Colorado Stock Option Plan of Hayes Wheels International, Inc. is a comprehensive program that is designed to provide employees with stock options as part of their compensation package. The plan offers a range of options, including Incentive Stock Options (SOS) and Nonqualified Stock Options (SOS), to eligible participants. Incentive Stock Options (SOS) are a type of stock option granted to employees that can offer certain tax advantages. These options are typically granted at a specific price, known as the exercise price or strike price, and can only be exercised after a predetermined period of time. To enjoy the favorable tax treatment, SOS must be held for at least one year from the date of exercise and two years from the date of grant. On the other hand, Nonqualified Stock Options (SOS) are stock options that do not qualify for the same tax advantages as SOS. While SOS do not have the same restrictions regarding exercise and holding periods, they are typically subject to ordinary income tax upon exercise. Hayes Wheels International, Inc.'s Colorado Stock Option Plan allows eligible employees to receive either Incentive Stock Options or Nonqualified Stock Options, depending on their individual circumstances and the company's discretion. This flexibility ensures that employees can benefit from stock ownership by tailoring the stock option type to their specific needs and financial goals. The plan also outlines the terms and conditions for granting, exercising, and vesting of stock options, as well as any restrictions or limitations that may apply. Participants in the plan can typically exercise their stock options once they have vested, subject to certain rules and regulations defined in the plan documents. Overall, the Colorado Stock Option Plan of Hayes Wheels International, Inc. aims to incentivize and reward employees by providing them with the opportunity to share in the company's success through stock ownership. By offering both Incentive Stock Options and Nonqualified Stock Options, the plan allows employees to choose an option type that aligns with their financial objectives and maximizes their potential benefits.

Colorado Stock Option Plan of Hayes Wheels International, Inc., which provides for grant of Incentive Stock Options and Nonqualified Stock Options

