Colorado Determining Self-Employed Contractor Status: A Comprehensive Guide In Colorado, determining the status of a self-employed contractor is crucial for both businesses and individuals engaging in independent contracting work. Understanding the various factors and legal requirements can help avoid potential legal issues and ensure compliance with state employment laws. In this detailed description, we will explore the concept of self-employed contractor status in Colorado, the criteria used to determine it, and the different types of classifications related to independent contractors. Key Terms: Colorado, self-employed contractor, determination, independent contractor, employment laws, legal requirements 1. Understanding Self-Employed Contractor Status in Colorado The status of being a self-employed contractor in Colorado refers to an individual who operates as an independent business entity, providing services or performing work for a client or company. Unlike traditional employees, self-employed contractors have more control over how they perform the work and are responsible for their own taxes, insurance, and other business-related aspects. 2. Criteria for Determining Self-Employed Contractor Status in Colorado To classify an individual as a self-employed contractor in Colorado, several criteria are considered. These criteria revolve around the level of control the individual has over their work and the relationship they have with the hiring entity. Key factors include: a. Control over Work: Self-employed contractors retain the right to control and direct the details of their work. They determine when, where, and how the work is performed. b. Independence: Contractors should demonstrate independence by having their own business name, business cards, and separate financial accounts. They may also have other clients and be responsible for their own profits and losses. c. Specialized Skills: Contractors are typically engaged for their specialized skills or expertise, differentiating them from an employee. They possess the necessary training and knowledge to perform their services. d. Written Agreements: Having a written contract or agreement explicitly stating the independent contractor relationship can strengthen the status determination. 3. Types of Colorado Determining Self-Employed Contractor Status In Colorado, there are different types of classifications closely related to independent contractors. Familiarizing yourself with these classifications can help you navigate the regulations and requirements appropriately. Some notable types include: a. Sole Proprietorship: A self-employed contractor may operate as a sole proprietor, meaning their business is owned and operated by a single individual. They bear full responsibility for the business's obligations and debts. b. Limited Liability Company (LLC): An individual can also choose to form an LLC for their self-employed contracting business. This provides personal liability protection and ensures a clear separation between their personal and business assets. c. Subcontractor: Subcontractors are independent contractors hired by a primary contractor to perform a specific part of a project or job. Subcontractors generally have their own clients and can further delegate tasks to their own employees or subcontractors. d. Freelancers: Freelancers, commonly found in creative or digital industries, are self-employed contractors who work on a project-by-project basis for multiple clients. They are often specialized in a particular field and maintain a high degree of control and autonomy over their work. Remember, accurately determining self-employed contractor status in Colorado is crucial to avoid potential misclassification penalties, labor disputes, and legal complications. Consulting legal professionals or the Colorado Department of Labor and Employment can provide further guidance and ensure compliance with the state's laws and regulations.

Colorado Determining Self-Employed Contractor Status

Description

How to fill out Colorado Determining Self-Employed Contractor Status?

