The Colorado Nonemployee Directors Nonqualified Stock Option Plan of Cocos, Inc. is a specific incentive program designed to reward nonemployee directors of the company with stock options. This plan is exclusive to Colorado state, allowing eligible directors residing in the region to participate. Colorado Nonemployee Directors Nonqualified Stock Option Plan provides nonemployee directors of Cocos, Inc. the opportunity to purchase company stocks at a predetermined price within a specified time frame. These stock options serve as a form of compensation for their valuable input, contributions, and service on the board of directors. The plan aims to align the interests of directors with the company's goals, promoting long-term commitment, and enhancing shareholder value. By offering stock options, Cocos, Inc. encourages directors to actively participate in strategic decision-making, provide professional guidance, and contribute to the overall growth and success of the business. Different types of Colorado Nonemployee Directors Nonqualified Stock Option Plans offered by Cocos, Inc. may include: 1. Standard Stock Option Plan: This plan enables nonemployee directors to purchase company stocks at a predetermined price for a specific period. The options may vest gradually over time or upon achieving certain performance milestones, encouraging directors to remain engaged and committed to the company's success. 2. Performance-Based Stock Option Plan: In this type of option plan, stock options are granted based on predetermined performance metrics. Nonemployee directors must meet specific targets or milestones to earn and exercise their options. This approach aligns director's compensation with the company's performance, fostering accountability and driving desired outcomes. 3. Restricted Stock Unit (RSU) Plan: Instead of traditional stock options, Cocos, Inc. may offer RSU plans to nonemployee directors. Under this plan, directors receive a specified number of RSS that convert into actual company shares upon vesting. RSS provides a tangible ownership stake in the company, promoting loyalty, and aligning the directors' interests with those of the shareholders. 4. Deferred Compensation Stock Option Plan: This unique option plan allows nonemployee directors to postpone the exercise of their stock options until a future date. By deferring option exercise, directors have the opportunity to manage their taxes and potentially benefit from any potential stock value appreciation over time. Cocos, Inc. ensures compliance with Colorado state regulations and guidelines governing nonemployee directors' compensation and stock option plans. The Colorado Nonemployee Directors Nonqualified Stock Option Plan reflects the company's commitment to attracting and retaining experienced directors, fostering a strong corporate governance framework, and driving sustainable growth.

Colorado Nonemployee Directors Nonqualified Stock Option Plan of Cucos, Inc.

Description

How to fill out Colorado Nonemployee Directors Nonqualified Stock Option Plan Of Cucos, Inc.?

If you wish to full, obtain, or produce legitimate file web templates, use US Legal Forms, the largest variety of legitimate types, that can be found on the Internet. Use the site`s basic and convenient research to discover the files you will need. Various web templates for business and specific reasons are sorted by classes and states, or key phrases. Use US Legal Forms to discover the Colorado Nonemployee Directors Nonqualified Stock Option Plan of Cucos, Inc. within a couple of clicks.

If you are presently a US Legal Forms customer, log in to the profile and click the Down load switch to obtain the Colorado Nonemployee Directors Nonqualified Stock Option Plan of Cucos, Inc.. You can even entry types you previously downloaded from the My Forms tab of your respective profile.

If you use US Legal Forms the very first time, refer to the instructions listed below:

- Step 1. Be sure you have chosen the form to the correct town/land.

