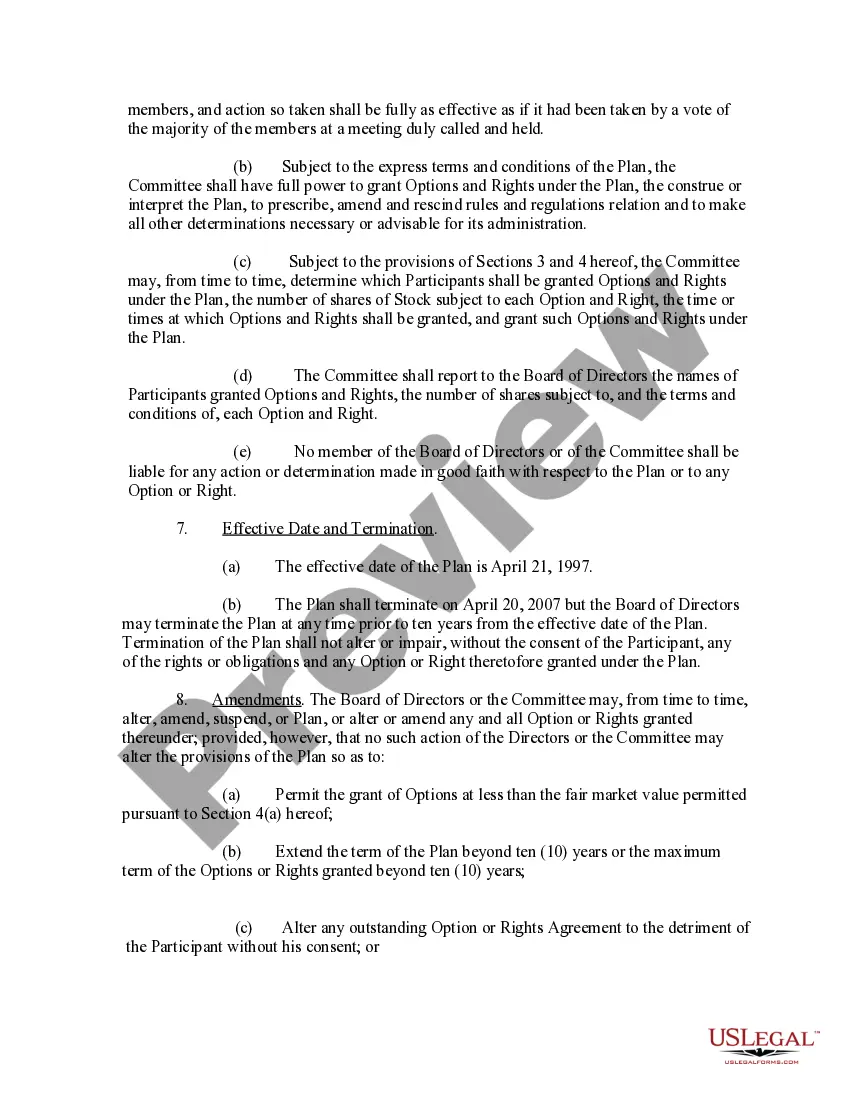

Colorado Incentive Stock Option Plan of the Bankers Note, Inc.

Description

How to fill out Incentive Stock Option Plan Of The Bankers Note, Inc.?

US Legal Forms - one of the greatest libraries of authorized varieties in the United States - delivers a variety of authorized document templates you can down load or print out. While using internet site, you will get 1000s of varieties for business and personal functions, sorted by types, suggests, or search phrases.You can find the latest variations of varieties just like the Colorado Incentive Stock Option Plan of the Bankers Note, Inc. within minutes.

If you already possess a registration, log in and down load Colorado Incentive Stock Option Plan of the Bankers Note, Inc. through the US Legal Forms local library. The Down load button will show up on every single develop you look at. You get access to all formerly downloaded varieties in the My Forms tab of your own profile.

If you want to use US Legal Forms the first time, allow me to share straightforward directions to get you started:

- Make sure you have selected the proper develop for your town/county. Click the Review button to examine the form`s articles. Browse the develop explanation to actually have selected the appropriate develop.

- If the develop doesn`t suit your requirements, use the Search discipline towards the top of the monitor to obtain the one which does.

- If you are happy with the shape, affirm your option by visiting the Acquire now button. Then, select the prices strategy you prefer and provide your accreditations to register for the profile.

- Approach the deal. Make use of your bank card or PayPal profile to perform the deal.

- Choose the formatting and down load the shape on your own product.

- Make adjustments. Fill up, edit and print out and indicator the downloaded Colorado Incentive Stock Option Plan of the Bankers Note, Inc..

Every template you added to your bank account lacks an expiry day which is yours permanently. So, if you want to down load or print out yet another duplicate, just check out the My Forms portion and then click in the develop you want.

Obtain access to the Colorado Incentive Stock Option Plan of the Bankers Note, Inc. with US Legal Forms, the most considerable local library of authorized document templates. Use 1000s of skilled and status-distinct templates that fulfill your company or personal requires and requirements.

Form popularity

FAQ

Taxes and Incentive Stock Options Although no tax is withheld when you exercise an ISO, tax may be due later when you sell the stock, as illustrated by the examples in this article. Be sure to plan for the tax consequences when you consider the consequences of selling the stock.

An incentive stock option (ISO) is a corporate benefit that gives an employee the right to buy shares of company stock at a discounted price with the added benefit of possible tax breaks on the profit.

qualified stock option (NQSO) is a type of stock option that does not qualify for special favorable tax treatment under the US Internal Revenue Code. Thus the word nonqualified applies to the tax treatment (not to eligibility or any other consideration).

Long options Exercising a call option increases the cost basis of the stock that is purchased. There is no taxable event until the stock is finally sold. Once sold, the holding period of the stock determines if the capital gain or loss is short- or long-term.

Exercising stock options means you're purchasing shares of a company's stock at a set price. If you decide to exercise your stock options, you'll own a piece of the company. Owning stock options is not the same as owning shares outright.

There are many requirements on using ISOs. First, the employee must not sell the stock until after two years from the date of receiving the options, and they must hold the stock for at least a year after exercising the option like other capital gains. Secondly, the stock option must last ten years.

Early exercising (ISOs and NSOs) Because the strike price of your stock options is usually set to the 409A valuation at the time you're granted the options, early exercising lets you exercise before the 409A valuation goes up. That way you're not making a phantom gain?and you won't owe any taxes.