Colorado Stock Option Agreement of Hayes Wheels International, Inc. - general form

Description

How to fill out Stock Option Agreement Of Hayes Wheels International, Inc. - General Form?

Discovering the right lawful papers design might be a battle. Naturally, there are a lot of templates available on the Internet, but how can you get the lawful type you will need? Utilize the US Legal Forms internet site. The assistance delivers 1000s of templates, such as the Colorado Stock Option Agreement of Hayes Wheels International, Inc. - general form, which can be used for business and personal needs. Every one of the varieties are inspected by professionals and satisfy federal and state demands.

Should you be previously authorized, log in to the bank account and then click the Down load button to get the Colorado Stock Option Agreement of Hayes Wheels International, Inc. - general form. Make use of your bank account to check throughout the lawful varieties you may have ordered in the past. Proceed to the My Forms tab of the bank account and obtain yet another copy of your papers you will need.

Should you be a whole new customer of US Legal Forms, allow me to share easy recommendations for you to comply with:

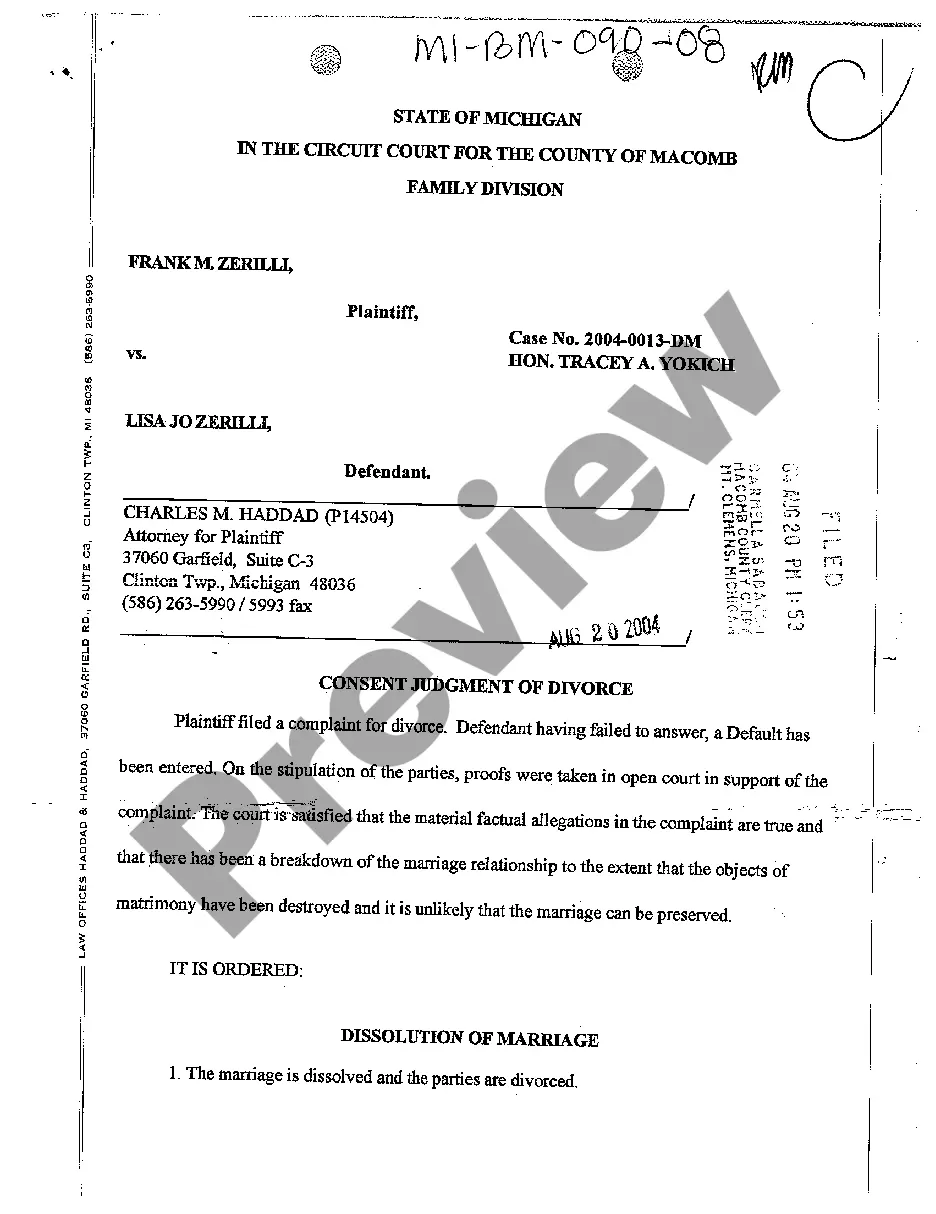

- Very first, make certain you have chosen the correct type for your area/state. You can examine the shape using the Review button and browse the shape outline to make sure this is basically the right one for you.

- When the type does not satisfy your expectations, utilize the Seach discipline to discover the correct type.

- When you are sure that the shape would work, select the Buy now button to get the type.

- Choose the pricing program you want and type in the needed information. Design your bank account and pay for the order making use of your PayPal bank account or Visa or Mastercard.

- Pick the document formatting and obtain the lawful papers design to the system.

- Complete, edit and print and sign the received Colorado Stock Option Agreement of Hayes Wheels International, Inc. - general form.

US Legal Forms may be the most significant collection of lawful varieties for which you can see numerous papers templates. Utilize the company to obtain professionally-produced paperwork that comply with condition demands.