Title: Colorado Resolution of Meeting of LLC Members to Dissolve the Company Keywords: Colorado LLC, Resolution of Meeting, Dissolve Company, LLC Members Introduction: In Colorado, the Resolution of Meeting of LLC Members to Dissolve the Company is a crucial step in formally dissolving a Limited Liability Company (LLC). This process entails a meeting of the LLC members where a resolution is passed to terminate the operations and existence of the company. This detailed description aims to provide an overview of this resolution, its importance, and the different types of resolutions that can be adopted by LLC members for dissolution purposes. 1. Colorado Resolution of Meeting of LLC Members to Dissolve the Company: The Resolution of Meeting of LLC Members to Dissolve the Company is a legally binding document that outlines the decision made by the members of an LLC to dissolve and wind up its affairs. It serves as a formal acknowledgment by the LLC members that the company's interests can no longer be effectively pursued or sustained. 2. Importance of the Resolution: a. Legal Recognition: The adoption and recording of a resolution provide legal recognition that the LLC members have unanimously agreed to dissolve the company. b. Liability Limitation: By properly dissolving the LLC, members can mitigate potential future liabilities that may arise from the continued operation of the company. c. Distribution of Assets: Dissolution allows for the proper distribution of the company's assets and settlement of debts to creditors or members. 3. Types of Colorado Resolution of Meeting of LLC Members to Dissolve the Company: a. Voluntary Dissolution Resolution: This type of resolution is passed when the members of the LLC voluntarily decide to dissolve the company. It requires the unanimous consent of all members as specified in the operating agreement or articles of organization. b. Dissolution by Statutory Event Resolution: This type of resolution is adopted when certain predefined events, as outlined in the LLC's articles of organization or operating agreement, trigger an automatic dissolution of the company. c. Dissolution by Court Order Resolution: In exceptional circumstances, a resolution may be adopted when the court orders the dissolution of the LLC due to violations of laws or the terms of the operating agreement. Conclusion: The Resolution of Meeting of LLC Members to Dissolve the Company is a vital process in ending the existence of an LLC in Colorado. It involves the adoption of a resolution during a meeting where members unanimously agree to dissolve the company. By understanding the different types of resolutions that can be adopted, LLC members can ensure compliance with relevant regulations and smoothly navigate the process of dissolution. Seeking legal advice and adhering to Colorado's specific laws is essential to successfully dissolve an LLC.

Colorado Resolution of Meeting of LLC Members to Dissolve the Company

Description

How to fill out Colorado Resolution Of Meeting Of LLC Members To Dissolve The Company?

