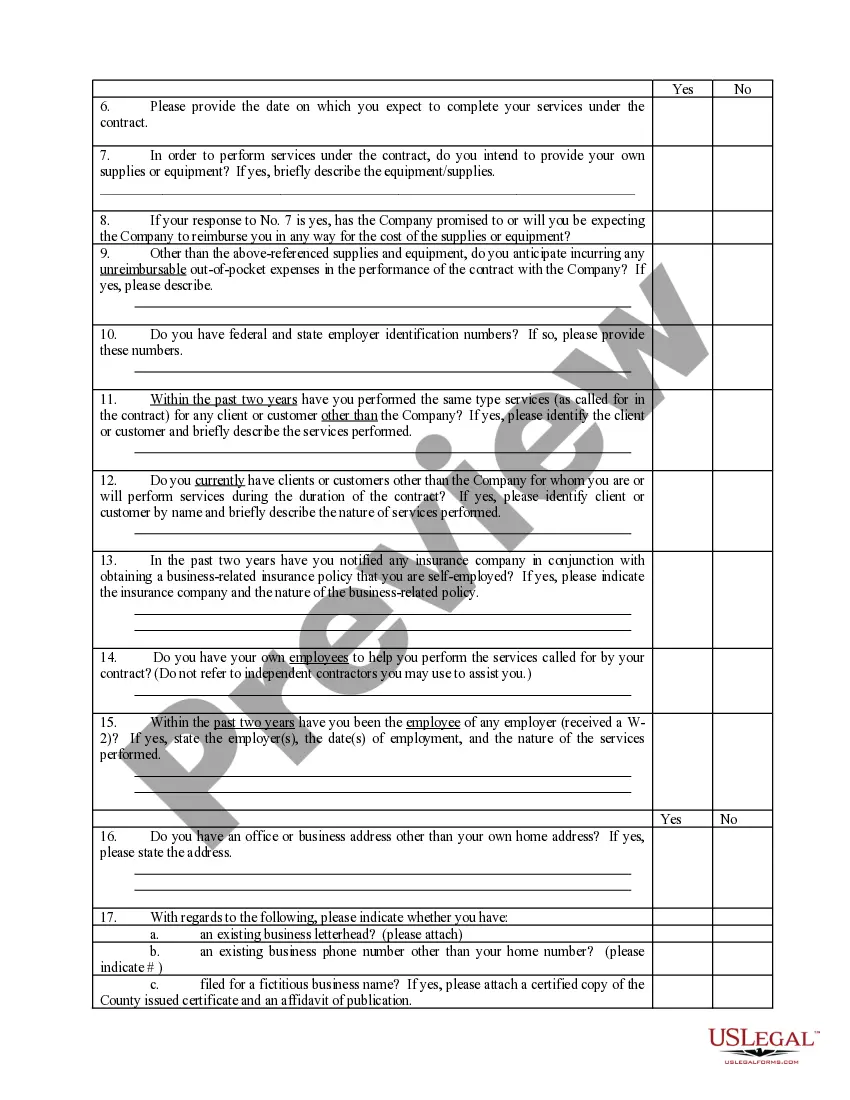

Colorado Self-Employed Independent Contractor Questionnaire

Description

How to fill out Self-Employed Independent Contractor Questionnaire?

If you require to fill, acquire, or generate legal document templates, utilize US Legal Forms, the foremost collection of legal documents available online.

Make use of the site's straightforward and user-friendly search to find the documents you require.

Various templates for business and personal purposes are categorized by type and state, or keywords.

Step 4. Once you have found the document you need, click the Acquire now button. Select your preferred payment plan and provide your credentials to register for an account.

Step 5. Process the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Use US Legal Forms to locate the Colorado Self-Employed Independent Contractor Questionnaire in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the Colorado Self-Employed Independent Contractor Questionnaire.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have selected the document for the correct city/state.

- Step 2. Utilize the Preview feature to view the document's contents. Remember to review the details.

