.

A spouse can choose to change the annuity contract into their name, assuming all rules and rights to the initial agreement and delaying immediate tax consequences. They will have the ability to collect all remaining payments and any death benefits and choose beneficiaries. The spouse then becomes the new annuitant.

There is nothing in the tax code that dictates how an annuity should be divided in a divorce situation. Therefore, each insurance company is forced to adopt its own procedures. In general, the insurance company's first priority is to establish a procedure that is easy and limits their potential liability.