Colorado Department Time Report for Payroll

Description

How to fill out Department Time Report For Payroll?

US Legal Forms - one of the most prominent collections of legal documents in the USA - offers a variety of legal document templates you can either download or print.

Using the website, you can access thousands of forms for both commercial and personal purposes, categorized by category, state, or keywords. You can find the latest editions of documents such as the Colorado Department Time Report for Payroll in just moments.

If you already hold a subscription, Log In and download the Colorado Department Time Report for Payroll from the US Legal Forms library. The Download button will be visible on each form you view. You can access all previously downloaded documents in the My documents section of your profile.

Process the payment. Use a Visa or Mastercard or PayPal account to complete the transaction.

Select the format and download the form to your device. Edit. Complete, alter, print, and sign the downloaded Colorado Department Time Report for Payroll. Each template you added to your account has no expiration date and belongs to you indefinitely. Therefore, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you need. Access the Colorado Department Time Report for Payroll with US Legal Forms, the largest repository of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- If you are utilizing US Legal Forms for the first time, here are simple instructions to assist you in starting.

- Ensure you have selected the correct form for the city/state.

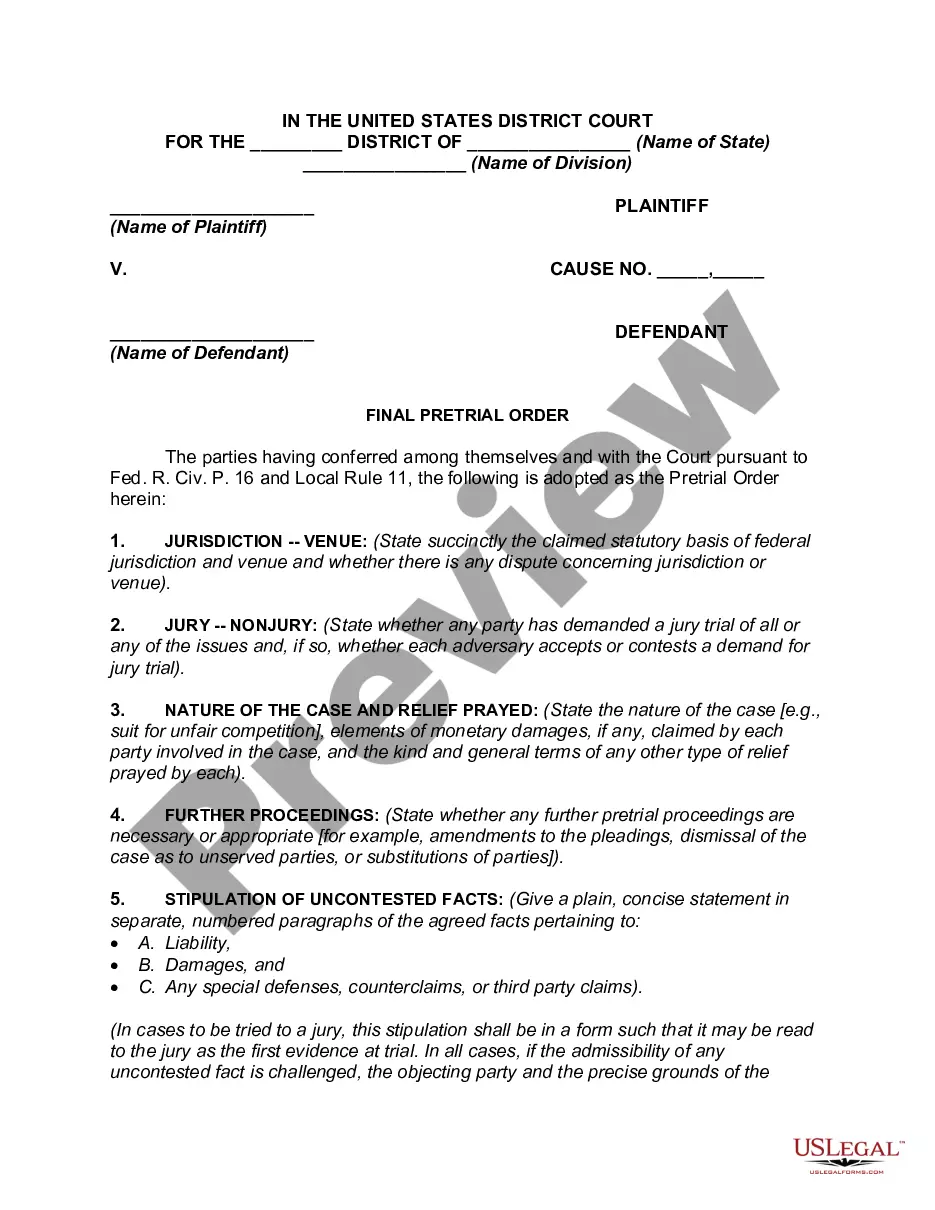

- Click on the Preview button to review the form's content.

- Examine the form summary to confirm you have chosen the appropriate form.

- If the form does not meet your requirements, use the Search field at the top of the screen to find one that does.

- If you are content with the form, confirm your choice by clicking the Get Now button.

- Then, choose the pricing plan you prefer and provide your details to register for an account.

Form popularity

FAQ

If the employer has overpaid an employee by mistake then the employer has the right to reclaim that money back. However, employees and workers are protected, under section 13 of the Employment Rights Act 1996, from any unlawful deductions from their wages.

Yup. Both state and federal labor and employment laws give employers the right to garnish an employee's wages subtract chunks from a worker's paycheck in cases of overpayment. The federal law, known as the Fair Labor Standards Act, is notoriously weak on worker protections when it comes to garnishing wages.

Colorado Wage Transparency Act In Colorado's 2008 Wage Transparency Act (S.B. 122), Colorado employers are prohibited from retaliating against employees for sharing wage information and from requiring employees to sign document purporting to deny the right to discuss pay information.

File a complaint: If your boss won't respond to your concerns about payment under the minimum wage or failure to pay a premium for overtime hours, you can file a complaint with the U.S. Department of Labor, Wages and Hour Division, which enforces the Fair Labor Standards Act (FLSA).

In most cases, yes. Federal employment lawsmost notably the Fair Labor Standards Act (FLSA)allow for a number of employer changes, including changing the employee's schedule.

The employer has 10 calendar days after termination of employment to audit and adjust the accounts and property value of any items entrusted to the employee before the employee's wages or compensation shall be paid.

In the absence of such agreement, Colorado wage law provides: All wages or compensation shall be due and payable for regular pay periods of no greater duration than one calendar month or thirty days, whichever is longer. Regular paydays must be no later than ten days following the close of each pay period.

No, employers cannot charge employees for mistakes, shortages, or damages. Only if you agree (in writing) that your employer can deduct from your pay for the mistake. Only if your employer has reason to believe you were responsible, and you agree (in writing) that your employer can deduct from your pay for the mistake.

If the employer fails to pay the wages to the employee as required by the Act, the employee has the right to file a written demand. If the employer does pay the wages within 14 days of the demand, the employee may be able to recover a significant penalty by filing a civil lawsuit.

As per Colorado Rev. Stat. Ann. § 8-4-109, when an employee is fired, the employer must give him or her a final paycheck immediately, or within six (6) hours of start of the next business day if the payroll office is closed, or within twenty-four (24) hours if the payroll office is offsite.