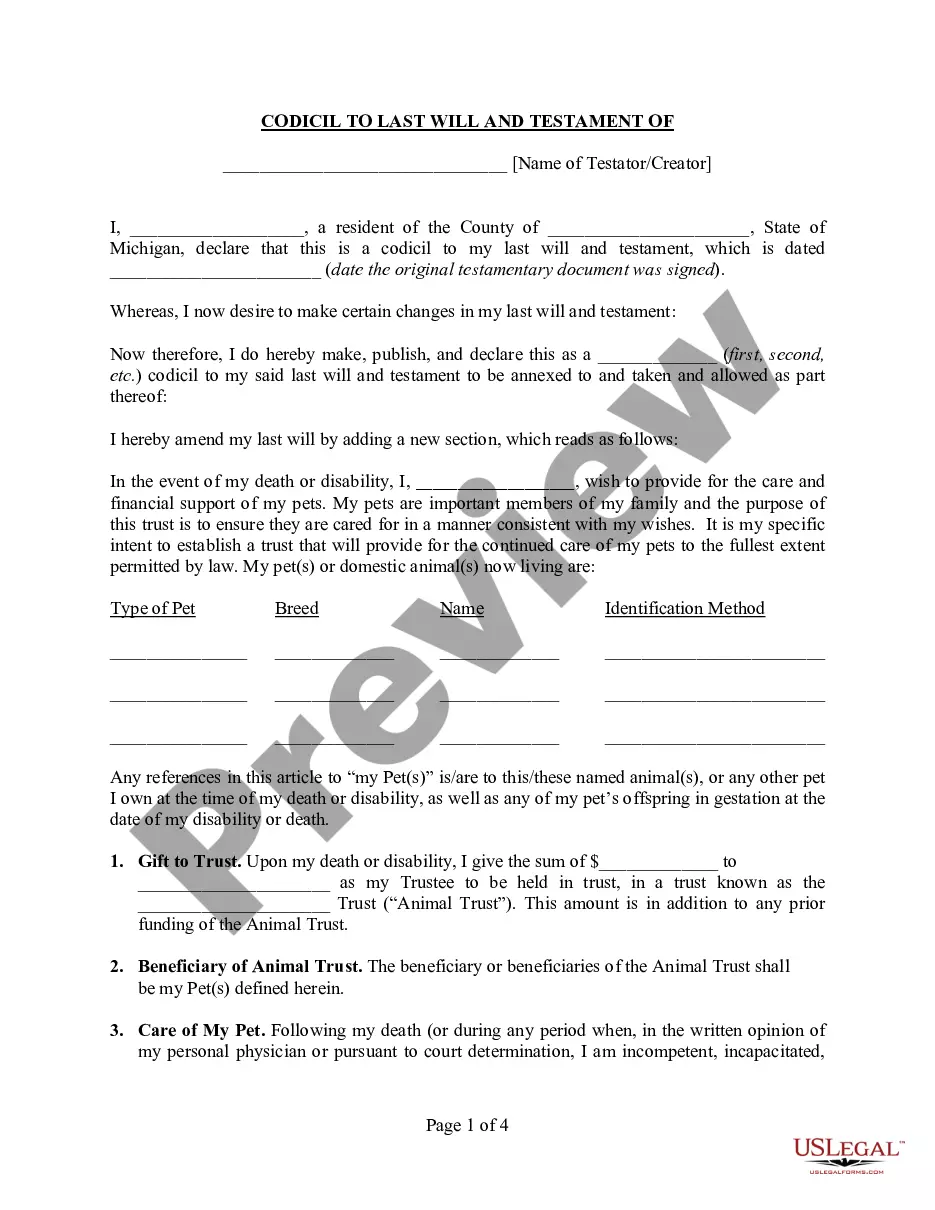

Are you currently inside a place where you need papers for either enterprise or specific purposes almost every time? There are plenty of legal document templates available on the Internet, but locating versions you can rely isn`t simple. US Legal Forms delivers a huge number of kind templates, much like the Colorado Determining Self-Employed Contractor Status, that are composed in order to meet state and federal demands.

When you are currently knowledgeable about US Legal Forms site and get an account, just log in. After that, you are able to down load the Colorado Determining Self-Employed Contractor Status format.

Should you not offer an profile and would like to begin to use US Legal Forms, abide by these steps:

- Obtain the kind you want and ensure it is to the proper town/region.

- Take advantage of the Review option to examine the form.

- Browse the information to actually have chosen the right kind.

- In the event the kind isn`t what you`re searching for, make use of the Look for discipline to obtain the kind that fits your needs and demands.

- Whenever you get the proper kind, just click Acquire now.

- Pick the pricing strategy you would like, submit the desired information and facts to generate your bank account, and purchase the transaction using your PayPal or bank card.

- Pick a convenient paper file format and down load your copy.

Locate all the document templates you may have purchased in the My Forms menus. You can get a more copy of Colorado Determining Self-Employed Contractor Status at any time, if possible. Just select the required kind to down load or produce the document format.

Use US Legal Forms, the most comprehensive assortment of legal varieties, to save lots of time and prevent blunders. The service delivers appropriately made legal document templates which you can use for a selection of purposes. Produce an account on US Legal Forms and begin producing your way of life easier.

Form popularity

FAQ

In the event that you are not paid as an employee, you are considered an independent contractor and must have a business license.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

Agency law imposes contract liability on principals and agents, depending on the circumstances. The crucial factor in determining whether someone is an independent contractor or an employee is the degree of control that the principal has over that party.

Under Colorado Law, an individual is presumed to be in covered employment unless and until it is shown that the individual is free from control and direction in the performance of services, both under contract and in fact, and that the individual is customarily engaged in an independent trade, occupation, profession or

What Is an Independent Contractor? An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes.

Generally speaking, the difference between independent contractors and employees in California is whether or not the entity paying for services has the right to control or direct the manner and means of work (tending to signify an employment relationship), or whether the person providing the services has independently

Pay basis: If you pay a worker on an hourly, weekly, or monthly basis, the IRS will consider it a sign the worker is your employee. An independent is generally paid by the job, project, assignment, etc., or receives a commission or similar fee.

AB 5 requires the application of the ABC test to determine if workers in California are employees or independent contractors for purposes of the Labor Code, the Unemployment Insurance Code, and the Industrial Welfare Commission (IWC) wage orders.

An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes.

Persons who follow a trade, business or professions such as lawyers, accountants or construction contractors who offer their services to the general public are usually considered independent contractors.