Full text and statutory guidelines for the Insurers Rehabilitation and Liquidation Model Act.

Colorado Insurers Rehabilitation and Liquidation Model Act

Description

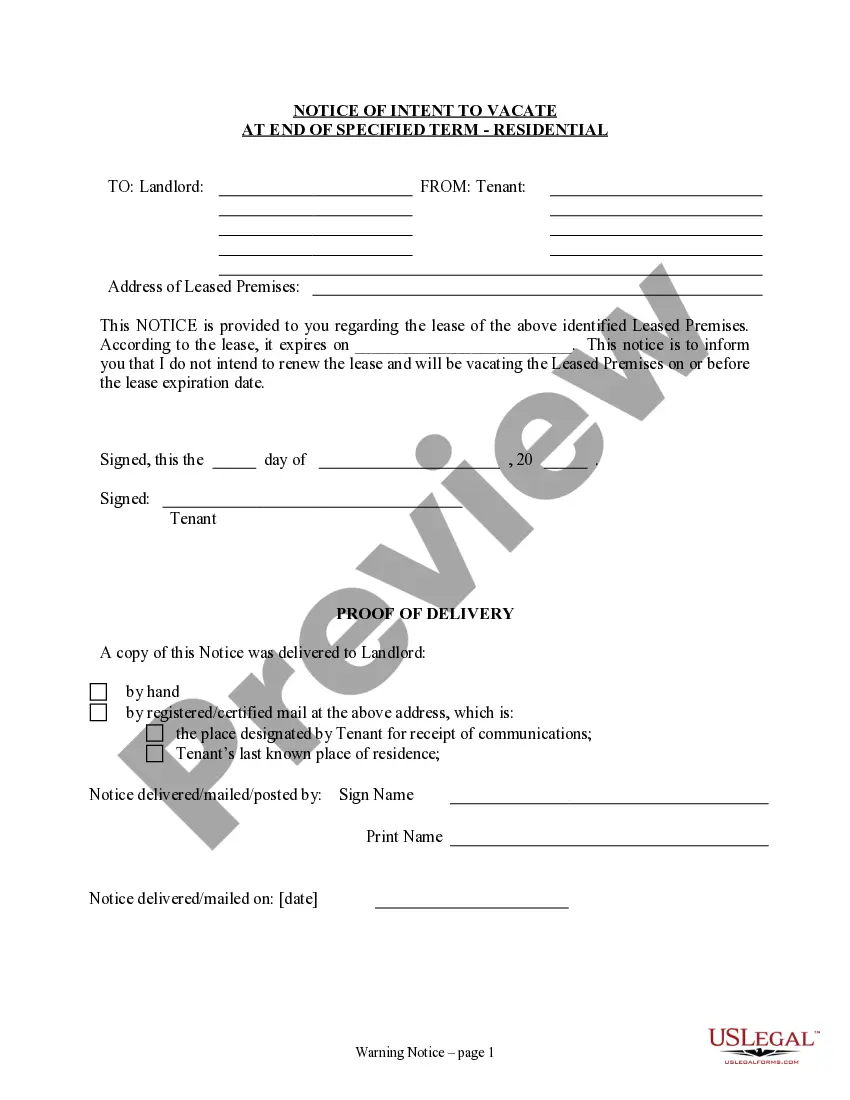

How to fill out Insurers Rehabilitation And Liquidation Model Act?

You are able to devote several hours online searching for the legal record format that suits the federal and state needs you want. US Legal Forms supplies a large number of legal kinds which can be evaluated by experts. You can easily obtain or print out the Colorado Insurers Rehabilitation and Liquidation Model Act from our assistance.

If you have a US Legal Forms account, you are able to log in and then click the Acquire option. Next, you are able to complete, revise, print out, or signal the Colorado Insurers Rehabilitation and Liquidation Model Act. Each legal record format you acquire is yours eternally. To have an additional copy for any bought form, visit the My Forms tab and then click the corresponding option.

If you work with the US Legal Forms website for the first time, adhere to the basic directions beneath:

- First, make sure that you have selected the correct record format for the region/area of your choosing. Browse the form explanation to make sure you have chosen the proper form. If readily available, utilize the Preview option to look with the record format too.

- In order to discover an additional version of your form, utilize the Search area to find the format that meets your requirements and needs.

- Once you have identified the format you would like, simply click Get now to carry on.

- Pick the rates program you would like, key in your accreditations, and register for an account on US Legal Forms.

- Comprehensive the financial transaction. You can utilize your Visa or Mastercard or PayPal account to pay for the legal form.

- Pick the formatting of your record and obtain it to the product.

- Make modifications to the record if necessary. You are able to complete, revise and signal and print out Colorado Insurers Rehabilitation and Liquidation Model Act.

Acquire and print out a large number of record layouts while using US Legal Forms web site, which offers the most important collection of legal kinds. Use professional and state-specific layouts to take on your organization or individual requires.

Form popularity

FAQ

An insured party can also bring a claim for common-law bad faith by an insurance company. Under this claim, the insured party would allege that the insurance company acted unreasonably, and that it did so with knowledge of or reckless disregard for the fact that no reasonable basis existed for its action.

Insurance bad faith is a legal term used when an insurer acts unreasonably or fails to fulfill its duties toward the policyholder. A primary component of an insurance company's obligation is the prompt processing and payment of legitimate claims, and any undue delay can be a violation of this duty.

(1) The commissioner or the commissioner's designee may conduct an examination of any company as often as the commissioner, in the commissioner's sole discretion, deems appropriate but shall, at a minimum, conduct a formal financial examination of every insurer licensed in this state not less frequently than once every ...

Colorado Revised Statutes Title 10. Insurance § 10-3-1115. Improper denial of claims--prohibited--definitions--severability. (1)(a) A person engaged in the business of insurance shall not unreasonably delay or deny payment of a claim for benefits owed to or on behalf of any first-party claimant.

Insured may bring a claim to recover two times the amount of covered benefits that insurer unreasonably delayed or denied even though insurer paid a portion of those benefits and insured seeks the remainder in another claim.

When an insurer is given an order of liquidation, who will protect the insureds' unpaid claims? The Insurance Security Fund was created to provide insureds with protection against an insurer's liquidation.

Breach of Contract Bad Faith An insured party can file a claim for breach of contract asserting that though they satisfied all terms of the insurance contract, the insurer breached the contract by failing to pay the valid claim.