A Colorado Management Agreement between a Trust and a Corporation is a legal document that outlines the arrangement between a trust, which is a fiduciary relationship wherein one party holds assets on behalf of another, and a corporation, which is a legal entity formed to conduct business activities. This agreement establishes the terms and conditions under which the corporation manages and administers the assets held by the trust. Keywords: Colorado, management agreement, trust, corporation, legal document, fiduciary relationship, assets, terms and conditions, manage, administer. There are different types of Colorado Management Agreements between a Trust and a Corporation, depending on the nature and objectives of the arrangement. Some common types include: 1. Investment Management Agreement: This type of agreement specifies that the corporation will be responsible for making investment decisions on behalf of the trust. It outlines the investment goals, strategies, and any limitations imposed by the trust. 2. Property Management Agreement: In this type of agreement, the corporation is appointed to handle the management and maintenance of the trust's real estate properties. It includes details on rent collection, property repairs, tenant relations, and other property-related tasks. 3. Financial Management Agreement: This agreement focuses on the overall financial management of the trust's assets. It may involve tasks such as budgeting, financial reporting, tax planning, and coordinating with other financial professionals, like accountants or tax advisors. 4. Business Management Agreement: This type of agreement is applicable when the trust holds ownership or interests in a business entity. It outlines the corporation's responsibilities in operating, managing, and strategizing for the success of the business, including decision-making authority, profit distribution, and day-to-day operations. 5. Estate Planning Management Agreement: This agreement addresses the management of the trust's assets for estate planning purposes. It includes provisions for asset distribution, tax planning, and long-term wealth preservation strategies. Each type of management agreement may vary in terms of its scope, duration, compensation, termination clauses, and other specific provisions, depending on the unique needs of the trust and the objectives of the corporation. In summary, a Colorado Management Agreement between a Trust and a Corporation is a legal document that governs the relationship between a trust and a corporation regarding the management and administration of the trust's assets. Understanding the specific type of management agreement is essential to ensure that the agreement aligns with the specific goals and requirements of both parties involved.

Colorado Management Agreement between a Trust and a Corporation

Description

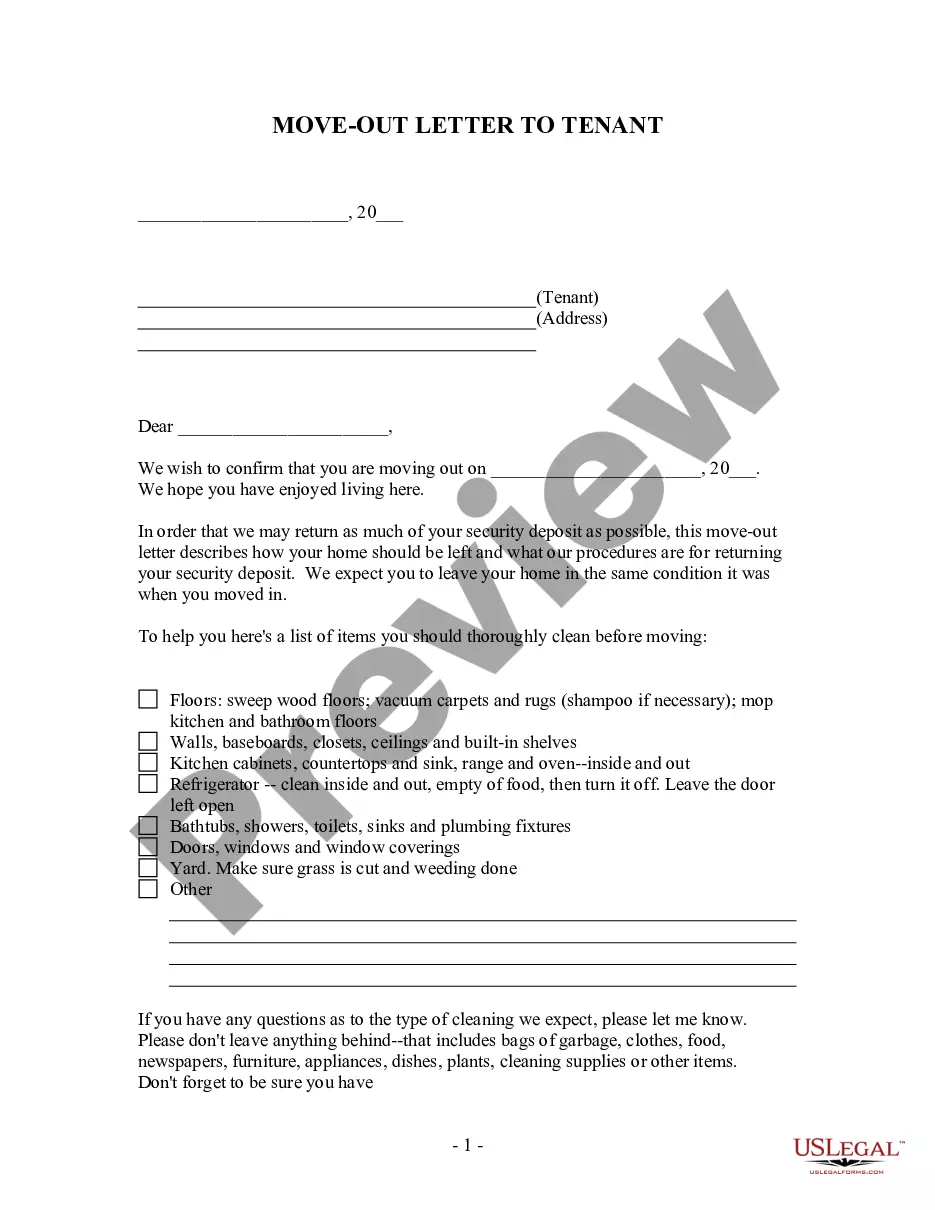

How to fill out Colorado Management Agreement Between A Trust And A Corporation?

Have you been in a situation the place you will need paperwork for both enterprise or personal functions nearly every day? There are tons of legal file web templates accessible on the Internet, but locating types you can rely isn`t easy. US Legal Forms delivers a large number of develop web templates, such as the Colorado Management Agreement between a Trust and a Corporation, that happen to be published to fulfill federal and state specifications.

In case you are previously informed about US Legal Forms internet site and possess a free account, just log in. After that, you can acquire the Colorado Management Agreement between a Trust and a Corporation template.

Unless you offer an bank account and would like to start using US Legal Forms, adopt these measures:

- Obtain the develop you need and ensure it is for that right town/region.

- Take advantage of the Preview button to review the form.

- Look at the description to ensure that you have chosen the appropriate develop.

- If the develop isn`t what you`re looking for, utilize the Lookup industry to get the develop that meets your needs and specifications.

- If you obtain the right develop, just click Buy now.

- Select the prices prepare you would like, complete the required information to make your account, and purchase your order using your PayPal or credit card.

- Decide on a convenient paper file format and acquire your version.

Locate each of the file web templates you may have bought in the My Forms food selection. You can obtain a further version of Colorado Management Agreement between a Trust and a Corporation anytime, if possible. Just click on the required develop to acquire or print the file template.

Use US Legal Forms, probably the most considerable collection of legal kinds, in order to save some time and stay away from faults. The services delivers professionally manufactured legal file web templates that you can use for an array of functions. Create a free account on US Legal Forms and initiate producing your way of life easier.