Colorado Fair Credit Act Disclosure Notice

Description

How to fill out Fair Credit Act Disclosure Notice?

If you need to complete, download, or create legal document templates, utilize US Legal Forms, the most significant collection of legal forms available online.

Take advantage of the website's simple and user-friendly search feature to locate the documents you require.

Different templates for business and personal purposes are organized by categories and claims, or keywords. Use US Legal Forms to find the Colorado Fair Credit Act Disclosure Notice with just a few clicks.

Every legal document template you purchase is yours forever. You can access all the forms you've acquired through your account. Go to the My documents section and select a document to print or download again.

Compete and download, then print the Colorado Fair Credit Act Disclosure Notice with US Legal Forms. There are thousands of professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click on the Download button to access the Colorado Fair Credit Act Disclosure Notice.

- You can also access forms you've previously obtained from the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow these steps.

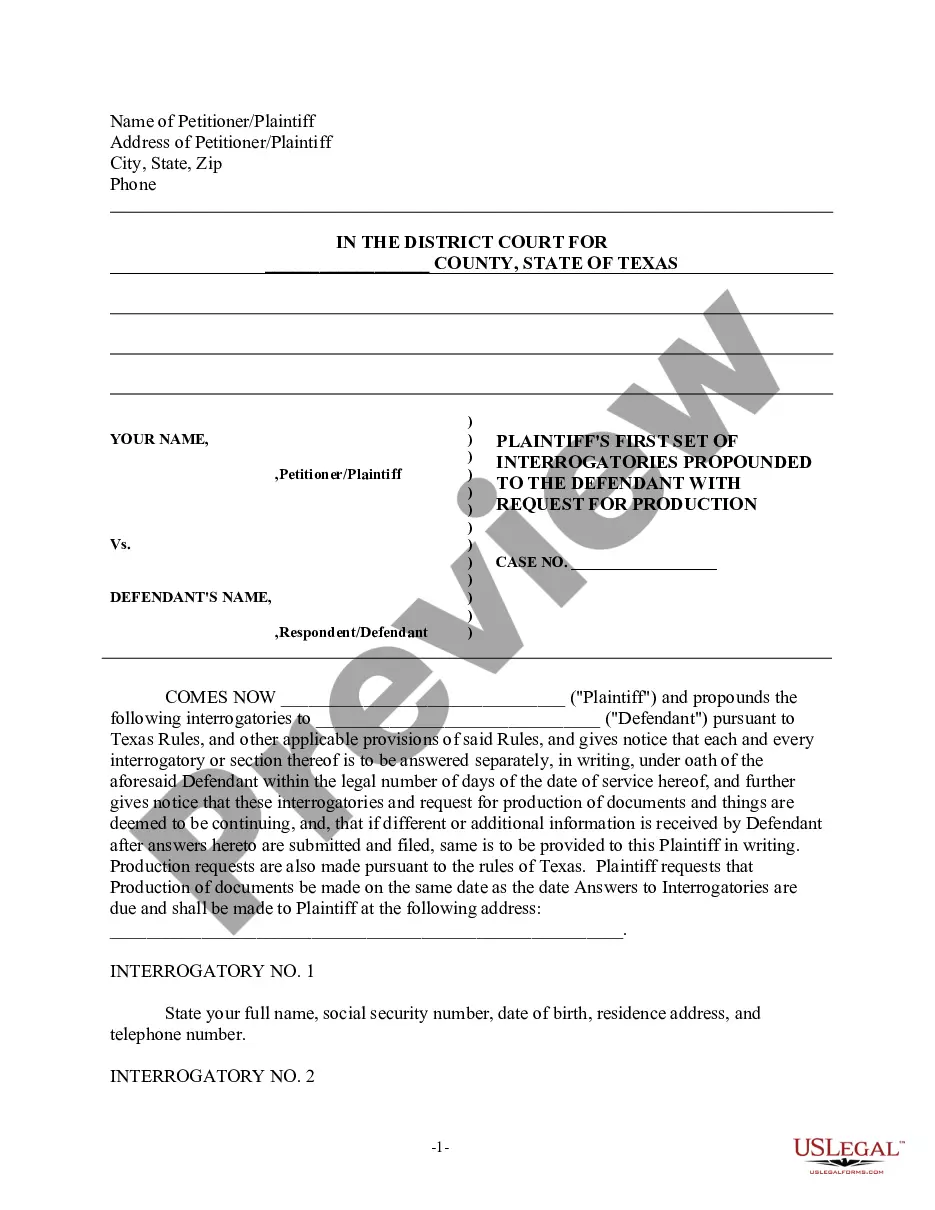

- Step 1. Ensure you have selected the correct form for your city/state.

