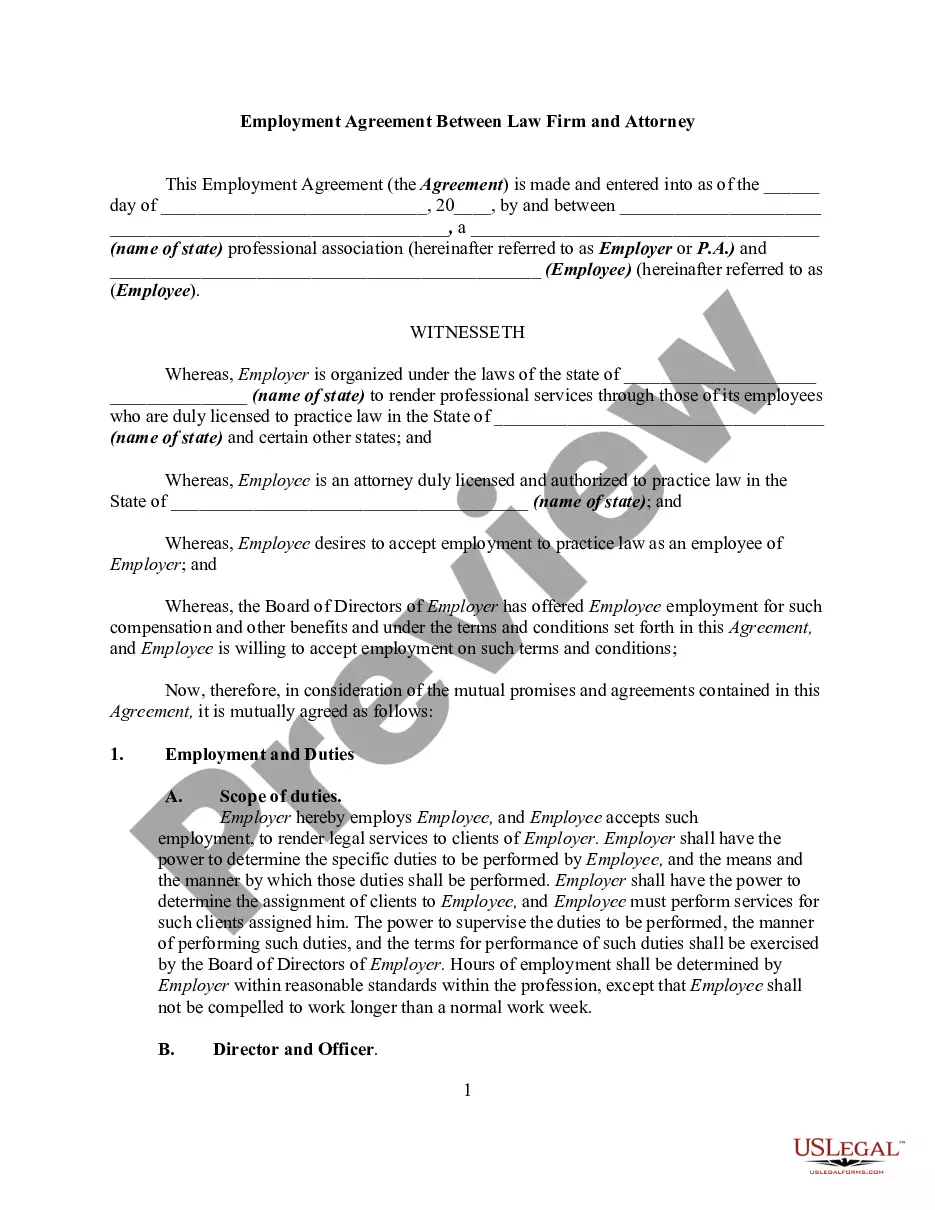

Colorado Employment Agreement between Professional Corporation and Attorney

Category:

State:

Multi-State

Control #:

US-134095267A-BG

Format:

Word;

Rich Text

Instant download

Description

Statutes in many jurisdictions provide for professional corporations, thus permitting individuals who are licensed to practice a profession to form a corporation for the practice of that profession. Among the reasons generally given for the enactment of these statutes were to enable professionals to take advantage of various tax provisions available to a corporation and its employees but not to self-employed persons or partnerships and to gain other benefits, such as limited-liability of the shareholders and continuity of life of the entity. As a statutory creation, a professional corporation has no rights outside the four corners of enabling statute.

Free preview