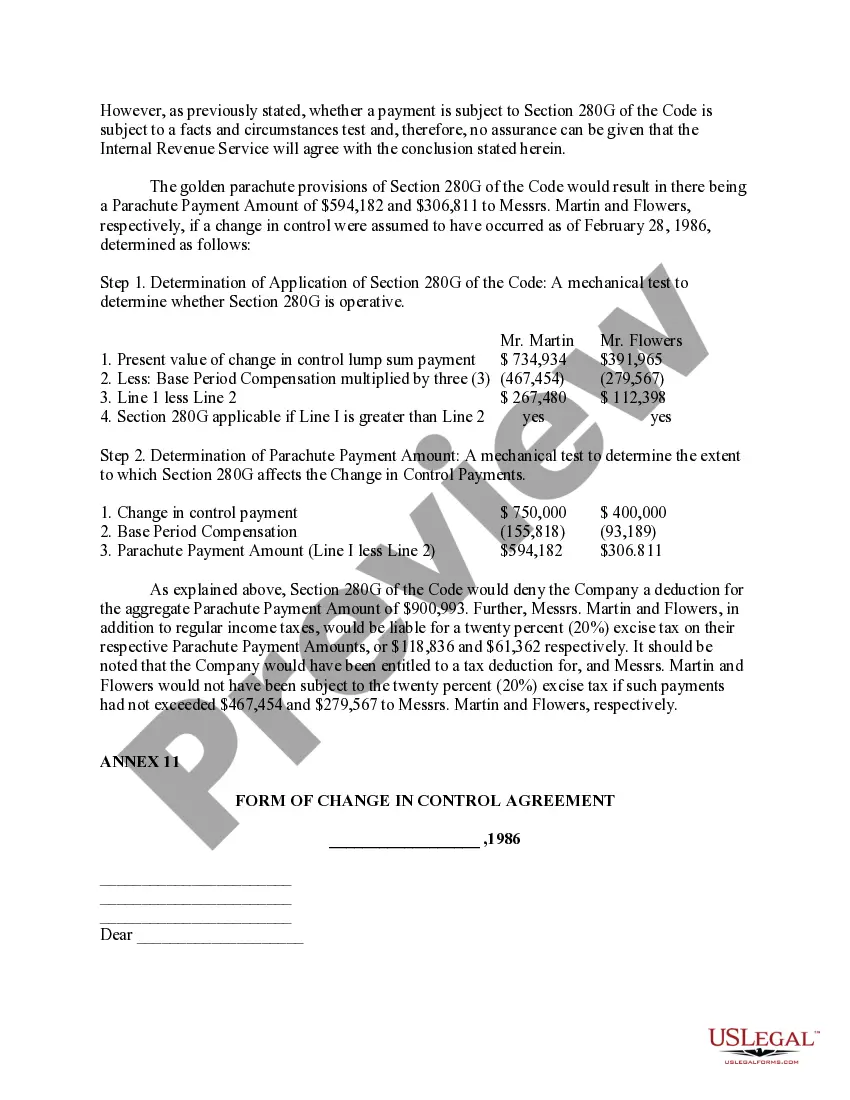

Title: Colorado Ratification of Change in Control Agreements: Ensuring a Smooth Transition in Corporate Ownership Introduction: Colorado Ratification of Change in Control Agreements provides a legal framework to govern the circumstances of a change in control or ownership of a company. This detail-oriented agreement safeguards the interests of all parties involved and ensures a smooth transition during such crucial periods. The following article will offer an in-depth understanding of what these agreements entail, outlining their importance, benefits, and the different types available. Key Points: 1. Importance of Ratification of Change in Control Agreements: — Protecting the interests of all parties involved during an ownership change. — Reducing potential disputes and ensuring a smooth transition of control. — Establishing clear guidelines and expectations for both management and shareholders. — Providing certainty and stability to stakeholders during times of change. — Minimizing legal exposure and potential financial risks. 2. Benefits of Ratification of Change in Control Agreements: — Clarifies the terms and conditions of the change in control process. — Outlines the rights, responsibilities, and obligations of all parties involved. — Protects shareholders' interests by ensuring fair treatment during the transition. — Provides financial and non-financial incentives for key employees to stay and contribute to the new ownership structure. — Enhances the bargaining power of the company during negotiations. 3. Types of Colorado Ratification of Change in Control Agreements: a) Traditional Change in Control Agreement: — A legally binding contract between the company and employees/key executives. — Specifies the terms and conditions of employment during or after the change in control. — Defines severance pay, accelerated vesting of stock options, and other benefits in case of termination after the change in control. b) Shareholder Agreement: — A legally binding contract between shareholders and the company. — Provides protection for shareholders' rights and interests during the change in control. — Can include provisions related to shareholder voting rights, financial compensation, and the transferability of shares. c) Corporate Bylaws Amendment: — An amendment to a company's bylaws to include specific provisions related to change in control. — Defines the process, eligibility criteria, and the rights and obligations of shareholders during the change in control. — Specifies any required approvals or consents from parties involved. Conclusion: Colorado Ratification of Change in Control Agreements provides a robust legal framework to protect the interests of all parties involved during a change in ownership. By clearly defining the rights and obligations of shareholders, executives, and the company, these agreements offer stability, enhance negotiations, and minimize risks associated with the transition. Whether through traditional agreements, shareholder agreements, or amendments to corporate bylaws, Colorado's legal system ensures a smooth and fair process for companies and their stakeholders.