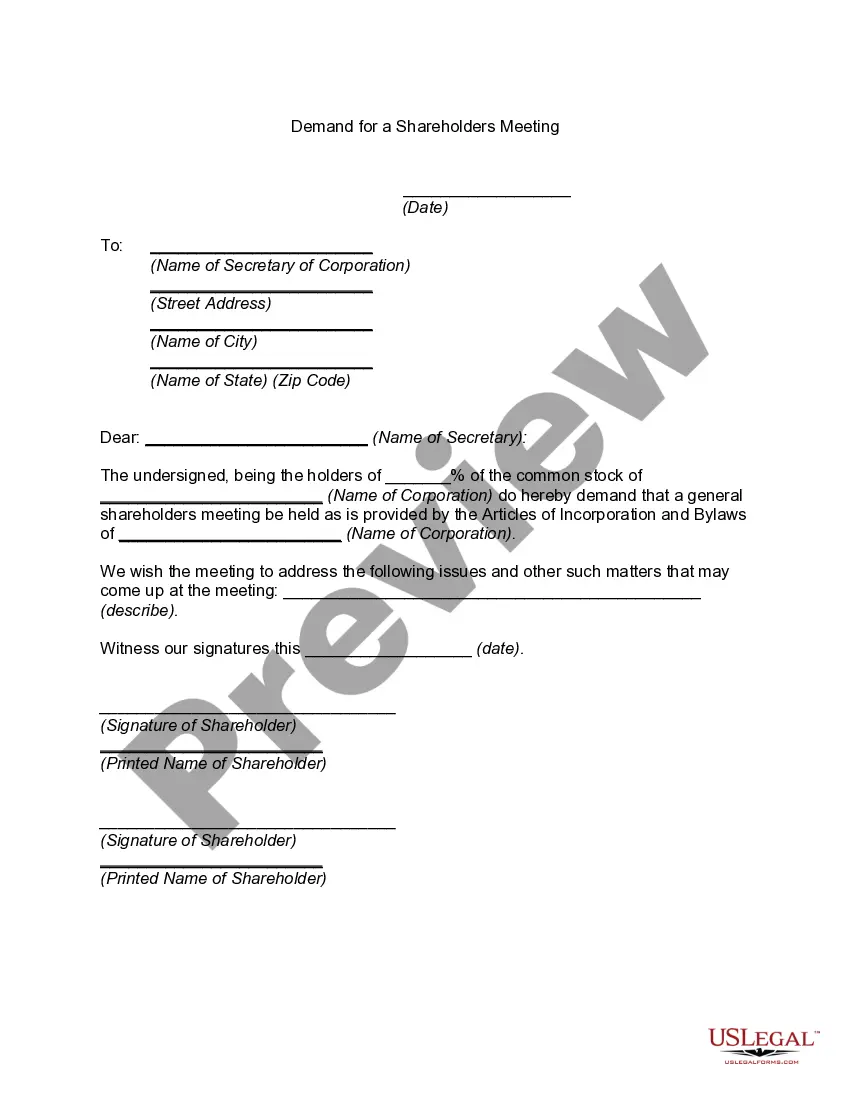

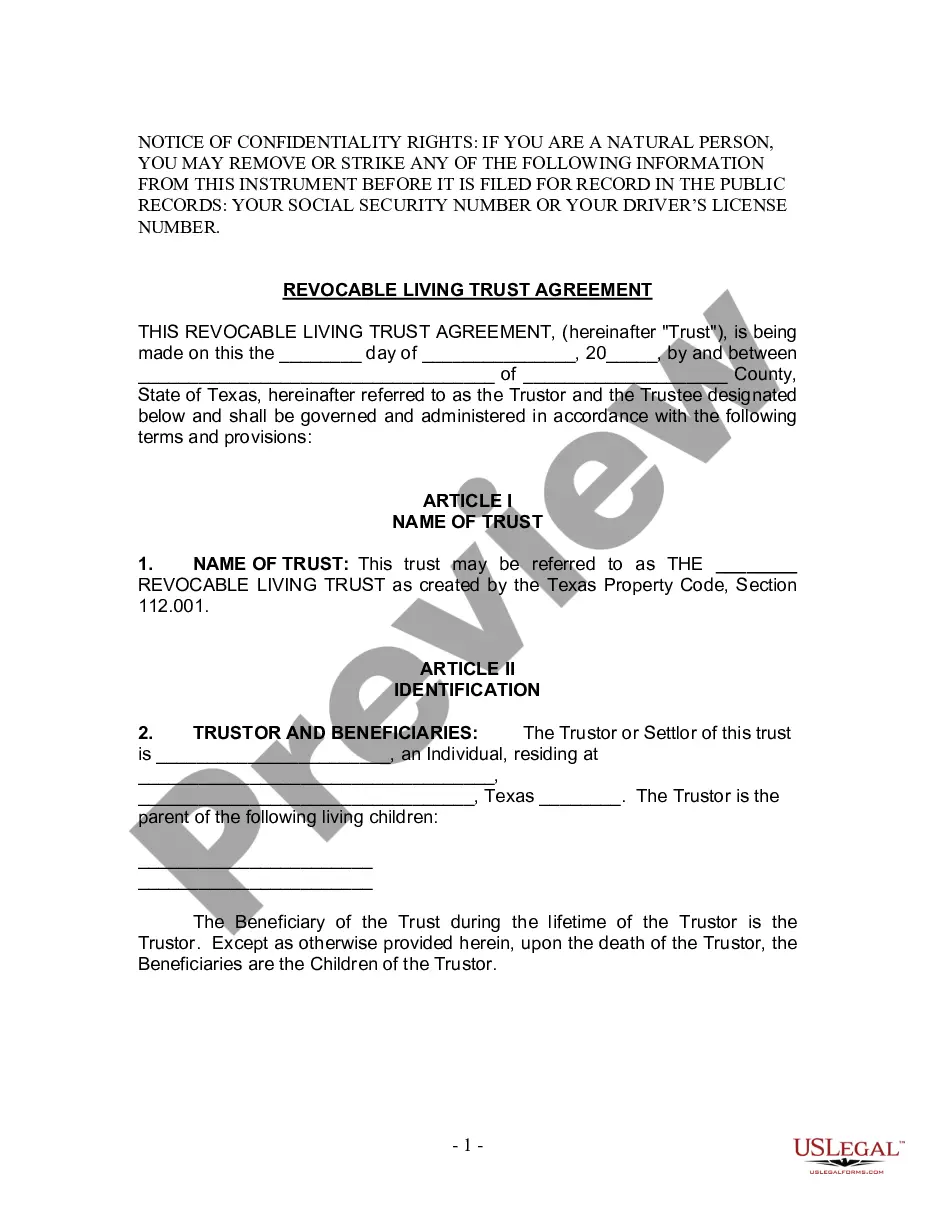

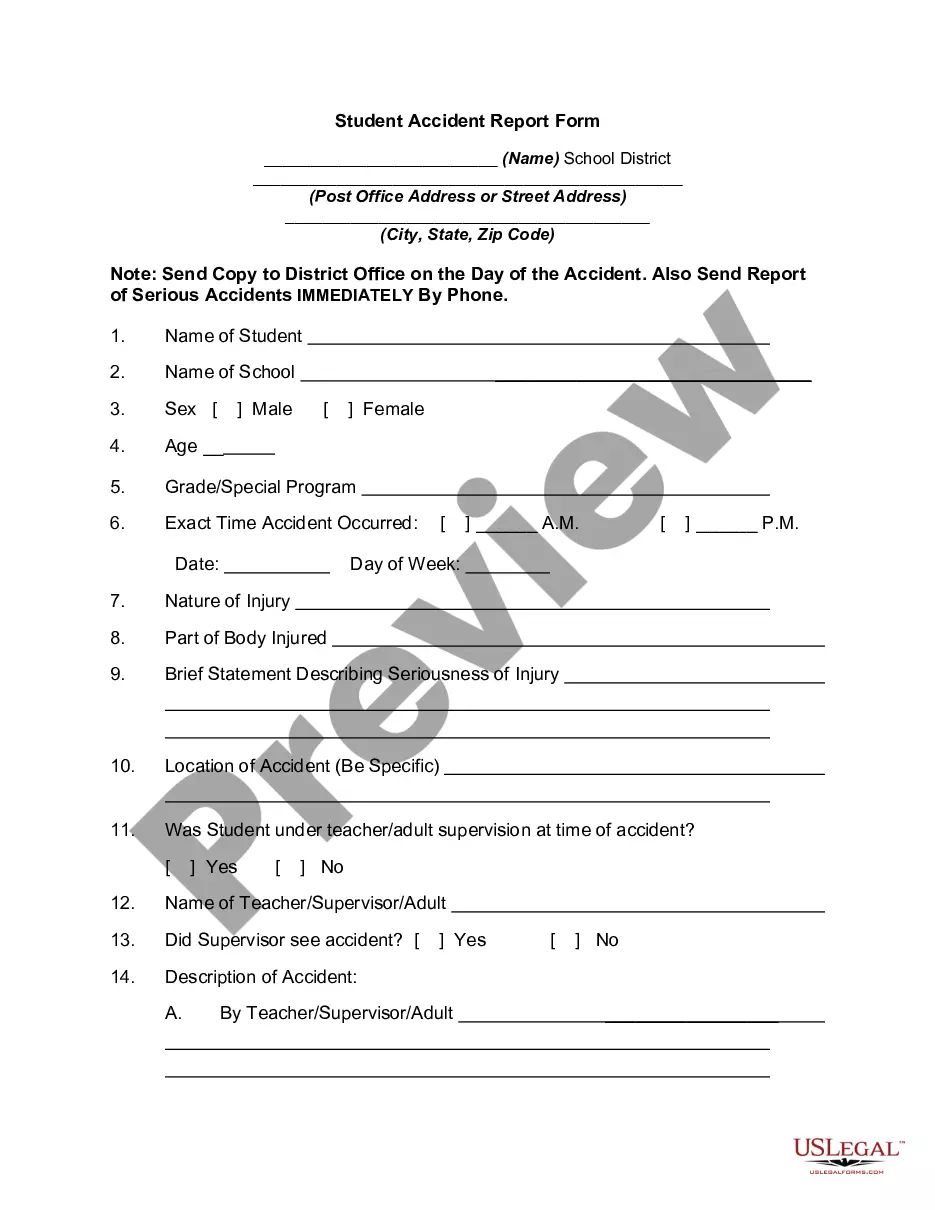

- Step 2. Utilize the Preview feature to review the content of the form. Be sure to check the details.

- Step 3. If you are not satisfied with the form, use the Search bar at the top of the page to find alternative versions of the legal document template.

- Step 4. Once you find the form you need, click on the Purchase now button. Choose your desired pricing plan and provide your information to create an account.

- Step 5. Process the payment. You can use your Visa or MasterCard or PayPal account to complete the transaction.

- Step 6. Select the format of the legal document and download it onto your device.

- Step 7. Fill out, edit, print, or sign the Colorado Fair Credit Act Disclosure Notice.

Form popularity

FAQ

The FCRA gives you the right to be told if information in your credit file is used against you to deny your application for credit, employment or insurance. The FCRA also gives you the right to request and access all the information a consumer reporting agency has about you (this is called "file disclosure").

A creditor must disclose a consumer's credit score and information relating to a credit score on a risk-based pricing notice when the score of the consumer to whom the creditor extends credit or whose extension of credit is under review is used in setting the material terms of credit.