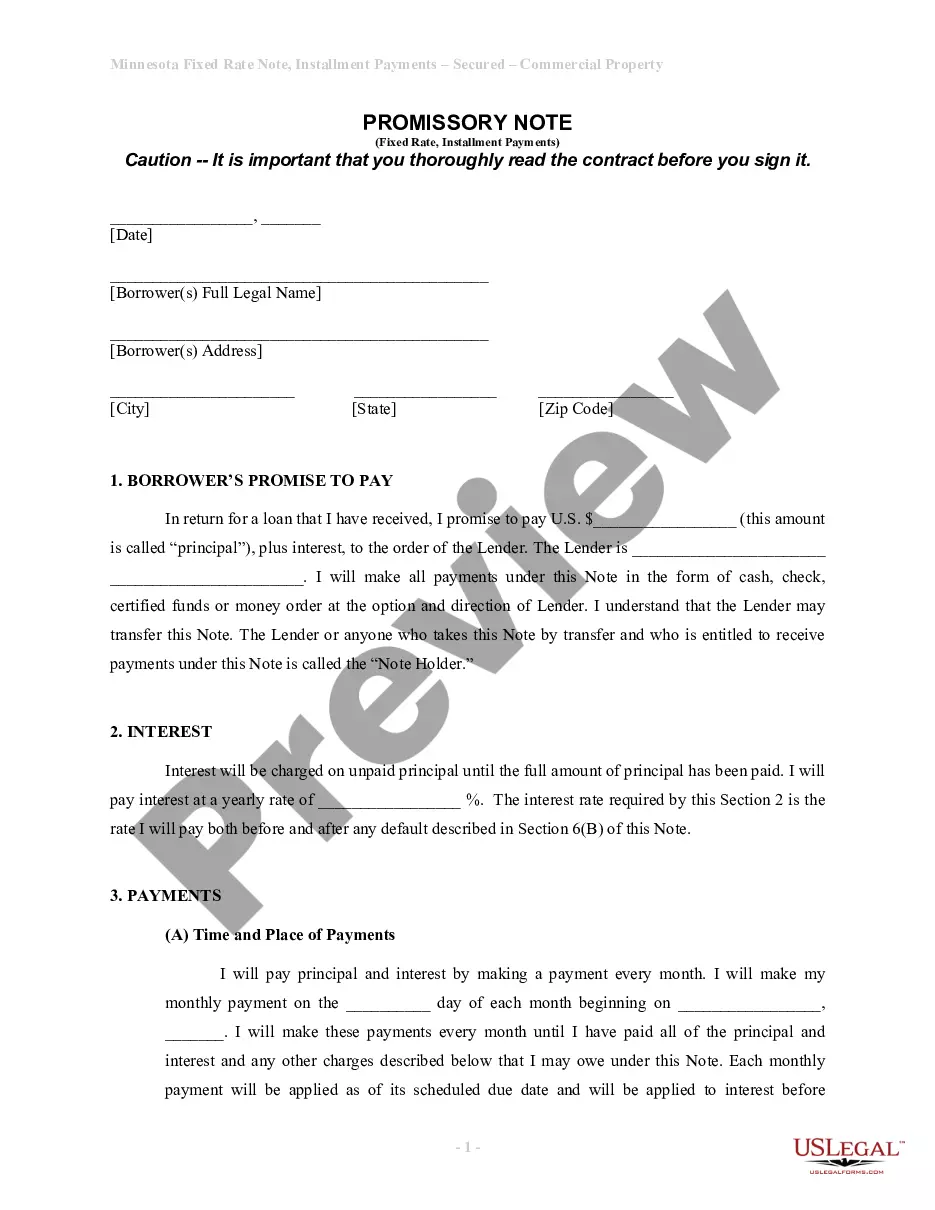

You can spend hrs on the web looking for the authorized file design which fits the federal and state specifications you want. US Legal Forms provides a large number of authorized varieties which can be evaluated by pros. It is possible to download or print the Colorado Resolution of Meeting of LLC Members to Dissolve the Company from the assistance.

If you currently have a US Legal Forms account, you are able to log in and click the Acquire key. Next, you are able to complete, modify, print, or indication the Colorado Resolution of Meeting of LLC Members to Dissolve the Company. Every authorized file design you buy is the one you have forever. To obtain another version associated with a obtained type, go to the My Forms tab and click the corresponding key.

If you work with the US Legal Forms website initially, stick to the easy guidelines listed below:

- First, ensure that you have selected the right file design for the area/town of your choosing. Read the type outline to make sure you have chosen the correct type. If readily available, utilize the Preview key to search from the file design at the same time.

- In order to discover another edition from the type, utilize the Lookup discipline to find the design that meets your needs and specifications.

- After you have found the design you would like, click on Acquire now to carry on.

- Pick the prices prepare you would like, type in your credentials, and register for a free account on US Legal Forms.

- Total the deal. You may use your charge card or PayPal account to cover the authorized type.

- Pick the format from the file and download it to the system.

- Make alterations to the file if required. You can complete, modify and indication and print Colorado Resolution of Meeting of LLC Members to Dissolve the Company.

Acquire and print a large number of file templates utilizing the US Legal Forms web site, which offers the biggest collection of authorized varieties. Use professional and state-certain templates to take on your small business or person requirements.

Form popularity

FAQ

Once you're on your business's listing on the website go to file a form and then select statement curing delinquency (as shown in the image below). You'll need to include the registered agent name, office address, and mailing address.

How to Dissolve an LLCVote to Dissolve the LLC. Members who decide to dissolve the company are taking part in something called a voluntary dissolution.File Your Final Tax Return.File an Article of Dissolution.Settle Outstanding Debts.Distribute Assets.Conduct Other Wind Down Processes.

To close an LLC completely, you need to file a final tax return with the state and the IRS. Make sure you check the box to show this is the final return for the LLC. Fill out Schedule K-1 and give a copy to each member so that they know what to report on their own personal taxes in terms of losses and gains.

If a registered entity fails to submit its annual report and pay the filing fee timely, eventually DFI will place the entity in 200bDelinquent Status. When in Delinquent Status, the entity will not be able to fb01le any other documents with the Department until the entity is brought back to good standing by fb01ling all past

These terms are often used interchangeably, but have distinct legal meanings. Dissolution is the winding up of the affairs of the entity in advance of the termination of the entity. Termination of the entity occurs when the entity ceases to legally exist.

The Colorado Secretary of State no longer administratively or involuntarily dissolves LLCs, but it will give your LLC delinquent status if it fails to: file periodic reports. appoint and maintain a registered agent.

A dissolution/withdrawal must be filed electronically through our website. On the Summary page of the entity, scroll down and select File a form. Once the form is ready for filing, the system will proceed to the first of three payment pages. Your filing is complete once you see a Confirmation page.

Colorado requires you to file the statement online through the Secretary of State website and pay a $25 fee. The online dissolution filing is typically processed immediately. You should note that following your LLC's dissolution, others can legally use the business name.

You can get some idea of what a statement of dissolution contains by downloading the sample form from the SOS website. However, Colorado requires that all statements of dissolution be filed online using the state's online filing system. There is a $25 fee to file the statement.