Colorado Salaried Employee Appraisal Guidelines - General

Description

How to fill out Salaried Employee Appraisal Guidelines - General?

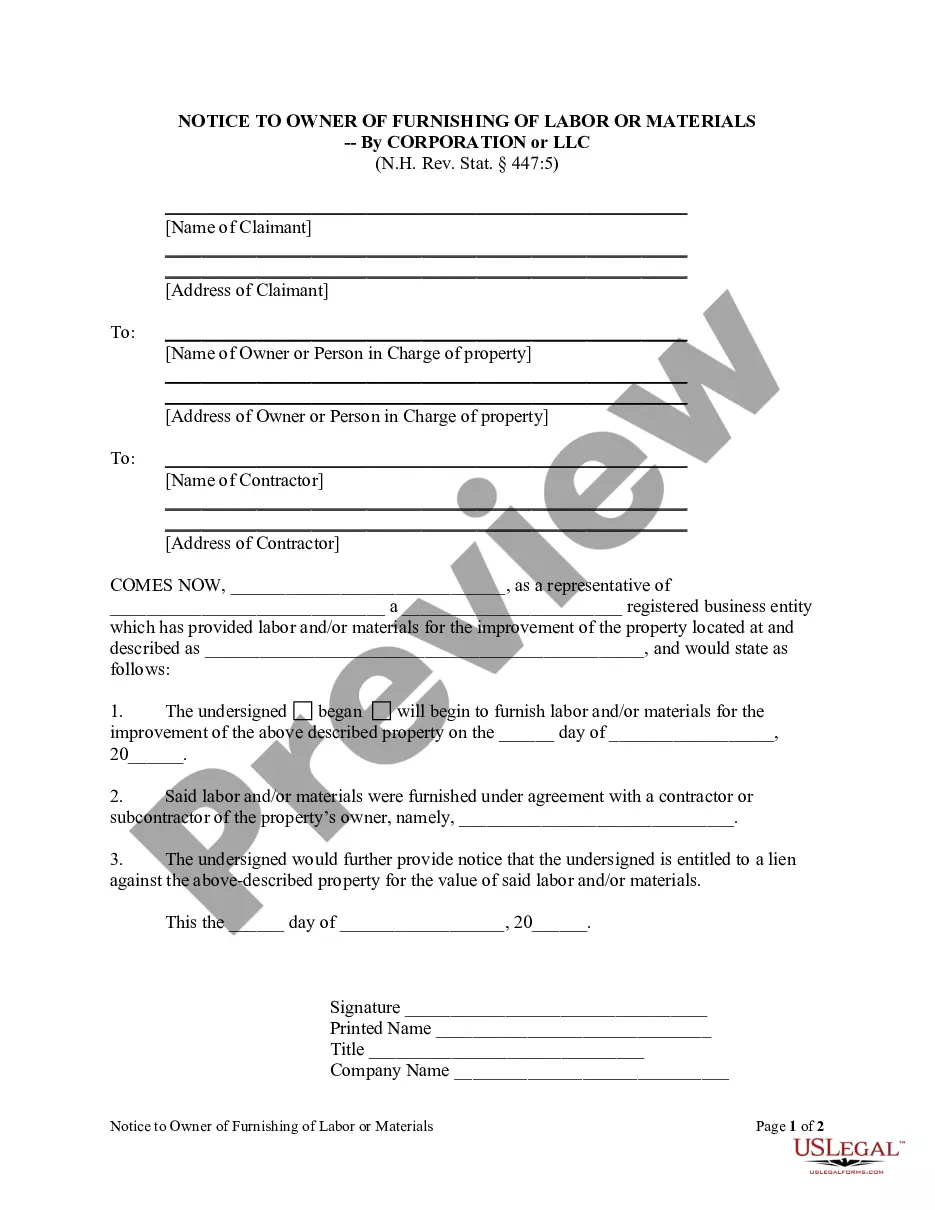

You can allocate time online attempting to locate the valid document format that meets the state and federal requirements you need.

US Legal Forms offers thousands of valid forms which can be evaluated by professionals.

You can obtain or print the Colorado Salaried Employee Appraisal Guidelines - General from our platform.