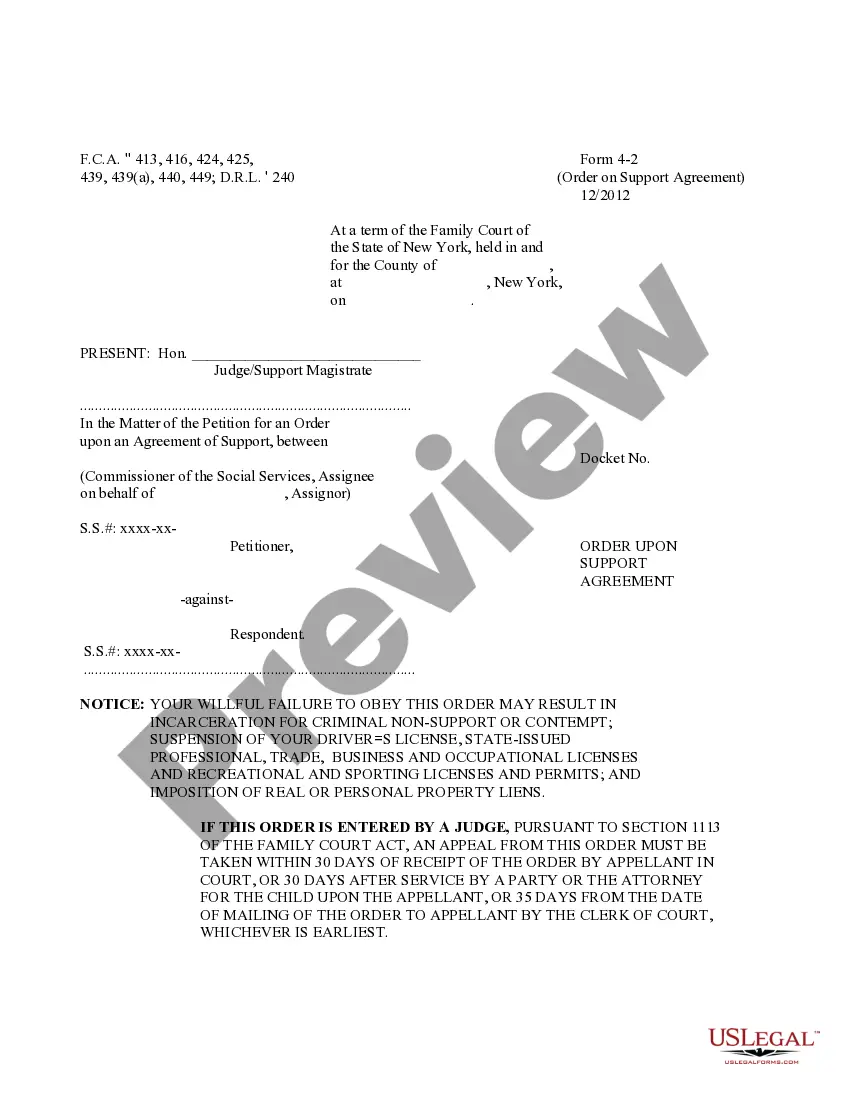

If you deny a consumer credit based on information in a consumer report, you must provide an adverse action notice to the consumer. if you grant credit, but on less favorable terms based on information in a consumer report, you must provide a risk-based pricing notice.

Under Colorado law, a consumer reporting agency shall, upon written or verbal request and proper identification of any consumer, clearly, accurately, and in a manner that is understandable to the consumer, disclose to the consumer, in writing, all information in its files at the time of the request pertaining to the

Updated April 29, 2022. An adverse action notice is sent to an individual when rejected based on information in a credit report or background check (consumer report). It is required when a person is denied employment, housing, credit, or insurance. Federal Laws Fair Credit Reporting Act (FCRA)

Thus, under the FCRA, certain consumer information will be subject to two opt-out notices, a sharing opt-out notice (Section 603(d)) and a marketing use opt-out notice (Section 624). These two opt-out notices may be consolidated.

Consumer reporting agencies must correct or delete inaccurate, incomplete, or unverifiable information. Inaccurate, incomplete, or unverifiable information must be removed or corrected, usually within 30 days. However, a consumer reporting agency may continue to report information it has verified as accurate.

A credit file disclosure provides you with all of the information in your credit file maintained by a consumer reporting company that could be provided by the consumer reporting company in a consumer report about you to a third party, such as a lender.

Under the FCRA, an employer may not run a background check on a prospective employee without first providing "a clear and conspicuous disclosure . . . in a document that consists solely of that disclosure, that a consumer report may be obtained for employment purposes." For efficiency, many employers include all

The Act (Title VI of the Consumer Credit Protection Act) protects information collected by consumer reporting agencies such as credit bureaus, medical information companies and tenant screening services. Information in a consumer report cannot be provided to anyone who does not have a purpose specified in the Act.