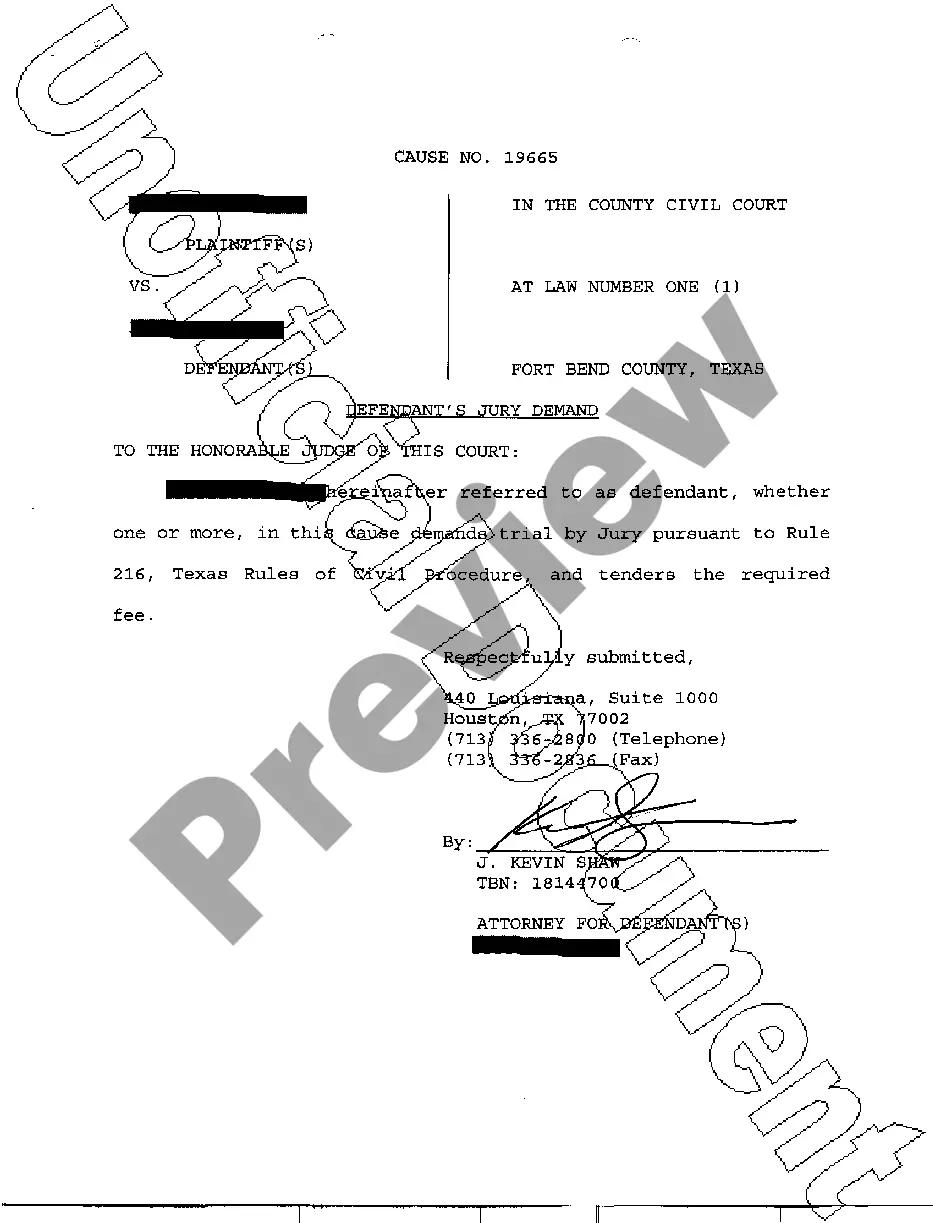

- Step 2. Make use of the Review option to examine the form`s articles. Never forget to see the information.

- Step 3. If you are unhappy using the type, take advantage of the Search discipline at the top of the display screen to find other versions in the legitimate type template.

- Step 4. Once you have found the form you will need, go through the Get now switch. Select the pricing strategy you choose and include your credentials to sign up on an profile.

- Step 5. Procedure the purchase. You can use your bank card or PayPal profile to complete the purchase.

- Step 6. Choose the structure in the legitimate type and obtain it on your device.

- Step 7. Total, edit and produce or sign the Colorado Nonemployee Directors Nonqualified Stock Option Plan of Cucos, Inc..

Every single legitimate file template you purchase is your own for a long time. You may have acces to each type you downloaded in your acccount. Click on the My Forms segment and decide on a type to produce or obtain once again.

Compete and obtain, and produce the Colorado Nonemployee Directors Nonqualified Stock Option Plan of Cucos, Inc. with US Legal Forms. There are many specialist and state-specific types you can use for your personal business or specific requirements.