Colorado Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse

Description

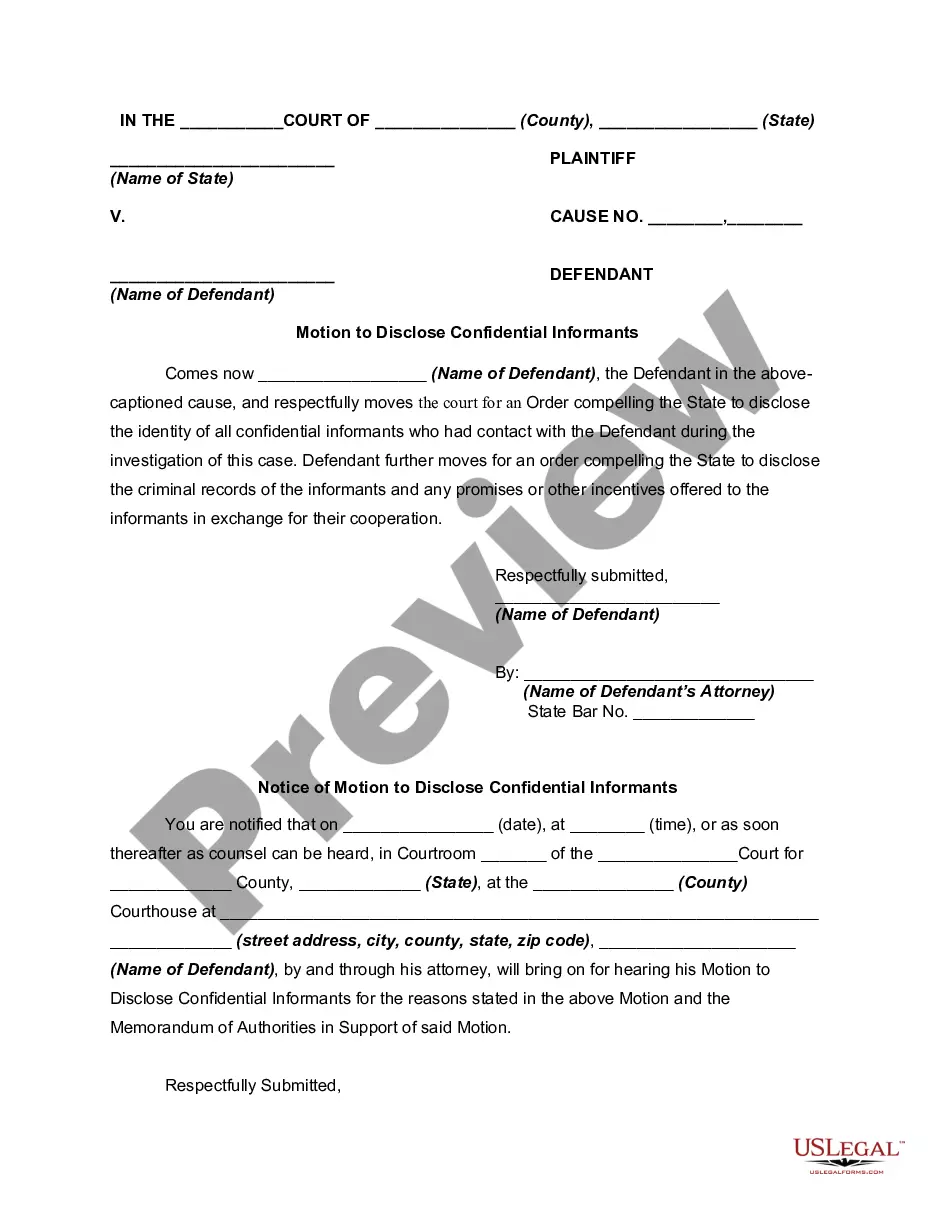

How to fill out Marital-deduction Residuary Trust With A Single Trustor And Lifetime Income And Power Of Appointment In Beneficiary Spouse?

If you have to full, obtain, or print legal papers layouts, use US Legal Forms, the largest variety of legal kinds, that can be found online. Take advantage of the site`s basic and practical search to obtain the paperwork you need. Different layouts for organization and person functions are categorized by categories and says, or search phrases. Use US Legal Forms to obtain the Colorado Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse with a few clicks.

In case you are previously a US Legal Forms buyer, log in to your profile and click the Download option to obtain the Colorado Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse. You can also accessibility kinds you earlier saved from the My Forms tab of your respective profile.

If you use US Legal Forms for the first time, refer to the instructions under:

- Step 1. Make sure you have chosen the shape for that proper metropolis/land.

- Step 2. Make use of the Review choice to check out the form`s content material. Never forget about to see the explanation.

- Step 3. In case you are not happy using the form, make use of the Look for industry near the top of the monitor to find other types in the legal form template.

- Step 4. When you have discovered the shape you need, select the Acquire now option. Pick the costs plan you like and put your qualifications to sign up on an profile.

- Step 5. Approach the transaction. You should use your credit card or PayPal profile to finish the transaction.

- Step 6. Find the formatting in the legal form and obtain it on your own device.

- Step 7. Total, revise and print or signal the Colorado Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse.

Each legal papers template you purchase is yours eternally. You may have acces to every form you saved with your acccount. Select the My Forms area and choose a form to print or obtain yet again.

Contend and obtain, and print the Colorado Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse with US Legal Forms. There are millions of specialist and state-distinct kinds you may use for your personal organization or person requires.

Form popularity

FAQ

Among the disadvantages are the following: As irrevocable trusts, once formed, they are exceedingly difficult to dissolve or amend. Only provides an estate tax exemption of up to $24.12 million in 2022 (or $25.84 million in 2023) Requires the transfer of assets into the trust, which can be a time-consuming procedure.

An example of when a marital trust might be used is when a couple has children from a previous marriage and wants to pass all property to the surviving spouse upon death, but also provide for their individual children.

RESIDUARY TRUST. Unlike the Marital Trust, the Residuary Trust can provide for substantial flexibility and give broader discretion to the Trustee. This trust may be structured as a single trust for the benefit of all your descendants or separate trusts for each of your children (and such child's descendants).

The first trust (the ?marital? trust) is for the surviving spouse, and the second trust (the ?bypass? or ?residual? trust) is typically for the couple's heirs. The surviving spouse can access the residual trust or receive income from it during their lifetime, but it does not belong to them.

Also called an "A" trust, a marital trust goes into effect when the first spouse dies. Assets are moved into the trust upon death and the income that these assets generate go to the surviving spouse?under some arrangements, the surviving spouse can also receive principal payments.

TESTAMENTARY TRUST These trusts can have many names including: Bypass Trust, Family Trust, Children's Trust, Residuary Trust or QTIP (Second Marriage Trust). Testamentary Trusts are typically created to provide support for surviving spouses, children or family groups.

The marital deduction is determinable from the overall gross estate. The total value of the assets passed on to the spouse is subtracted from that amount, giving us the marital deduction. This interspousal transfer can occur during the couple's lifetime or after one spouse's death, ing to a will.

In order to qualify the trust instrument must provide that at least one trustee be a United States citizen or domestic corporation, and that any distribution from the trust principal be subject to the United States trustee's right to withhold the estate tax due on the distribution.