Colorado Change in location of main office

Description

How to fill out Change In Location Of Main Office?

US Legal Forms - one of the greatest libraries of legal types in the USA - offers an array of legal file layouts you may download or print. Using the internet site, you can find a large number of types for business and person uses, sorted by groups, suggests, or search phrases.You will find the most recent variations of types like the Colorado Change in location of main office in seconds.

If you already have a monthly subscription, log in and download Colorado Change in location of main office in the US Legal Forms catalogue. The Acquire switch can look on each type you view. You gain access to all in the past saved types within the My Forms tab of your own account.

If you want to use US Legal Forms initially, allow me to share easy directions to get you started off:

- Be sure you have picked the right type to your area/region. Click on the Review switch to analyze the form`s content material. Look at the type explanation to ensure that you have chosen the right type.

- In case the type does not suit your specifications, make use of the Research discipline at the top of the display screen to get the one who does.

- In case you are content with the form, validate your selection by simply clicking the Purchase now switch. Then, pick the costs strategy you like and give your qualifications to sign up on an account.

- Method the deal. Make use of credit card or PayPal account to complete the deal.

- Choose the structure and download the form on the device.

- Make alterations. Fill out, revise and print and indication the saved Colorado Change in location of main office.

Every single template you included in your account lacks an expiry day and it is yours for a long time. So, if you wish to download or print one more version, just visit the My Forms portion and click on on the type you will need.

Obtain access to the Colorado Change in location of main office with US Legal Forms, one of the most considerable catalogue of legal file layouts. Use a large number of expert and express-distinct layouts that satisfy your business or person needs and specifications.

Form popularity

FAQ

Form 8822 is available by calling the IRS at 1-800-TAX-FORM (1-800-829- 3676), or at most local IRS offices. You can also download this form from the IRS Web site at .irs.gov under the "Forms and Publications" section.

Need to update your address or name? Log in to your Revenue Online account. Select the "More..." tab. Click "Manage Names & Addresses" in the "Name & Addresses" box. Select the "Addresses" tab. Click "Change" (if this is the first time you have added an address, click "Add") Follow the steps to change your mailing address.

Information about developments affecting Form 8822 (such as legislation enacted after we release it) is at .irs.gov/form8822. You can use Form 8822 to notify the Internal Revenue Service if you changed your home mailing address.

Need to update your address or name? Log in to your Revenue Online account. Select the "More..." tab. Click "Manage Names & Addresses" in the "Name & Addresses" box. Select the "Addresses" tab. Click "Change" (if this is the first time you have added an address, click "Add") Follow the steps to change your mailing address.

Nonresident Definition However, the person may have temporarily worked in Colorado and/or received income from a source in Colorado. A nonresident is required to file a Colorado income tax return if they: are required to file a federal income tax return, and. had taxable Colorado-sourced income.

Food and beverage expense deduction However, for tax years 2021 and 2022, section 274(n)(2)(D) of the Internal Revenue Code generally permits deduction of 100% of the expense for food and beverages provided by a restaurant.

Email to: DOR_taxapplications@state.co.us, or Mail to: Colorado Department of Revenue, Taxpayer Service Center, PO Box 17087, Denver, CO 80217-0087 Use this form to notify the department of the address and/or name change.

To change your address with the IRS, you may complete a Form 8822, Change of Address (For Individual, Gift, Estate, or Generation-Skipping Transfer Tax Returns) and/or a Form 8822-B, Change of Address or Responsible Party ? Business and send them to the address shown on the forms.

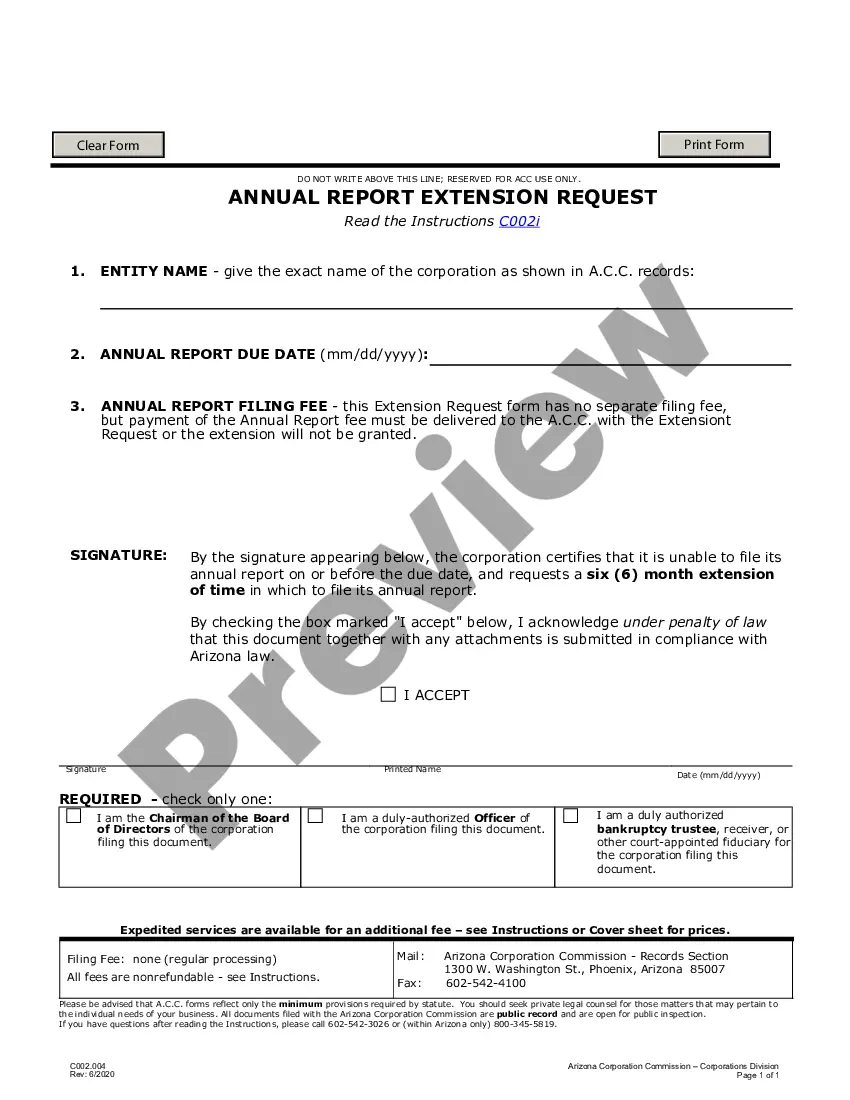

Use this form to notify the Department of Revenue of a name or address change. To change the address for a specific physical location you operate or sell into, refer to your sales tax license for the 8-digit Colorado Account number followed by a 4-digit location (site) number and indicate in the form.

The Colorado Retail Sales Tax Return (DR 0100) is used to report not only Colorado sales tax, but also sales taxes administered by the Colorado Department of Revenue for various cities, counties, and special districts in the state.