Description

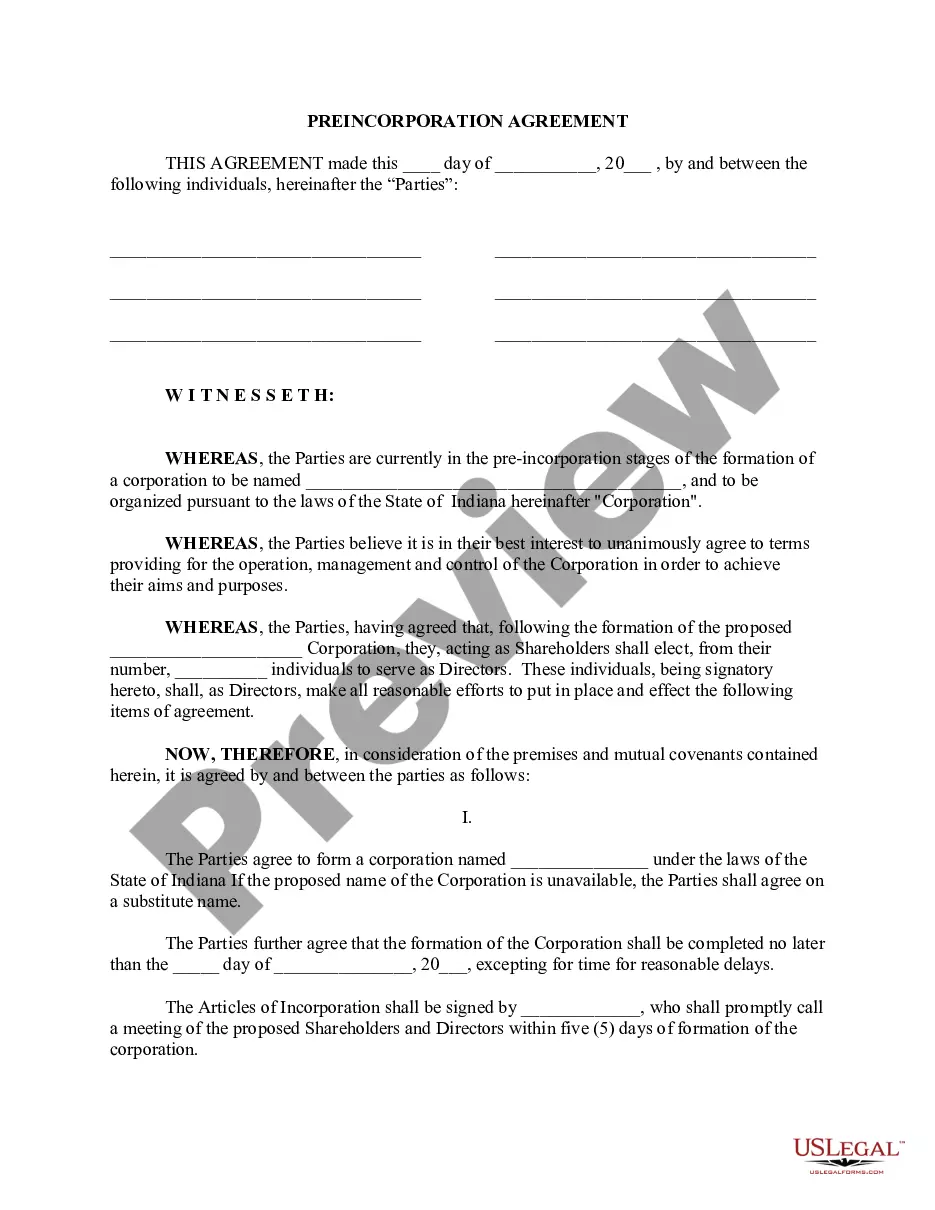

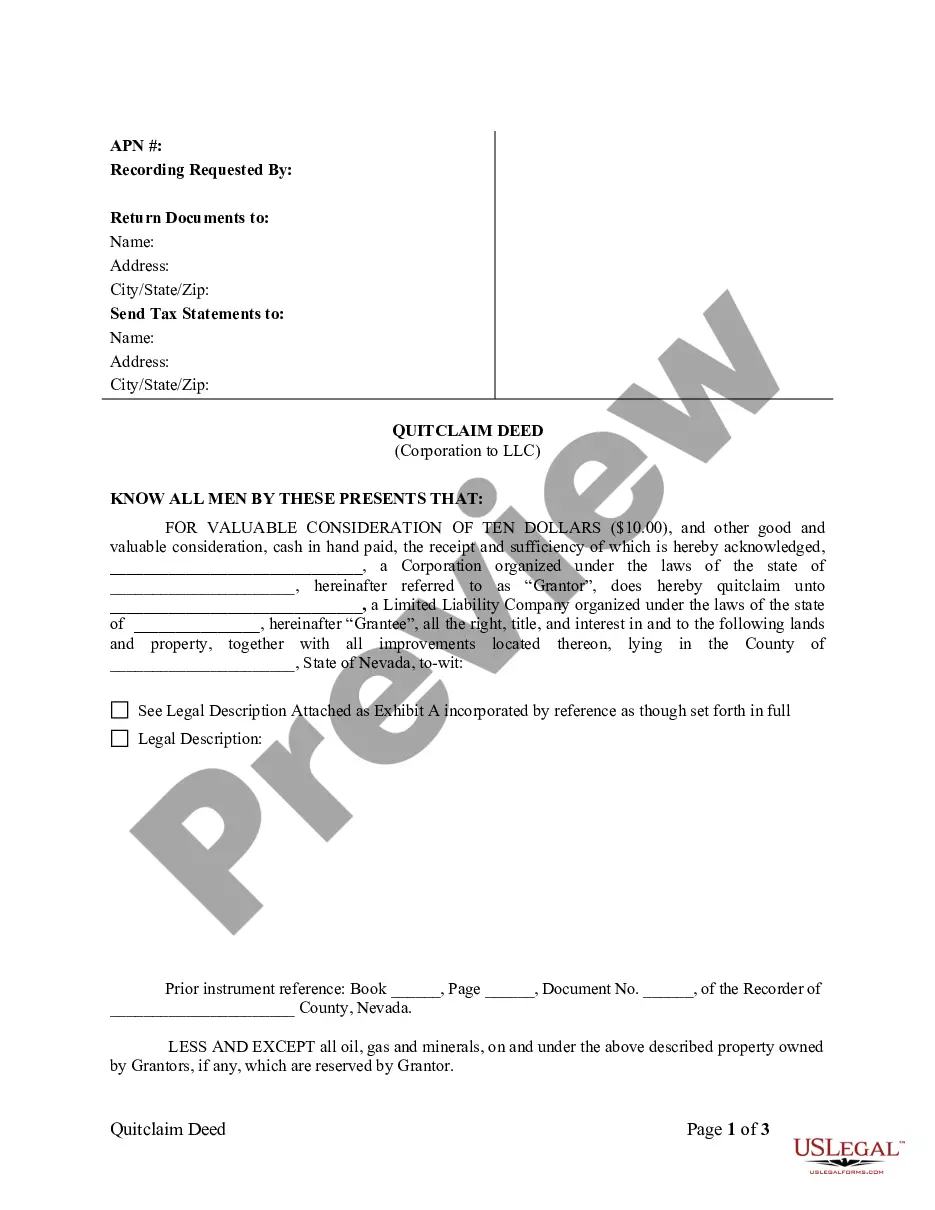

How to fill out Colorado Stock Option Plan Of Hayes Wheels International, Inc., Which Provides For Grant Of Incentive Stock Options And Nonqualified Stock Options?

You may commit hours on the web looking for the legitimate file template that fits the state and federal requirements you require. US Legal Forms provides 1000s of legitimate forms that are evaluated by pros. You can actually obtain or print the Colorado Stock Option Plan of Hayes Wheels International, Inc., which provides for grant of Incentive Stock Options and Nonqualified Stock Options from my services.

If you have a US Legal Forms profile, you can log in and click on the Down load button. After that, you can total, edit, print, or signal the Colorado Stock Option Plan of Hayes Wheels International, Inc., which provides for grant of Incentive Stock Options and Nonqualified Stock Options. Each legitimate file template you acquire is your own property permanently. To have another backup for any bought develop, go to the My Forms tab and click on the corresponding button.

Should you use the US Legal Forms website the very first time, keep to the simple guidelines below:

- Initial, ensure that you have chosen the correct file template for the area/metropolis of your liking. See the develop outline to make sure you have selected the appropriate develop. If readily available, use the Review button to appear through the file template at the same time.

- In order to discover another model of your develop, use the Search industry to find the template that fits your needs and requirements.

- After you have found the template you want, click Buy now to carry on.

- Select the pricing program you want, type your qualifications, and register for a free account on US Legal Forms.

- Comprehensive the transaction. You should use your bank card or PayPal profile to pay for the legitimate develop.

- Select the structure of your file and obtain it to the product.

- Make changes to the file if possible. You may total, edit and signal and print Colorado Stock Option Plan of Hayes Wheels International, Inc., which provides for grant of Incentive Stock Options and Nonqualified Stock Options.

Down load and print 1000s of file web templates making use of the US Legal Forms site, which provides the largest selection of legitimate forms. Use professional and state-specific web templates to handle your business or specific requires.

