Colorado Articles 5.11, 5.12 and 5.13 of Texas Business Corporation Act

Description

How to fill out Articles 5.11, 5.12 And 5.13 Of Texas Business Corporation Act?

Have you been in a situation where you will need documents for possibly enterprise or person purposes nearly every day? There are tons of legitimate file themes available on the net, but discovering kinds you can trust is not effortless. US Legal Forms offers a large number of develop themes, just like the Colorado Articles 5.11, 5.12 and 5.13 of Texas Business Corporation Act, that happen to be published to satisfy state and federal requirements.

Should you be previously acquainted with US Legal Forms website and get an account, simply log in. Following that, you can download the Colorado Articles 5.11, 5.12 and 5.13 of Texas Business Corporation Act format.

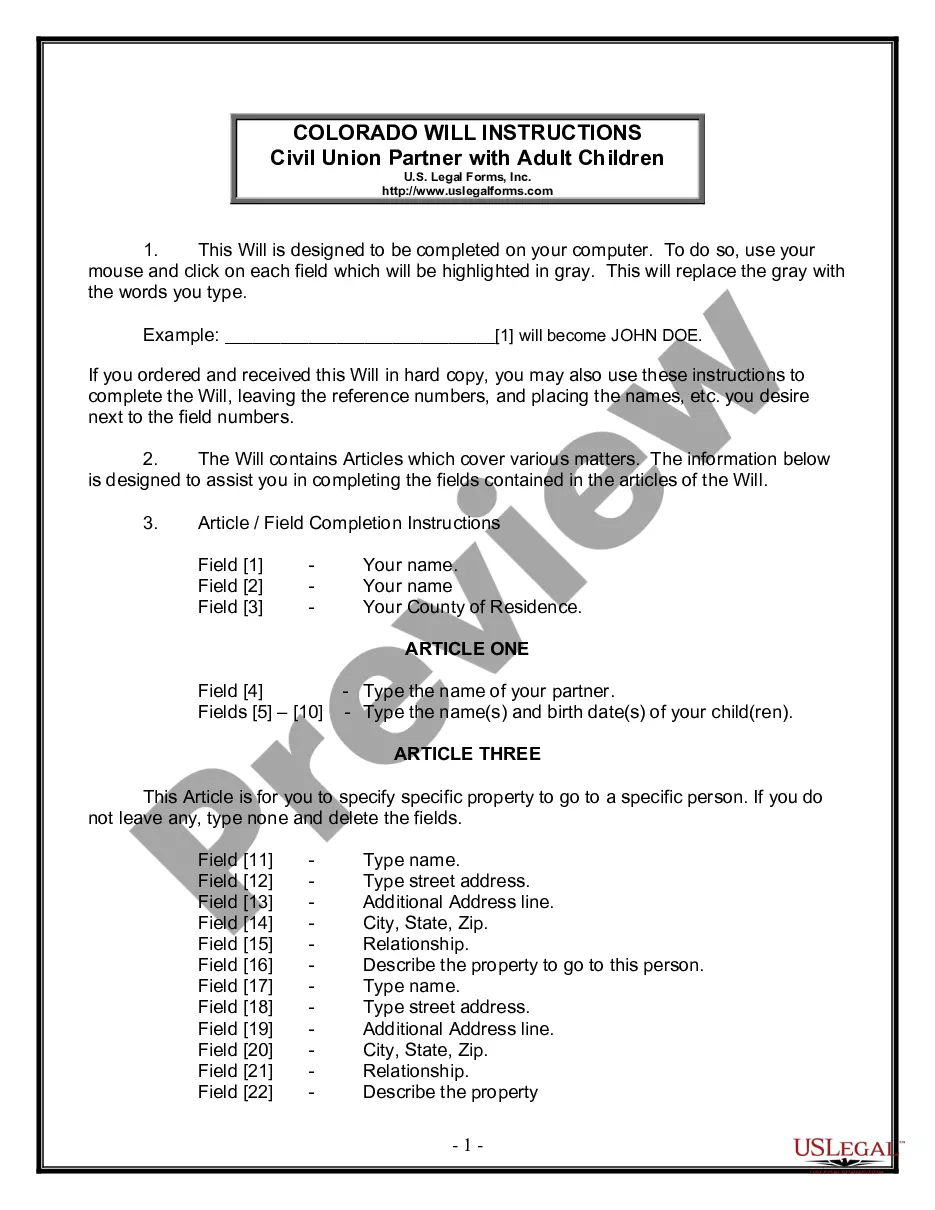

If you do not have an profile and need to begin to use US Legal Forms, adopt these measures:

- Find the develop you require and ensure it is to the appropriate town/state.

- Take advantage of the Review key to review the form.

- Read the description to ensure that you have selected the correct develop.

- If the develop is not what you are searching for, utilize the Look for field to obtain the develop that meets your needs and requirements.

- Once you get the appropriate develop, just click Get now.

- Choose the pricing plan you want, complete the necessary info to generate your money, and purchase the order using your PayPal or credit card.

- Select a practical file format and download your version.

Find all the file themes you may have bought in the My Forms food selection. You may get a more version of Colorado Articles 5.11, 5.12 and 5.13 of Texas Business Corporation Act any time, if required. Just select the necessary develop to download or print out the file format.

Use US Legal Forms, the most extensive selection of legitimate forms, to save lots of time as well as stay away from faults. The service offers skillfully made legitimate file themes that can be used for a variety of purposes. Make an account on US Legal Forms and begin creating your lifestyle a little easier.

Form popularity

FAQ

Under Article 2.21 of the Texas Business Corporation Act (TBCA), for example, shareholders or affiliates cannot be held liable for a corporation's contractual obligations unless they caused the corporation to be used to perpetrate ?an actual fraud? primarily for the purpose of personal benefit?.

The BOC was enacted in 2003. It was effective as of January 1, 2006 though it provided a transition period during which some entities were governed by the BOC and others were governed by the statutes under which they were formed.

Action by Directors. (a) The act of a majority of the directors present at a meeting at which a quorum is present at the time of the act is the act of the board of directors of a corporation, unless the act of a greater number is required by the certificate of formation or bylaws of the corporation or by this code.

The Uniform Commercial Code allows a creditor, typically a financial institution or lender, to notify other creditors about a debtor's assets used as collateral for a secured transaction by filing a public notice (financing statement) with a particular filing office.

The TBOC is the codification of statutes governing most for-profit and non-profit entities in Texas that: Was enacted by the legislature in 2003 and extensively amended in 2005, Became effective on January 1, 2006, and. Completely replaced the prior law it amended and codified on January 1, 2010.