Title: Colorado Ratification of Change in Control Agreements: Ensuring a Smooth Transition in Corporate Ownership Introduction: Colorado Ratification of Change in Control Agreements provides a legal framework to govern the circumstances of a change in control or ownership of a company. This detail-oriented agreement safeguards the interests of all parties involved and ensures a smooth transition during such crucial periods. The following article will offer an in-depth understanding of what these agreements entail, outlining their importance, benefits, and the different types available. Key Points: 1. Importance of Ratification of Change in Control Agreements: — Protecting the interests of all parties involved during an ownership change. — Reducing potential disputes and ensuring a smooth transition of control. — Establishing clear guidelines and expectations for both management and shareholders. — Providing certainty and stability to stakeholders during times of change. — Minimizing legal exposure and potential financial risks. 2. Benefits of Ratification of Change in Control Agreements: — Clarifies the terms and conditions of the change in control process. — Outlines the rights, responsibilities, and obligations of all parties involved. — Protects shareholders' interests by ensuring fair treatment during the transition. — Provides financial and non-financial incentives for key employees to stay and contribute to the new ownership structure. — Enhances the bargaining power of the company during negotiations. 3. Types of Colorado Ratification of Change in Control Agreements: a) Traditional Change in Control Agreement: — A legally binding contract between the company and employees/key executives. — Specifies the terms and conditions of employment during or after the change in control. — Defines severance pay, accelerated vesting of stock options, and other benefits in case of termination after the change in control. b) Shareholder Agreement: — A legally binding contract between shareholders and the company. — Provides protection for shareholders' rights and interests during the change in control. — Can include provisions related to shareholder voting rights, financial compensation, and the transferability of shares. c) Corporate Bylaws Amendment: — An amendment to a company's bylaws to include specific provisions related to change in control. — Defines the process, eligibility criteria, and the rights and obligations of shareholders during the change in control. — Specifies any required approvals or consents from parties involved. Conclusion: Colorado Ratification of Change in Control Agreements provides a robust legal framework to protect the interests of all parties involved during a change in ownership. By clearly defining the rights and obligations of shareholders, executives, and the company, these agreements offer stability, enhance negotiations, and minimize risks associated with the transition. Whether through traditional agreements, shareholder agreements, or amendments to corporate bylaws, Colorado's legal system ensures a smooth and fair process for companies and their stakeholders.