Form popularity

FAQ

Incentive stock options, or ISOs, can only be given to full-time or part-time employees. Other rules have to be followed in order to maintain ISO status, such as stockholders approving the option plan. An ISO has to be exercised within 90 days of employment termination.

An incentive stock option (ISO) is a corporate benefit that gives an employee the right to buy shares of company stock at a discounted price with the added benefit of possible tax breaks on the profit. The profit on qualified ISOs is usually taxed at the capital gains rate, not the higher rate for ordinary income.

Nonqualified: Employees generally don't owe tax when these options are granted. When exercising, tax is paid on the difference between the exercise price and the stock's market value. They may be transferable. Qualified or Incentive: For employees, these options may qualify for special tax treatment on gains.

Only employees can receive ISOs, whereas NSOs may be granted to any service providers (e.g., employees, directors, consultants, and advisors). ISOs must be exercised within three months following termination of employment (even if the holder continues providing services in some other capacity).

The ISO $100K limit, also known as the ?ISO limit? or ?$100K rule,? exists to prevent employees from taking too much advantage of the tax benefits associated with ISOs. It states that employees can't receive more than $100,000 worth of exercisable ISOs in a given calendar year.

There are many requirements on using ISOs. First, the employee must not sell the stock until after two years from the date of receiving the options, and they must hold the stock for at least a year after exercising the option like other capital gains. Secondly, the stock option must last ten years.

Incentive stock options, or ISOs, are a type of equity compensation granted only to employees, who can then purchase a set quantity of company shares at a certain price, while receiving favorable tax treatment. ISOs are often awarded as part of an employee's hiring or promotion package.

Non-qualified Stock Options (NSOs) are stock options that, when exercised, result in ordinary income under US tax laws on the difference, calculated on the exercise date, between the exercise price and the fair market value of the underlying shares.