If available, utilize the Review button to look through the document format as well.

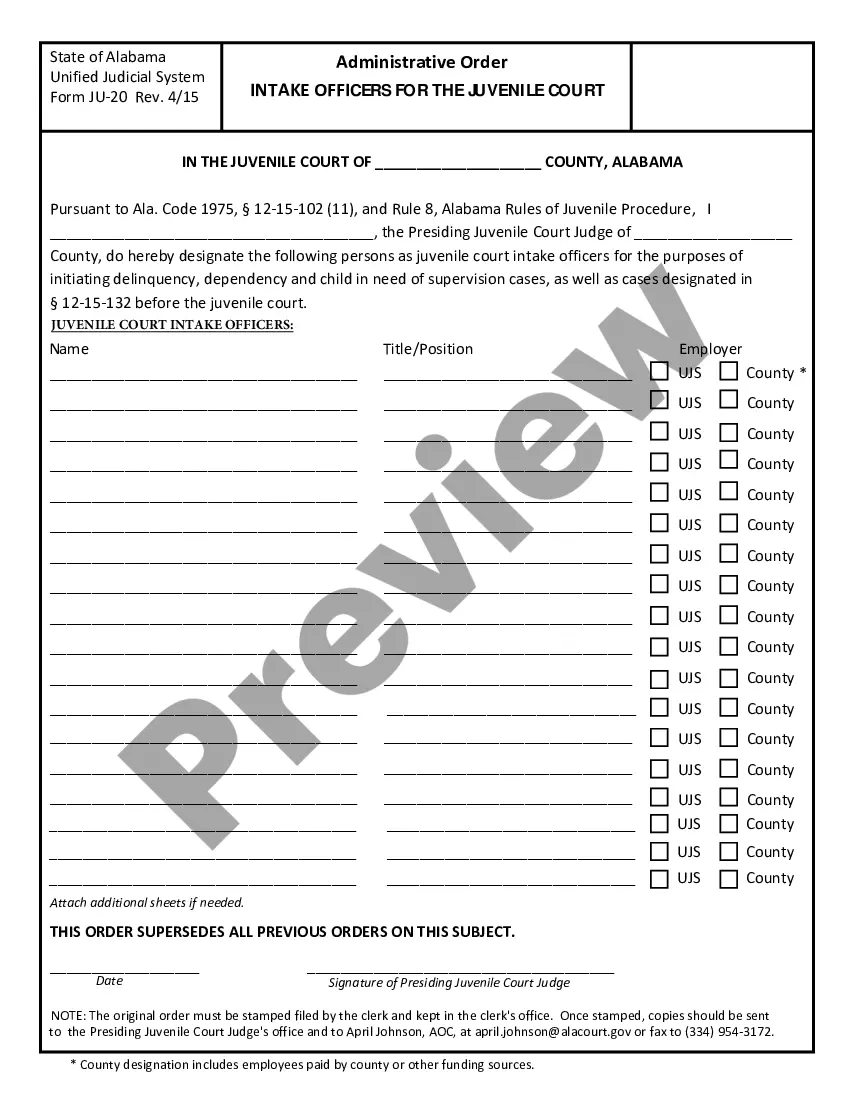

- If you currently possess a US Legal Forms account, you may Log In and then click the Obtain button.

- Subsequently, you can complete, modify, print, or sign the Colorado Salaried Employee Appraisal Guidelines - General.

- Each legal document format you acquire is yours permanently.

- To obtain an additional copy of any purchased form, visit the My documents tab and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, confirm that you have selected the correct document format for the county/city of your choice.

- Read the document description to ensure you have chosen the appropriate form.