- Step 3. If you are not satisfied with the document, use the Search bar at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

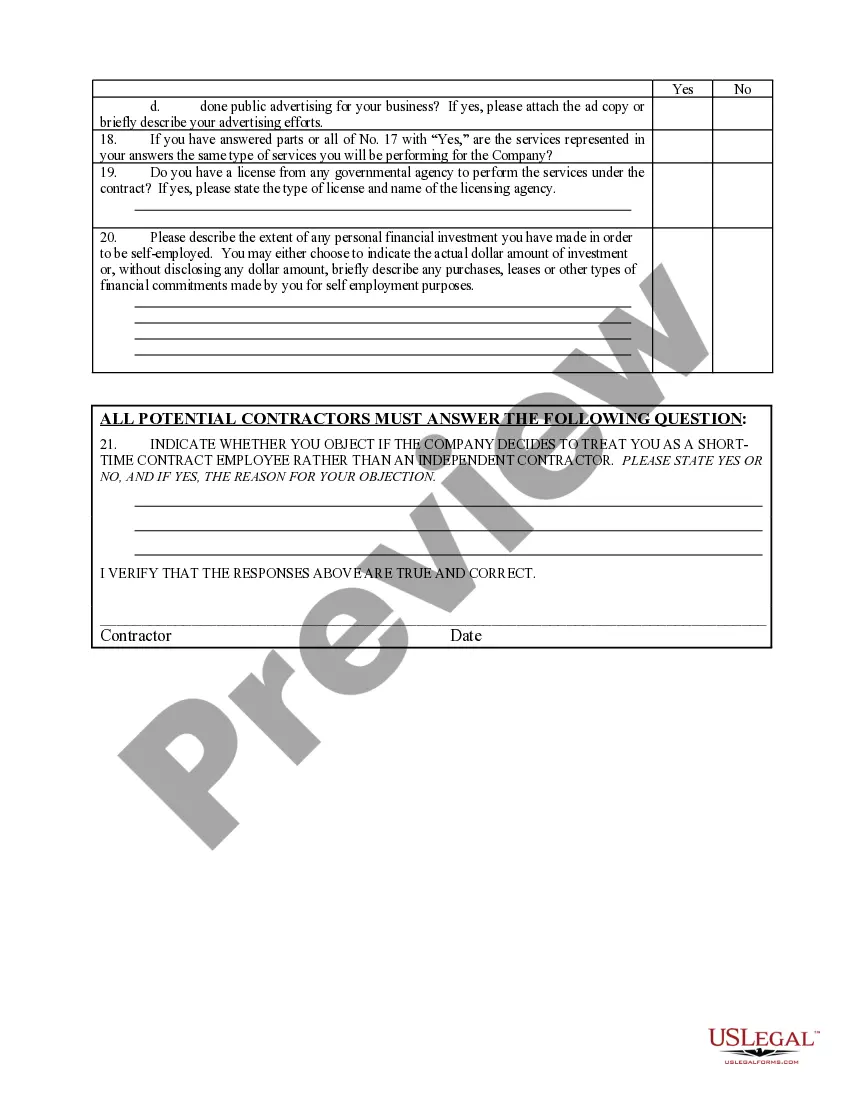

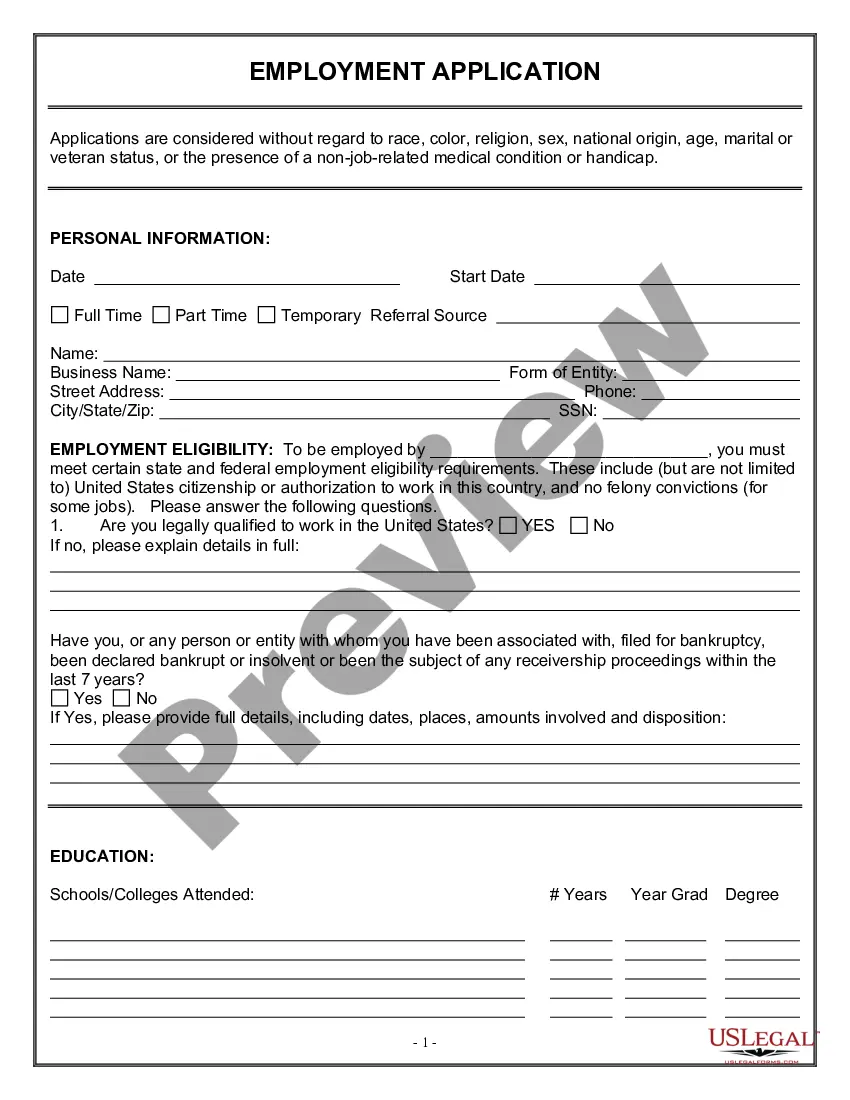

Filling out the declaration of independent contractor status form requires you to provide basic personal information and declare your business independence. Make sure to explain your relationship with the hiring party clearly. The Colorado Self-Employed Independent Contractor Questionnaire can assist in organizing the required details, making the process seamless and efficient.

The Pandemic Unemployment Assistance program, known as PUA, for the first time provided coverage for gig workers and independent contractors, who don't pay into state unemployment systems. The PEUC fund provided payments to people who exhausted their regular unemployment benefits.

In the event that you are not paid as an employee, you are considered an independent contractor and must have a business license.

Persons who follow a trade, business or professions such as lawyers, accountants or construction contractors who offer their services to the general public are usually considered independent contractors.

Who Needs A Contractor License In Colorado? You Need to Determine Which Contractor License You Need In Colorado, general contractors must obtain licenses at the municipal level, while electricians and plumbers must obtain licenses at the state level.

These factors are: (1) the kind of occupation, with reference to whether the work usually is done under the direction of a supervisor or is done by a specialist without supervision; (2) the skill required in the particular occupation; (3) whether the employer or the individual in question furnishes the equipment used

1099 Worker Defined A 1099 worker is one that is not considered an employee. Rather, this type of worker is usually referred to as a freelancer, independent contractor or other self-employed worker that completes particular jobs or assignments. Since they're not deemed employees, you don't pay them wages or a salary.

Under Colorado Law, an individual is presumed to be in covered employment unless and until it is shown that the individual is free from control and direction in the performance of services, both under contract and in fact, and that the individual is customarily engaged in an independent trade, occupation, profession or

The state now requires that anyone filing a 1099 either has an LLC associated with their operations as a contractor or that they fully incorporate their business.

In the event that you are not paid as an employee, you are considered an independent contractor and must have a business license.