Form popularity

FAQ

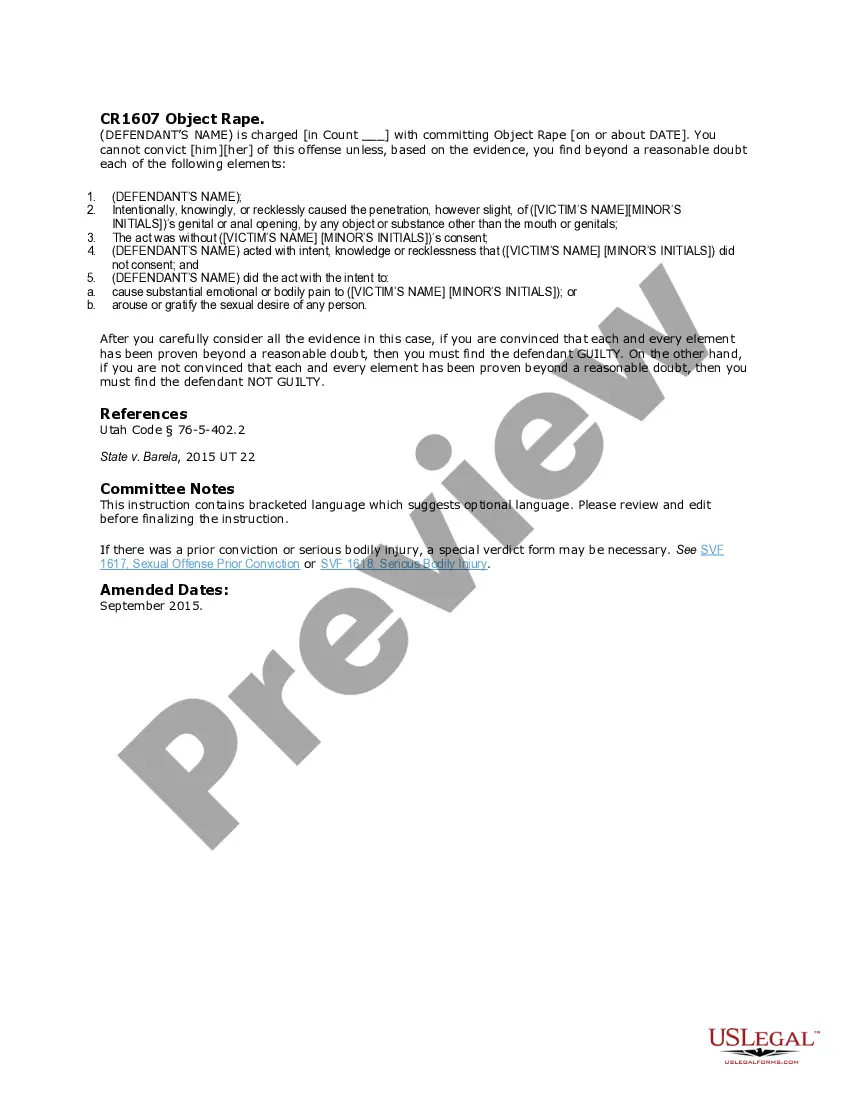

Because they're exempt, salaried employees, you would pay them their $1000/week salary for all four pay periods, regardless of the number of hours workedand no overtime pay is required. So, if your employee is both salaried and classified as exempt, they are not entitled to overtime pay.

In order to be exempt, an employee must meet the salary and duties requirements. Effective January 1, 2021, the salary threshold for overtime exemption is $40,500, then will increase to $45,000 in 2022, to $50,000 in 2023, and to $55,000 in 2024.

Under Colorado law, certain employers must give employees a 30-minute meal break once the employee has worked five hours. Meal breaks are unpaid, as long as the employee has an uninterrupted, duty-free meal break. This means the employee can't be required to do any work or to wait around for work that might pop up.

40 hours in one workweek. 12 hours in one workday. 12 consecutive hours, regardless of whether the work period overlaps into a second day.

Under Colorado's break law, certain employers are required to provide a 30-minute meal break to employees who have worked at least five hours in the workday. Although a meal break for employees is required the law doesn't require an employer to pay for employee's meal breaks.

Commissioned sales employees of retail or service establishments are exempt from the FLSA/Colorado overtime pay provisions if more than half of the employee's earnings come from commissions and the employee averages at least one and one-half times the minimum wage for each hour worked.

Generally, for each hour worked over 40/week or 12/day by both salaried and hourly employees, federal and Colorado overtime laws require overtime pay to be paid at a rate of one and a half times the employee's regular hourly rate.